- Ethereum ETFs saw a $515 million weekly record inflow.

- Meanwhile, ETH has declined over the past week, by 1.85%.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I’ve seen it all – the highs and the lows, the booms and the busts. And I must say, the recent inflow into Ethereum ETFs is quite intriguing. On one hand, we’re seeing a record-breaking $515 million weekly inflow, which should typically signal a bullish trend. But on the other hand, Ethereum itself has declined over the past week, by 1.85%.

Over the past month or so following the approval of Ethereum ETFs in July, the market has had difficulty maintaining consistent growth. Lately, though, there’s been an uptick in attention towards Ethereum ETFs over the last fortnight.

One significant factor contributing to this was the persistent arrival of institutional investors, who were eagerly waiting for an upward market trend (bull run).

Spot Ethereum ETFs see inflows

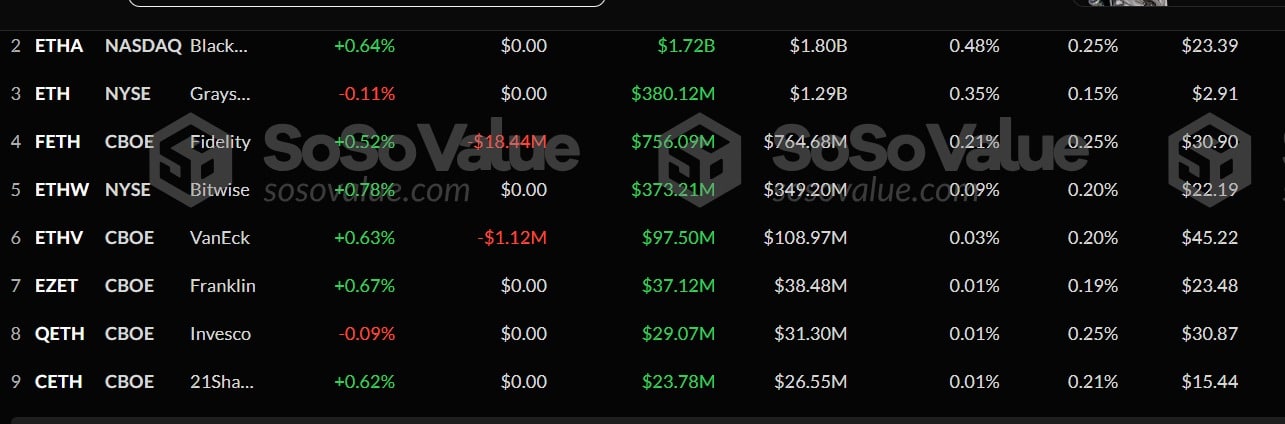

Based on AMBCrypto’s assessment of Sosovalue, there was a substantial increase in investments into Ethereum Exchange-Traded Funds (ETFs) from the 9th to the 15th of November. Over this span, these ETH ETFs recorded an all-time high inflow amounting to $515.17 million.

After experiencing a continuous influx of funds for more than three weeks, we reach this significant level. Although the weekly inflow set a remarkable record, it was surpassed by a massive daily inflow on the 11th of November, peaking at an impressive $295.4 million.

Amidst this, Blackrock’s ETHA witnessed the highest total inflow of $287 million, increasing its total to $1.7 billion.

In the second spot during this timeframe was Fidelity’s FETH, experiencing an increase in its market value to approximately $755.9 million, accompanied by a $197 million influx of funds.

Meanwhile, Grayscale’s ETH’s inflow touched $78 million, while Bitwise’s number stood at $54 million.

During this timeframe, the leading investments experienced growth, whereas Ethereum (ETHV) and 21 Shares had a more modest increase in investment. As a result of these inflows, Ethereum’s ETFs accumulated a total value of approximately $9.15 billion.

Implication on ETH price chart

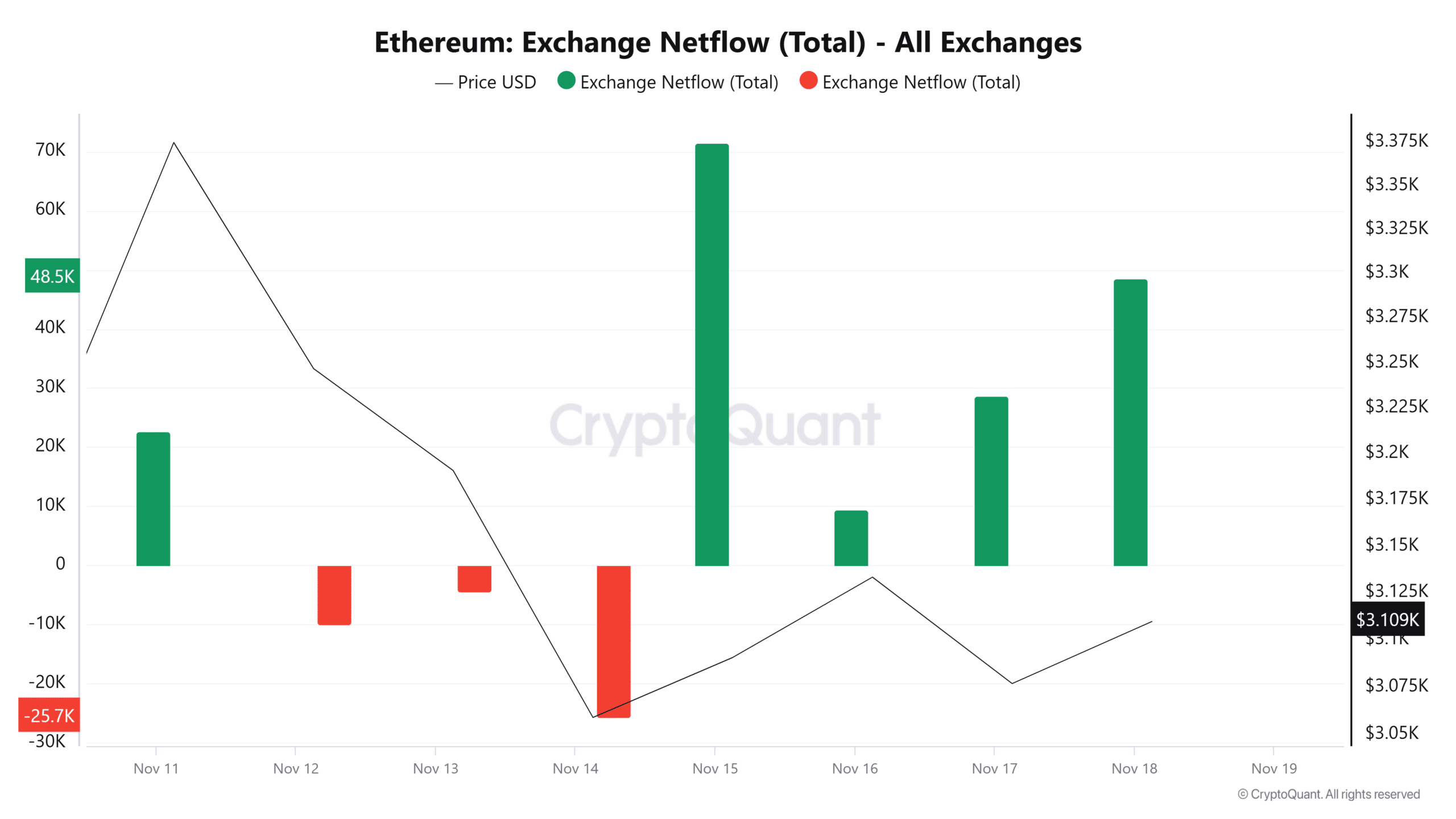

Despite the anticipated benefits on Ethereum’s (ETH) price trend, it didn’t materialize during that specific timeframe. Conversely, ETH experienced a decline instead, dropping from a peak of $3446 to a bottom of $3012 in this period.

Even on the 11th of November, when the inflow was the largest on daily charts, ETH declined.

This trend has persisted even at the time of this writing. In fact, at press time, Ethereum was trading at $3122, marking moderate declines on daily and weekly charts, dropping by 1.22% and 1.85% respectively.

These market conditions suggested that ETH was struggling with bearish sentiment in a bull market.

It’s clear that the market trend for ETH might be changing because the RVGI line crossed below its signal line in a downward direction. This indicates that the bullish momentum could be decreasing, possibly hinting at an upcoming shift in the trend.

Furthermore, Ethereum’s outgoing traffic from exchanges has been less than incoming for the last four days, suggesting a higher influx of Ethereum into exchanges compared to withdrawals. Such instances often indicate a lack of investor confidence.

Despite a surge in investments into Ethereum ETFs, resulting in unprecedented inflows, these events haven’t translated positively on Ethereum price graphs as one might expect. In fact, during this same timeframe, the value of Ethereum has actually decreased, contrary to the impact of the ETF inflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Based on current market trends, there could be an impending downturn. If this occurs, the price of Ethereum may stabilize near the $3000 level.

Given that the cryptocurrency market continues its upward trajectory, if bullish forces regain dominance, Ethereum (ETH) could break through the $3200 resistance level in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-11-18 15:36