-

Exchange outflows hit a yearly high, suggesting bullish conviction.

ETH’s price may find it challenging to surpass $3,255 in the short term.

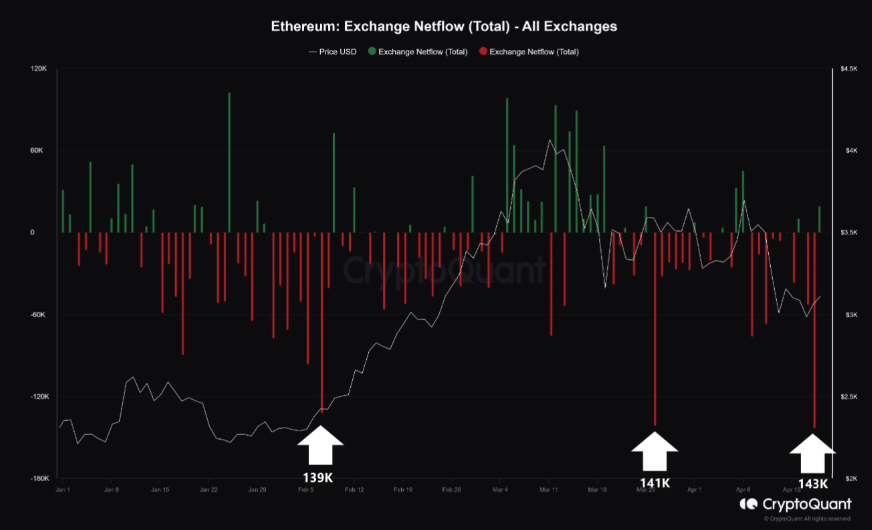

Surprisingly, Ethereum (ETH) saw its greatest number of withdrawals from exchanges on April 18, 2024. According to CryptoQuant, a total of 143,000 ETH were taken out of trading platforms on that day by market players.

An outflow of coins being exchanged can indicate reluctance among sellers, potentially signaling that a significant price drop or capitulation for the altcoin may be avoided. This phenomenon was previously observed on the 7th of February and 26th of March in Ethereum’s case.

In February, the price of ETH had reached $2,372 after an amassing of supplies. By the close of the month, however, its value had risen to an impressive $3,386.

In March, the outflow didn’t lead to the same outcome due to a later price drop. Nevertheless, AMBCrypto discovered explanations for the sudden surge in outflows.

Dogged holders keep the faith

Some people are optimistic that the SEC in the United States will give the green light to Ethereum ETFs by May. However, others remain skeptical and believe that approval may not be granted.

Burakkesmeci, an author on CryptoQuant, also seemed to agree with the viewpoint, mentioning that,

Before the Bitcoin spot ETF was approved, a large quantity of Bitcoins were withdrawn from exchanges. It’s not occurring to the same extent now, but it’s important to consider the possibility that this trend could repeat.

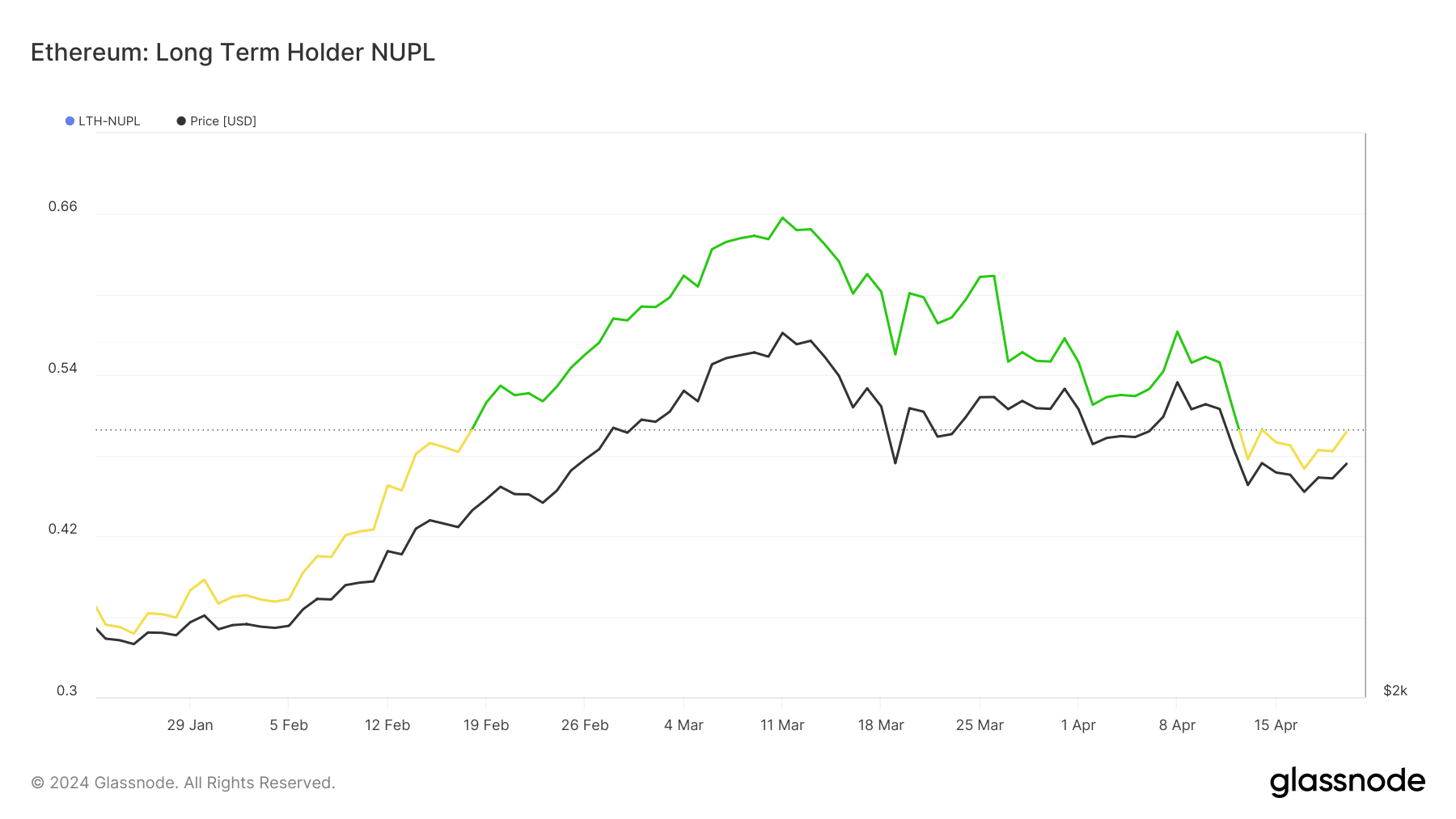

An alternative explanation for the surge in ETH‘s price might be rooted in the conviction that it will surpass Bitcoin’s (BTC) performance during this market cycle. However, it is essential to note that this perspective lacks substantial evidence. To validate this claim, AMBCrypto examined Ethereum’s Long-Term Holder Net Unrealized Profit and Loss Ratio (LTH-NUPL).

An acronym, LTH-NUPL stands for Long-Term Holders’ Net Unrealized Profit/Loss. This measurement indicates the actions of crypto owners who have possessed the digital asset for over six months.

At present, the LTH-NUPL indicator is located in the hopeful (yellow) zone, even though it was previously trending towards the elated (green) area. However, this shift hasn’t resulted in any notable changes to its value.

ETH targets a lower low

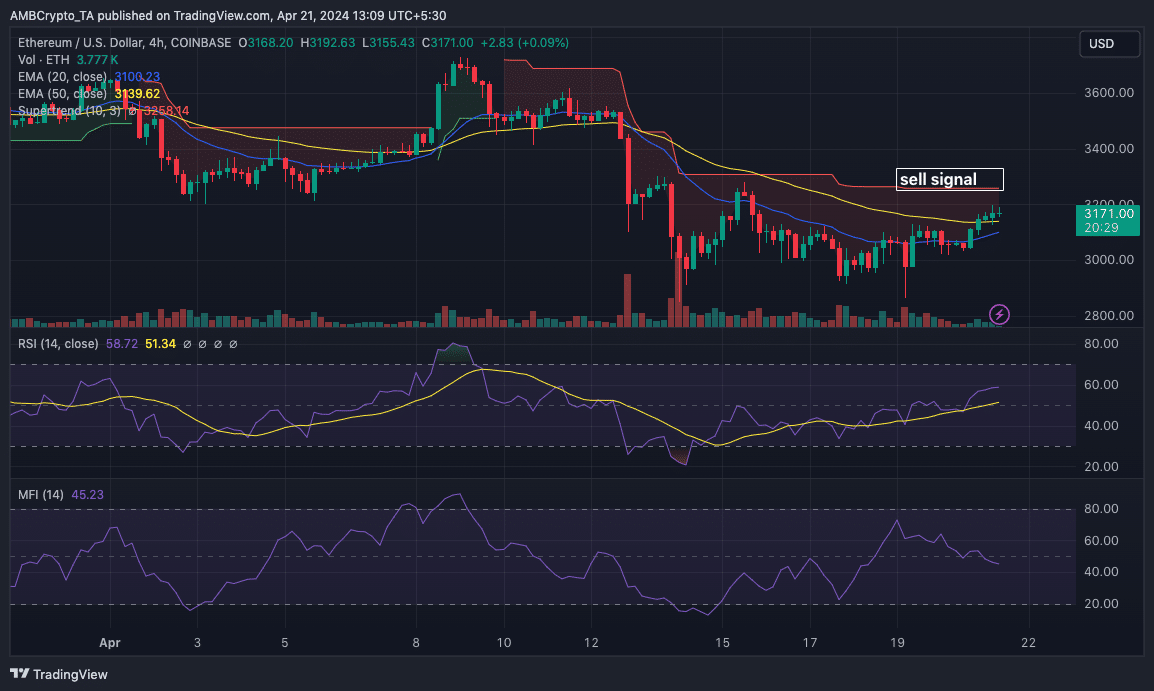

Currently, each Ethereum Heritage Token (EHT) is exchanging for $3,175, marking a 3.67% price rise over the past 24 hours. Technically speaking, there’s growing momentum for this digital asset.

The RSI reading of 58.64 suggested that there was still some room for the price to rise further based on historical trends.

Yet, the Exponential Moving Average (EMA), in contrast, displayed an opposing message. Presently, the 20 EMA (represented by blue) sits above the 50 EMA (denoted by yellow), suggesting a downward trend.

Furthermore, when the Supertrend indicated a sell sign at $3,255, it suggested that if the cryptocurrency’s value continues to rise, there is a possibility of it being rejected at this price.

Read Ethereum [ETH] Price Prediction 2024-2025

The Money Flow Index (MFI) followed the trend of the Supertrend and showed a warning sign. Its descending trend suggested that there was a net outflow of funds from the Ethereum market.

As such, the price could fail to break through the resistance at $3,500.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-04-21 14:15