- Ethereum ETF inflows hit a high, but bearish sentiment emerges.

- Futures data highlighted cautious trader sentiment.

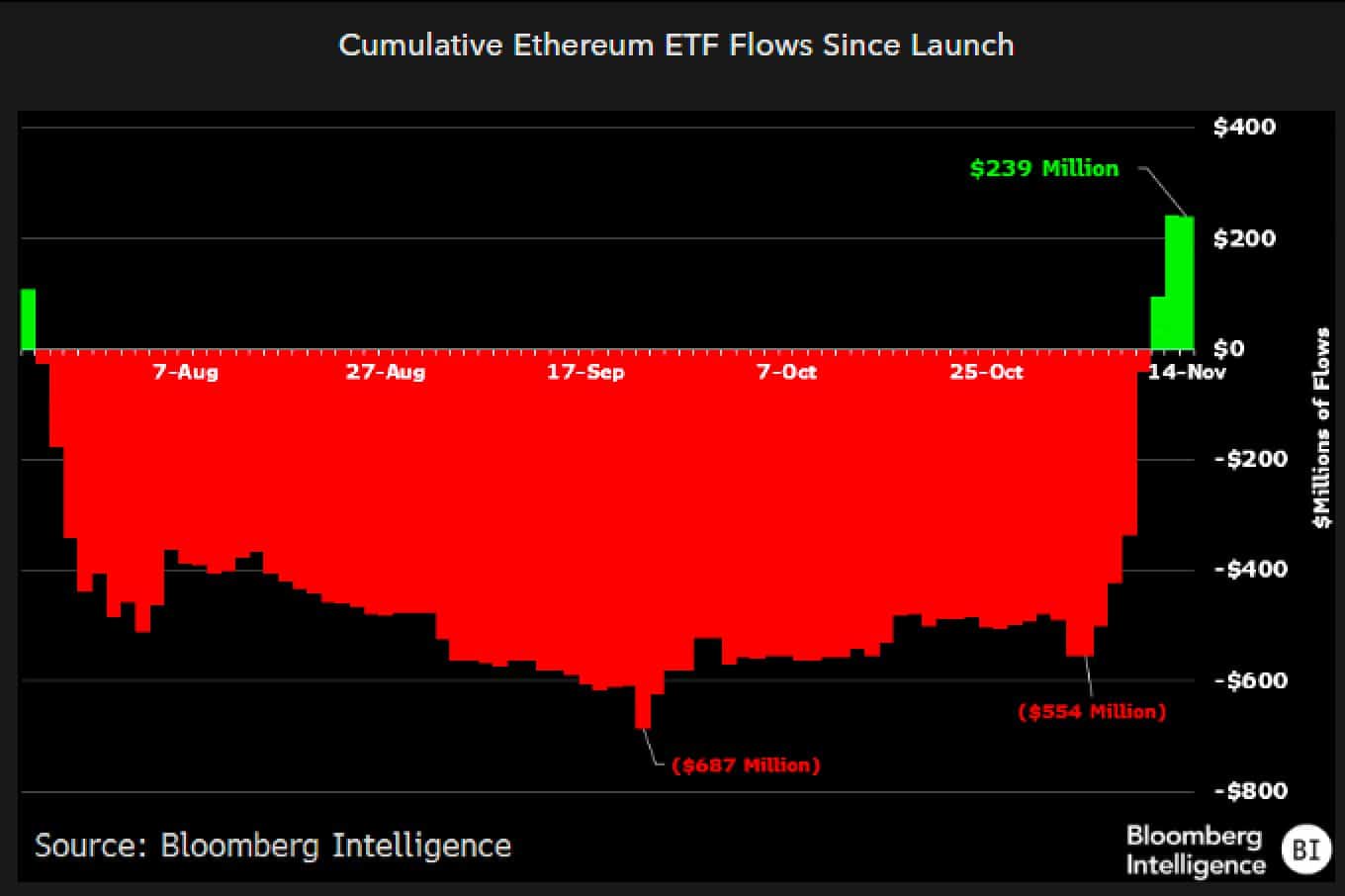

As a seasoned crypto investor who witnessed the 2017 bull run and the subsequent bear market, I can say that the recent inflow of $515 million into Ethereum ETFs is an encouraging sign but not one to blindly trust. The post-election optimism has indeed fueled a renewed interest in cryptocurrencies, but the sudden shift from green to red in ETH ETF flows should serve as a reminder that the market can be unpredictable and volatile.

🌪️ EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastAs an analyst, I’ve observed that Moonvember was indeed kind to Ethereum [ETH] Exchange-Traded Funds (ETFs). To be precise, according to AMBCrypto, these ETFs experienced an unprecedented influx of approximately $515 million last week.

This significant event caught the attention of market analysts, with Eric Balchunas, a seasoned ETF analyst at Bloomberg, highlighting an impressive shift in color on the ETF chart for X (previously known as Twitter), moving from red to green.

He highlighted this as a significant recovery for ETH ETFs, noting that the dramatic turnaround came after a prolonged period of persistent outflows.

Post-election optimism fuels Ethereum ETFs

It’s common knowledge that the cryptocurrency market experienced a significant surge following Donald Trump’s win in the 2024 U.S. presidential elections. Many analysts believe this boost was triggered by heightened investor interest in Ethereum (ETH) exchange-traded funds (ETFs).

As Bloomberg ETF analyst James Seyffart put it in an X post,

As an analyst, I’d suggest discussing Ethereum ETF data using terms similar to Before (BE) and After (AE) my presidential term. This approach simplifies the analysis by comparing the Ethereum ETF data before and after my election.

Balchunas offered another perspective, describing the recent activity as,

Over the past week, and indeed throughout this entire year, the financial movements can be characterized as ‘Beta mixed with Bitcoin‘ – reflecting both the broader market trends and the volatile nature of digital currencies, especially following the recent election.

Although the market indicates some level of extension, the executive asserts that Exchange Traded Fund (ETF) investors maintain an unusually positive and bullish perspective.

ETH ETF flows face a red tide

Despite reaching a significant milestone in inflow last week, it appears that the flow of assets into the Ethereum ETF has been moving in the opposite direction.

According to information from SoSo Value, there were significant withdrawals during the latter part of the previous week. Specifically, on November 14th, $3.24 million was withdrawn, while a larger amount of $59.87 million was taken out on November 15th.

This week saw a continuation of the same trend, as on the 18th of November alone, there were further outflows amounting to $39.08 million. Out of the nine ETFs, it was only Fidelity’s FETH that recorded inflows.

Meanwhile, the top three ETFs saw outflows, while others saw no flows at all.

If this ongoing trend continues, it could mean that ETH ETFs will close the week with losses for the first time since early November – a significant shift from the positive outlook observed previously.

ETH faces pressure

As a crypto investor, I’ve noticed that Ethereum’s price surge, fueled by the election excitement, seems to be slowing down. After reaching an all-time high of around $3,400, Ethereum has since taken a step back.

Currently, this altcoin is being traded at $3,116.66. Over the course of the last seven days, its value has decreased by 6.33%. In the last day, there was a minimal decrease of 0.06%, according to information from CoinMarketCap.

Futures market data from Coinglass painted a mixed picture. Trading activity was heating up, with a 57.77% surge in volume.

Nevertheless, Open Interest rose only moderately by 0.76%, implying that traders were cautious about making firm investments. The Long/Short ratio stood at 0.9535 during the previous 24 hours, hinting at a slightly bearish tilt as apprehension seemed to be on the rise.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although Ethereum ETFs have garnered attention due to their strong investment inflows, recent trends of outflows and price adjustments suggest a market that might be preparing for a period of cooling down.

Is this current optimistic phase just a brief flash—or the beginning of an extended period of growth?

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-20 04:08