-

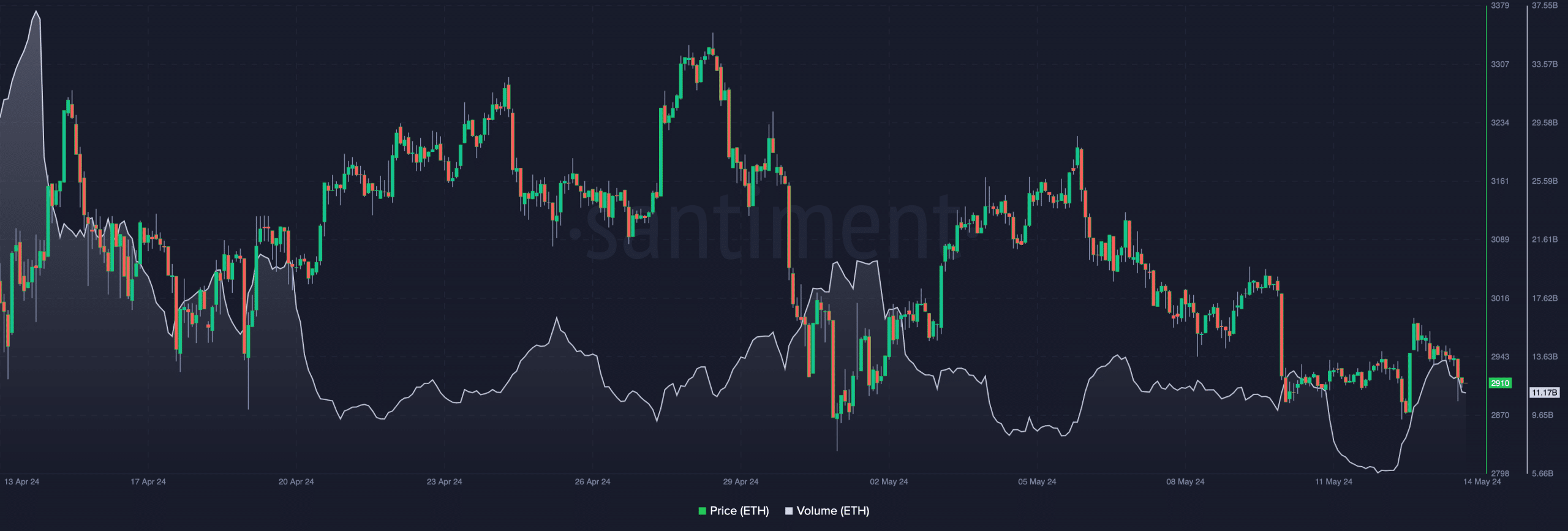

Declining on-chain volume in ETH indicates waning interest ahead of ETF verdict.

A financial institution predicted a delay for Ethereum ETF, but not an outright rejection.

As a seasoned crypto investor with a keen interest in Ethereum [ETH], I’ve been closely following the developments surrounding the Ethereum ETF applications and the SEC’s decision. While some are optimistic about the approval, recent events have cast doubt on the outcome.

Significant occurrences are scheduled to transpire prior to the close of May. Among these, the crypto sphere eagerly anticipates the U.S. Securities and Exchange Commission’s (SEC) verdict on multiple Ethereum [ETH] exchange-traded fund (ETF) proposals.

An Exchange-Traded Fund (ETF) referred to as Ethereum ETF, is a type of investment fund that allows investors to buy shares representing ownership in the underlying Ethereum cryptocurrency without having to handle the complexities of actually owning and storing the digital asset itself.

As a crypto investor, I must admit that the possibility of an approval for a particular investment product is still up for debate. Some individuals in the community believe that the Securities and Exchange Commission (SEC) has no choice but to give their nod due to their previous approval of Bitcoin ETFs. However, it’s essential to remember that each application is unique and evaluated on its own merits.

A stumbling block appears

Yet, some hold the opinion that current trends suggest a different perspective from the regulator on this matter. Notably, Gary Gensler is one individual who may impede Ethereum ETF approval.

The SEC chairman, Gensler, has openly expressed his disapproval of the cryptocurrency sector for some time. More recently, the SEC issued Wells Notices to certain companies, among them being Consensys.

The Securities and Exchange Commission (SEC) issues a Wells Notice as a formal communication to inform the recipient that the agency intends to instigate enforcement proceedings against them.

Consensys is a leading organization specializing in blockchain technology with a strong focus on Ethereum. Given its close association with Ethereum, there’s a likelihood that regulatory bodies like the SEC might disapprove of their applications.

Despite stating that they don’t anticipate receiving approval this month, J.P. Morgan made it clear that this isn’t a definitive denial. They elaborated on the fact that:

As a researcher examining the market expectations towards the Grayscale Ethereum Trust (ETHE), I’ve observed that there is a notable discount between the current trading price and the net asset value (NAV). This discrepancy suggests that investors do not anticipate an approval from regulatory bodies this month, contrary to any implied assumptions based on the current market pricing.

The Securities and Exchange Commission (SEC) has until sometime between May 23rd and 24th to make a decision. Yet, there were signs of uncertainty in the wider financial markets regarding favorable outcomes from this particular development.

Interest in ETH falls

It was clearly reflected in the succession of withdrawals from Ethereum investment vehicles, as reported by AMBCrypto. Additionally, we took into account the transaction volume on the blockchain for our evaluation.

At present, the recorded volume stands at 11.17 billion. This represents a substantial drop compared to the previous high in March. A diminishing trading volume for Ethereum indicates waning enthusiasm among investors and traders towards the altcoin.

Should the Securities and Exchange Commission (SEC) grant approval for an Ethereum Exchange-Traded Fund (ETF), it’s plausible that Ethereum’s (ETH) price could experience a significant surge. At present, ETH is valued at approximately $2,910 per unit. With the green light from the SEC, ETH might reach new heights, potentially climbing as high as $3,500.

If the situation isn’t as anticipated, there’s a possibility the price could drop to $2,700. Yet, investors will closely monitor developments with the proposed Bitcoin ETFs from VanEck and ARK.

Applicants are closing the loopholes

As a crypto investor following the developments of ARK and 21Shares closely, I’ve noticed an interesting update regarding their Ethereum ETF applications. Initially, they both proposed including staking as part of their submissions. However, in a more recent amendment on May 10th, they altered this approach.

Companies anticipated including staking in their offerings by February, with the reasoning being that Ethereum could generate revenue for their businesses.

Despite the SEC’s ongoing uncertainty regarding whether to classify cryptocurrencies as securities, they have been compelled to exercise caution in their decision-making process. This situation, however, does not automatically mean that an Ethereum ETF will receive approval.

In the meantime, J.P. Morgan also commented on the possibility of a delay.

Based on the financial institution’s information, refusal could lead to legal action, similar to how Grayscale initiated a lawsuit against the regulator prior to the approval of Bitcoin ETFs.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As a crypto investor, I’ve noticed that Grayscale, similar to me, has expressed interest in transforming its Ethereum Trust into an Exchange-Traded Fund (ETF). This means, if approved, investors would be able to buy and sell shares of the ETF just like they would with a regular stock. It’s an exciting development that could potentially make investing in Ethereum more accessible and convenient for many.

If the SEC declines approval for spot Ethereum ETFs, despite the existing approvals for futures-based Ethereum ETFs, they may encounter a legal battle and ultimately succumb to it.

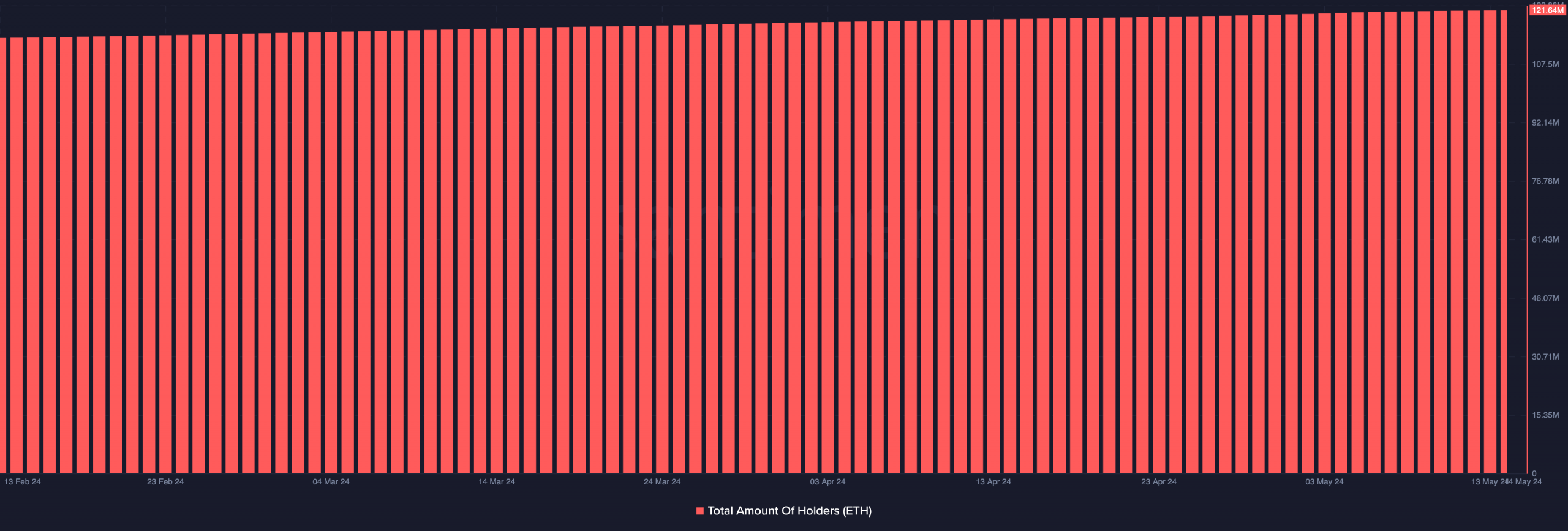

As a researcher, I’ve uncovered some intriguing data regarding Ethereum (ETH) and its growing community. Despite the pending verdict, the number of us – Ethereum holders – has been on an upward trend. To be more precise, according to the insights from Santiment, over 120 million individuals have taken possession of ETH.

Read More

2024-05-15 01:12