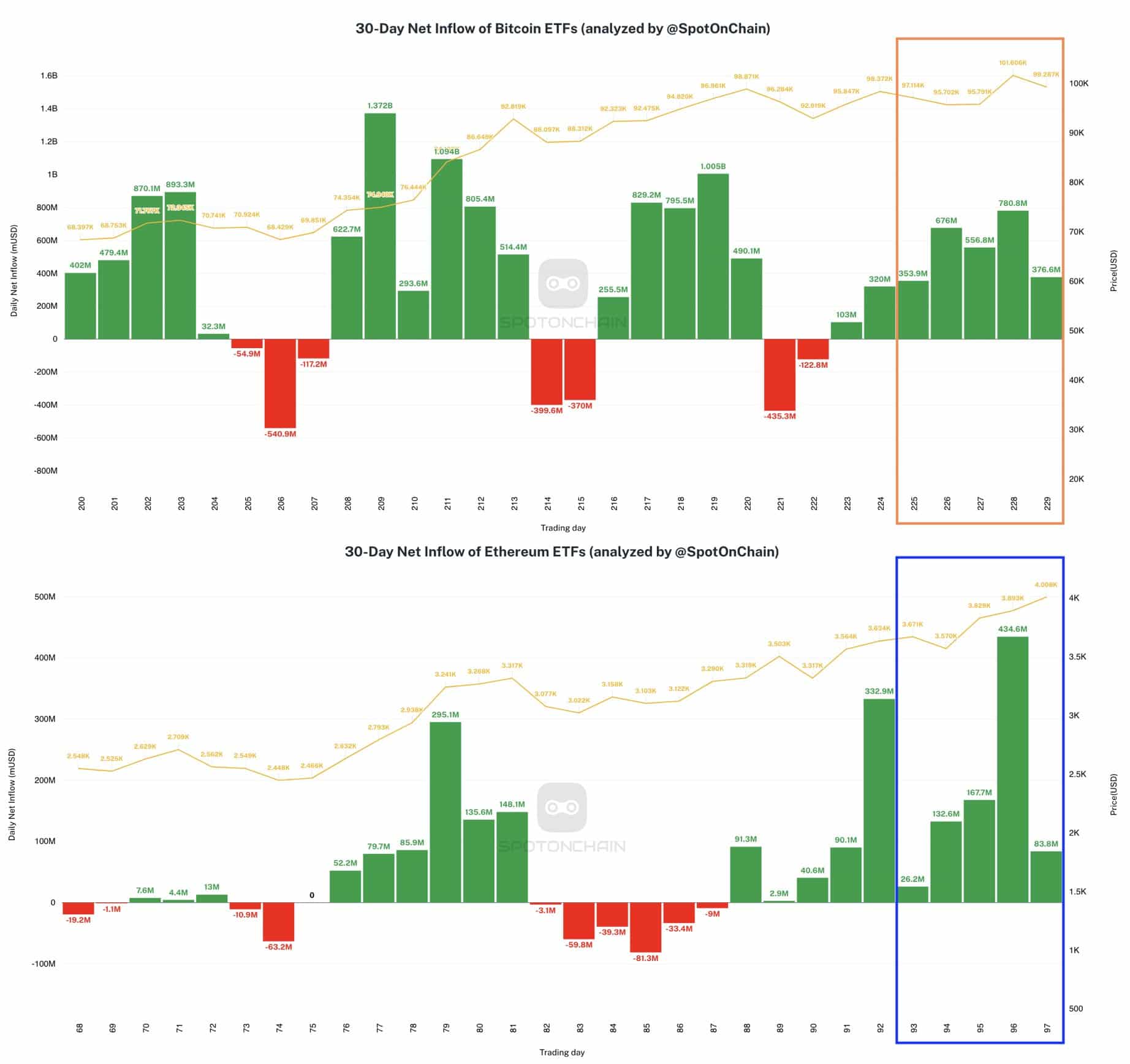

- ETH ETFs recorded the largest weekly inflows of $844M.

- Options traders increased bets on $4.5K, $5K, and $6K targets.

As a seasoned researcher with over two decades of experience in the crypto market, I must say this recent surge in ETH is truly intriguing. The massive inflows into ETH ETFs and the bullish bets by options traders are reminiscent of the dot-com boom of the late 90s – a time when everyone was betting on the next big thing.

Over the past week, U.S.-based Ethereum Exchange Traded Funds (ETFs) experienced their biggest weekly investments since they were introduced, with a total of $844 million flowing in for five straight days, as indicated by data from SpotOnChain.

During that stretch, the maximum daily investment reached an impressive $428.5 million, primarily driven by BlackRock and Fidelity. This substantial influx and demand boosted the worth of Ethereum to surpass $4,000 for the first time since March 2024.

The impressive turnaround in performance significantly contrasts with the underwhelming initial release of the product back in July. To what extent will the steady increase in investments propel the worth of Ethereum?

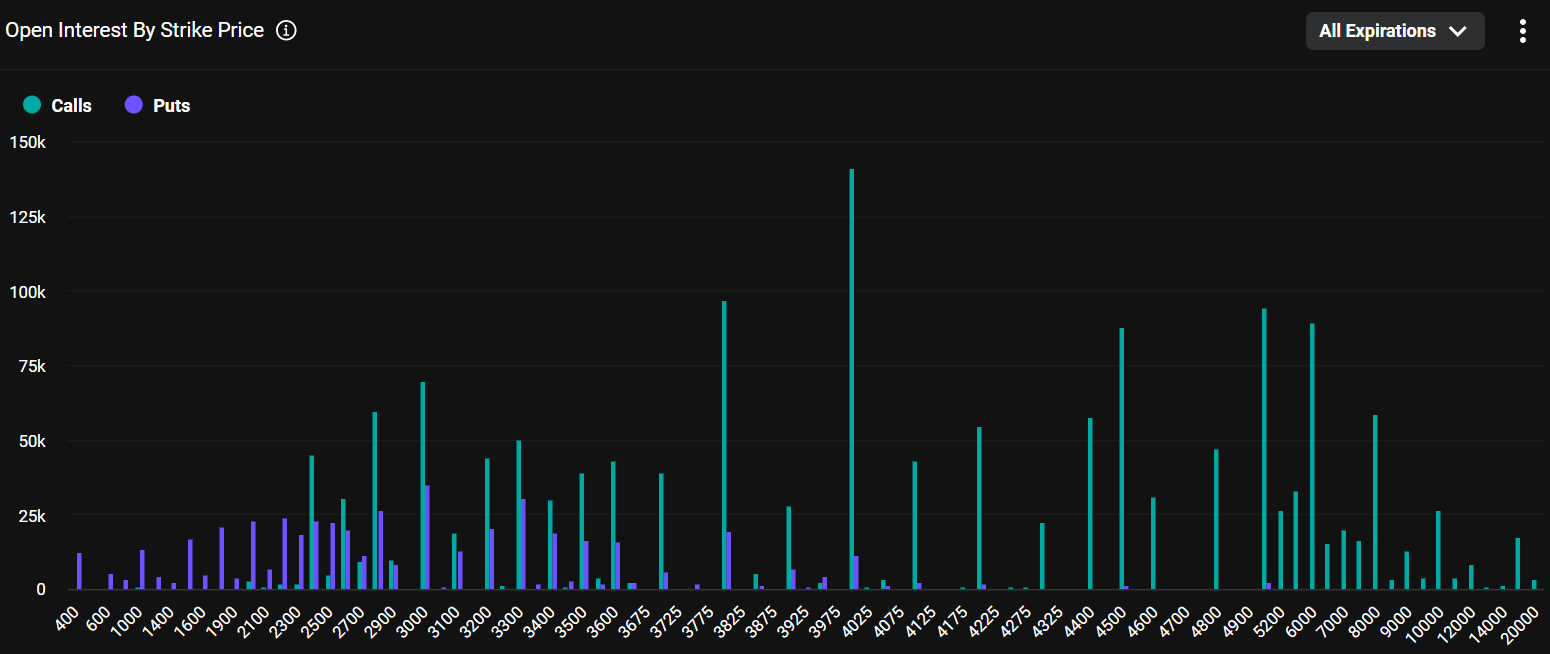

Options traders eye $5K-$6K

Traders specializing in options weren’t taken aback by last week’s $4K dip in ETH. In fact, they anticipated it, as approximately $660 million was wagered in option contracts predicting Ethereum would reach that level. Now, their attention is focused on what could come next.

Based on information from Deribit, there were several potential prices with substantial open interest at $4,500, $5,000, and $6,000. Notably, large wagers were also made for the $8,000 price point.

Approximately 374 million dollars were invested with a goal of reaching 5,000 dollars. There were approximately 353 million and 348.5 million dollars in potential value for call options at 6,000 dollars and 4,500 dollars respectively, representing optimistic wagers.

Essentially, options traders had faith that Ethereum (ETH) would surpass price points of $5,000 and $6,000 in the long term. By December, they anticipated reaching around $4,500 to $5,000; however, the $6,000 threshold was projected for early 2025.

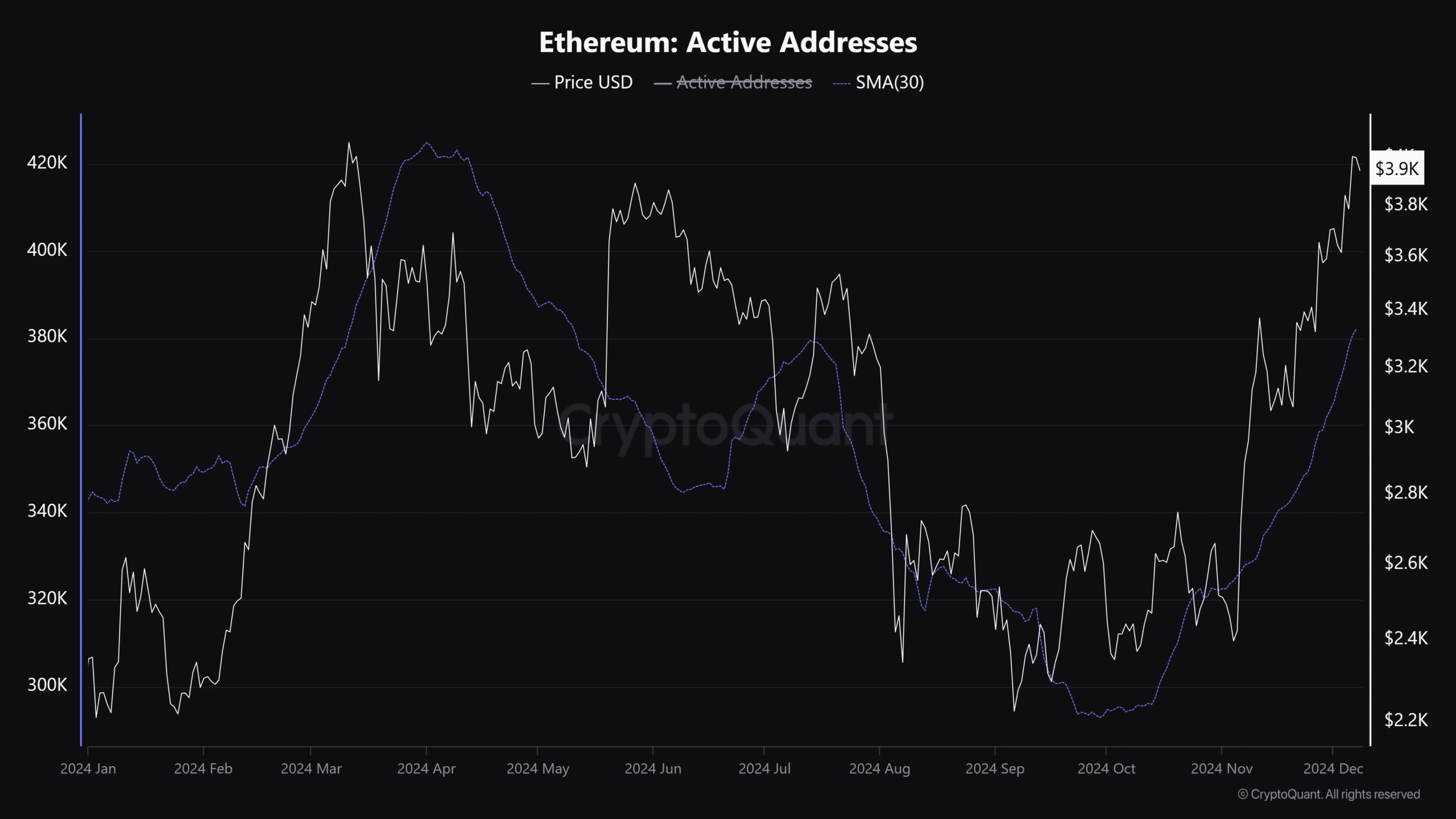

As a crypto investor, I’ve noticed an uptick in the market’s enthusiasm, evident in the surge of active Ethereum (ETH) addresses. This rise has also fueled optimism within the options market, suggesting a positive trajectory ahead.

Over the past month, the number of active Ethereum addresses has grown significantly since October’s lows, with the figure now exceeding 380,000 as we speak.

Should the optimistic market outlook persist, a surge in investor attention might lead to an upward trend in Ethereum prices.

Read Ethereum [ETH] Price Prediction 2024-2025

At the moment, Ethereum (ETH) has stabilized just under $4,000. Looking at the price graph, significant Fibonacci levels align with where option traders have set their goals.

The $4.5K and $5K were immediate upside levels, while $3.6K was a key support.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-12-08 17:11