-

Bitcoin ETFs outperform Ethereum, with BTC inflows surging while ETH ETFs struggle with outflows.

Bitcoin’s dominance and first-mover advantage reinforce its lead over Ethereum in the ETF market.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous trends and shifts that have reshaped the investment landscape. In recent times, the rise of Bitcoin Exchange Traded Funds (ETFs) has been nothing short of remarkable.

Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastBitcoin [BTC] Exchange-Traded Funds (ETFs) have made a substantial difference in the cryptocurrency market, demonstrating impressive growth following their debut.

Bitcoin and Ethereum ETF analysis

As a researcher, I’ve just learned that, based on the recent update by Farside Investors, there has been an inflow of approximately $252 million into Bitcoin Exchange Traded Funds (ETFs). This suggests growing interest in these investment vehicles among investors.

“BlackRock’s IBIT took the top spot with inflows of $86.8 million, followed by Fidelity’s FBTC with inflows of $64 million.” This maintains the original meaning while being easier to read and understand.

Nevertheless, despite the rush of investments, Grayscale’s GBTC encountered difficulties, with outflows amounting to $35.6 million by August 23rd.

From my perspective as a researcher, I’ve observed that Ethereum ETFs have faced challenges, predominantly seeing withdrawals ever since their launch. As recently as the 23rd of August, these ETFs reported an outflow of approximately $5.7 million.

Specifically, neither BlackRock’s ETHA nor Fidelity’s FETH experienced any new investments, but FETH from Bitwise, ETHW, and VanEck did see some fresh investment dollars.

As a crypto investor, I’ve noticed that my holdings in Grayscale’s Ethereum Trust (ETHE) have been on the decline lately. Interestingly, the total outflow from ETHE was approximately $9.8 million, which surprisingly eclipsed the combined outflows of all other Ethereum ETFs.

Remarking on the same, an X handle with the username- Crypto Crib noted,

“During the past week, exchange-traded funds (ETFs) based on Ethereum (ETH) experienced a total withdrawal of approximately $44 million, while Bitcoin (BTC) ETFs saw an influx of around $506 million.”

Not so surprising!

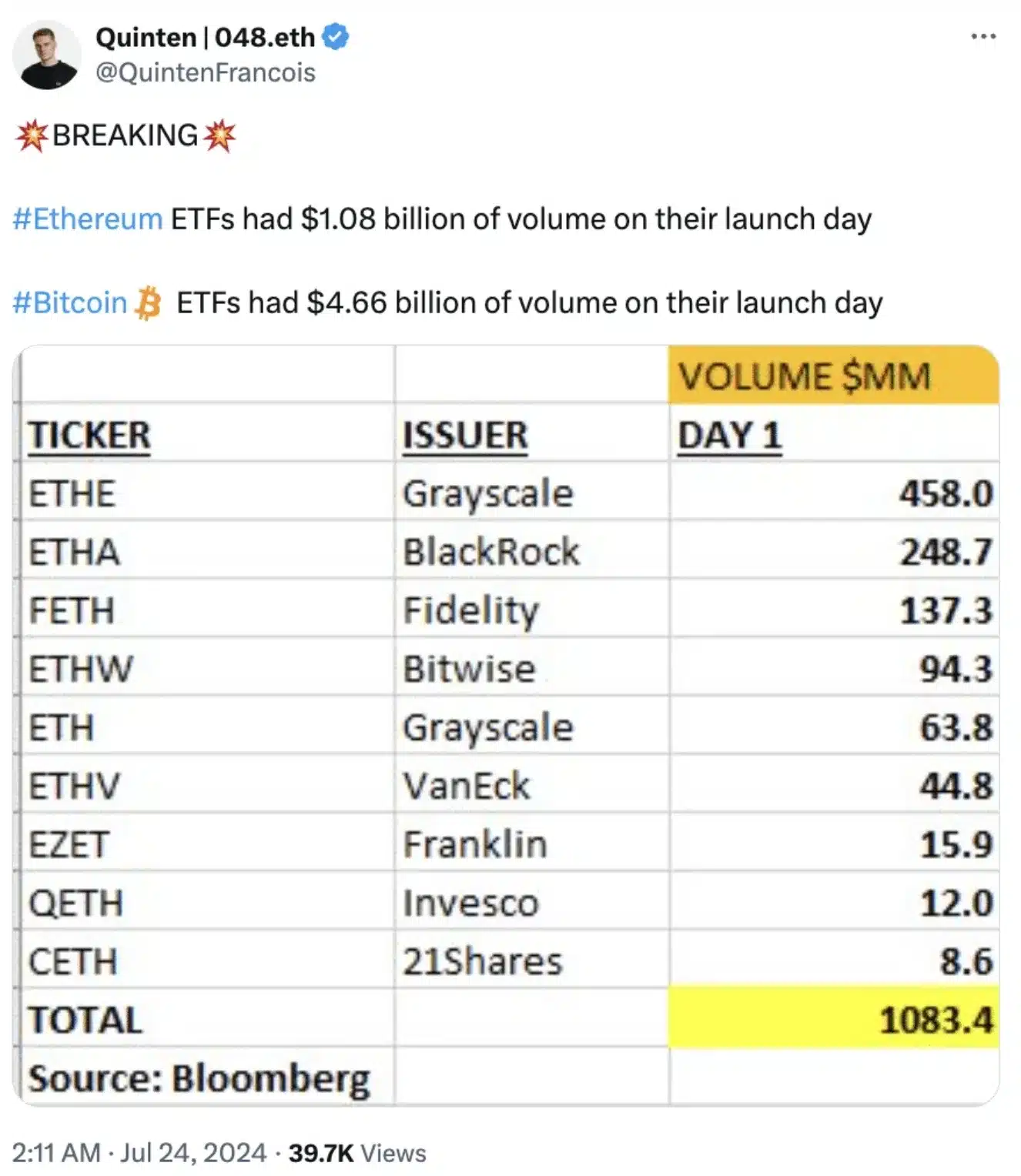

Yet, it’s not unexpected that the trading volumes for Ethereum ETFs were just a fourth of those experienced by spot Bitcoin ETFs during their initial days.

The introduction of Spot Bitcoin ETFs sparked great enthusiasm within the market, establishing a high benchmark that Ethereum ETFs haven’t been able to surpass as of now.

Initially, Bitcoin ETFs experienced high trading activity levels, but Ethereum ETFs have faced less engagement, suggesting a muted market reaction and implying that they haven’t sparked the same level of excitement as their counterparts.

Impact on the token’s prices

After the introduction of Bitcoin ETFs, Bitcoin surged to a record peak of $73,000 in March.

In contrast, Ethereum has faced challenges, struggling to surpass the $3K mark.

According to the most recent data from CoinMarketCap, Ethereum’s current price stands at approximately $2,735, which is below the projected $4,000 mark that was previously expected.

What’s behind this?

This difference might also be due to Bitcoin’s longstanding leadership and initial advantage, which has made it a favored option for numerous investors, thereby reinforcing its status as the go-to cryptocurrency.

Furthermore, Bitcoin’s highly acclaimed proof-of-work mechanism, considered the epitome of decentralization, adds to its allure when compared to other options such as Ethereum.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-27 00:40