-

Are we set to see a demand resurgence for ETH from Ethereum ETFs?

Sell pressure slows down but weak demand may fuel directional uncertainty.

As an analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of market swings and trends. While the recent positive net flows of Ethereum ETFs are certainly a promising sign, it’s important to remember that the road to recovery is rarely straightforward.

As an analyst, I’ve observed a bumpy and predictable beginning for Ethereum [ETH] ETFs, marked by significant withdrawals in the initial period. However, fresh data hints at potential shifts in this trend.

Fresh data shows that Ethereum ETFs experienced a surge of inflows for the first time within the past day, marking the first occasion of such activity in the previous nine days.

Previously, Exchange-Traded Fund (ETF) withdrawals mirrored the selling pressure seen in Ethereum’s market trends following its approval. Is it possible that this change could signal a path towards recuperation?

While an increase in positive Ethereum ETF investments might not automatically lead to a bullish market, Ethereum has shown signs of bullish recovery over the last five days in July.

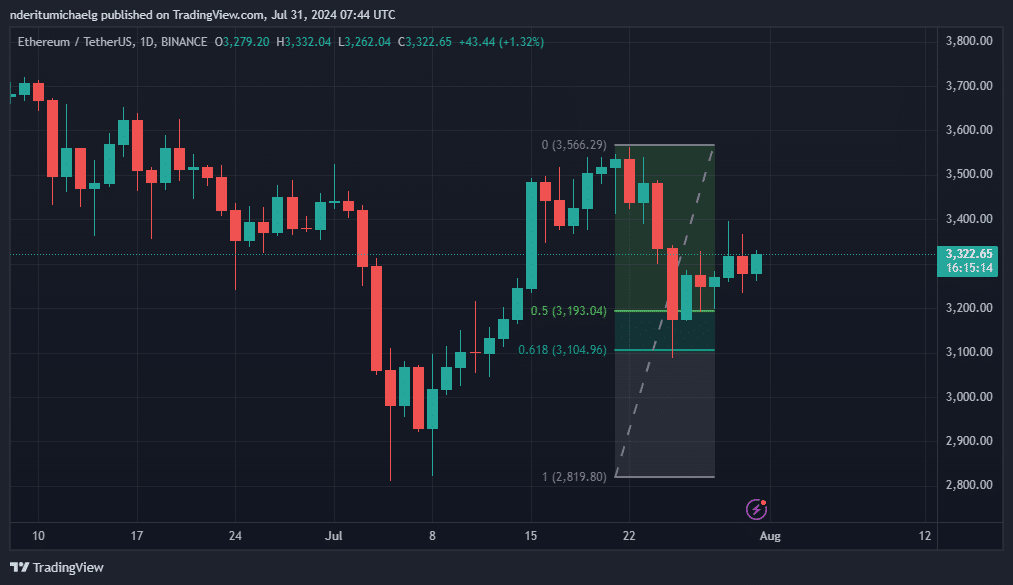

As I delve deeper into my analysis, one intriguing possibility I’m exploring is the re-accumulation at significant Fibonacci retracement levels. In the case of Ethereum, the recent downturn seems to have sparked a renewed interest among buyers within the range between the 0.5 and the 0.618 Fibonacci levels.

If continued purchasing persists for Ethereum’s ETH, the current increase (net positive inflows) might lead to further price growth. Yet, it’s essential to note that there are other elements affecting the movement of the ETH price as well.

The uptrend of Ethereum (ETH) might be further boosted by increased optimism, given that its 20-day Moving Average has surpassed its 50-day Moving Average. Typically, such a crossover is seen as a bullish signal.

Economic data from the Federal Open Market Committee (FOMC) and announcements about interest rates by the Federal Reserve (FED) could significantly affect the market’s supply and demand levels. For instance, if there is an expectation for rate cuts in the near future, this could positively influence investor sentiment, potentially encouraging ‘bullish’ attitudes among investors.

Assessing Ethereum ETFs influence on ETH’s on-chain data

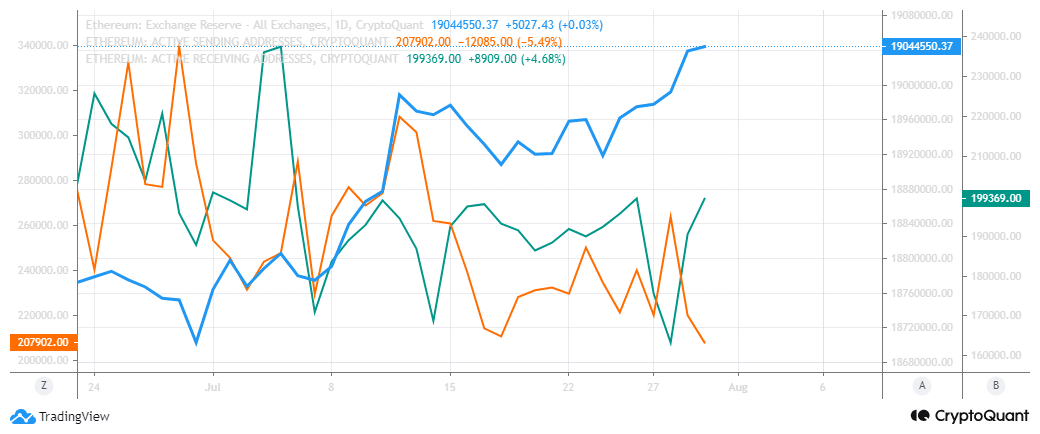

We explored Ethereum’s onchain data to determine the current state of demand. Exchange reserves grew by 341,374 ETH in the last four weeks, which may explain why its bulls have struggled during the same period.

There has also been an overall decline in active addresses.

During the period from July 28, we noticed an increase in the number of active receiving addresses, while there was a decrease in active sending addresses over the same timeframe. This pattern might suggest a renewed interest or demand in whatever is being transacted through these addresses.

Despite the fact that exchange reserves remain at their highest for the month, it suggests a low demand, as evidenced by the flow of exchanges. This observation is supported by the exchange movements.

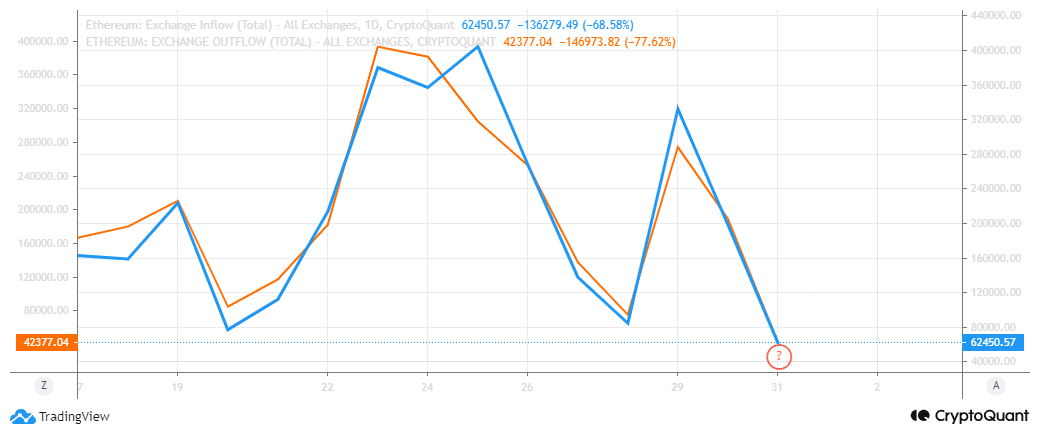

Over the past five days, I’ve noticed a decrease in the inflow of ETH to exchanges, which could be why selling pressure has eased up. Interestingly, there’s been a similar slowdown in the outflow of ETH from exchanges as well. This might suggest that investors are holding onto their crypto assets for now, rather than actively buying or selling.

Read Ethereum (ETH) Price Prediction 2024-25

A plausible explanation for the previous findings might be that the market is exhibiting signs of fear. Following the approval of ETFs, selling pressure could continue to drive prices down, and investors are holding off on making further moves until they see undeniable indications of a bear market’s exhaustion.

A renewed interest in Ethereum ETFs, along with a shift in exchange reserves, could serve as robust evidence supporting its growth.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-07-31 17:11