-

The final approval of ETH ETFs’ S-1s could happen in 2-3 months per analyst.

If so, will Grayscale ETH Trust bleed like GBTC?

As an experienced analyst, I’ve closely followed the regulatory developments surrounding Ethereum [ETH] ETFs and have taken note of Nate Geracci’s prediction that the SEC could approve S-1s within 2-3 months. If his estimation proves accurate, it would be a significant milestone for the crypto market.

Following the submission of Form 19b-4s for Ethereum [ETH] ETFs with the Securities and Exchange Commission (SEC), market analysts have been providing rough approximations regarding when the SEC might give its final approval to these S-1s (registration statements).

As a crypto investor following the latest developments closely, I’m keeping an eye on Nate Geracci, the insightful policy and market analyst at ETF Store. According to his predictions, we may see the S-1 approvals come through within the next 2-3 months.

“The SEC hasn’t announced a definitive timeline for approving spot Ethereum ETF registration statements. However, based on previous trends and industry speculation, I anticipate it could happen within the next few weeks, with a possibility of up to 2-3 months.”

As a savvy crypto investor, I anticipated that Geraci’s predictions about the SEC’s approval of the 19b-4s would be on point. However, I knew that many in the market were bracing for an SEC rejection on May 23rd. To my surprise, and perhaps to the frustration of some, Geraci’s analysis proved correct when the SEC slowly processed the S-1s instead.

So, his projection can’t be merely overruled or overlooked.

The analyst added that ‘heavy lifting already done following spot BTC ETFs & eth futures ETFs.’

Eric Balchunas, an ETF analyst at Bloomberg, agreed with Geraci’s prediction and identified July as a likely month for the approval process to be completed.

“July 4th feels like a good over/under’

Ethereum ETG: Will Grayscale bleed out again?

Should the news be verified, the attention of market analysts is likely to shift towards Grayscale’s Ethereum Trust (ETHE). They will closely watch if ETHE will experience outflows similar to those seen in Grayscale Bitcoin Trust (GBTC) following the approval of a spot Bitcoin [BTC] Exchange-Traded Fund (ETF) in January.

In January alone, GBTC recorded $6.5 billion in outflows, per a recent Kaiko insights report.

If the current trend persists with Grayscale’s ETHE, we can expect more disgruntled investors to withdraw their shares, leading to increased outflows.

Based on current assets under management of $11 billion for ETHE, Kaiko predicts an average daily outflow of approximately $110 million if this investment product experiences similar redemptions as GBTC.

If the outflows from ETHE continue at a comparable rate, it would equate to approximately $110 million in daily outflows on average. This represents around 30% of Ethereum’s typical daily trading volume on Coinbase.

Previously, cryptocurrency analyst James Van Straten expressed skepticism about the likelihood of significant withdrawals from the Grayscale Ethereum Trust (ETHE). He believed that Grayscale’s low-cost Ethereum Mini Trust ($ETH) might help mitigate any potential outflows.

I’m undecided about potential outflows for $ETHE if it follows the trend of $GBTC. However, the launch of a smaller fees mini trust for $ETH could occur simultaneously, making things easier for investors as they wouldn’t need to take any action – unlike with $GBTC.

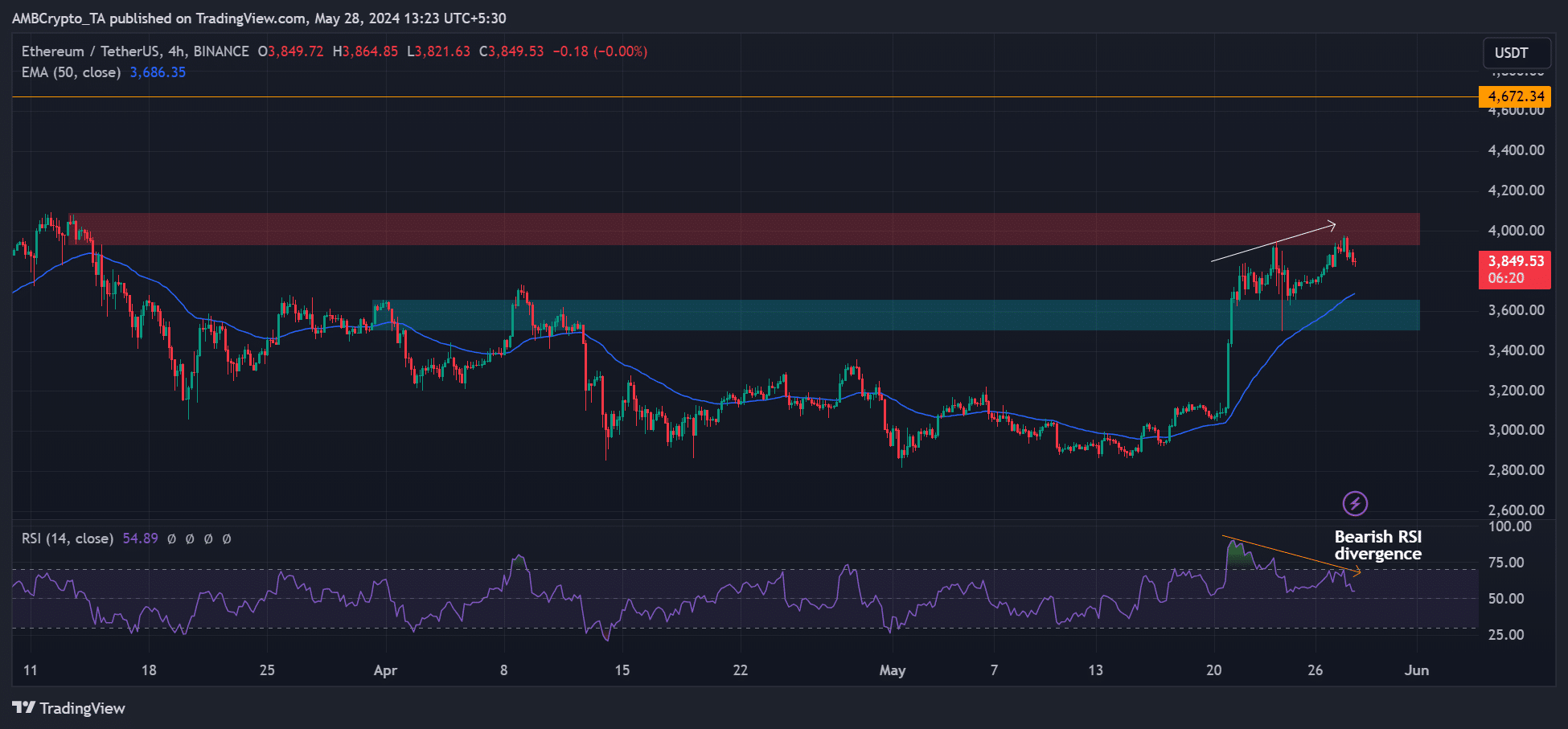

During this period, there emerged a bearish RSI divergence on the ETH 4-hour chart. This signified that while the price was recording higher peaks, the RSI was registering lower peaks instead.

Typically, such a divergence leads to price pullback.

Ether (ETH) may retreat towards its 50-day moving average, around $3,680 (represented by the blue line), or revisit its previous dwelling and potential support level at approximately $3,600 (marked in cyan). Following this, it could potentially bounce back to encounter resistance and the daily bearish congestion area around $4,000 (denoted by the red mark).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-28 15:35