Ah, the winds of fortune seem to have shifted, and what a delightful spectacle it is! The President of the United States, perhaps tired of watching the world spin in its usual, dreary way, has decided to pause tariffs for 90 days. And lo and behold, what happens? The cryptocurrency market, like a fragile bird that suddenly finds its wings, takes flight—none more so than Ethereum (ETH). A soaring 13% rise in price, as if the very heavens themselves have opened up and offered a moment of grace. Such a moment comes after a long, agonizing spell of nothing but descent into the murky depths of despair.

Ethereum (ETH) Current Price Momentum

And now, here we stand—at $1,670, my dear reader, in the wondrous realm of “Ethereum’s Current Price Momentum.” A 13% surge in the past 24 hours, a mere flicker of hope in this pitifully cynical world. The trading volume, that grand indicator of the pulse of the market, has swelled to a staggering 85%. It seems as though, after a long period of torpor, the traders and investors have suddenly remembered the sweet taste of potential profits. But, of course, they are only drawn to the feast when the beast begins to stir from its slumber.

Ethereum Technical Analysis and Upcoming Levels

It would seem that Ethereum’s weary, downcast spirit has momentarily risen from the abyss. We are told by the so-called “experts”—those sages of the digital marketplace—that the price surge has arrested the cruel, unrelenting decline. A bullish engulfing candlestick, yes, a pattern of such magnificence, formed at the sacred support level of $1,440. A signal! A glimmer of hope! If the heavens do not intervene, we may yet see a rise—a bold, perhaps even reckless rise—of 11%, bringing Ethereum to the grandiose $1,850 level in the days ahead. Surely, the traders shall be dancing in the streets, for they are ever the optimists, or so they claim!

But do not let your hopes get too high, my friends, for Ethereum remains in the clutches of the 200-day Exponential Moving Average (EMA), a vile instrument that signals the persistence of the downtrend. Oh yes, let us not forget that even as we speak of lofty ascensions, the cryptic world of digital currency still holds the downward forces in its grip. Yet, for now, let us cling to our brief moment of optimism—who knows what may happen next?

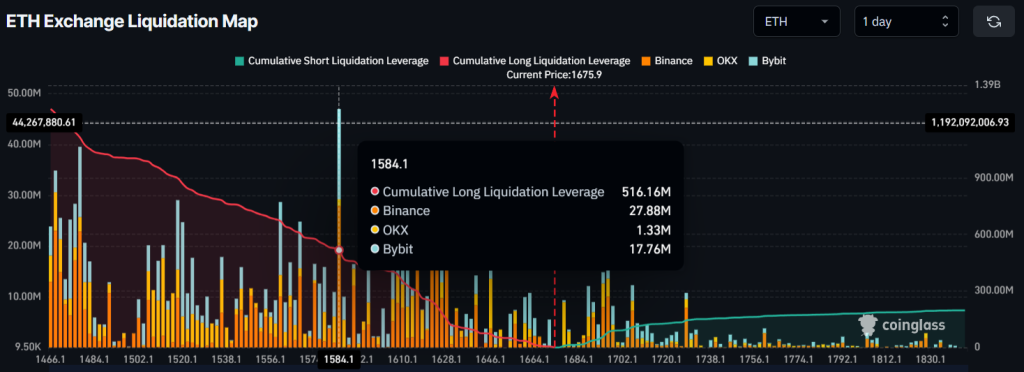

Traders, ever the gamblers, are betting feverishly on the bull, for they see a glimmer of fortune where others see only darkness. According to Coinglass, a firm specializing in on-chain analytics (those trusted oracles of our time), the sentiment is overwhelmingly bullish. And why wouldn’t it be? The market has shown a temporary surge, and traders, with their insatiable hunger for profit, are indulging. A $516 million worth of bullish bets are currently placed. Ah, the reckless abandon of human nature!

Traders’ $516 Million Worth of Bullish Bet

The long/short ratio stands at 1.03. A meager number, perhaps, but still, it suggests that optimism reigns supreme. Long positions are dominant, my dear friend. Traders have built a fortress of $516 million worth of long positions, while only a mere $80 million worth of short positions dare to challenge them. The odds are clear, or so it seems—but history has a way of defying the obvious.

And so we come to the end of our journey, but do not despair, for the road ahead is as uncertain as ever. With $516 million in long bets, Ethereum stands at the precipice of a great leap—or a great fall. The traders dominate, confident in their future riches, but perhaps, just perhaps, they are chasing a mirage. Who can say what tomorrow holds? Certainly not I, nor any of us. But this is the thrill, the madness, the very essence of the market. And in that, there is a strange beauty.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-10 00:39