-

ETH’s RSI formed a bullish divergence on the daily timeframe

53.88% of top traders now hold long positions, while 46.12% hold short positions

As a seasoned analyst with years of experience navigating the tumultuous waters of the crypto market, I find myself standing at a crossroads with Ethereum (ETH). On one hand, we have the bearish dumping spree by institutions, pushing ETH prices down and filling my heart with dread. Yet on the other, there’s a silver lining in the form of bullish technical indicators that are whispering sweet nothings into my ear.

Given the downward trend in the market, it’s clear that large investors such as institutions and ‘whales’ are consistently selling Ethereum (ETH), the second-largest cryptocurrency globally. This selling pressure has led to significant decreases in its value, as evident on price charts.

Indeed, as indicated in a recent post on X (formerly known as Twitter), these institutions transferred a substantial amount of approximately 55,035 Ether, equivalent to around $123 million USD, to Binance during the busy Asian trading period.

Institutions offload millions worth of ETH

The analysis conducted on the blockchain platform unveiled that the participating entities were Wintermute, a prominent algorithmic trading company, and Metalpha, a specialized digital asset management service.

In a span of merely two hours, they collectively sold off approximately 46,947 ETH valued at around $104.74 million and 8,088.8 ETH worth roughly $18.05 million. This substantial sell-off could potentially influence the price trend of Ethereum.

Potential reason behind the recent dump

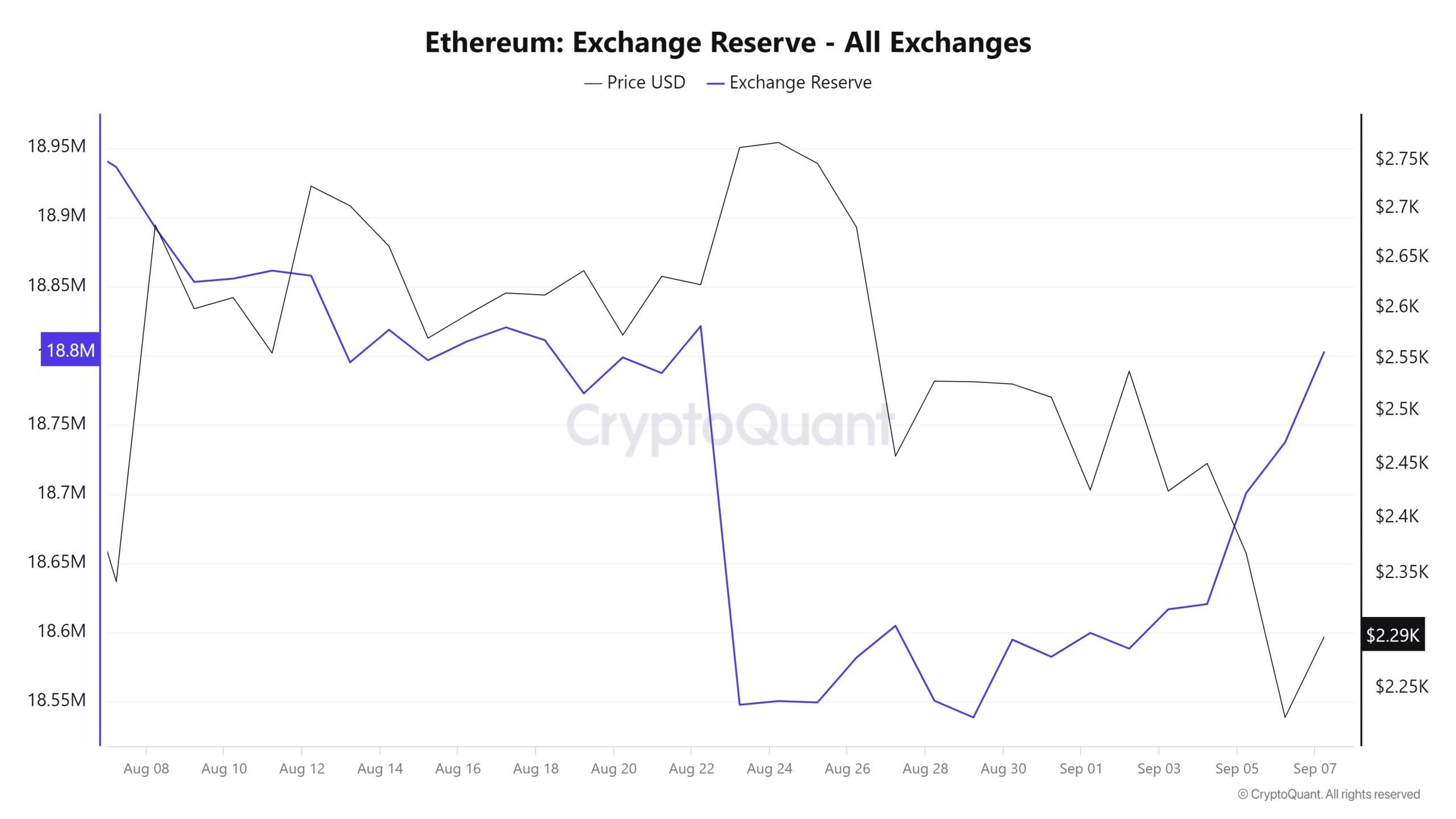

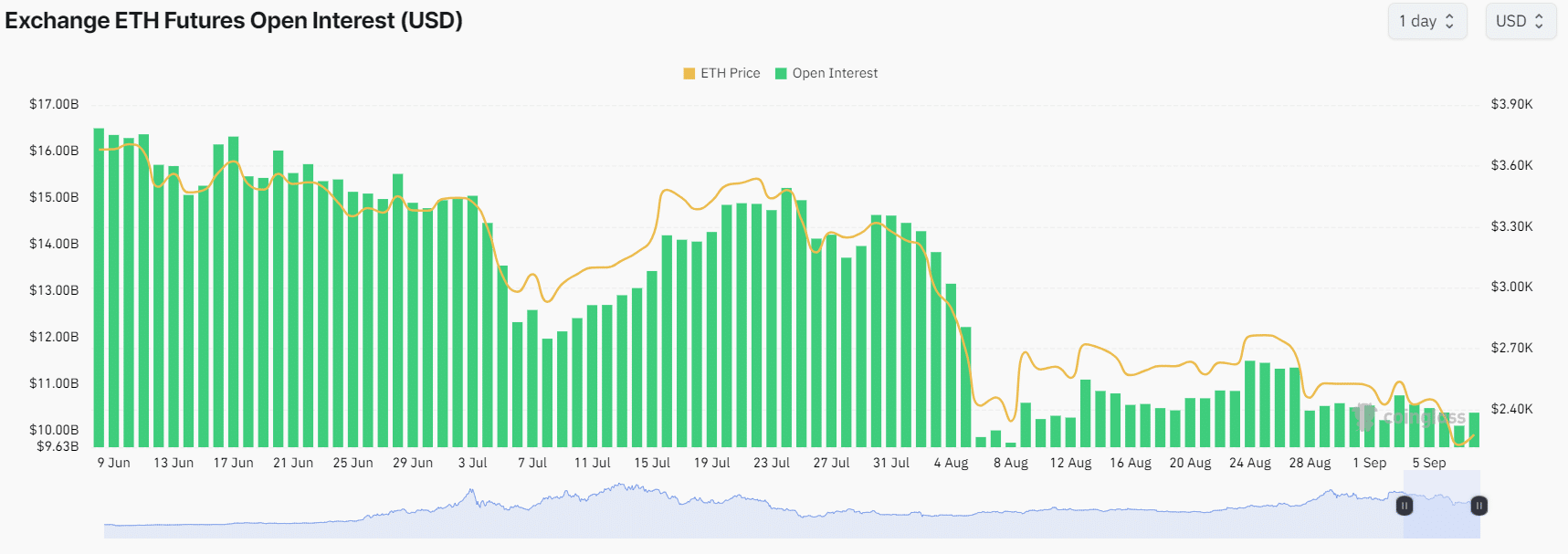

“The main causes for this decline might stem from the prolonged pessimistic feeling in the market, the continued increase in Ethereum’s exchange reserve levels, and a decrease in Futures Open Interest for the past three months straight.

As a researcher examining data from CryptoQuant, I’ve observed an interesting trend: Ethereum exchange reserves have been consistently increasing since the 28th of August. This upward trajectory could suggest that large investors, institutional entities, or even whales are transferring their Ether holdings to exchanges, potentially preparing for a mass sell-off.

The open interest for CoinGlass’s futures exchange has consistently decreased, suggesting either the closing out of long positions or the end of futures contracts without any new positions being created.

As a seasoned crypto investor, I can’t help but notice a pattern. Historically, September has been seen as a challenging month for digital currencies, with potential downturns or corrections in price. However, this period often seems to set the stage for an impressive surge in value come October.

Ethereum technical analysis and key levels

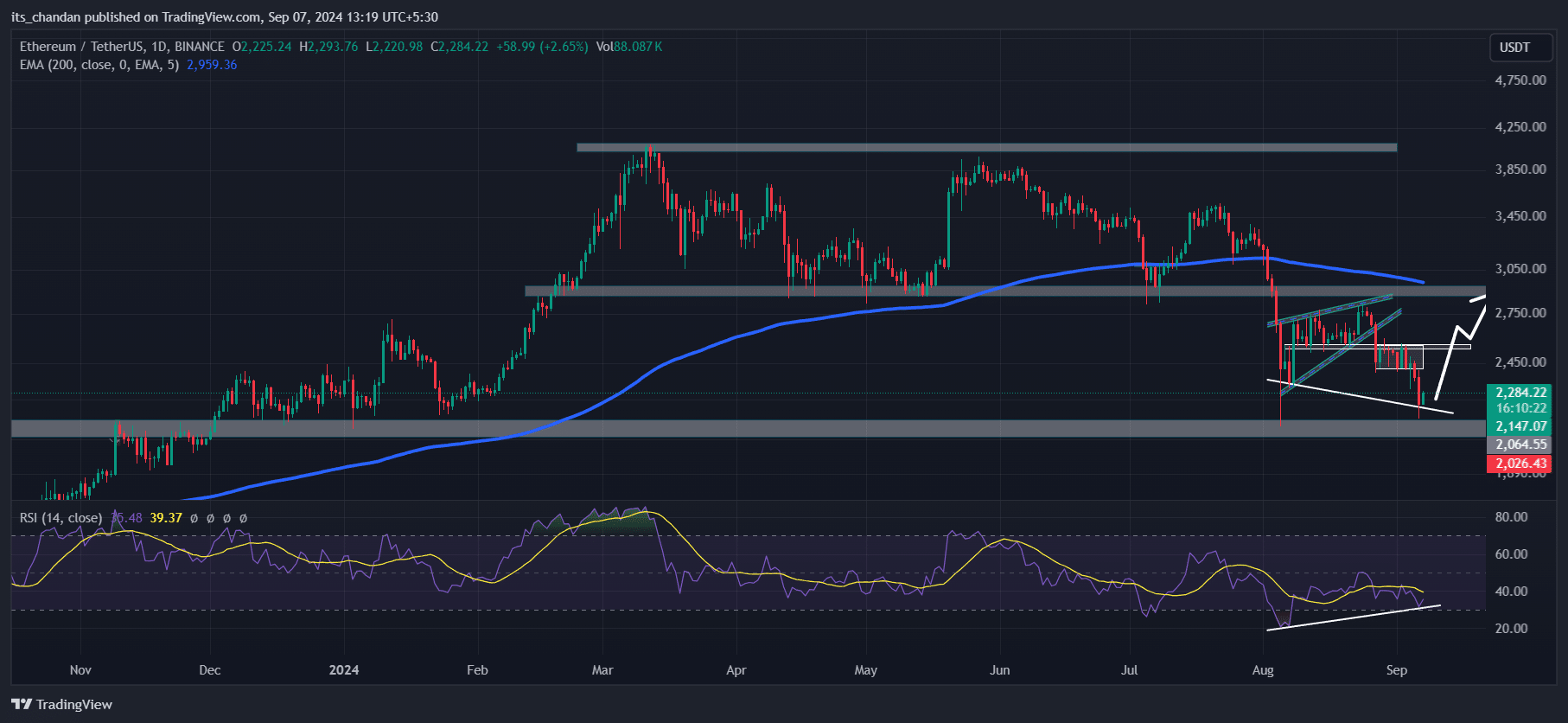

Based on an examination of its price history, Ethereum recently tested a vital support point of approximately $2,140. This particular level has demonstrated significant strength in holding up the value of ETH since the end of 2023.

On the daily chart, ETH‘s Relative Strength Index (RSI) showed a bullish divergence, suggesting a potential shift in the trend from bearish to bullish.

Due to the latest test of ETH‘s support levels and the emergence of a bullish divergence, it seems quite likely that Ethereum’s price might surge by around 25% to 30%, potentially reaching $2,500 or even $2,550.

Bullish outlook by on-chain metrics

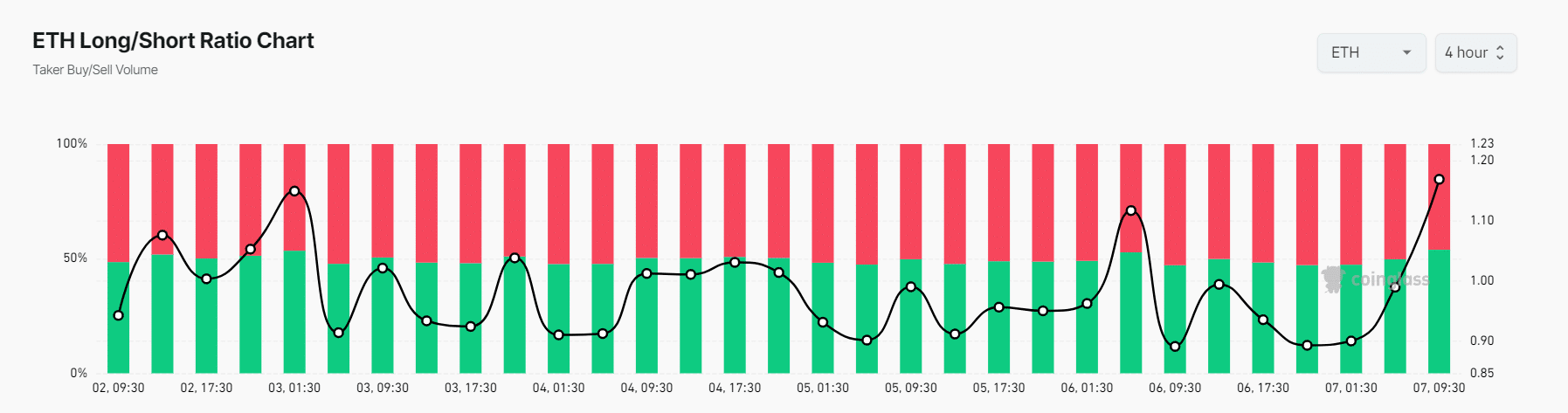

On the shorter timeframe, ETH had some bullish indicators too.

In simpler terms, the long/short ratio of CoinGlass’s Ethereum (ETH) was showing a positive outlook. At the moment of reporting, this ratio on a four-hour scale was 1.168, suggesting a bullish trend. A value greater than 1 usually signals optimism in the market.

The data also revealed that while 53.88% of top traders held long positions, 46.12% held short positions.

During this time frame, the total value of open ETH Futures contracts also rose by 1.80%, indicating a surge in trader activity. As ETH approached its robust support zone, it underscored the involvement of these participants.

Ethereum’s price performance

As I write this, Ethereum (ETH) is hovering around the $2,280 mark, having experienced a 2% drop over the past 24 hours.

During this timeframe, the trading volume nearly doubled (approaching 100% increase), suggesting greater involvement from traders and investors, implying a more active market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-07 20:08