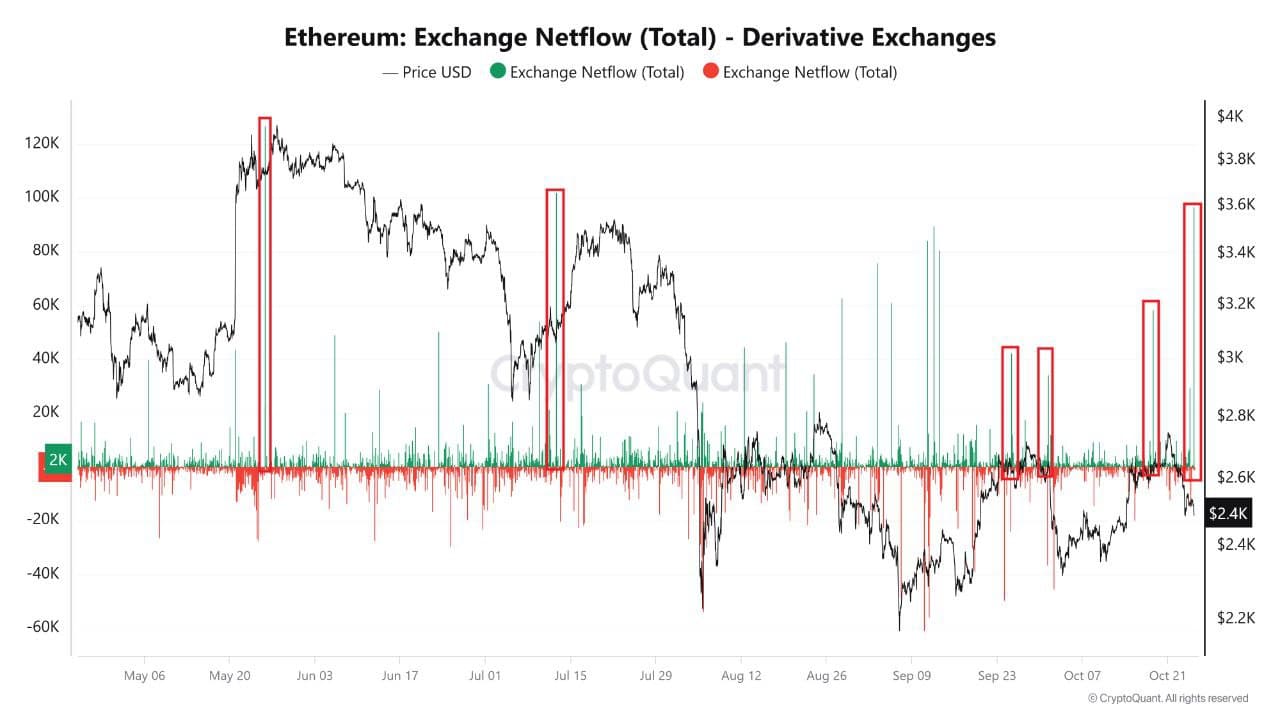

- The markets saw an influx in Ethereum into derivative exchanges.

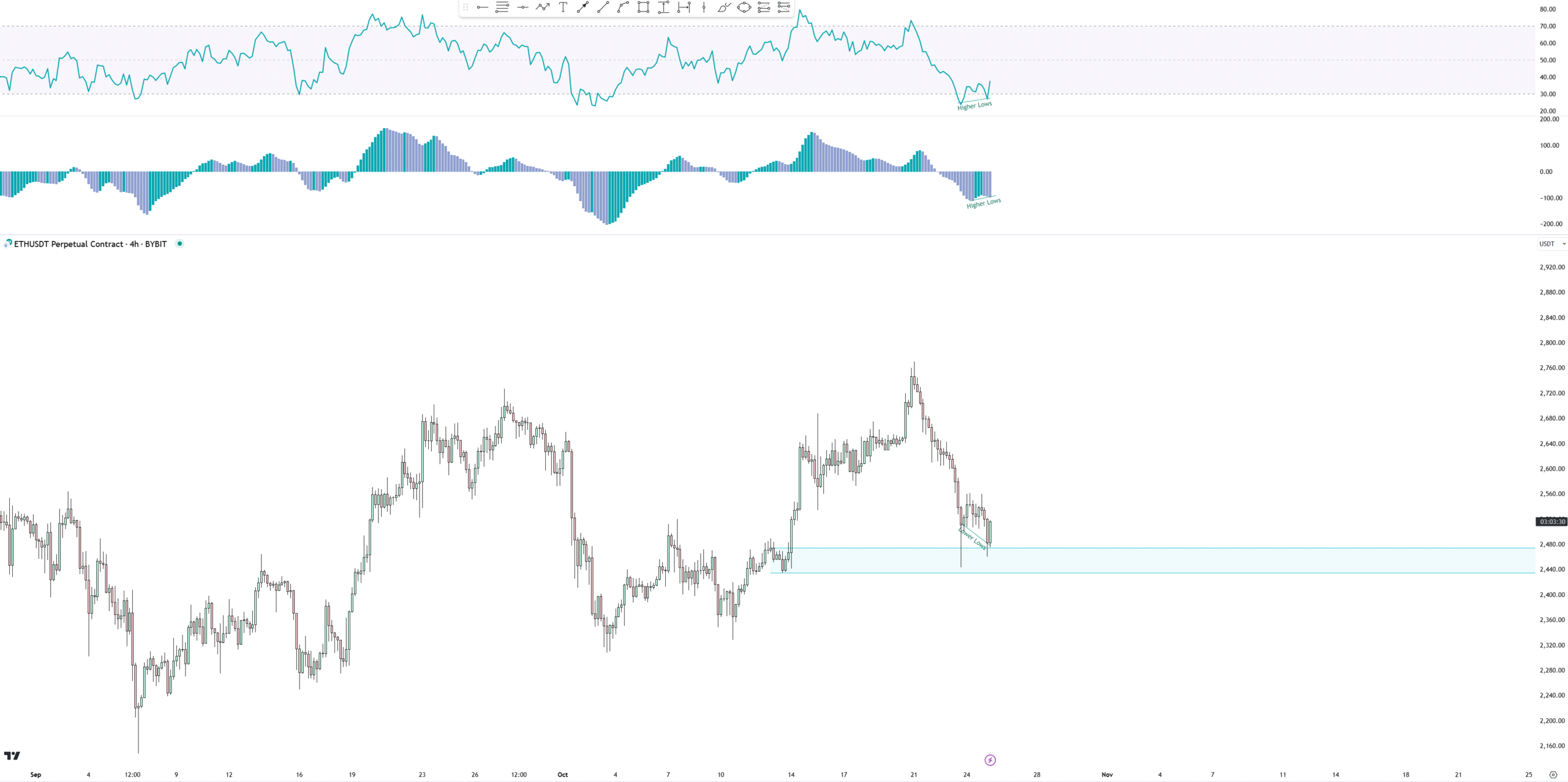

- Recent charts showed a possible 4-hour bullish divergence on ETH.

As a seasoned researcher with years of experience in the crypto market, I have witnessed numerous cycles and trends that have shaped my perspective on Ethereum [ETH]. The recent surge of 96,000 ETH into derivative exchanges has piqued my interest, given its historical implications.

It’s been noted that Ethereum (ETH), a significant digital currency, has become a topic of interest lately. The increase of around 96000 ETH moving into derivatives trading platforms suggests a significant uptick in market action.

Previously, comparable influxes have often resulted in fluctuations or declines in ETH prices, as demonstrated by the instances in May and July of this year. This surge might indicate an impending price adjustment or potentially lay the groundwork for a significant change in the market dynamics.

In the waning days of the year, I find myself observing with keen interest the potential trajectory of Ethereum’s performance. It seems that Ethereum could mirror Bitcoin‘s recent surge, which emerged following a lengthy period of consolidation. This breakout has sparked a wave of optimism throughout the crypto market.

U.S. elections accompanied by a divergence signal

In prior United States electoral periods, Ethereum’s market behavior has followed a similar pattern. In the 2020 elections, Ethereum experienced a significant increase, bursting free from its period of stability.

With the elections now just days away, a similar pattern could occur.

If past trends persist, there’s a possibility that the value of Ethereum could recover, especially considering the optimistic outlook for cryptocurrency regulation under potential shifts within the U.S. government.

Nevertheless, this result is still tentative because the global economic and cryptocurrency climate has significantly changed since 2020.

Indicating a potential increase in ETH value, the latest charts suggest a bullish divergence over a 4-hour period. This pattern could be an indication of growing demand and a change in market trend.

Despite its unconventional shape, Ethereum’s responses suggested resilience.

The structure clearly showed two distinct branches, forming an elegant arch shape, suggesting a favorable perspective.

The majority of the negative change occurred during the initial phase of this pattern, usually indicating reduced selling pressure for the subsequent phase.

Yet, analysts urged caution and recommended that traders hold off on making moves until they see a robust “green candle” (a bullish candlestick pattern) which clearly signals a reversal, as this might not necessarily overturn the current bearish perspective.

ETH/BTC testing its 2016 highs

In a fresh update, the value of Ethereum has reached prices last seen in 2016 compared to Bitcoin. At present, Ethereum’s trade is occurring beneath a prolonged downward sloping trendline, often referred to as a falling wedge pattern, which serves as a significant level of support in longer timeframes.

As a crypto investor, I’m keeping a close eye on Ethereum (ETH) and its potential to adjust further relative to Bitcoin (BTC). If ETH fails to surpass its current level, it might continue its correction trend.

Even though Ethereum has proven robust in the current market, investors’ enthusiasm hasn’t picked up significantly, which leaves the potential direction of its price undetermined.

If ETH takes this backing into account, it might spark new investor attention, possibly leading to a significant change in the market as early as the remainder of this year or even the beginning of the next.

Read Ethereum’s [ETH] Price Prediction 2024–2025

However, until ETH confirms a breakout, a cautious outlook remains prudent for investors.

As substantial influxes, tendencies typical during elections, and a potential bullish discrepancy stoked optimism for an upward trend, Ethereum needs to surmount crucial barriers of resistance when compared to Bitcoin.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-27 09:12