-

Ethereum has failed to hold levels above $2,800, with the recent uptrend showing signs of weakening.

Despite the exchange-supply ratio at record lows, ETH price continues to struggle.

As a seasoned crypto investor who has weathered numerous market cycles, I find myself cautiously optimistic about Ethereum [ETH]. While it’s heartening to see the exchange reserves at record lows and increased open interest, the recent price action is concerning. The failure to hold levels above $2,800 and the weakening uptrend are bearish signals that I can’t ignore.

On August 24th, Ethereum [ETH] surged to a high not seen for weeks and exceeding $2,800, as the overall cryptocurrency market experienced an upswing. However, ETH has since slightly dipped by 0.6% over the last 24 hours, currently trading at approximately $2,742.

Data from Whale Alert showed that some large ETH holders might be looking to cash in profits after one whale recently moved $34 million worth of ETH to Coinbase.

With the recent uptrend showing signs of weakening, where is ETH headed next?

Bearish signals emerge

At the moment of reporting, I’ve noticed a significant decrease of approximately 18% in Ethereum trading volumes according to CoinMarketCap data. This decline seems to align with a minor price drop, suggesting that fewer buyers are currently backing the uptrend.

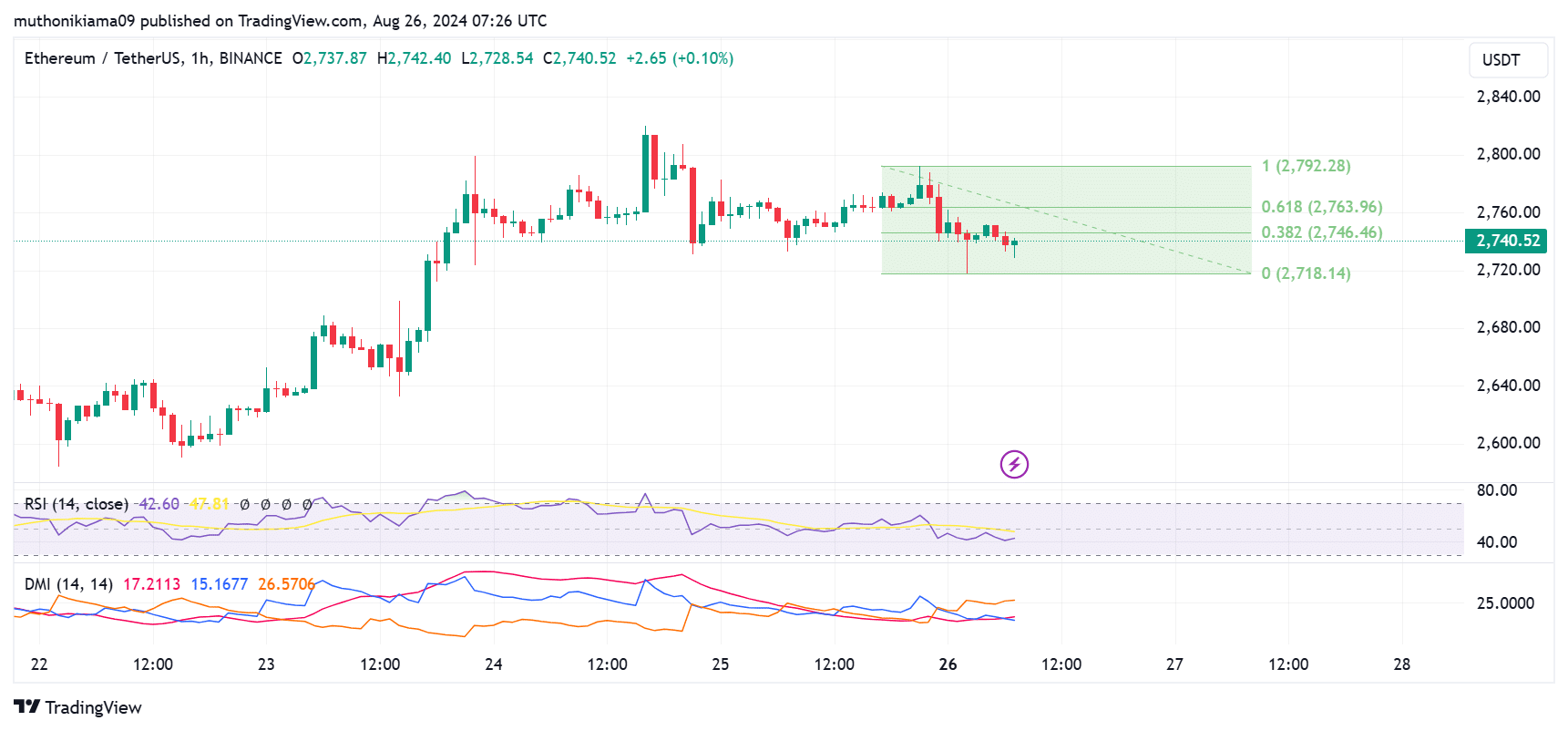

In simpler terms, when the Relative Strength Index (RSI) is at 42, it suggests that more sellers are active in the market compared to buyers. Additionally, the RSI line has been creating lower valleys on the hourly chart, indicating a weakening upward trend.

With the RSI line crossing below the signal line, it confirms a prevailing bearish momentum.

In simpler terms, the Directional Movement Indicators (DMI) suggest that the market is currently being dominated by bears. The +DI line, which is colored blue, is positioned below the -DI line, which is orange, indicating a downward trend. However, the Average Directional Index (ADX), represented by the red line, is at 14, suggesting that the bearish trend is not particularly strong or significant.

If the downward trend continues, Ethereum (ETH) might fall even more to reach its 0% Fibonacci level, which is approximately $2,718. Should it fail to maintain this price point, there’s a possibility of additional decreases following.

Exchange reserves continue to drop

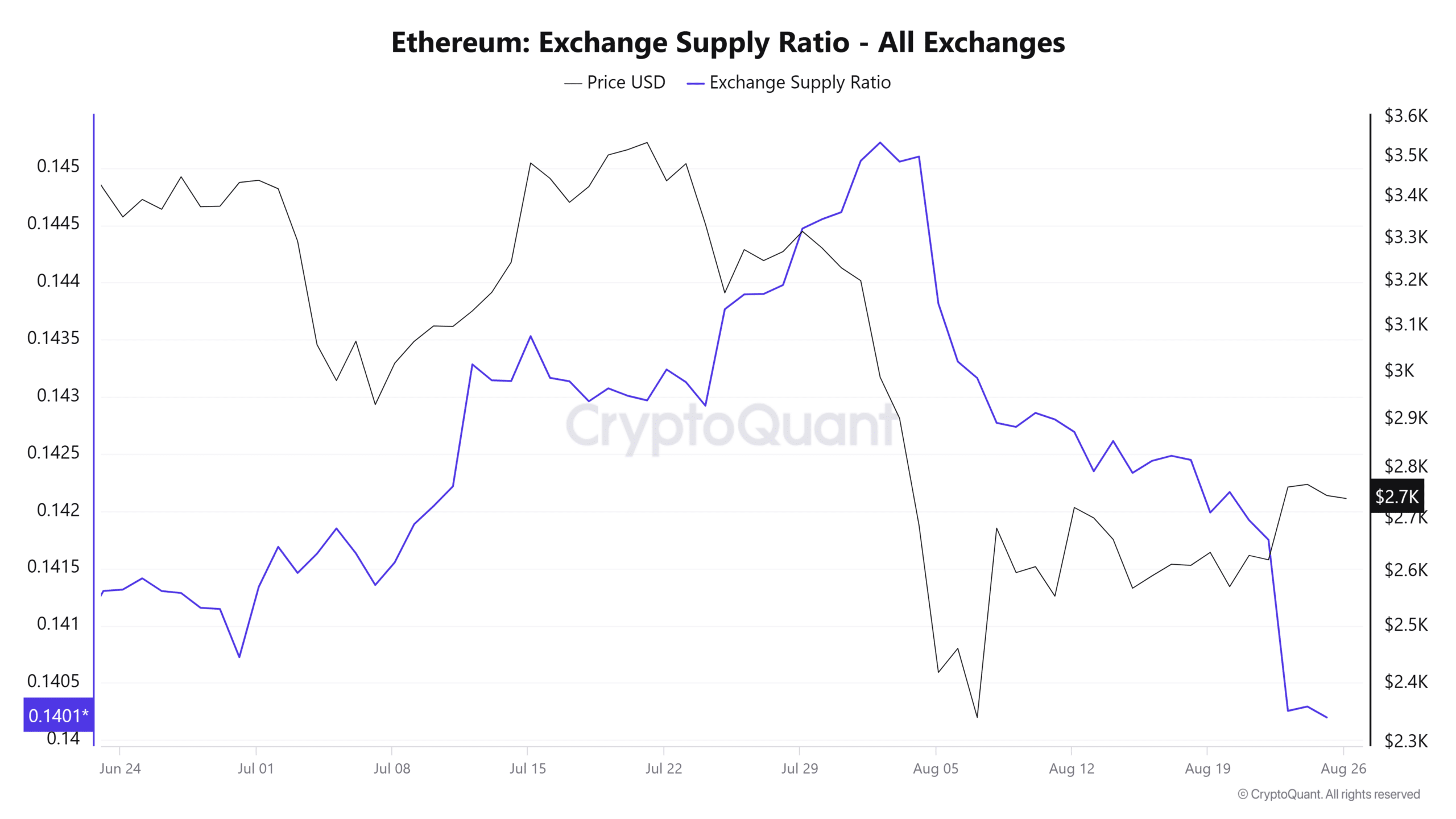

As an analyst, I’ve observed a significant decrease in Ethereum exchange reserves, reaching all-time lows, following a surge on the 5th of August coinciding with the price plunge.

A low amount of Ethereum being held on exchanges implies that fewer investors are prepared for quick sales, thereby decreasing immediate selling pressure and lowering the chances of Ethereum experiencing significant price declines in the short term.

This month, the ratio of Ethereum exchange supply has significantly decreased, indicating that traders are less eager to offload their Ethereum holdings at present prices.

Increased investor interest in ETH can further be seen in the rising open interest.

Read Ethereum (ETH) Price Prediction 2024-25

As a researcher, I’ve noticed an intriguing trend with Ethereum’s open interest: After dipping below $10 billion in early August, as I’m writing this, it has surged to over $11.5 billion according to Coinglass data.

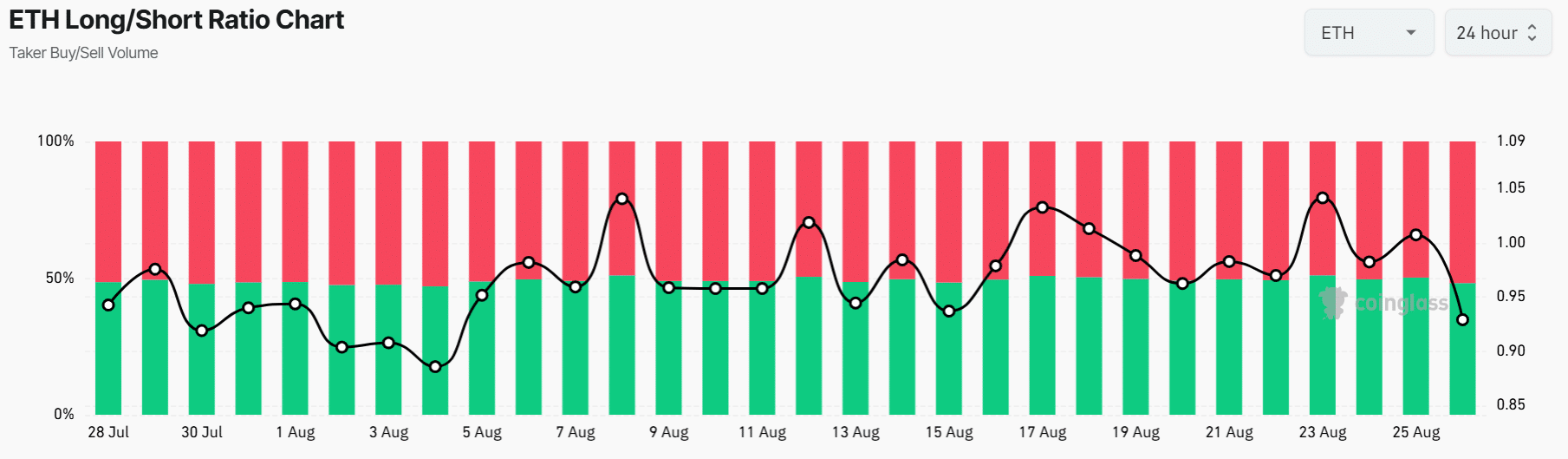

On the other hand, since the long/short ratio stands at 0.92, it indicates that more traders are betting on ETH‘s price decrease by opening short positions.

Read More

2024-08-26 15:03