-

ETH reserves spiked by over 100,000 in the last 24 hours alone

On the price charts, the altcoin climbed to over $2,400

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of spikes and dips. The recent surge in Ethereum exchange reserves caught my attention, as it often signals potential selling pressure. However, the positive netflows and the fact that ETH closed on a positive note suggest that buyers are still active and eager to absorb any incoming supply.

During its most recent trading day, Ethereum‘s price exhibited a considerable shift, however, the noteworthy event was the surge in exchange reserves for Ethereum. In other words, there seemed to be an increase in Ethereum being transferred to exchanges, which could suggest that some owners may be preparing to offload their ETH.

Instead, an analysis of the netflow data indicated that buyers were able to match the influx of supply with sufficient demand, thereby maintaining equilibrium. This balance between buying and selling activities contributed to ETH ending the trading period on an optimistic note.

Ethereum reserves spike

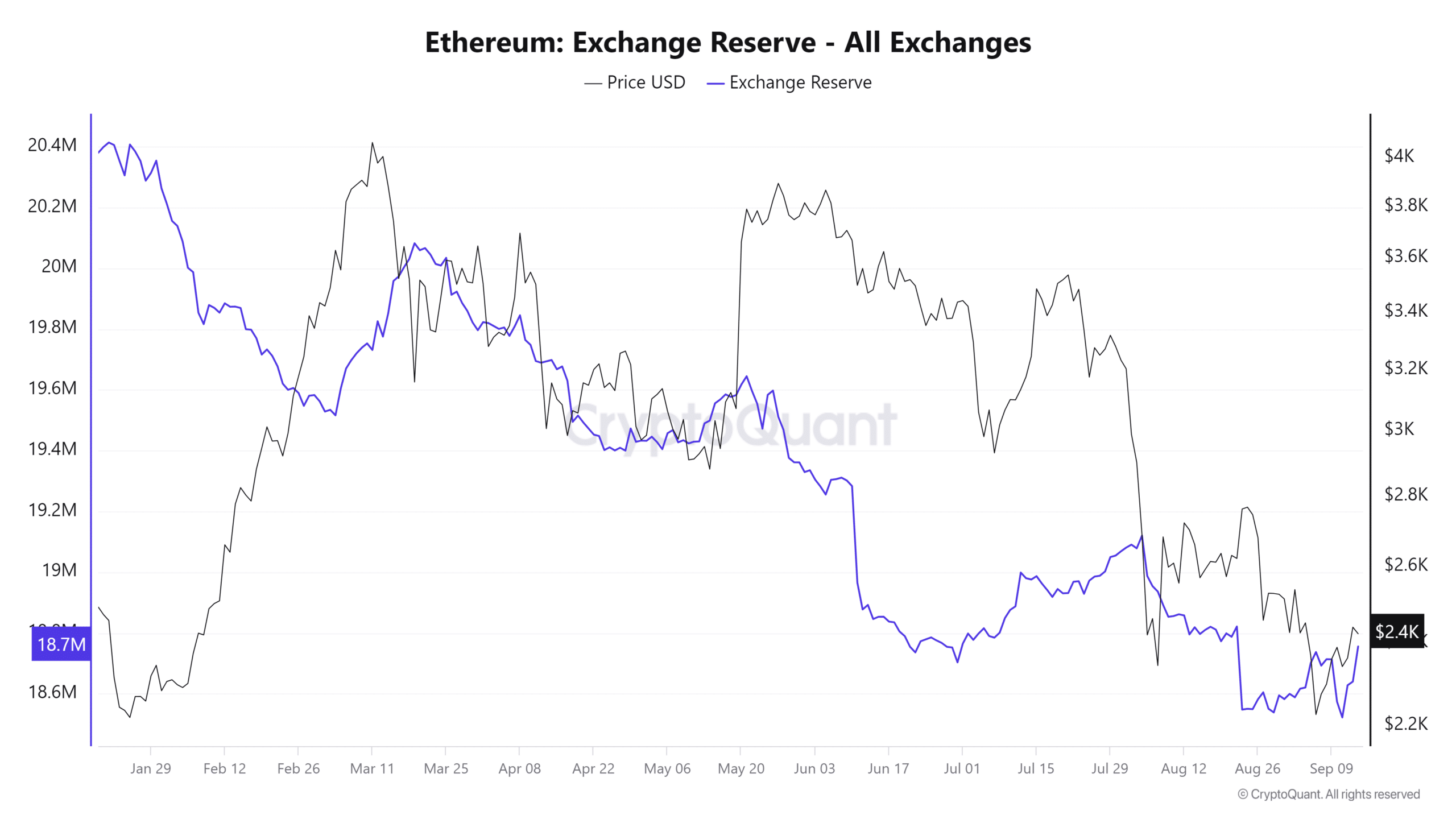

Over the past day, there’s been a substantial increase in the Ethereum holdings on the CryptoQuant exchange as per an examination conducted.

On September 13th, the amount of ETH held in reserve was roughly 18.6 million. Since then, it has risen to around 18.755 million, representing an increase of more than 100,000 ETH within a single day. This is the first significant boost in the exchange reserves’ volume in nearly a month.

It also indicates that more traders have moved their ETH to exchanges over the aforementioned period.

As an analyst, I often observe a surge in asset movement towards exchanges, which typically indicates that traders are readying themselves to offload their holdings. This could be due to the current price trend encouraging them to cash in on recent profits they’ve made.

As a crypto investor, I can’t help but notice the impact of their actions on the Ethereum market. These decisions seem to have stirred the price volatility, intensifying the short-term strain on Ethereum.

ETH pulls near its neutral line

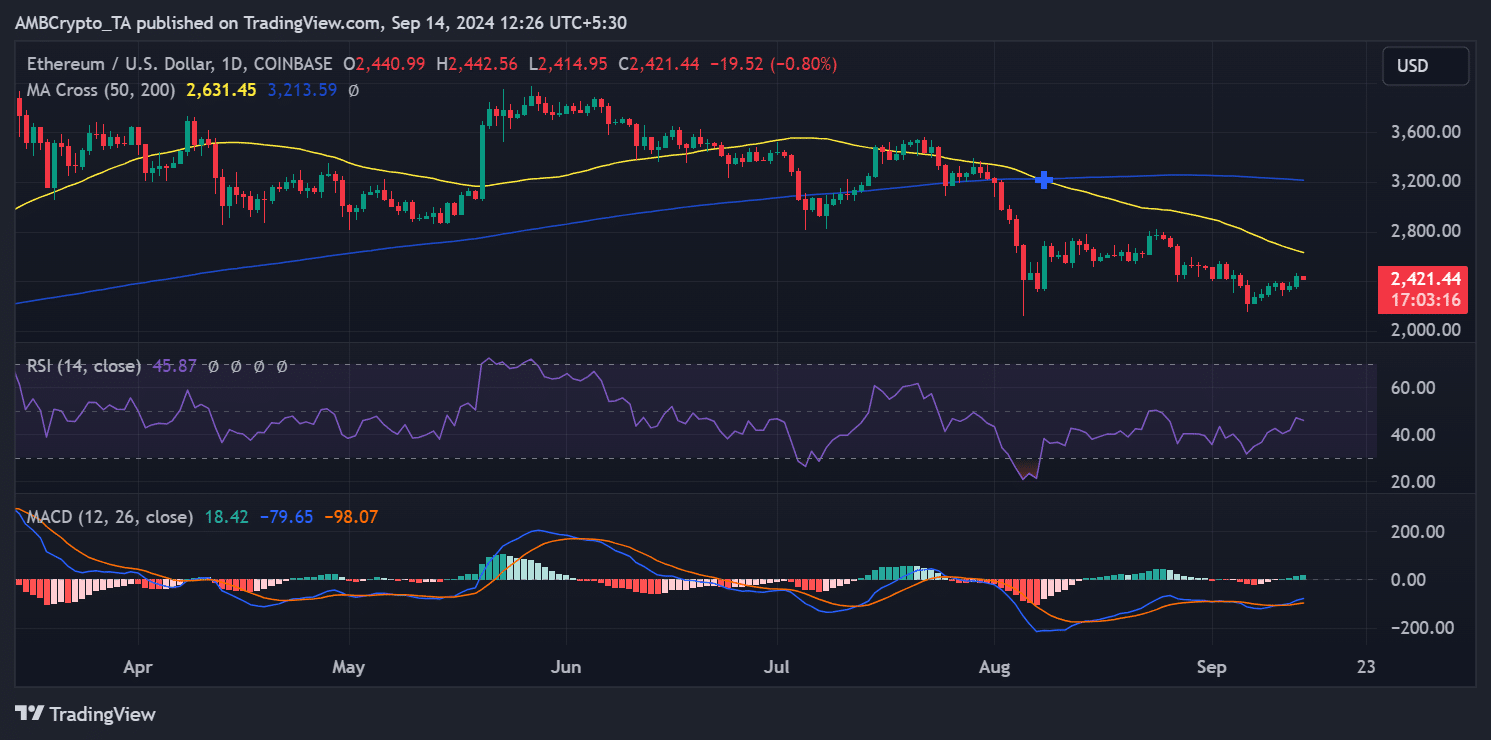

An analysis of Ethereum’s daily price trend from the last trading session revealed a significant upward move.

During today’s trading session, Ethereum (ETH) started off at approximately $2,361 and ended around $2,440, representing an increase of more than 3%. This upward trend was significant because it was ETH’s first return to the $2,400 price point in over a week.

It seems reasonable to assume that the increase in prices led traders to move their Ethereum (ETH) to exchanges, possibly in anticipation of making a profit, which resulted in an upsurge in exchange reserves.

Conversely, the increase in price indicates a greater number of buyers compared to sellers, which offset the flow of ETH into exchanges. The heightened demand managed to counteract the selling pressure, resulting in a favorable close for the price.

In spite of the current situation, the Relative Strength Index (RSI) stayed close to the centerline, suggesting a more prominent downward trend. As I write this, Ethereum had partially reversed its gains from the last session and was being traded at approximately $2,420.

This suggests a temporary dip after an uptrend, but Ethereum’s resistance close to the $2,400 mark might indicate potential bullish energy in the short term, provided buyers maintain their activity.

Ethereum netflows flash positive, but…

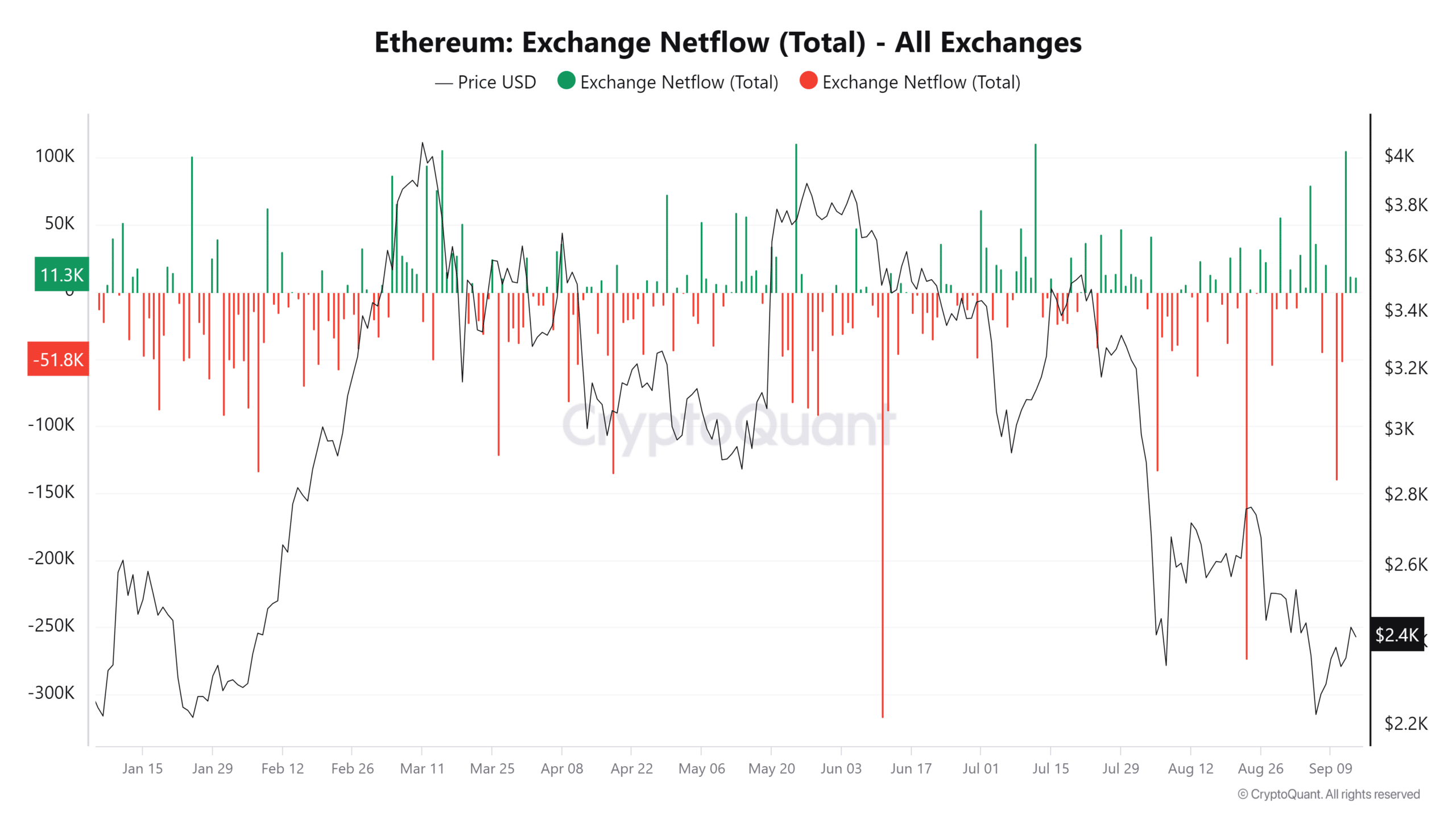

During my recent examination into Ethereum’s transactional trends from the previous trading day, I observed a significant influx. As reported by CryptoQuant, this inflow amounted to more than 12,000 Ether, suggesting a general increase in interest and accumulation of the cryptocurrency.

A higher influx of ETH into exchanges (net inflows) indicates that more traders are selling their Ethereum. Yet, despite a substantial increase in exchange reserves, these outflows may seem modest.

Upon scrutinizing the data, I discovered a noteworthy trend: while there was an uptick in Ethereum (ETH) deposits, the rate of withdrawals was comparably high. This suggests that exchanges experienced a relatively even flow of funds, with sellers depositing ETH at roughly the same pace as buyers were withdrawing it.

– Read Ethereum (ETH) Price Prediction 2024-25

The upward trend in netflows indicates that even though there was an increase in Ethereum being transferred to exchanges for sale, the demand to buy Ethereum was substantial enough to counterbalance this selling pressure, coming very close to neutralizing the deposits.

Maintaining an equilibrium among buyers and sellers kept Ethereum’s pricing consistent, despite short-term market volatility, suggesting a favorable outlook for Ethereum’s immediate price resilience.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-14 17:12