-

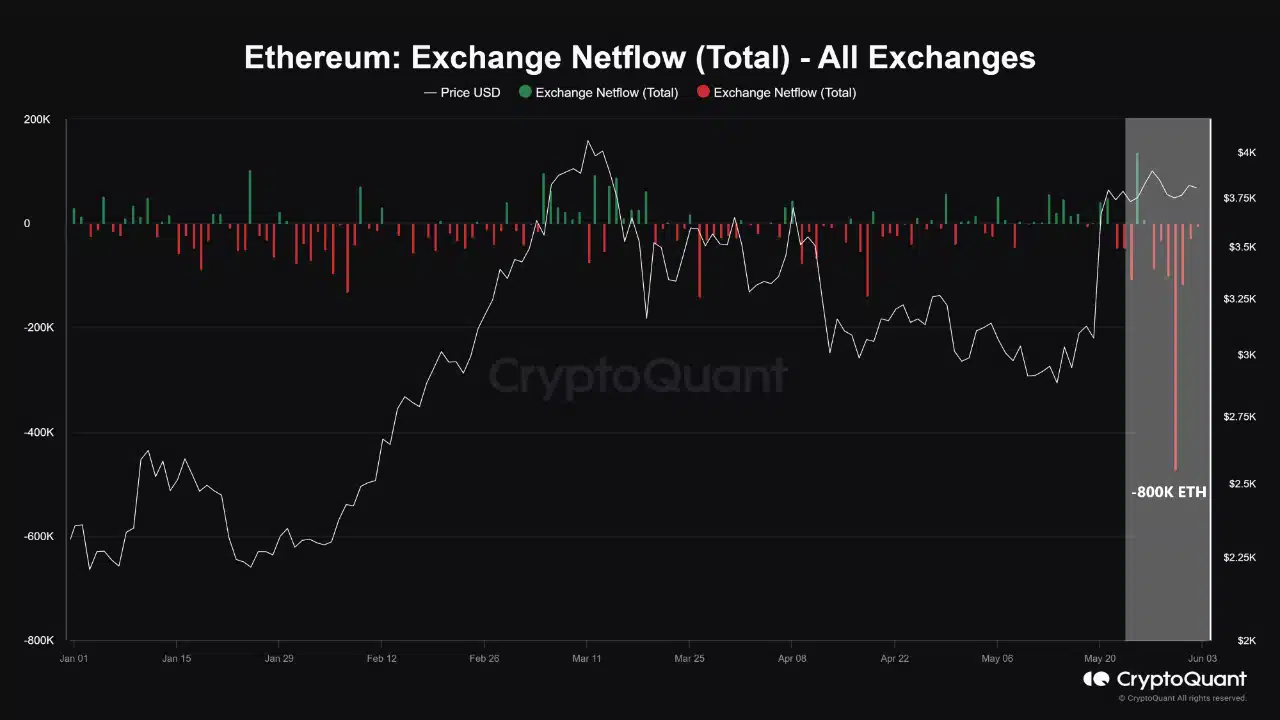

800,000 ETH (worth $3 billion) were withdrawn from exchanges post-ETF approval.

Large investors and institutions may be positioning for a bullish future.

As an experienced crypto investor, I find the recent market developments surrounding Ethereum [ETH] particularly intriguing. The relatively stable price action in the face of significant regulatory and structural changes is a testament to Ethereum’s growing maturity as a digital asset class.

As a crypto investor, I’ve noticed that Ethereum‘s market performance has been quite robust lately, managing to hold its ground around the $3,500 to $4,000 price range, even with some market swings.

I’ve observed Ethereum’s value fluctuating between the $3,800 and $3,700 mark over the last week, with a recent closing price around $3,768.

As a crypto investor, I’ve noticed a stable trend over the past week with only a minimal 2.1% loss. However, even a small 1.1% decrease in the last day can make us feel uneasy, but it might just be a normal fluctuation within the market.

However, this could be indicative of a more profound dynamic at play within the crypto market.

The tranquility in Ethereum’s pricing lately aligns with major advancements in both the regulatory sphere and market framework, most notably the U.S. Securities and Exchange Commission (SEC) giving its green light to an Ethereum Spot Exchange-Traded Fund (ETF).

Reaching this regulatory achievement has prompted a significant response among crypto exchanges, resulting in a noticeable change in the distribution of Ethereum holdings.

Whale movements and market impact

After the Exchange-Traded Fund (ETF) received approval, an astonishing surge of activity ensued within the Ethereum network. Approximately 800,000 Ether tokens, equivalent to a staggering $3 billion in value, were withdrawn from exchanges over a mere eight-day period. As a researcher studying this phenomenon, I find these figures remarkable and indicative of the significant impact the ETF approval has had on Ethereum’s market dynamics.

The large-scale withdrawal of Ethereum from exchanges recalls past occurrences with Bitcoin after ETF announcements, implying that investors are making calculated moves in preparation for increased market interest.

According to Cryptoquant’s examination, these withdrawals could be indicative of organized actions by institutional investors gearing up to meet the demands of their clients following the anticipated ETF launch.

The implications of such significant market movements are quite profound.

According to crypto expert Burak Kesmeci’s analysis on CryptoQuant’s QuickTake, it is possible that major investors, referred to as “whales,” or institutions could be preparing for a bullish outlook on Ethereum following the ETF decision.

As a market analyst, I believe that the significant transfer of Ethereum from large holders, as mentioned by Kesmeci, could boost its price in the intermediate term. This is due to the fact that these sizable stashes lessen the amount of Ethereum readily available for trading, thereby possibly triggering a rise in prices as the desire for the cryptocurrency continues to escalate.

Investor appetite for ETH grows, but what do fundamentals say?

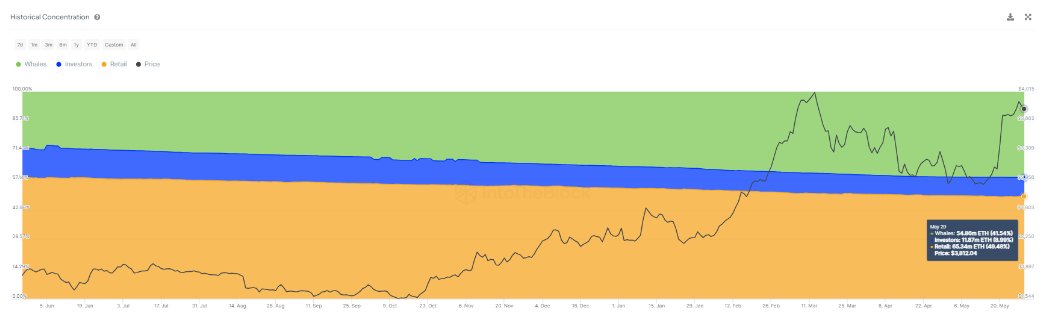

According to the findings from IntoTheBlock, there has been a notable increase in Ethereum holdings among larger investors.

By the end of May 31st, 2024, approximately 41% of Ethereum wallets contained over 1% of the total circulating supply. This is a notable rise compared to earlier in the year. Such a high concentration indicates increasing faith among major Ethereum investors in its future worth.

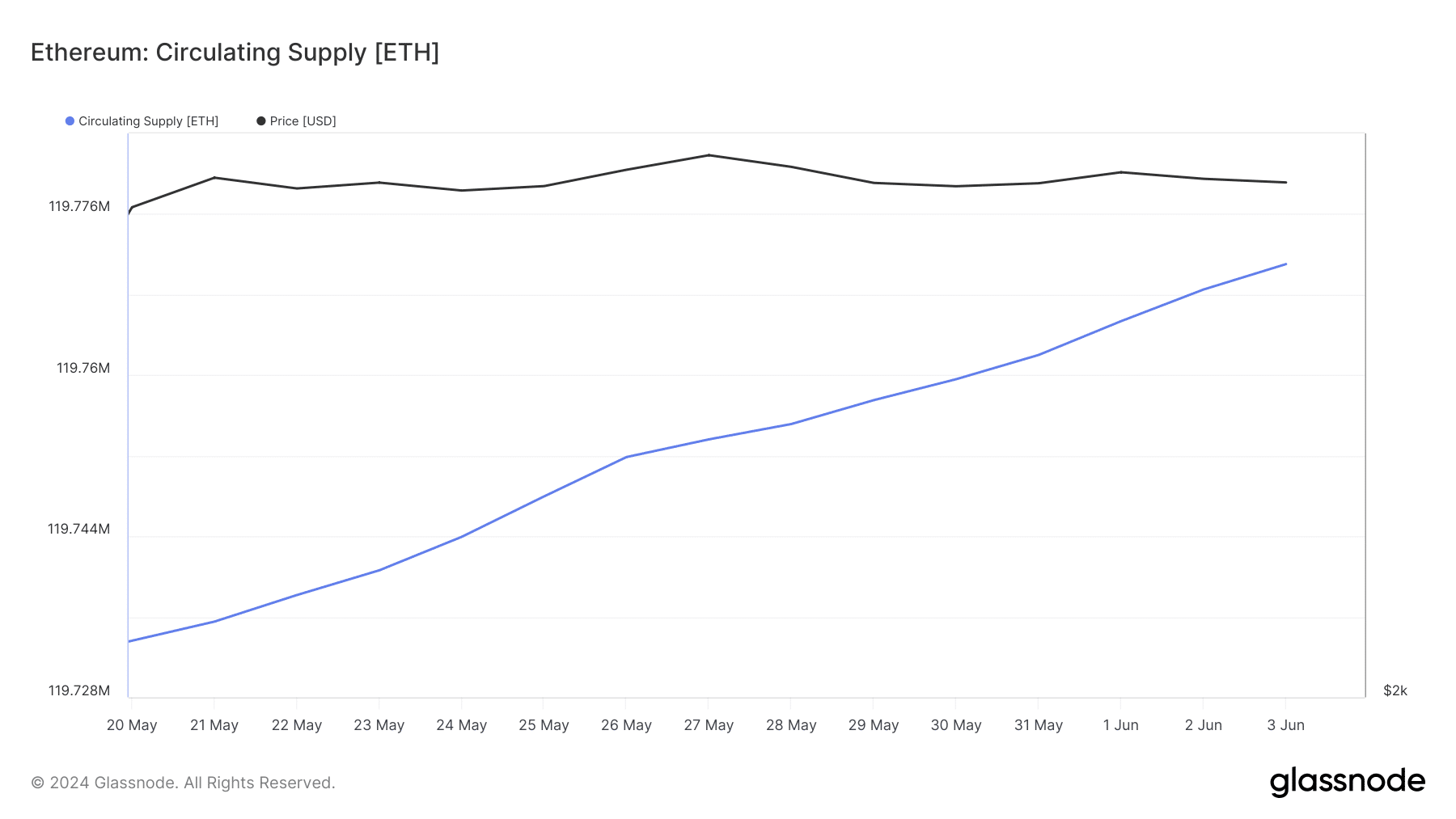

Although it’s crucial to take into account the larger market trends, it’s important to note that even with the possibility of a supply shortage, the total amount of Ethereum in circulation keeps increasing. This suggests that not every major holder is presently hoarding Ethereum.

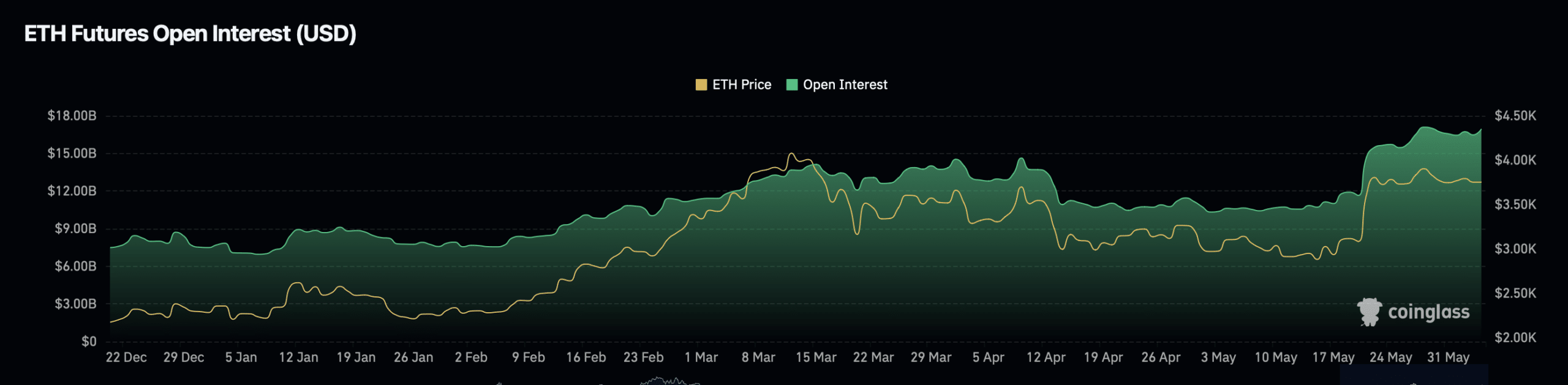

The data from trading metrics like open interest and market volume in Ethereum futures markets indicate a vibrant and bustling trading scene. This lively activity may significantly impact Ethereum’s price trend.

As an analyst, I’ve observed a notable increase in Ethereum’s open interest over the past day. The value of this metric has climbed nearly 3%, reaching a significant figure of $17 billion. This surge has also sparked a substantial rise in open interest volume, which now stands at around $21.40 billion – an uptick of approximately 15%.

Is your portfolio green? Check the Ethereum Profit Calculator

As a researcher studying the cryptocurrency market trends, I’ve recently examined Santiment’s data and discovered some noteworthy findings regarding Ethereum (ETH) holders. Specifically, those holding between 0.01 to 10 ETH have collectively reduced their overall ETH possession, while addresses containing more than 10 ETH have likewise sold off a portion of their assets.

The profit-making actions of both small-scale and large-scale investors have not significantly affected prices in a negative way yet.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-04 20:08