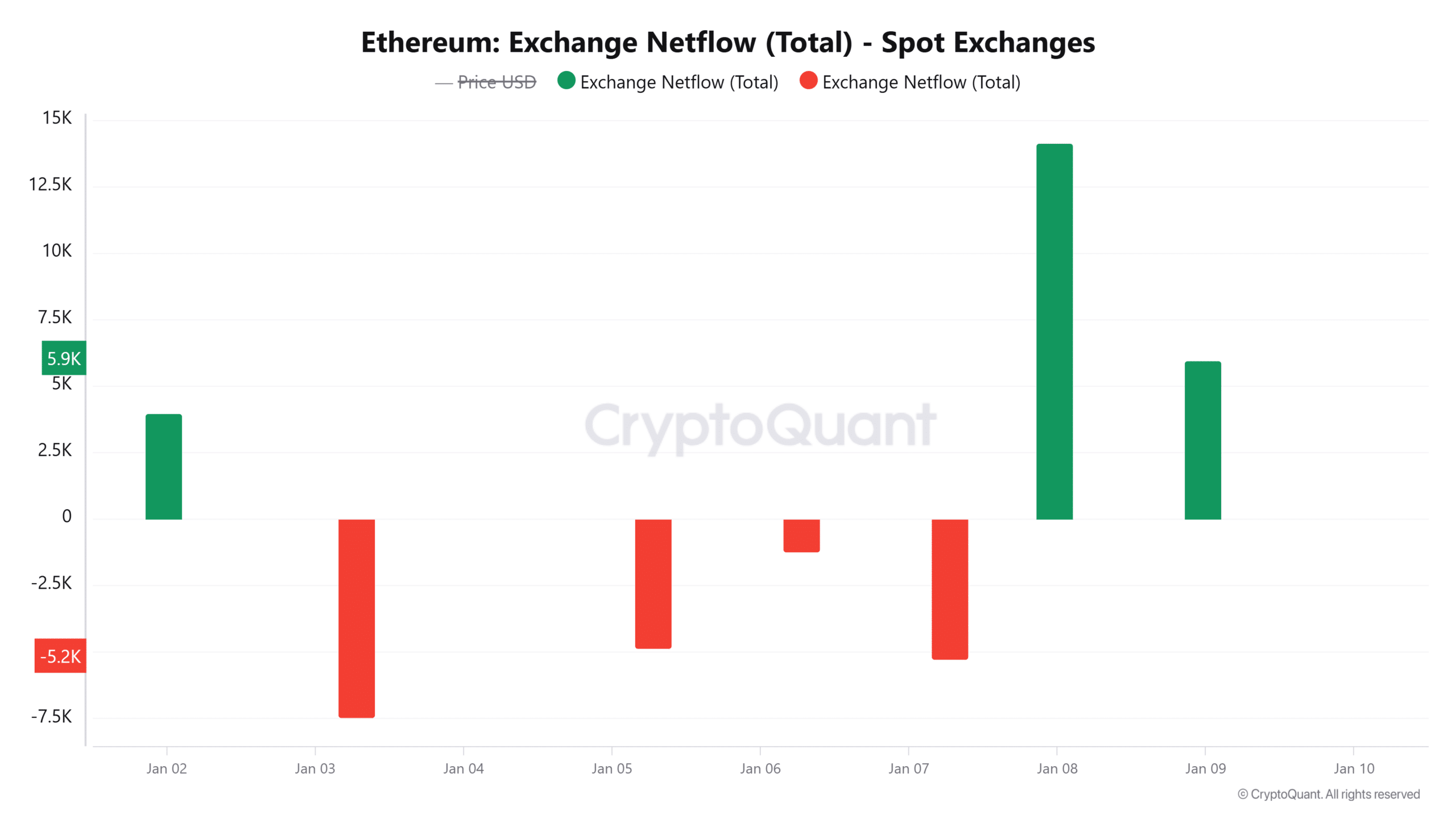

- More than $46M worth of ETH was moved to exchanges on the 8th of January, marking the highest net inflows in nearly three weeks.

- The sell-off comes amid weak demand after spot ETH ETFs posted the second-highest outflows since launch.

2025 hasn’t seen substantial growth for Ethereum [ETH] so far. Over the past two days, the leading alternative coin has slid from approximately $3,700 to currently trade at $3,324 as we speak.

One reason Ethereum has been showing a downtrend could be reduced interest or demand. An example of this was seen on the 8th of January, as there were significant outflows from Ethereum-based exchange-traded funds (ETFs) amounting to $159 million, according to SoSoValue.

This was the second-highest level of outflows since the products launched in July last year.

In addition to large institutional investors, it appears that individual or retail traders are currently engaging in a period of distributing their holdings, which has led to an increase in selling actions among them.

ETH faces intense selling pressure

On January 8th, as indicated by data from CryptoQuant, there were approximately 14,143 net inflows of ETH into spot exchanges, with a total value exceeding $46 million. This marked the highest level of such inflows in about three weeks.

These influxes caused the Ethereum exchange reserves to reach an all-time high of 8.06 million ETH within the past week. This peak level has not been surpassed for seven days.

As a crypto investor, when I observe a surge in Ethereum tokens moving towards exchanges, it’s a red flag for me. It suggests that traders are planning to offload their ETH, which could create a bearish atmosphere. If these tokens are indeed sold, the market floods with them, causing a downward price trend.

Will sellers push ETH below $3,000?

As a researcher studying the behavior of Ethereum’s market trends, I’ve noticed a notable pattern in its weekly chart. A vital level of support can be found at $2,870. Historically, when this level is breached, it has often been followed by substantial price drops.

If the rate of coins being sold persists even as there’s not enough market demand to buy them up, Ethereum (ETH) might fall closer to this support point. Yet, so far, the purchasing interest seems to outweigh the selling pressure.

At the moment of observation, I noted that the Relative Strength Index (RSI) reading was approximately 52, indicating a position close to neutrality in terms of market momentum.

If neither buyers nor sellers seem to be dominating the market, Ethereum might move into a phase of sideways movement or consolidation. Yet, it’s crucial for traders to keep an eye on the bearish signals suggested by the red Awesome Oscillator (AO) bars.

Ethereum’s leverage ratio hits record highs

The estimated level of risk among Ethereum traders, as indicated by the leverage ratio, has soared to an unprecedented 0.605, reaching a new peak.

This increasing ratio suggests that derivative traders are eager to create fresh trading opportunities. It might also signal that they are aiming to profit from brief market fluctuations, as their speculative interest intensifies.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Increased borrowing might lead to swift changes in prices as a result of compulsory sell-offs caused by sudden market fluctuations.

Yet, even though there’s growing curiosity, the desire for long positions seems to be dwindling, as evidenced by the falling funding rates. This suggests a lessening of optimistic feelings among investors.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-09 19:05