-

An ICO-era whale has dumped $12 million ETH on Kraken.

ETH’s market sentiment and demand were still weak.

As a seasoned researcher who has witnessed numerous cryptocurrency market fluctuations, I can’t help but feel a sense of deja vu with this latest development involving Ethereum [ETH]. The significant sell-off by an ICO-era whale is reminiscent of the heady days of 2017 when such events were commonplace.

During trading, a significant whale from the Initial Coin Offering (ICO) period of 2017 exerted substantial selling pressure on Ethereum [ETH].

According to analyst EmberCN, the whale received 150,000 ETH (worth) through the ICO.

On October 8th, the entity moved 5,000 ETH, which is equivalent to approximately $12.22 million. According to analysts, this whale has allegedly sold off over $113 million worth of ETH (around 45,000 coins) since September.

Four hours ago, a whale who had previously received 150,000 Ether through an Initial Coin Offering (ICO) transferred another 5,000 ETH, equivalent to approximately $12.22 million, to the exchange Kraken. Over the past two weeks, this same whale has sold a total of 45,000 ETH, with each transaction averaging around $2,516.

Despite the latest sell-off, the whale still held over $200 million worth of ETH.

ETH’s price reaction

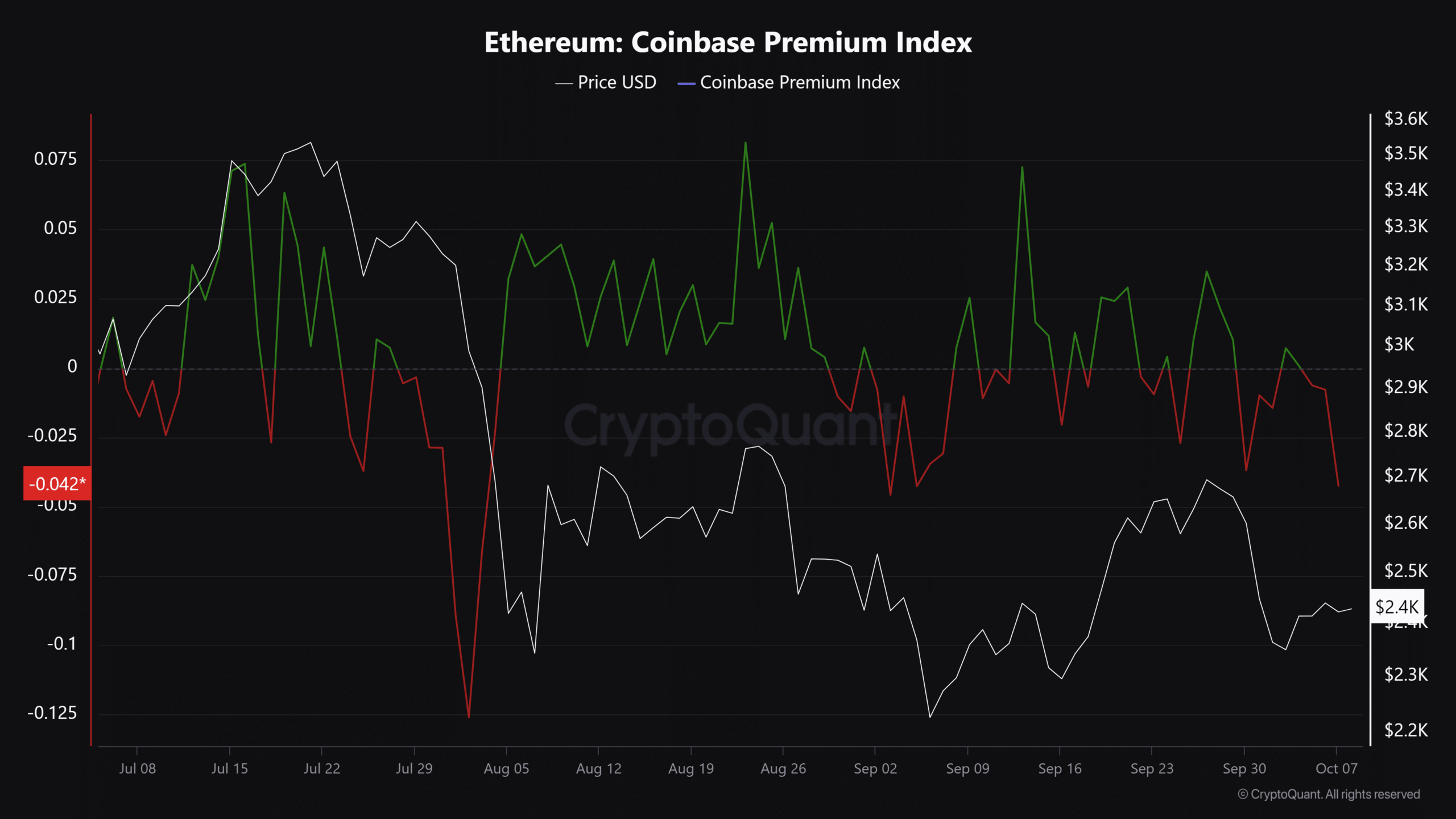

It’s interesting to note that the lack of enthusiasm among U.S. investors towards Ethereum (ETH) is similar to the whale’s disinterest in its own ‘dump’. This is demonstrated by the negative values on the Coinbase Premium Index, indicating a low demand for ETH at the current moment.

In other words, due to current low interest, a swift recovery above $2500 for ETH, as previously anticipated after its recent drop, might be postponed.

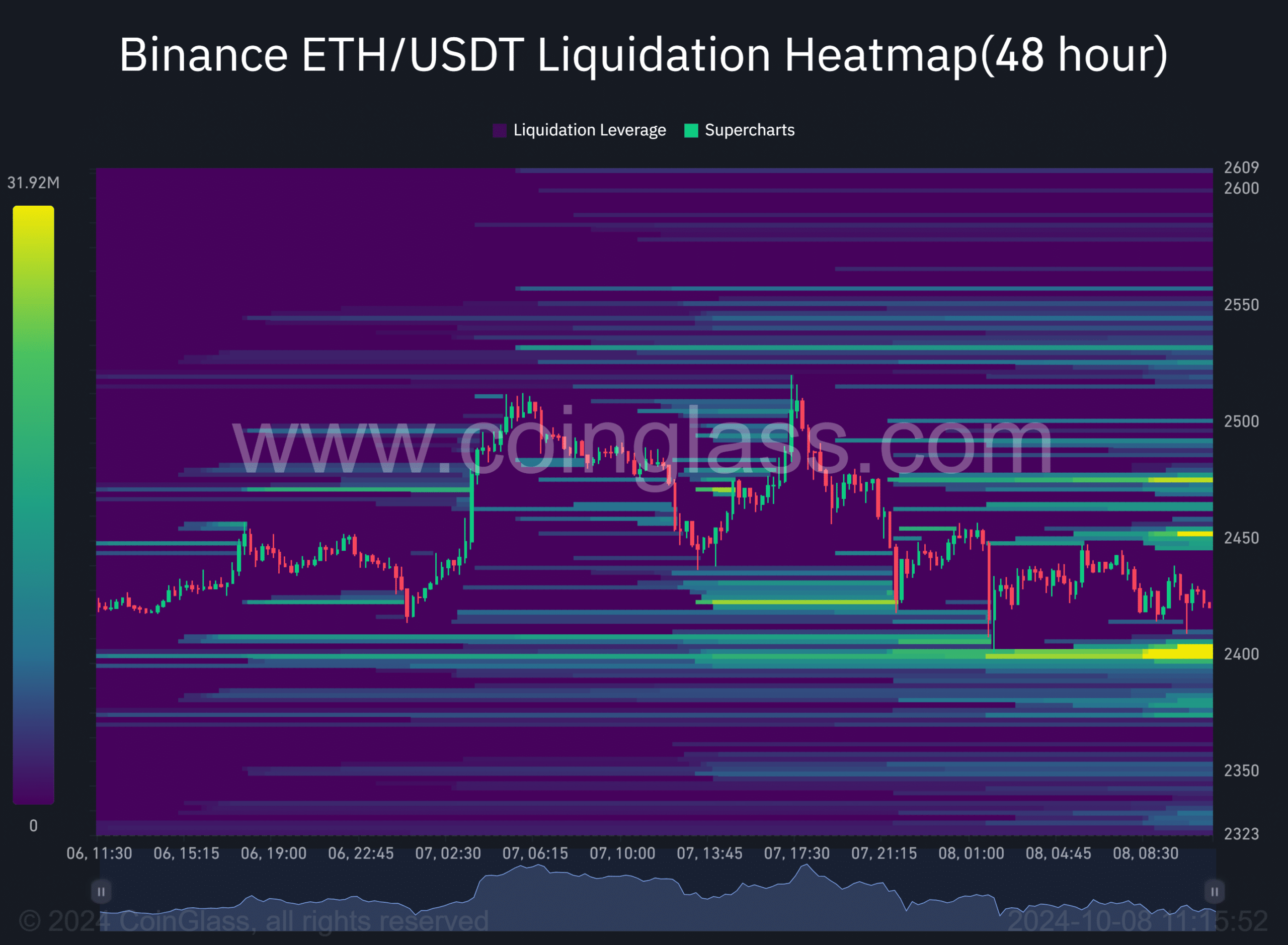

For a brief period, the analysis of whale transactions and liquidation maps pointed out $2400 and $2550 as significant levels to keep an eye on.

If a liquidity grab ensued, considerable long positions at $2400 could be liquidated (bright cluster). This could attract price action.

On the other hand, significant overhead short positions were building near $2450 and $2550.

The findings from our whale order analysis align with the previously mentioned liquidation data. Interestingly, as we speak, there’s a potential obstacle for sellers on Binance exchange, as there’s a sell wall set between $2500 and $2520 (indicated by red lines), while buyers might find support at $2400 (represented by green lines).

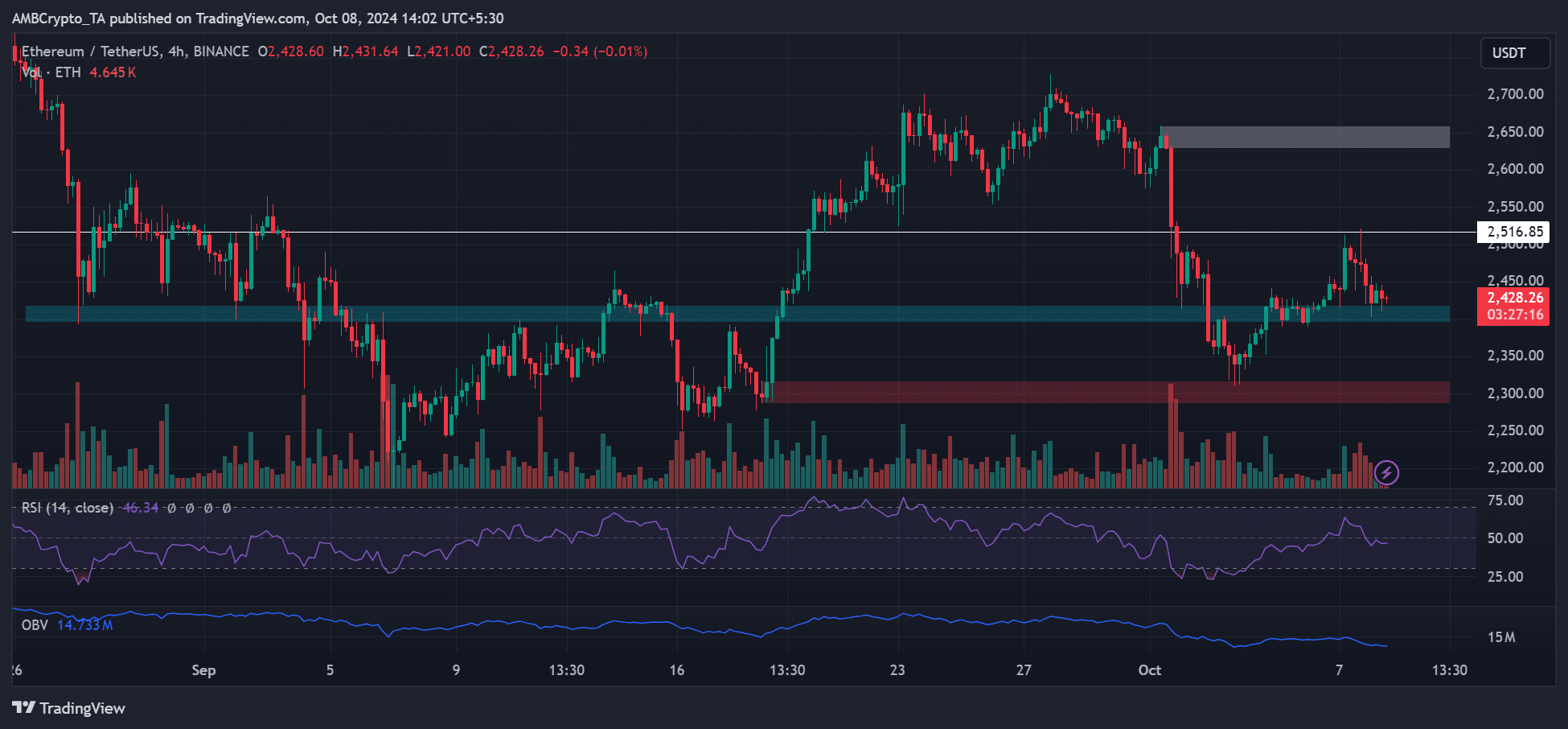

On smaller-scale trading charts, Ethereum (ETH) has dipped to temporary support around $2,400. Currently, its value stands at approximately $2,420, representing an 8% decrease over the last week.

Despite technical indicators showing weakness, with the Relative Strength Index (RSI) remaining below the average and a decrease in trading volume, Ethereum’s immediate recovery might rely on maintaining its position above $2400 and regaining the $2500 mark.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-08 18:15