-

The Fed’s suck of $161B out of the market to impact Ethereum.

ETH ancient whale on a quiet-selling-spree.

As a seasoned analyst with over two decades of experience navigating financial markets, I have seen my fair share of market turmoil and recovery cycles. The current situation with Ethereum [ETH] is indeed intriguing, given the confluence of factors at play.

Even amidst the challenges that have impacted the wider cryptocurrency industry, Ethereum [ETH] continues to hold its ground as a significant force within the market.

As a crypto investor, I’m keeping a close eye on the Federal Reserve’s recent moves, since they’ve withdrawn a staggering $161 billion from the market.

The increase in the Treasury General Account, from $714 billion to $875 billion, occurred after corporations made their tax payments, which serves as confirmation of this transaction.

As the Fed continues to liquidate positions in risk-on assets, this has impacted market liquidity.

This week, it’s expected that the Reverse Repo program will gradually decrease available funds, a process that will last up until the 30th of September.

These advancements might influence both the pricing of Ethereum and the related Exchange Traded Funds (ETFs), since fluctuations in market dynamics often occur due to shifts in liquidity amounts.

Impact of liquidity squeeze on ETH price and its ETFs

The price movements of Ethereum are significantly impacted by the liquidity policies set by the Federal Reserve, with particular relevance to the ETH/USD trading pair.

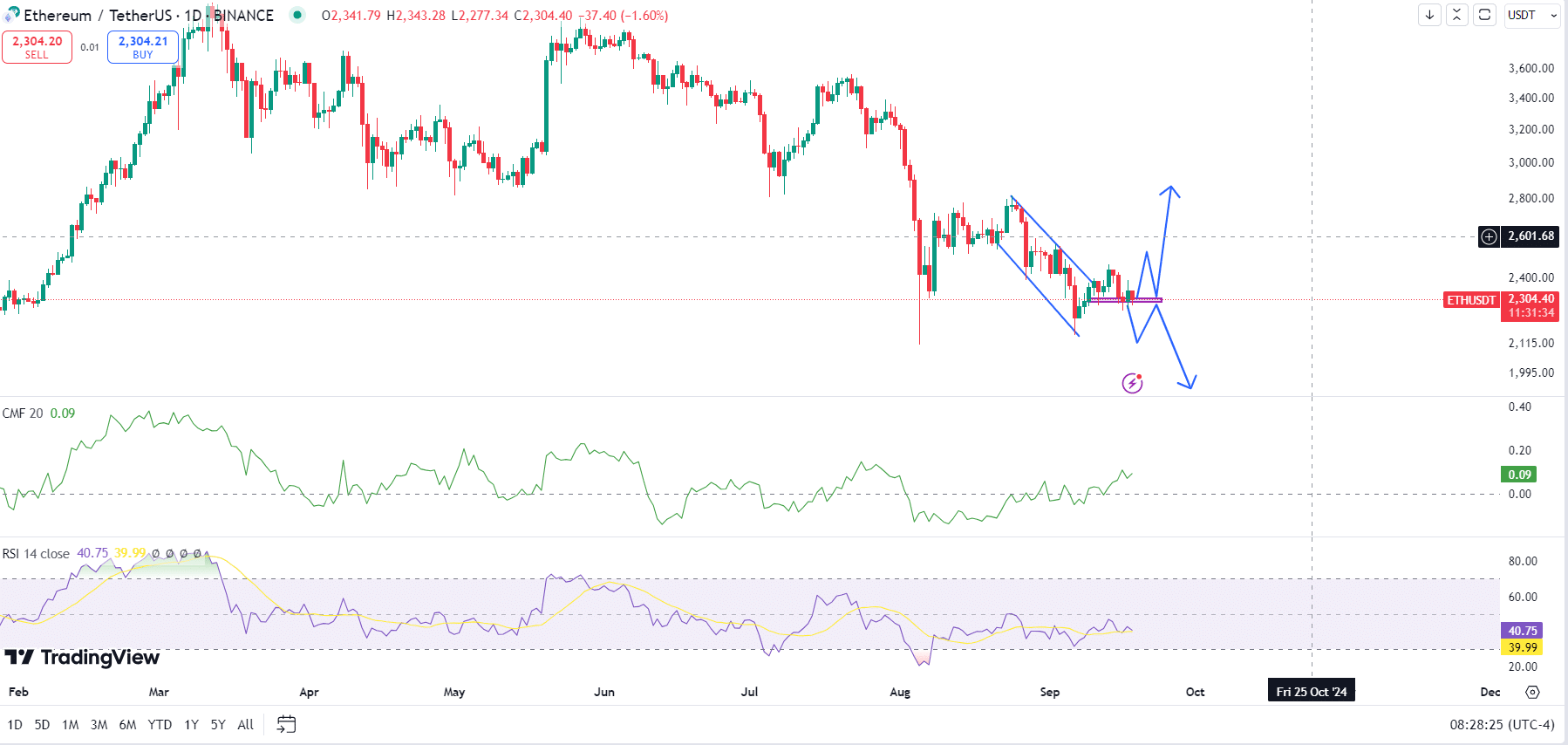

Currently, Ethereum is being traded at $2,298 as we speak. Since March 2024, it has been following a general downward trajectory, and there have been noticeable price fluctuations, particularly in August.

ETH broke out of a descending trend channel and is now hovering around the $2,300 level.

Should Ether (ETH) manage to maintain its value above the crucial price barrier, it might be able to bypass the unfavorable impacts of the Federal Reserve’s liquidity decrease, potentially leading to a change in its price trend for the better.

However, if ETH dips below $2,300 and stays there, the liquidity squeeze could drive prices lower.

In a favorable turn of events, the Chaikin Money Flow (CMF) index stands at 0.09, indicating growing interest in accumulation and increased buying activity.

The indicator known as the Relative Strength Index (RSI) has risen above its 14-day moving average, suggesting possible upward price movement or a bullish trend might be on the horizon.

From my perspective as an analyst, while these technical signs hint at a potential price rebound for Ethereum, the current liquidity issues might push its value downwards further before any significant uptrend occurs.

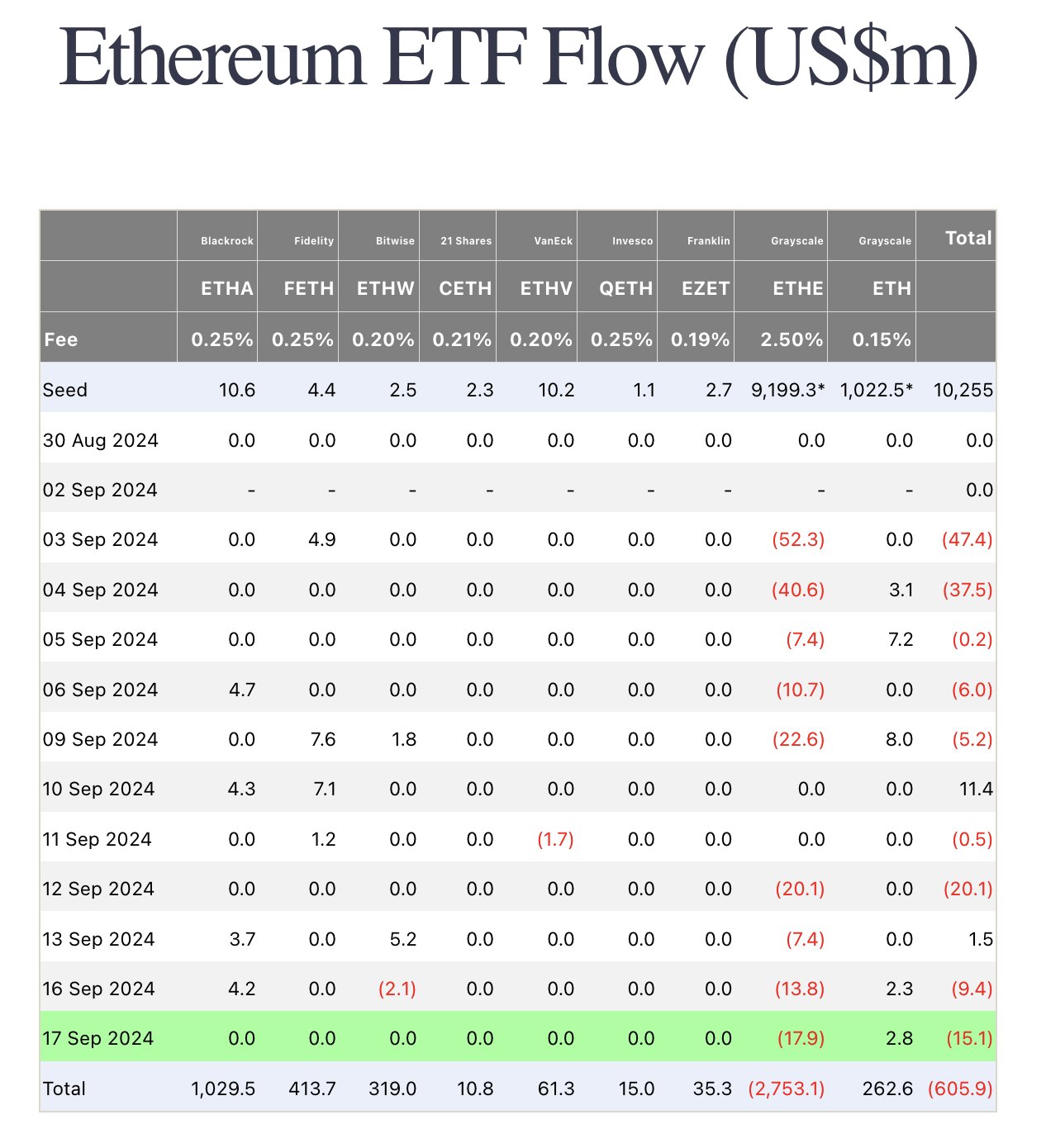

Furthermore, it’s worth noting that Ethereum Exchange Traded Funds (ETFs) have seen significant withdrawals, despite the introduction of ETFs tracking Ethereum spot prices, which has facilitated investment in Ethereum assets.

Reducing liquidity by the Federal Reserve might intensify the existing tendency, restricting funds for investing in speculative assets such as Ethereum ETFs. Over the past week, there have been net withdrawals amounting to approximately $25.5 million from these Ethereum ETFs.

Money flowed into the Grayscale Mini ETF (ETH), totaling approximately $2.8 million. Conversely, there were substantial withdrawals from the Grayscale ETF (ETHE), resulting in a loss of around $17.9 million. This trend suggests a change in investor attitudes or preferences regarding these funds.

The recently published data shows that we experienced a total outflow of approximately $15.1 million, contributing to a negative balance.

Ancient whale selling

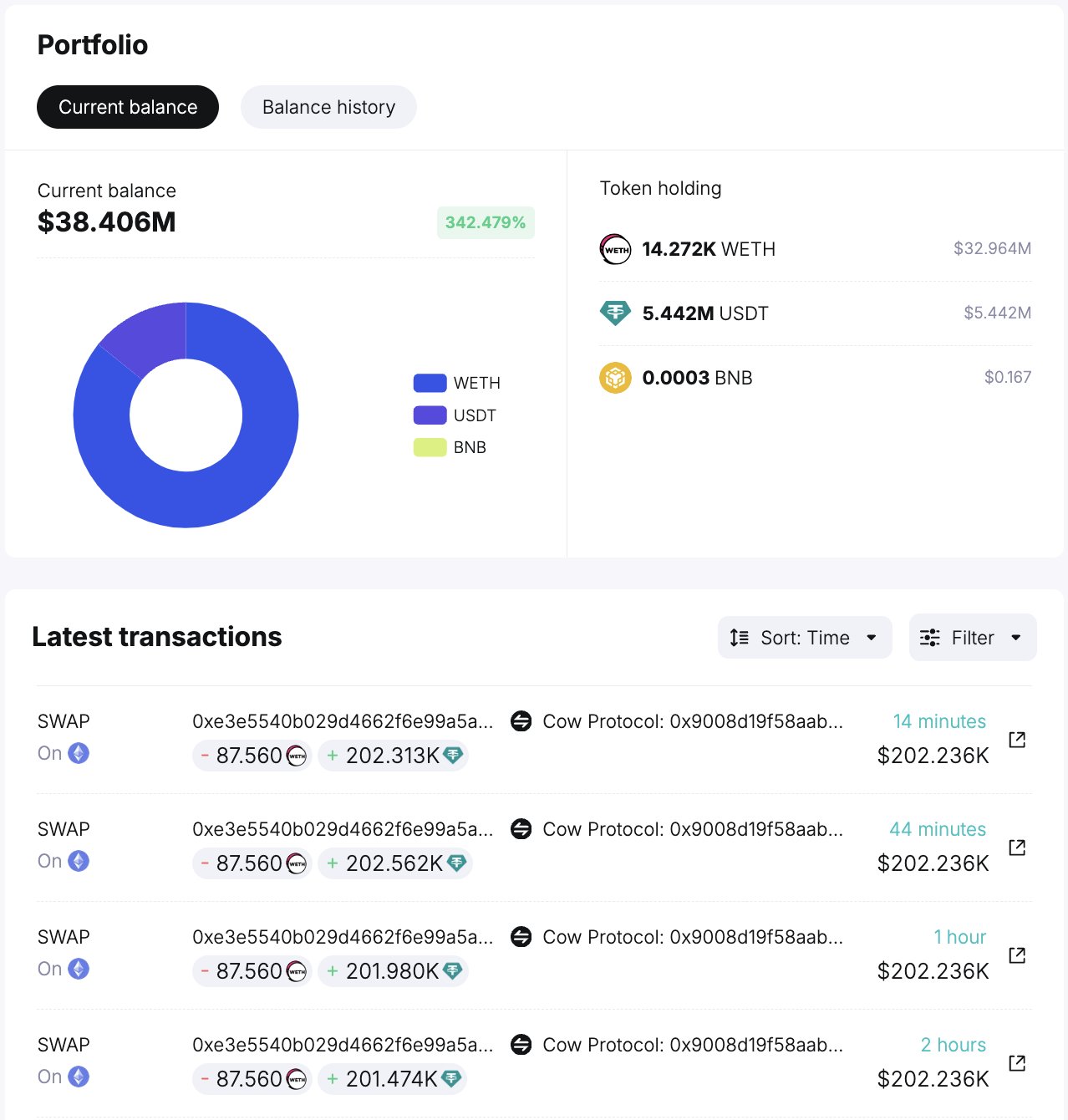

To summarize, a major Ethereum investor (often referred to as a “whale”) has been subtly unloading substantial quantities of Ether (ETH) in recent times.

2,364 units of ETH were offloaded by the whale for approximately 5.44 million USDT. This was done in 27 separate transactions, with an average price per unit of ETH being about $2,302. However, even after this recent wave of selling, the whale retains a substantial amount of WETH (14,272 units), which is currently worth around 33 million USDT.

Despite the negative feeling among traders caused by the Federal Reserve’s decision to reduce liquidity, which could lead to a decline in the price of the whale, the pace of selling may decelerate if market conditions become more favorable.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The cost of Ethereum might drop more as a result of the Federal Reserve’s tightening of liquidity, yet certain technical signals hint at a possible turnaround.

On the other hand, ETH ETFs and large investor behavior suggest a note of warning, indicating that the market might require additional liquidity to sustain prices moving upwards.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-18 23:04