-

Ethereum has seen an increased inflationary trend recently.

ETH was trading at around $3,300 as of this writing.

As a researcher with extensive experience in the cryptocurrency market, I’ve closely observed Ethereum’s [ETH] recent shift towards inflationary trends despite its historical deflationary nature. The current trading price of ETH hovers around $3,300.

In more straightforward terms, Ethereum [ETH], which was once known for its deflationary tendencies, has recently adopted a more inflationary approach.

Despite the process for burning ETH as part of its new transaction fee model in EIP-1559 remaining active, the total amount of Ethereum in circulation has continued to grow.

Investors and market analysts are optimistic that the approval process for Ethereum-based exchange-traded funds (ETFs) will lead to heightened demand for ETH.

Ethereum becomes more inflationary

As a crypto investor, I’ve noticed that Ethereum’s inflation rate has hit a new high since the beginning of the year, with the latest network upgrade in March being a significant contributing factor.

Based on Ultrasound Money’s figures, approximately 112,000 new Ethereum units have entered circulation in the previous four-month period.

As a crypto investor, I can explain that the recent surge in supply is primarily due to the aftermath of the upgrade we experienced on March 13th.

As a researcher studying Ethereum (ETH), I can share that the recent network upgrade is a crucial aspect of its continuous evolution and enhancement. This update has brought about substantial changes to Ethereum’s economic framework.

Ethereum not easing up on burns

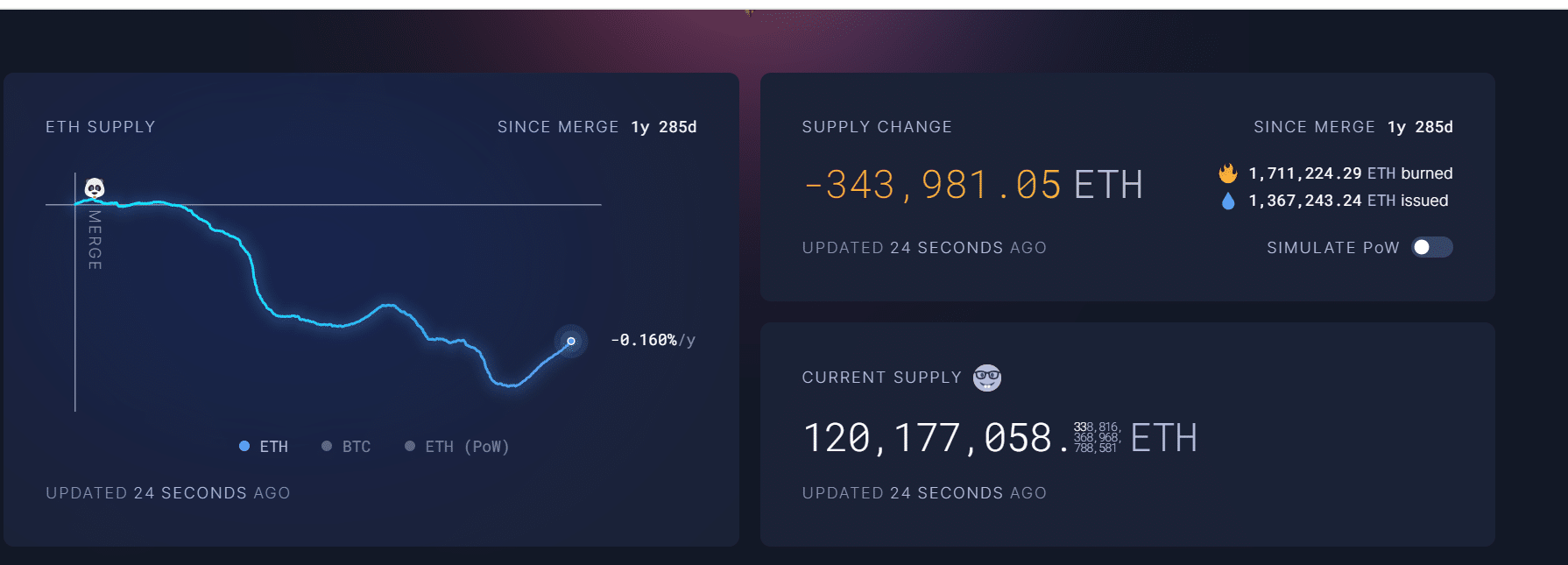

In spite of Ethereum’s recent increase in supply following the upgrade, which has shown signs of inflation, the net effect of the Merge implementation has been deflationary.

Based on Ultrasound Money’s report, approximately 1.7 million Ethereum have been destroyed as transaction fees, while roughly 1.3 million new Ethereum have entered circulation post-Merge. This implies a net decrease of over 344,000 Ethereum in circulation.

As a researcher studying Ethereum’s economic dynamics, I would express it this way: The upgraded mechanism effectively kept the additional supply in check, preserving Ethereum’s allure as a deflationary digital asset.

The decrease in Ethereum’s supply, coupled with a consistent or growing demand, significantly influences its future value. This dynamic could result in an upward trend in Ethereum’s market price, making it an alluring investment opportunity for investors.

Ethereum ETFs imminent

As a researcher studying the world of exchange-traded funds (ETFs), I’m excited to share that recent developments suggest a brighter future for an Ethereum ETF. This optimistic outlook is underscored by the insights of Bloomberg ETF analyst Eric Balchunas.

On June 26th, VanEck, a major figure in the exchange-traded fund (ETF) sector, submitted an important form 8-A for establishing their Ethereum Trust.

For corporations aiming to list securities on national stock exchanges and indicate their preparedness for an Exchange-Traded Fund (ETF) launch, this form is indispensable.

As an analyst, I’ve observed Eric Balchchunas’ insightful observation regarding the strategic timing of Grayscale’s filing for a Bitcoin futures ETF. He drew a parallel to VanEck’s past actions with their Bitcoin spot ETF, which was filed exactly one week prior to its launch on January 11th.

As a researcher studying market trends, I’ve noticed a striking resemblance between the progression of events in the Ethereum ecosystem and the timeline leading up to the launch of the related ETF. This observation could imply that we might be on the verge of seeing the ETH ETF come to fruition.

How it could impact ETH

The introduction of Ethereum ETFs could significantly impact the market dynamics for ETH.

Read Ethereum (ETH) Price Prediction 2024-25

Through expanded and controlled availability of Ethereum (ETH) to institutional and individual investors via these ETFs, there’s a potential boost in the demand for Ethereum.

The increased need for Ethereum, combined with its current deflationary features, may help reduce surplus supply and strengthen Ethereum’s tendency towards deflation.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-27 03:08