- Ethereum may experience increased liquidity as the election cycle comes to a close.

- However, various factors cast doubt on its rebound potential.

As a seasoned crypto investor with scars from past bear markets etched deeply into my trading portfolio, I can’t help but feel a mix of excitement and caution as we approach the election week. The potential for Ethereum to capitalize on increased liquidity is enticing, especially given its favorable greed index. Yet, the cloud of uncertainty looming over ETH‘s rebound potential is hard to ignore.

In less than a week, the cryptocurrency market is gearing up for increased activity, which might spark Ethereum [ETH] to escape its current downturn. Given that Ethereum’s greed index is currently advantageous, this may indicate a profitable moment for purchasing.

Nevertheless, there’s some ambiguity about whether it will happen again, but if the past trend repeats, Solana might regain its momentum during Bitcoin‘s market highs, much like it did recently by recording four consecutive days of robust daily growth while Bitcoin retreated. This could potentially hinder Ethereum’s chances of recovery.

Over the upcoming weekend, I anticipate that events may unfold significantly, potentially positioning Ethereum (ETH) to strive towards the $3K milestone under optimal market circumstances.

Ethereum’s core metrics facing pressure

Over the past period, this cycle has proven to be quite tough for Ethereum. Even though there’s been a significant 40% surge in daily active addresses on its mainnet and Layer 2 platforms, the price of ETH hasn’t matched this growth, instead dipping nearly 7% following a close at $2.7K only a week earlier.

In addition, complications are mounting as the transaction fees on Ethereum’s network have dropped to record lows, lagging behind networks like Solana. This presents an extra hurdle for Ethereum, since at these low rates, questions about network security might surface.

In essence, several elements have hindered Ethereum (ETH) from maximizing its opportunities during Bitcoin’s high points. The apprehension among investors concerning the future of Ethereum is escalating, causing them to view alternative blockchain platforms as more promising.

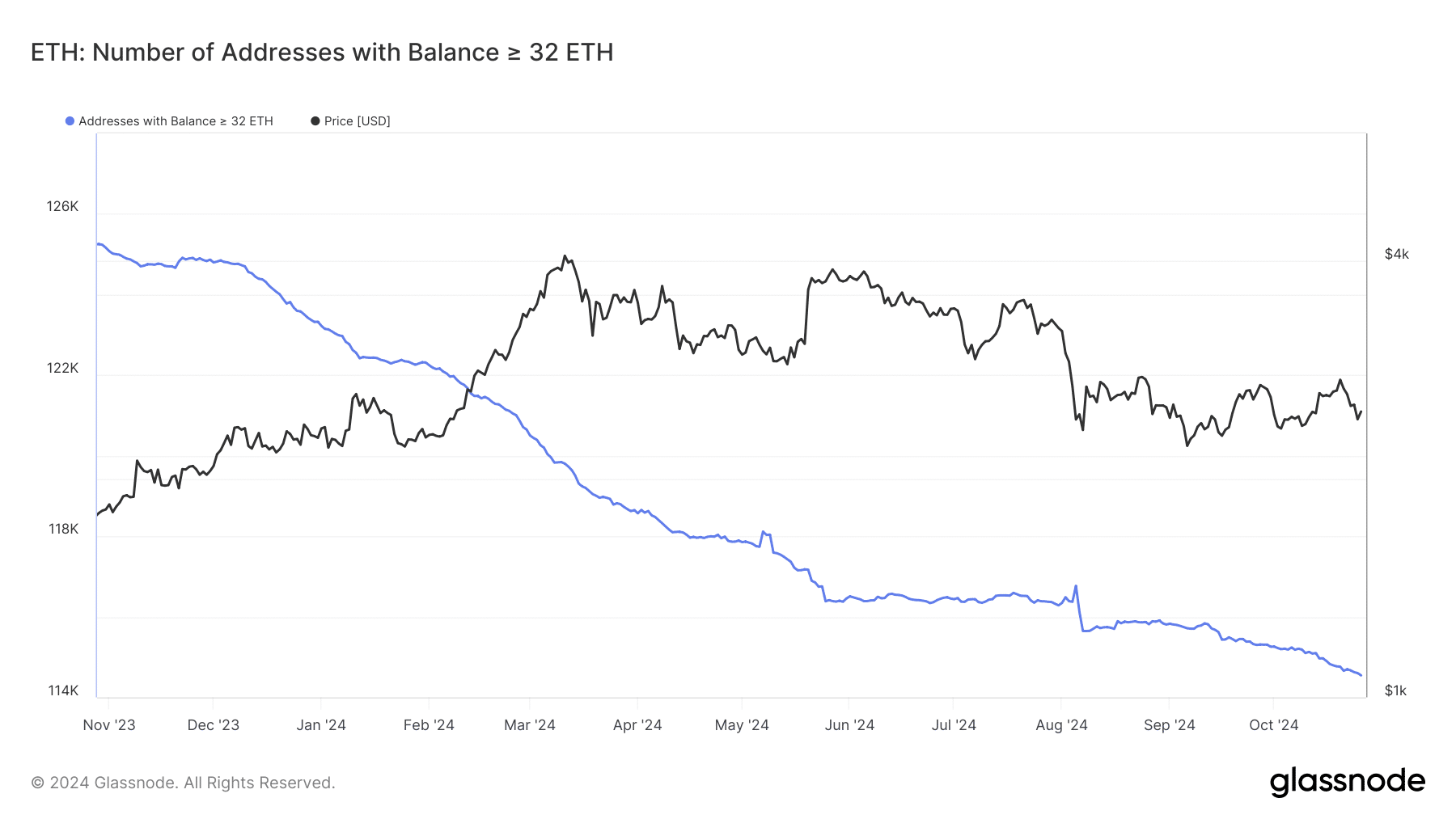

Source : Glassnode

To compound these issues, the Ethereum network has seen a substantial decrease in active validators, with staked wallets at their lowest point in a year. The Proof-of-Stake (PoS) system necessitates a minimum of 32 Ether for staking, and this drop in validator numbers stirs worries about the network’s overall wellbeing.

Slowing down the verification of transactions within a network might cause it to become overloaded, potentially pushing users towards other platforms. Notably, there’s been a significant shift from Ethereum (ETH) to Solana (SOL), as Solana offers greater processing capacity leading to faster transaction times and lower costs.

This trend underscores Ethereum’s struggle to retain its user base.

Election liquidity won’t be enough

If the network doesn’t tackle these challenges, the election buzz may only yield short-term gains for ETH, lacking the strength needed for a true breakout.

Ethereum needs to regain its significant influence in the cryptocurrency market, a position that dropped significantly during the last market phase and is now at an all-time low of 13% compared to Bitcoin, which hasn’t been surpassed since April 2021.

When Bitcoin’s dominance is high, it often marks the beginning of a period where alternative cryptocurrencies (altcoins) perform well. However, should this trend persist, Ethereum could find it challenging to retake its prominent place in the crypto market.

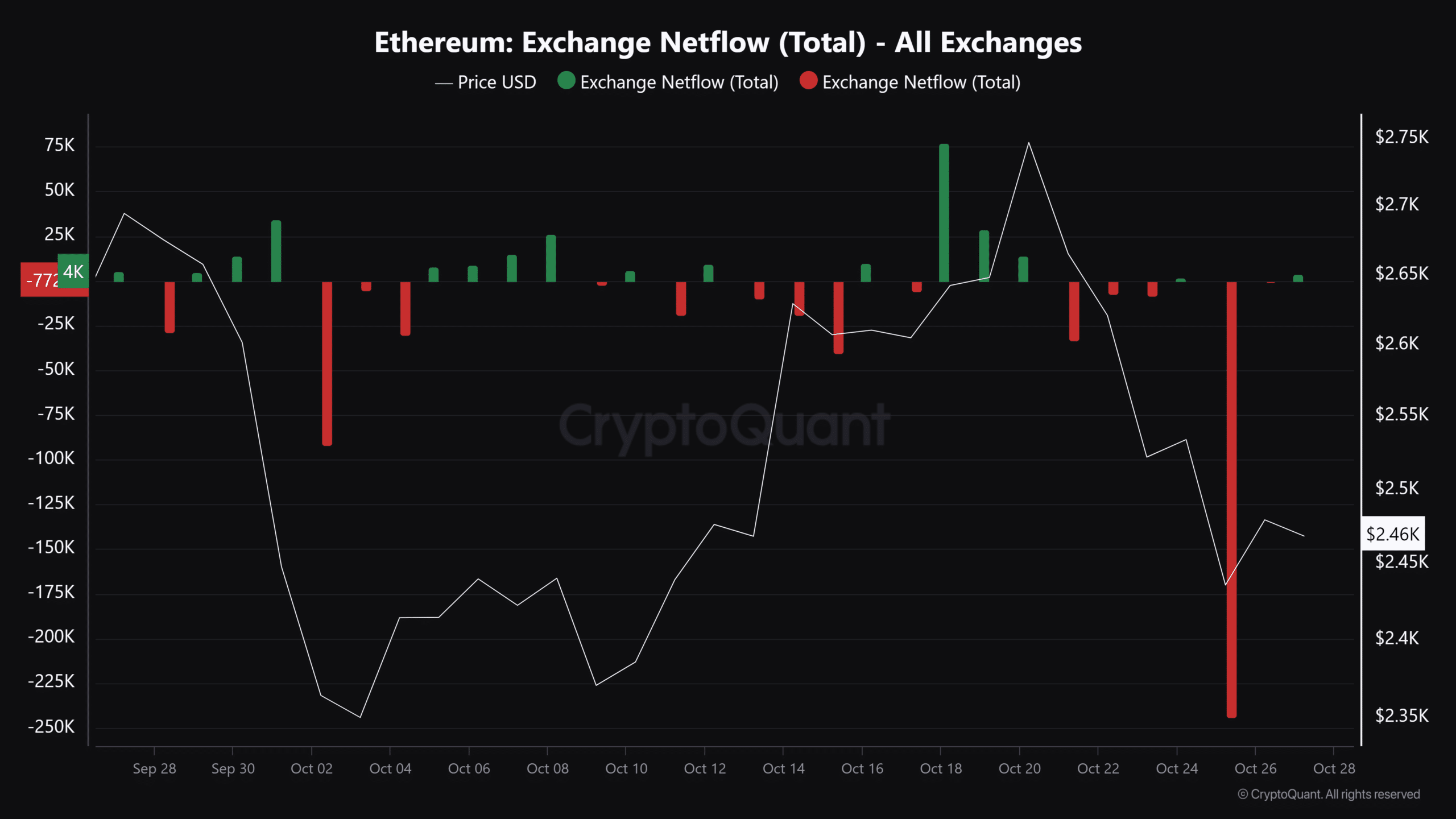

Source : CryptoQuant

Two days back, there was a notable increase in Ethereum (ETH) withdrawals, amounting to 244,000 ETH from exchanges. This could indicate that investors view the current price as a temporary decrease, which might assist bulls in upholding the $2.4K support level.

However, the impact on the price failed to materialize.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As the election nears its end, it’s likely that Ethereum (ETH) may see temporary price increases. This surge could potentially halt its downward trajectory and enable bulls to counteract the bearish influence.

Unless Ethereum can ensure network stability, it’s unlikely to break free from its downturn. Continuing to ignore these problems could lead to persistent poor performance and potentially harm Ethereum’s standing in the market.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-28 09:12