-

Chinese authorities have moved 7,000 ETH to exchanges in the last 24 hours.

These coins are part of the 542,000 ETH seized from a crypto Ponzi scheme in 2018, which could be dumped in the market.

As a seasoned analyst with years of experience in the volatile and unpredictable world of cryptocurrencies, I find myself increasingly concerned about the recent developments surrounding Ethereum [ETH]. The sudden movement of 7,000 ETH by Chinese authorities from seized assets, part of a much larger hoard of 542,000 ETH, could potentially trigger a sell-off that might send shockwaves through the market.

At the moment of reporting, Ethereum [ETH] was exchanging hands for approximately $2,401, marking a nearly 2% decrease over the past day. This decline occurred concurrently with a pessimistic outlook sweeping across the broader cryptocurrency sector, prompting the Fear and Greed Index to reach a seven-day low of 39, implying that traders are feeling apprehensive.

Nevertheless, Ethereum owners may find cause for concern as Chinese authorities consider selling off approximately 542,000 ETH, equivalent to over $1.3 billion, potentially leading to a sell-off.

Ethereum’s “unexpected” supply overhang

According to onchain researcher ErgoBTC, ETH faces an unexpected supply overhang after 7,000 ETH was moved to exchanges. These tokens are part of the 542K ETH seized from the PlusToken crypto ponzi scheme in 2018.

By the time it ended, this plan amassed over 194,000 Bitcoins [BTC] and 830,000 Ethereum [ETH]. It’s presumed that most of the Bitcoin was offloaded between the years 2019 and 2020. Approximately a third of the amassed ETH was subsequently sold in the year 2021.

In August 2024, the leftover Ethereum amounting to 542,000 ETH was distributed across several wallets. According to the findings of a researcher, it appears that some of these Ethereum coins have recently started moving.

On the 9th of October, approximately 15,700 Ether was removed from these accounts, with around half being transferred to BitGet, Binance, and OKX trading platforms.

Based on recent findings, the transfer activities resemble those observed when government entities offloaded Bitcoins back in 2020. This could potentially escalate selling pressure for Ethereum in the near future, making its position quite risky.

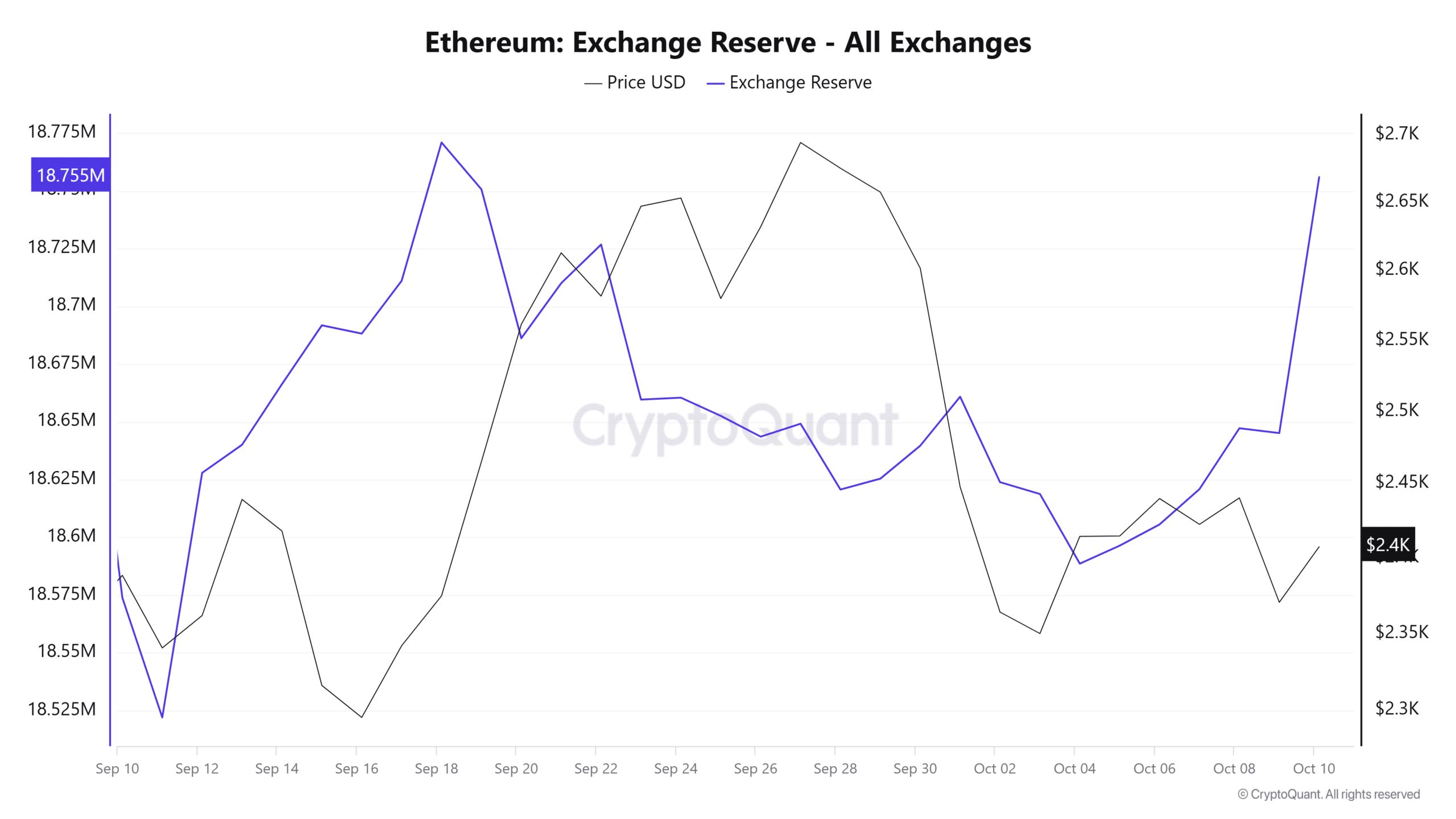

Ethereum exchange reserve hit a three-week high

As a crypto investor, I’ve noticed an influx of deposits into Ethereum exchanges, pushing the reserve levels to their highest point in nearly three weeks, according to CryptoQuant’s latest data.

Over the past day, the overall Ethereum held on exchanges has surged past 110,000 tokens, marking a new three-week high.

It appears that a significant number of traders are transferring their Ethereum coins to various exchanges, suggesting they plan to offload them. Interestingly, the largest surge in reserves occurred on derivatives exchanges. This trend might lead to an increase in Ethereum’s price fluctuations or volatility.

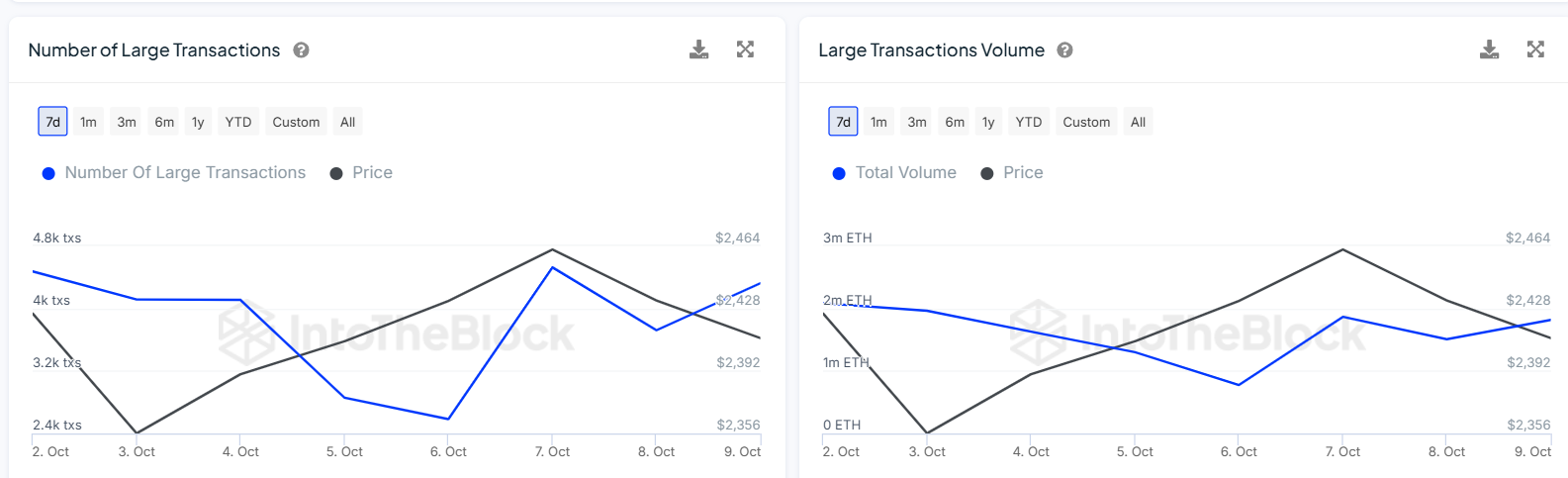

According to data from IntoTheBlock, there’s an increase in significant transaction volumes, hinting at heightened whale activity. Since Ethereum isn’t experiencing growth despite this surge in large transactions, it might imply that these transactions are more about selling rather than buying.

The data from liquidations indicates that large amounts of Ethereum held on exchanges are contributing to a downward trend. As per Coinglass, over $31 million USD of Ethereum was liquidated within the past day, and about $27 million USD of this was long positions being closed.

Read More

2024-10-11 05:11