- Ethereum fees dropped to its lowest point since October.

- There has also been an overall decline in fees on L2s.

As a researcher with extensive experience in the crypto space, I find it intriguing to observe the recent decline in Ethereum [ETH] transaction fees and the overall reduction in fees on Layer 2 solutions (L2s). While this development is welcome news for many users, it raises questions about the possible reasons behind these fee fluctuations.

Recently, Ethereum [ETH] has experienced a notable decrease in its average transaction fees, marking a departure from its previous reputation for high fees.

“This decline raised the query: Is the transaction volume on the platform actually diminishing, or is it that Layer 2 solutions are handling the fees instead?”

Ethereum’s average fees decline

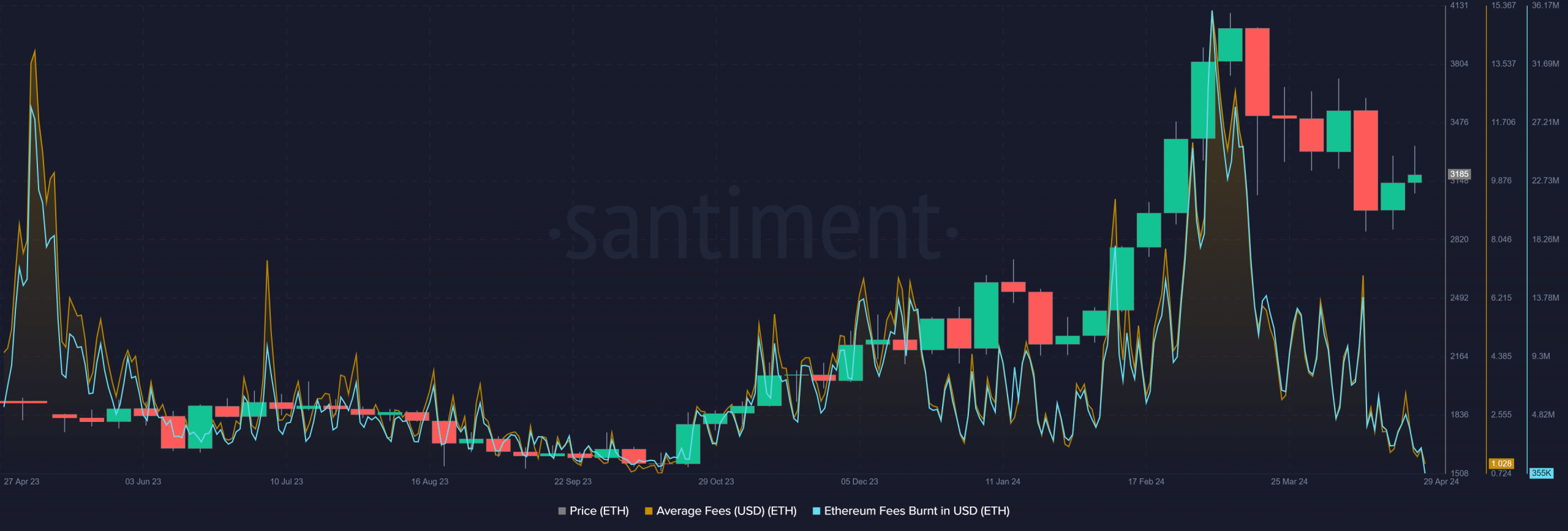

I’ve been closely monitoring Ethereum network fees with Santiment data, and I’m pleased to report that they have taken a downturn lately. As of the 28th of April, the average fee on the network stood at around $1.28 – the lowest point since October 2023.

At the present moment, the average fee has dropped down to approximately $1.02.

Concurrently, there has been a reduction in the amount of ETH fees burned.

Currently, the burnt fee chart indicates a significant drop, with the fee reaching its lowest point in months at approximately $355,000.

As a crypto investor, I’ve noticed that the average transaction fee surpassed $15 back in March. Moreover, the burned fees reached an astonishing total of over $35 million during that period.

Additionally, according to AMBCrypto’s analysis of Crypto Fees data, Ethereum transaction fees have seen a significant decrease in the past few weeks.

As of press time, the overall network fee stood at approximately $3.3 million.

Comparing this figure to previous weeks, it was evident that fees have halved.

The data from Santiment supported this observation, indicating that fee fluctuations tend to align with market trends. Specifically, fees increase during market upswings and decrease during market declines.

Furthermore, the decline is often attributed to a decrease in network transactions.

Are L2s taking the Ethereum transactions and fees?

As a researcher studying the blockchain ecosystem, I’ve observed that the latest Ethereum network upgrade has brought about significant cost savings for transactions on Layer 2 solutions (L2s). This reduction in fees has resulted in a noticeable surge in transaction volumes.

As a researcher studying user data, I’ve noticed an impressive upward trend in the number of individuals utilizing our L2 platform. We’ve recently surpassed the 4 million mark, indicating significant expansion within a relatively short timeframe.

An in-depth examination of Grow the Pie’s data revealed that fewer than 2 million unique addresses were actively used on major Layer 2 networks.

AMBCrypto’s analysis also showed a decline in transaction count, which was around 6.3 million.

An evaluation of fees on level 2 platforms showed a noticeable reduction within the past month, resulting in fees totalling under $1 million.

With more and more people joining, the decline in active users and revenue seems to signal a decrease in overall transaction volume.

The overall decline may pave the way for an increase once the price of Ethereum starts to rise.

ETH sees a weak start to the week

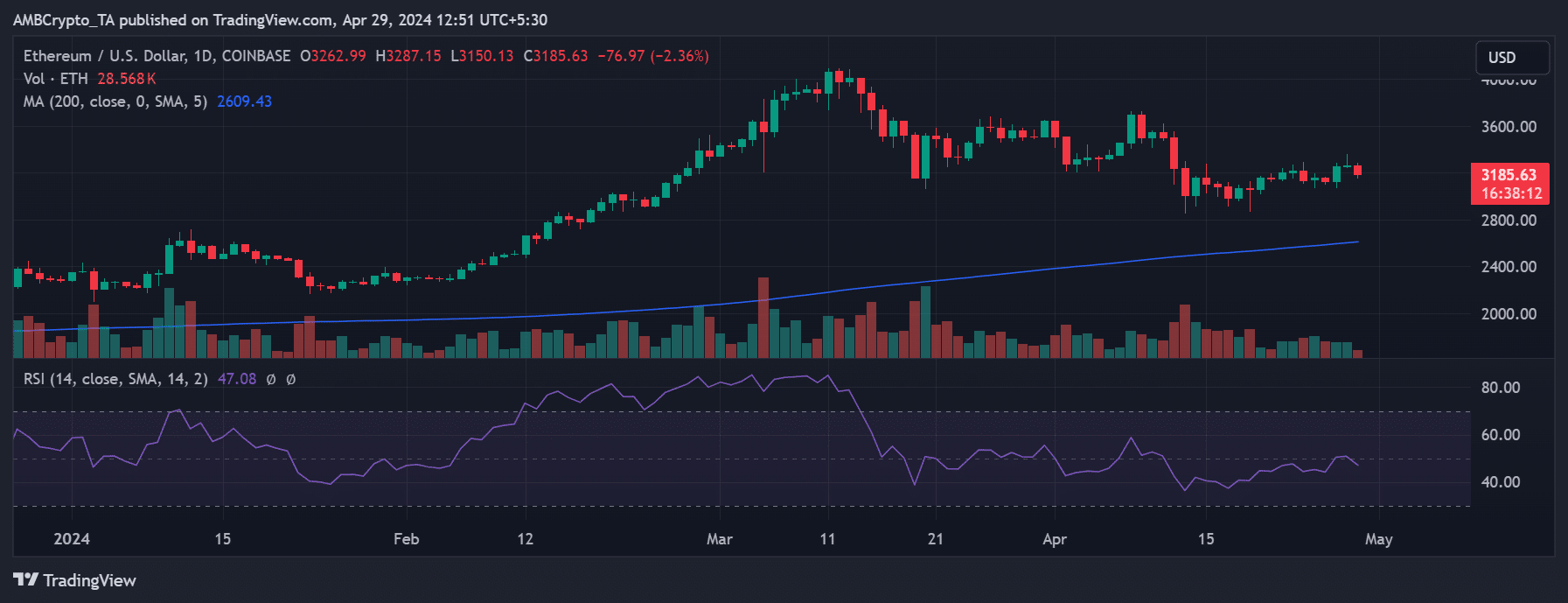

According to AMBCrypto’s assessment of Ethereum’s price trend, the cryptocurrency has primarily stayed around the $3,000 mark in the past few days.

The price reached approximately $4,000 in March but subsequently fell back. Furthermore, during the month of April, it dropped beneath the $3,000 mark.

Last week, I observed a notable surge towards the end of the period, with a substantial rise of 3.93%. Consequently, the price tag reached approximately $3,253.

On the 28th of April, my analysis shows that the upward momentum remained, but the rate of growth was more subdued. The figure hovered around a 1% increase, and the price point was roughly $3,262.

Read Ethereum’s [ETH] Price Prediction 2024-25

At present, there’s been a drop of more than 2% in its value, with the price hovering around $3,180.

As a researcher studying the Ethereum market trends, I’ve noticed an uptick in trading fees. This could be a sign that traders are expecting an imminent price hike for Ethereum.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-04-29 17:13