-

Ethereum’s NFT sales volume rose 31% last week, significantly impacting the network’s transaction fees.

ETH has been on consecutive decline in the last three days of the month.

As an experienced analyst with years spent navigating the ever-evolving cryptocurrency landscape, I find myself intrigued by the recent developments in Ethereum [ETH]. The surge in NFT sales has significantly impacted the network’s transaction fees, pushing them to a 3-month high. This trend is not unexpected, considering the growing popularity of NFTs and the sheer volume of transactions they generate.

The transaction costs for Ethereum [ETH] have seen a substantial drop since the introduction of its EIPs (Ethereum Improvement Proposals).

Lately, there’s been a bit of an increase in fees due to the surge in Non-Fungible Token (NFT) transactions and overall network activity.

Ethereum transaction fees reach 3-month high

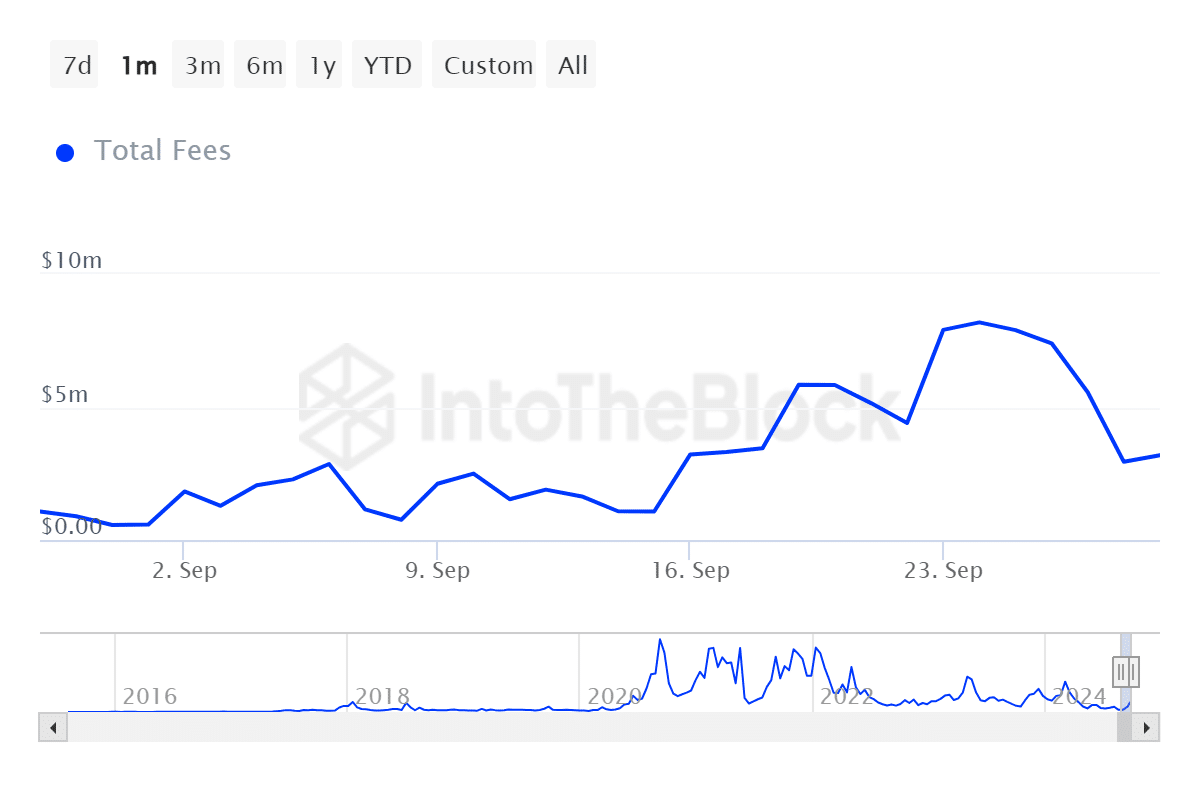

As per information from IntoTheBlock, Ethereum’s transaction costs have reached their peak in the past three months. The combined weekly transaction fees surged to $45 million, a level last seen in mid-June of 2024.

An in-depth examination reveals that starting roughly around September 22nd, the daily fees started climbing significantly. The volume jumped from approximately $4 million to nearly double its original amount, only to later decrease.

At press time, the fees had settled at around $3 million.

As an analyst, I found that, coinciding with this period, average transaction fees on Ethereum began to climb noticeably based on data obtained from Etherscan.

On September 22nd, the average charge was $4, but it increased significantly and reached more than $7 by the 24th of September. As of now, it has decreased to approximately $2.85.

Ethereum NFT market gains momentum

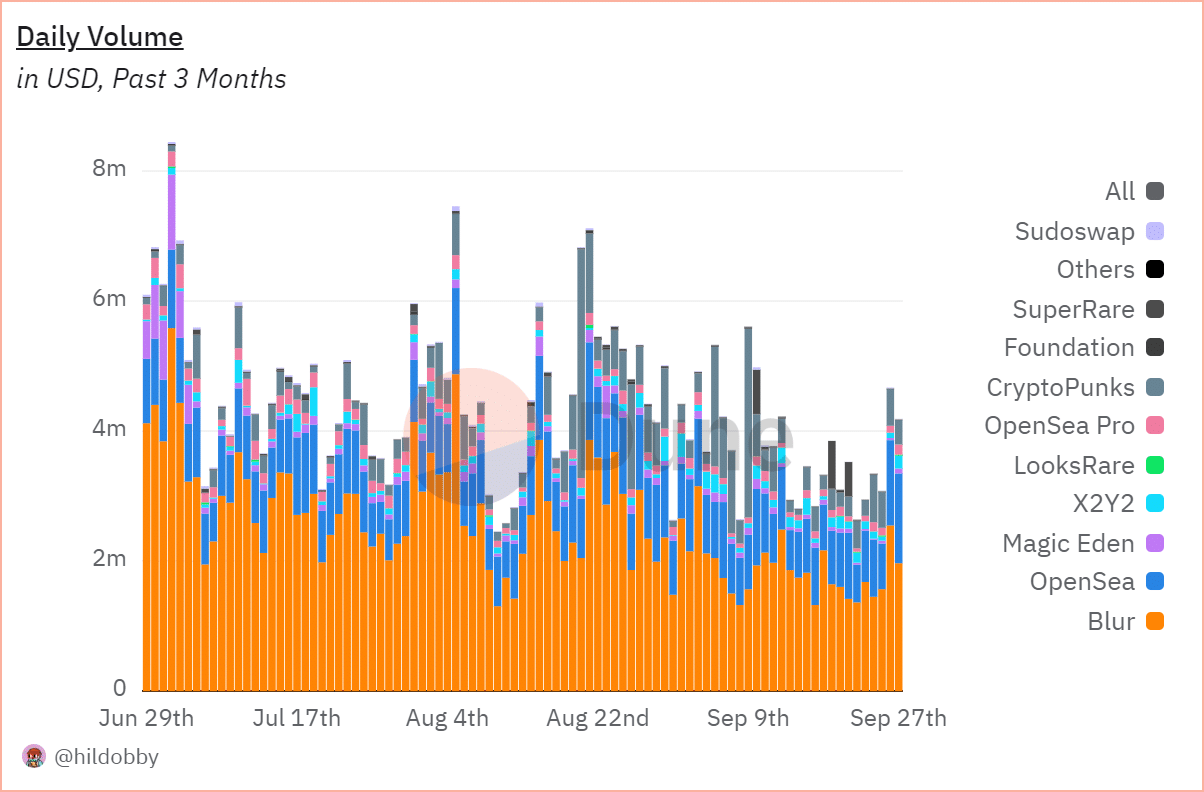

The NFT market on the Ethereum network has shown signs of renewed activity.

According to DuneAnalytics, it appears that the amount of NFT trades has seen a slight uptick lately, which seems to be influencing an upward trend in transaction costs.

Analysis showed that daily NFT volume has consistently surpassed $4 million in recent days.

Moreover, it’s worth noting that Ethereum led in NFT sales for the last seven days, with a total of $29.3 million in sales, marking a 31% growth compared to the previous week.

Ethereum transaction volume remains stable

Even with an increase in charges and Non-Fungible Token (NFT) transactions, Ethereum’s total transaction volume has managed to stay consistent.

According to DefiLlama’s data, there haven’t been major jumps in overall transaction counts, with the exception of a minor uptick to approximately 1.2 million transactions on the 27th of September.

For several weeks now, the daily transaction count has been steadily hovering near the 1 million figure.

Read Ethereum’s [ETH] Price Prediction 2024-25

Despite an uptick in fees on the Ethereum network recently, driven by increased NFT-related transactions, the total number of transactions being processed across the network remains consistent.

This suggests that NFT sales have been a key driver of the current fee spike.

Read More

2024-09-30 17:11