- Ethereum has finally caught a breather in the last 48 hours.

- The price held steady above the $3,000 price range.

As a seasoned crypto investor with a few battle scars from past market volatility, I’ve learned to keep a close eye on Ethereum’s [ETH] price movements and market sentiment. The last 48 hours have brought some much-needed relief as the price held steady above the $3,000 price range.

Until facing substantial price reductions, Ethereum [ETH] held steady within the $3,500 price range.

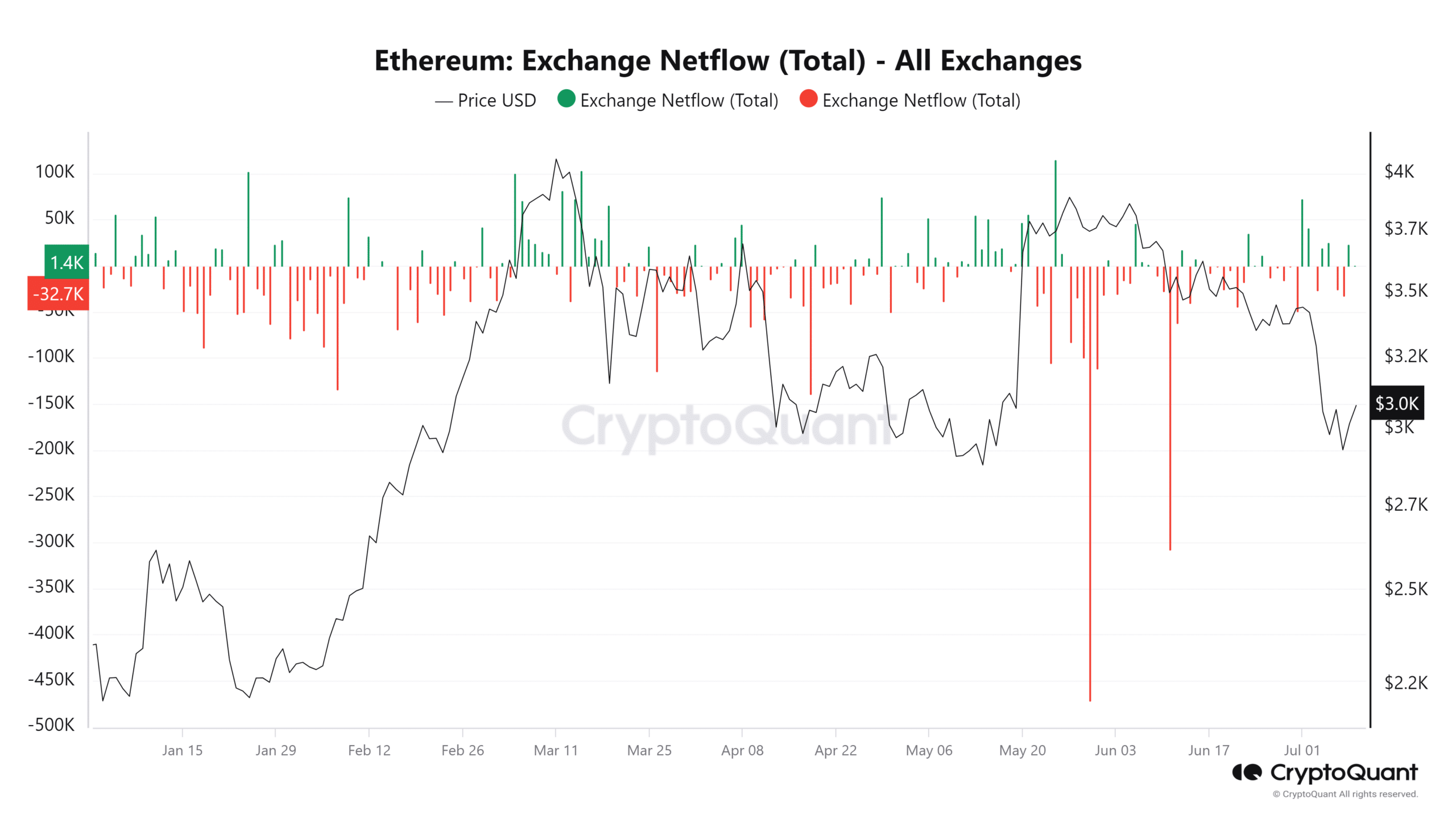

In spite of the current slump, the transfer of Ethereum between exchanges has shown contrasting trends, mirroring differing attitudes among investors.

Ethereum recovers from declines

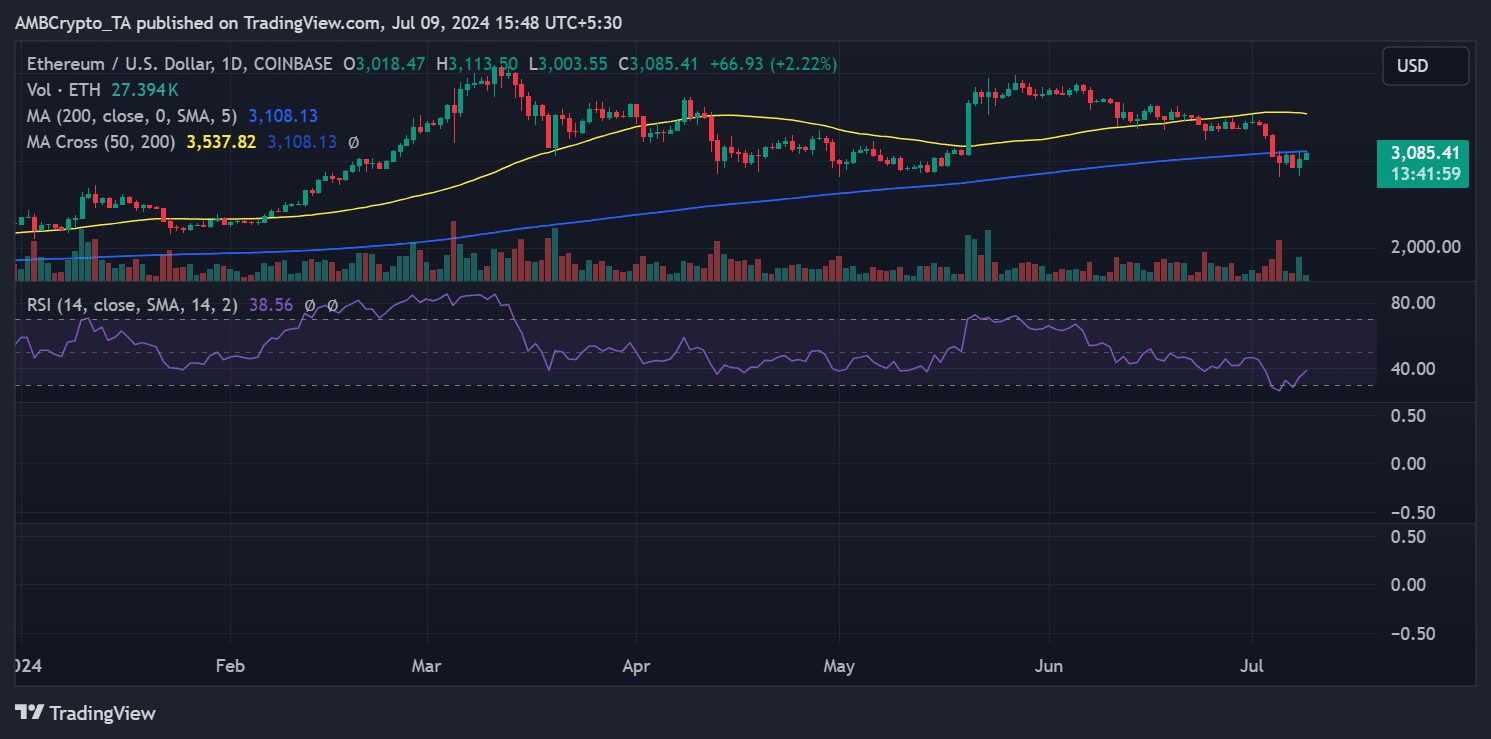

An analysis by AMBCrypto of Ethereum’s price action on a daily basis showed that July began with significant volatility. The cryptocurrency was priced around $3,430 on the first day of the month.

The following day, it experienced a slight decline but stayed within the $3,400 range.

Following that, a more noticeable downward trend emerged in the subsequent days, and Ethereum’s price reached approximately $2,980 by July 5th.

After that point, ETH went through significant ups and downs, shifting between gains and declines. However, by the 8th of July, there was a clear rebound, resulting in a nearly 3% rise, which bumped its price to approximately $3,018.

As of this writing, it was trading with an increase of over 2% at approximately $3,083.

As a crypto investor, I closely monitor various technical indicators to gauge market trends and potential buying opportunities. One such indicator is the Relative Strength Index (RSI). When the price of a cryptocurrency starts to rise, I’ve observed that the RSI often follows suit with a slight increase as well. This correlation can be an early sign of a bullish trend, making it an essential tool for my investment strategy.

At present, even with this advancement, the Relative Strength Index (RSI) was hovering around 40 at the current moment, beneath the neutral 50 threshold. This suggests that although investor sentiment is showing signs of recuperation, the market remains predominantly bearish.

Ethereum’s stable sentiments

As a crypto investor closely monitoring Ethereum’s market trends, I’ve been keeping an eye on the exchange netflow data provided by CryptoQuant. The recent analysis shows that Ethereum has seen a fluctuating pattern when it comes to inflows and outflows. This inconsistency suggests that trader sentiment towards Ethereum is mixed.

As an analyst, I’ve observed an uptick in Ethereum deposits into exchanges over the past two days relative to withdrawals. This trend implies that traders may be gearing up for selling or trading activities, possibly aiming to cash in on profits or minimize potential losses.

In the period prior to this, there were more Ethereum withdrawals than deposits reported in the exchange data, as signified by a negative netflow.

Traders often shift their assets to personal wallets for secure, long-term storage or decrease their involvement with exchanges to minimize potential risks.

As an analyst, I would interpret the absence of substantial inflows or outflows as a sign that traders’ sentiment has remained stable. In other words, their attitudes towards buying or selling securities have not undergone any significant shift, indicating that typical market behaviors persist.

Volume confirms buyers’ dominance

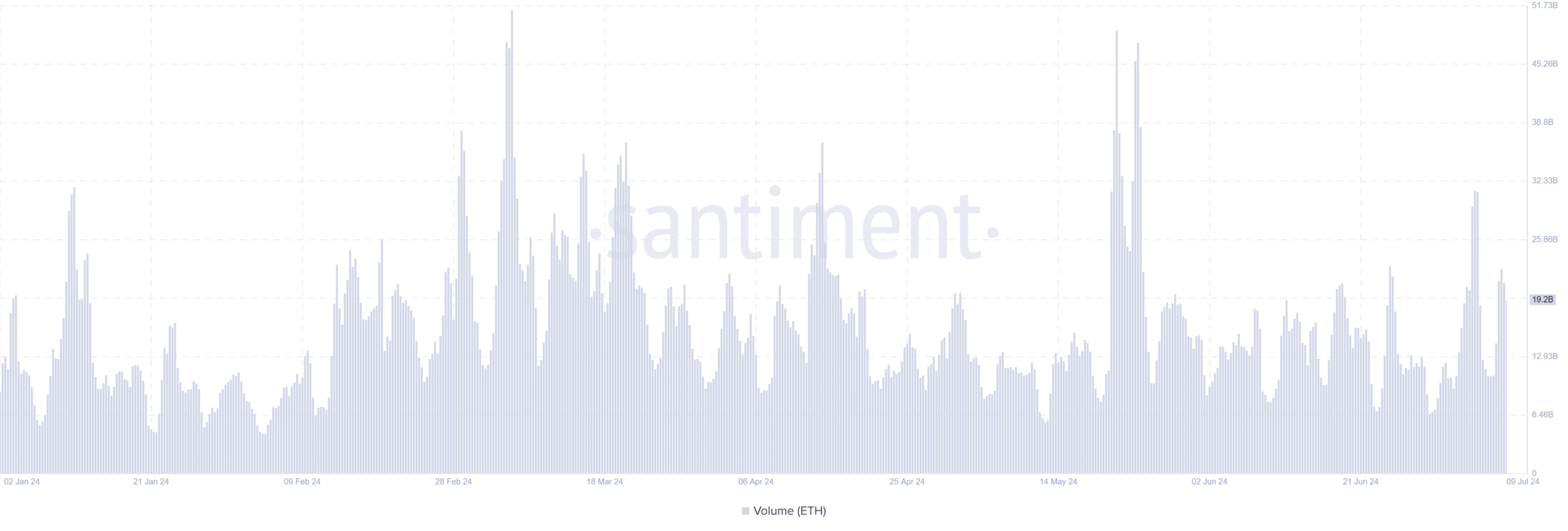

Over the previous 48 hours, Ethereum’s trading volume has shown a significant uptick, implying a surge in market engagement.

As a crypto investor, I’ve noticed an intriguing trend based on recent data from Santiment. The trading volume took a momentary dip, dipping down to approximately $10 billion on the 7th of July.

Realistic or not, here’s ETH market cap in BTC’s terms

Despite the initial decrease, the trading volume experienced a swift rebound by the 8th of July, reaching over $21 billion. At present, it continues to be substantial, exceeding $19 billion.

As an analyst, I’ve observed a significant uptick in trading volume recently, which is particularly noteworthy given the current price trend. This observation suggests that buyers have been more active in the market than sellers.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Solo Leveling Arise Amamiya Mirei Guide

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-07-10 04:08