- Ethereum shows potential for a bullish reversal, with a rare daily bullish divergence and narrowing Bollinger Bands.

- Macroeconomic shifts and on-chain data could propel Ethereum’s price upward, despite recent bearish momentum.

As a seasoned analyst with over a decade of experience in the financial markets, I have seen my fair share of bull and bear runs, and I must say that Ethereum [ETH] presents an intriguing opportunity at present. The daily bullish divergence and narrowing Bollinger Bands suggest a potential price reversal, which is further supported by the technical indicators such as the MACD and RSI.

At the moment of reporting, Ethereum (ETH) appeared to be showing indications of a price turnaround, as a bullish divergence was developing on the daily chart. This is the first instance of a bullish divergence for ETH in more than two years.

Michaël van de Poppe, a crypto analyst, recently noted,

“The market indicators look promising right now, because Ether ($ETH) has shown its initial bullish trend on the daily chart for the first time in over two years.”

However, he also posed the critical question:

“Will this be the actual reversal signal?”

Technical indicators signal possible price movement

At the moment of reporting, Ethereum was valued at $2,514.53, representing a minor 0.89% decrease in the past day and a more substantial 4.94% drop over the last week. However, despite this recent dip, technical signs point towards a possible change.

The Bollinger Bands are becoming more constricted, usually signaling that a substantial price shift may soon occur.

Currently, ETH is being traded beneath the midpoint of its Bollinger Band, hinting that the asset’s price movement might still be influenced by a bearish trend.

According to the Moving Average Convergence Divergence (MACD), the MACD line continued staying beneath the signal line, and both lines were moving towards decreasing values.

Although it indicated persistent downward pressure, the histogram hinted at a subtle lessening, potentially signaling the initial phases of a potential reversal or stabilization.

Currently, the Relative Strength Index (RSI) stands at 39.7, indicating that it falls within the range classified as ‘oversold’.

Therefore, as there’s still some pressure to sell, it might present a chance for purchasers to get back into the market, possibly causing a temporary rise.

Macroeconomic influences

Macroeconomic factors could also play a crucial role in Ethereum’s potential price surge.

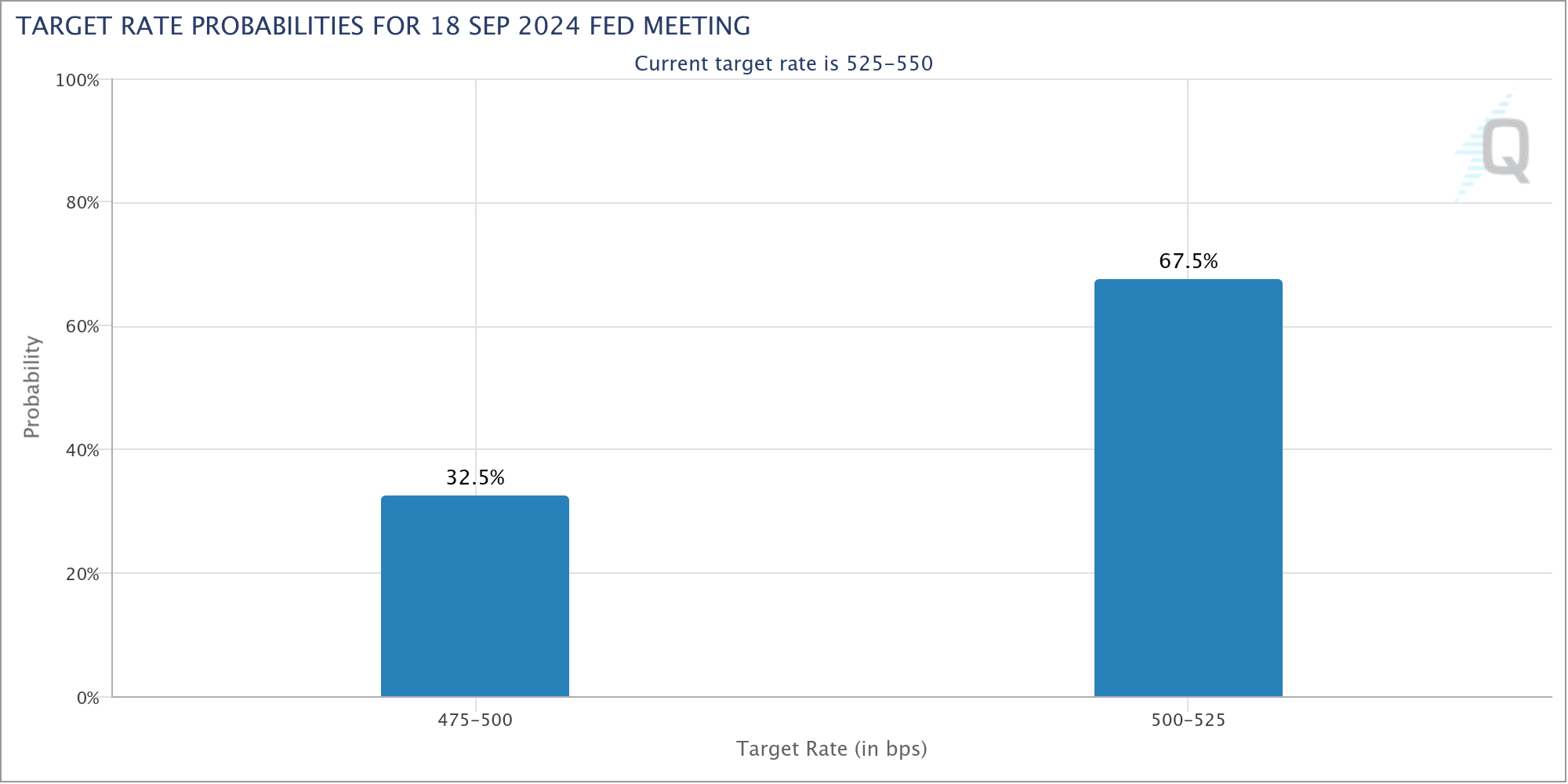

It’s anticipated that the Federal Reserve will lower interest rates in September, and there’s a possibility they may reduce them even more due to decreasing inflation rates and economic instability.

Lowering interest rates often increases the allure of riskier investments, such as cryptocurrencies, because the value of safer options, like the US dollar, becomes less appealing.

Historically, when interest rates are reduced, there tends to be an increase in investments flowing into the cryptocurrency market, as investors look for greater yields in non-traditional assets.

Due to Ethereum’s well-established network and increasing popularity, it may significantly gain from the changing attitude among investors.

Adopting a more accommodating approach by the Federal Reserve might lessen the strength of the US dollar, potentially boosting the value of Ethereum even more.

Ethereum’s growth prospects

Data verified on the blockchain also indicates a favorable perspective for Ethereum. As reported by DefiLlama, the combined value locked within Ethereum’s decentralized finance (DeFi) platforms amounted to approximately $46.966 billion at the time of reporting.

Furthermore, the system handled a 24-hour trading volume of approximately $1.13 billion, receiving inflows totaling around $2.44 million.

Read Ethereum’s [ETH] Price Prediction 2024–2025

390,291 active addresses were seen over the past 24 hours, with an additional 64,793 new accounts joining the network, demonstrating sustained user interest and network activity.

As a researcher, I’m consistently intrigued by the robust attention surrounding the Ethereum network. This persistent interest might potentially bolster the value of Ethereum in the upcoming months.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-30 12:08