-

Ethereum Foundation liquidated 2,500 ETH amid market volatility, totaling approximately $6.06 million.

ETH faced critical support at $2,300; failure to hold this level could lead to a significant decline.

As a seasoned crypto investor who has weathered numerous market storms since the early days of Bitcoin, I find myself both intrigued and cautious by these recent developments with Ethereum [ETH]. The Ethereum Foundation’s strategic liquidation of 2,500 ETH, followed by the selling spree from a prominent 2017 ICO whale, has certainly added fuel to the market volatility.

Notably, the Ethereum Foundation recently sent approximately 2,500 Ethereum (ETH), equivalent to roughly 6.06 million dollars, to the digital currency platform, Bitstamp.

Details of Ethereum Foundation’s recent transfer

On October 8th, at 8:14 AM and 8:19 AM UTC, these transactions took place, which are part of a larger pattern of liquidations by the Foundation in response to shifting market circumstances.

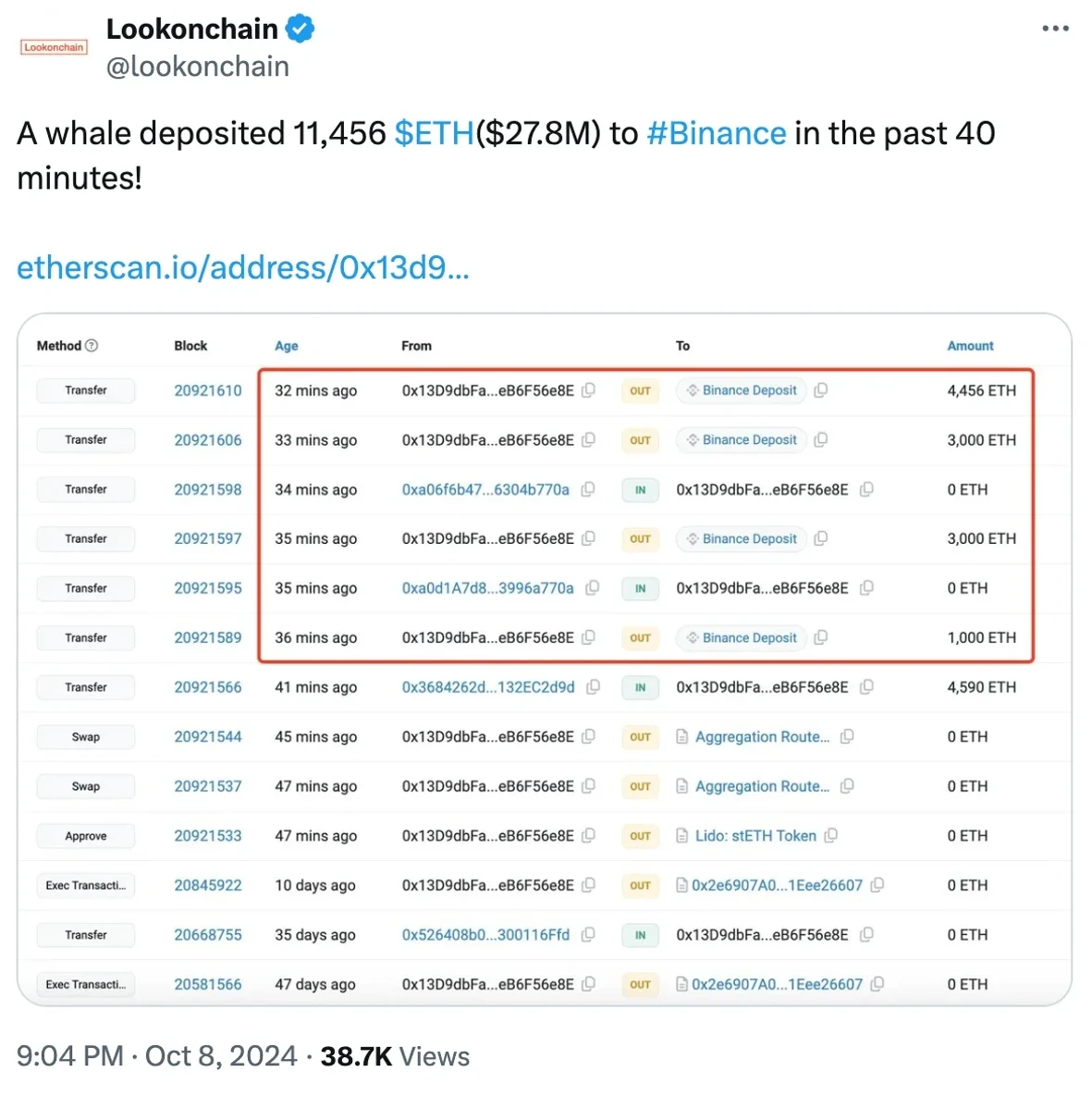

In the course of my analysis, it’s worth noting that a significant player from the 2017 Initial Coin Offering (ICO) period has been quite active. On the very same day, this influential figure moved a substantial amount of 5,000 Ether—roughly equivalent to $12.22 million at current rates.

It appears that this whale is said to have sold more than $113 million worth of Ethereum since September, which puts additional strain on the market due to the increased supply.

New findings from Lookonchain suggest that the Ethereum Foundation has been proactively adjusting their Ethereum (ETH) assets, likely due to the current downturn in the crypto market.

To strategically distribute funds, the Foundation divided 2,500 Ether (valued at around $3.03 million per segment) and sent it to Bitstamp in two separate transactions.

It seems this strategy is all about transforming some of their digital resources into hard cash or reliable digital currencies, demonstrating a forward-thinking stance in managing assets while navigating the current complexities in the market.

Community reaction

In response to the circumstances, diverse crypto communities took action, as underscored by a user on X (previously Twitter), who pointed out:

“What the heck is going on with ETH?”

Adding to the fray was another X user-Sweep who noted,

“what’s cooking, what does the whale knows.”

According to a recent analysis by Ali Martinez, Ethereum finds itself at a significant juncture, and the $2,300 price point has been highlighted as an essential level of support.

Martinez noted that approximately 2.77 million addresses were acquired.

If positive market trends persist and the price stays over this level, it could indicate a strong possibility of substantial growth, potentially even trebling in value.

If the price drops under $2,300, there might be a significant decrease of about 30%, potentially causing ETH‘s value to drop to approximately $1,600.

Impact on ETH’s price

Despite growing pessimism regarding Ethereum, the most recent report from CoinMarketCap showed that Ethereum was currently priced at $2,433.51 in real-time trading, indicating a minor uptick of 0.16% over the past day.

Although there was a small rise, the RSI value continued to stay beneath the neutral point at 45, implying that downward pressure from bears is still influencing the market.

On the other hand, the expanding Bollinger Bands suggest increased market volatility, implying that bullish forces could potentially overpower bearish tendencies in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-09 19:04