- Ethereum’s Funding Rates hit 0.03%, signaling bullish sentiment and rising market interest.

- The key levels to watch are $3,800 resistance and $3,700 support as momentum builds.

As a seasoned crypto investor with scars from the infamous 2018 bear market etched into my digital ledger, I can confidently say that Ethereum’s current market dynamics have me feeling a sense of cautious optimism. The surge in Ethereum Funding Rates to levels last seen during the epic 2024 rally is reminiscent of the days when ETH was just shy of $5,000.

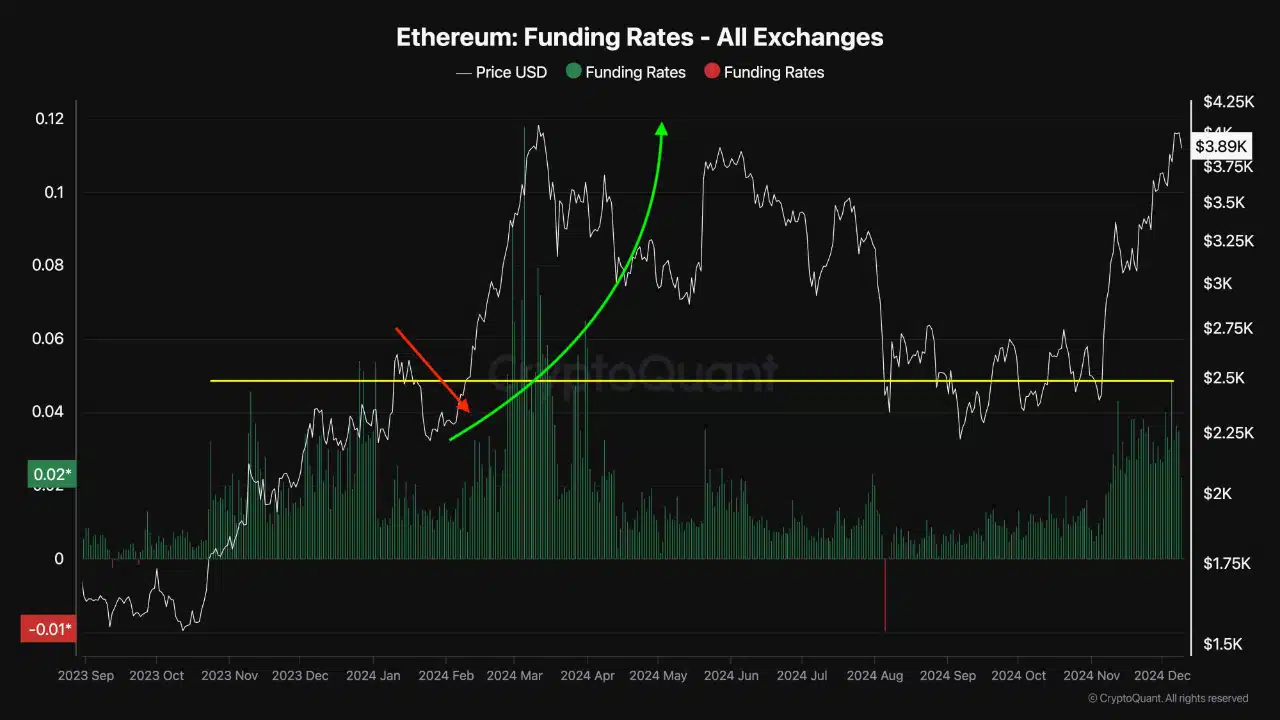

The Funding Rates for Ethereum have soared to peaks not seen since early 2024, indicating a significant 88% upsurge in ETH at that time. This surge is a reflection of the escalating optimism among traders in the derivatives market, fueled by an increase in active positions and strategic position adjustments.

According to the data, there could be a positive trend developing for Ethereum, with key price points being closely monitored by the market.

Ethereum Funding Rates hit a major milestone

According to CryptoQuant, the Ethereum Funding Rates chart has experienced a substantial rise to 0.03%, which represents a crucial shift in market trends.

As a crypto investor, I’ve noticed that when funding rates are high, it suggests traders are heavily betting on long positions, indicating they anticipate further price growth. Back in January 2024, when funding rates mirrored the current levels, Ethereum experienced a significant upward surge.

This funding rate milestone may now foreshadow renewed bullish trends if historical patterns hold.

Long/short ratio shows nuanced market sentiment

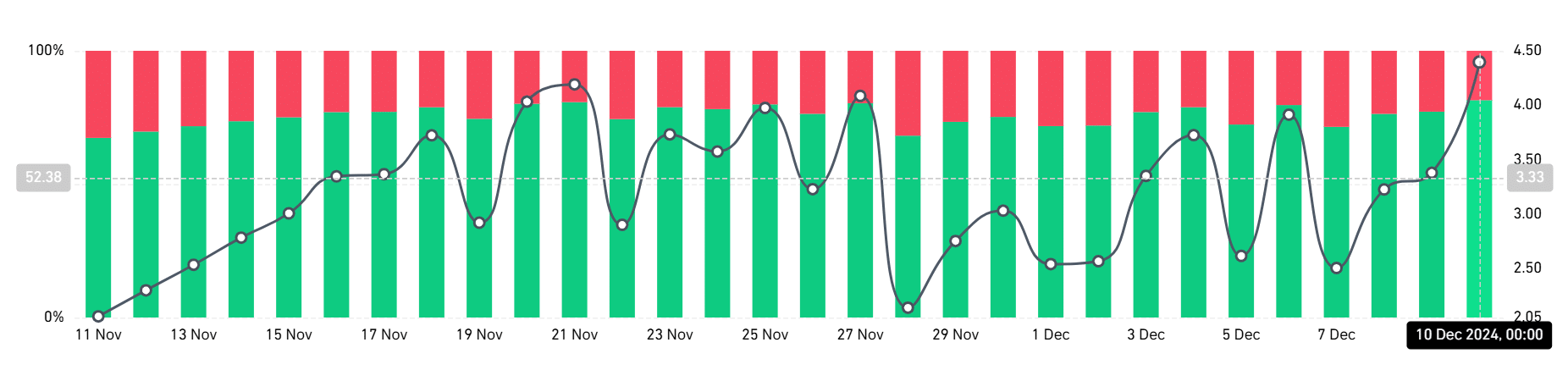

At the moment, according to Coinglass, the proportion of long and short positions is approximately 48.18% for long positions and 51.81% for short positions, with a long/short ratio of about 0.9301%. This means that for every $100 invested in long positions, there are slightly more ($100.93) invested in short positions.

Upon examination, I found a significant disparity in the distribution of trading accounts: Long positions account for approximately 81.47%, while short positions make up only around 18.53%. This equates to a long-to-short account ratio of roughly 4.40.

This imbalance indicates a market with relatively fewer traders taking large bets on Ethereum’s short-term decline, compared to the vast majority who believe in its long-term price growth.

Such an imbalance might cause increased market turbulence, because significant selling could set off swift changes in pricing.

Open interest: Rising market participation

The total value of outstanding contracts for Ethereum derivatives climbed above $19.5 billion, showing more trading and investment enthusiasm among people. This continuous growth in open contracts, along with escalating Ethereum Funding Rates, suggests a significant surge of capital flowing into the market.

Previously, similar circumstances have often led to large price changes, and the present situation seems to indicate that Ethereum could experience another substantial increase in value.

Lately, there’s been a substantial decrease in open interest, which is now approximately $17.5 billion. Remarkably, optimistic feelings among investors remain robust despite this decline.

Momentum builds around key Ethereum levels

Currently, Ethereum stands at approximately $3,722.55, showing a favorable upward trend. The day’s graph exhibits a robust bullish pattern, as crucial technical markers line up to foster additional increases.

The 50-day moving average, currently at $3,140, provides solid support, while the 200-day moving average at $3,003 confirms a long-term uptrend. The Relative Strength Index (RSI) is at 57.74, indicating moderate bullish sentiment.

Recently, Ethereum faced resistance around the $3,800 price point and was met with significant selling activity, causing a minor retreat. If Ethereum manages to surpass the $3,800 level, it could potentially challenge the psychological barrier of $4,000.

On the negative side, a quick level of support can be found around $3,700, while a more substantial support is close to the 50-day moving average.

The activity in Ethereum trading has surged alongside rising open interests and funding rates. These indicators suggest robust investor involvement and diminish the chances of misleading price spikes. The alignment of these statistics provides a strong argument supporting the optimistic viewpoint on Ethereum’s price trend.

The surge in Ethereum Funding Rates, rising open interest and a nuanced long/short ratio reflect the market’s increasing optimism about Ethereum’s future.

Read Ethereum (ETH) Price Prediction 2024-25

Keeping an eye on past patterns that suggest a possible strong surge, it’s crucial for traders to stay vigilant about the potential fluctuations stemming from excessively leveraged positions.

If Ethereum manages to surpass its significant resistance points, it suggests that the current bullish trend may continue over the next few days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-10 17:16