- Ethereum’s funding rates underlined growing optimism, but sentiment remains cautious

- Declining active addresses and rising leverage ratios highlighted mixed trends in Ethereum’s retail and Futures markets

As a seasoned researcher with years of experience navigating the ever-evolving cryptocurrency market, I find myself intrigued by the current state of Ethereum. The recent price volatility has certainly stirred up a storm among investors, with optimism growing but tempered by caution.

Recently, Ethereum’s price has shown substantial fluctuations, causing varying responses among investors. The cryptocurrency surged past $2,700 on the 30th of October, boosting investor confidence. Lately, this positive mood has been tested due to its recent decline in value.

In the past day, the value of Ethereum decreased by 5.1%, reaching a low of $2,475 before leveling off at approximately $2,496 as I’m writing this. This price drop has ignited conversations about Ethereum’s market resilience, focusing on the opinions of investors in Ethereum Futures.

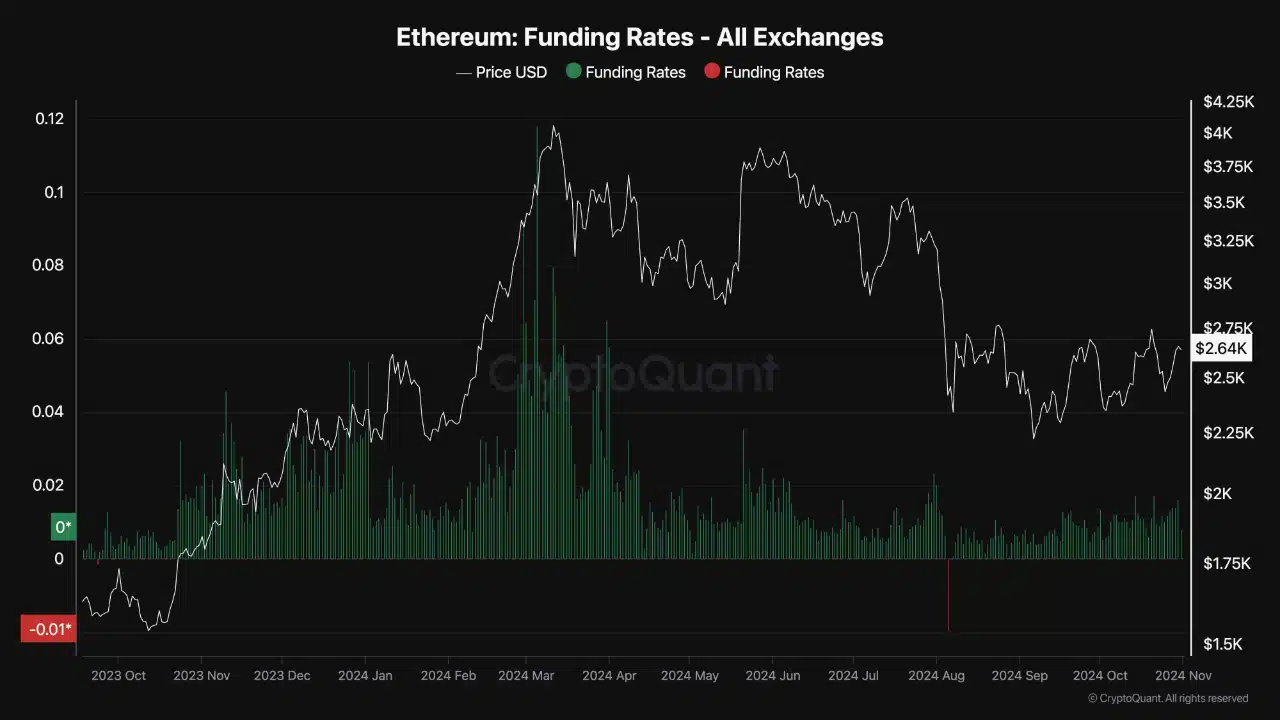

Despite the recent price setback, however, a CryptoQuant analyst highlighted that Ethereum’s Futures market funding rates revealed a positive outlook among traders. The funding rate, which reflects the balance between buyers’ and sellers’ optimism, registered an uptrend recently.

Funding rates and investor sentiment in Ethereum Futures

A rise in positive funding rates suggests increased interest among traders to invest more in Ethereum Futures, demonstrating a generally optimistic outlook. Yet, these rates have not yet surpassed the highs seen in March, when Ethereum’s price was rapidly increasing. This means that while optimism is present, it has not yet reached the level needed to trigger a significant upward trend or breakout.

The rates at which funds are exchanged in Ethereum Futures provide a glimpse into the general trader mood, demonstrating the degree of bullish or bearish pressure within the market. When funding rates are positive, it suggests that traders are more inclined to maintain long positions, indicating a bullish outlook. Conversely, negative funding rates indicate a prevailing bearish sentiment.

The rising trend in Ethereum’s funding rate indicates an increasing preference for holding long positions in the Futures market. This is particularly noticeable as investors are optimistic about potential price increases. Nevertheless, the lower funding rates compared to earlier this year imply that although sentiment is improving, it might not be robust enough yet to trigger a significant price surge.

The ability of ETH to break through resistance and continue its uptrend relies significantly on the prolonged increase of funding rates. An elevation in these rates indicates a higher demand for long-term investments in ETH, which could potentially create more buying pressure on the cryptocurrency.

If the funding rates increase, it suggests that investors have increased confidence. This boosted confidence may allow Ethereum to surpass current resistance points, possibly causing its price to rise even further.

This sentiment, combined with market trends, could shape Ethereum’s trajectory in the coming weeks.

Active addresses and leverage ratios indicate market trends

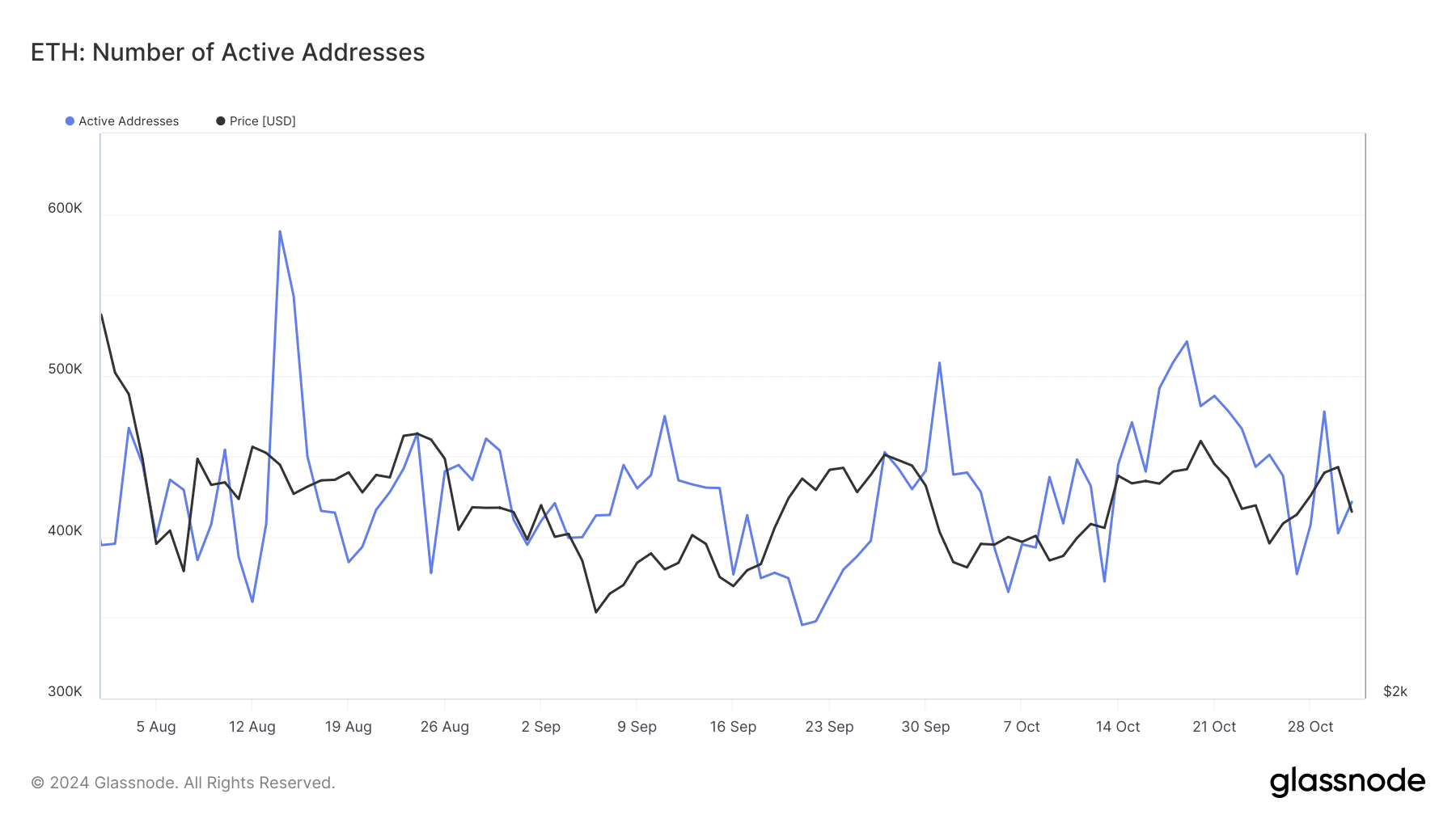

The number of active Ethereum addresses, which serves as an indicator of retail interest, has been showing a downward trend outside the Futures market. According to data from Glassnode, the active addresses dropped from around 550,000 on August 14 to about 421,000 at the current time.

As a crypto investor, I’ve noticed a decrease in active Ethereum (ETH) addresses, which might be indicative of reduced enthusiasm among retail investors. This could be a reflection of the overall market’s caution. Active addresses serve as a measure of involvement and interaction within the ETH community, so their decline may imply that fewer investors are actively trading or moving their ETH. This could potentially slow down buying momentum.

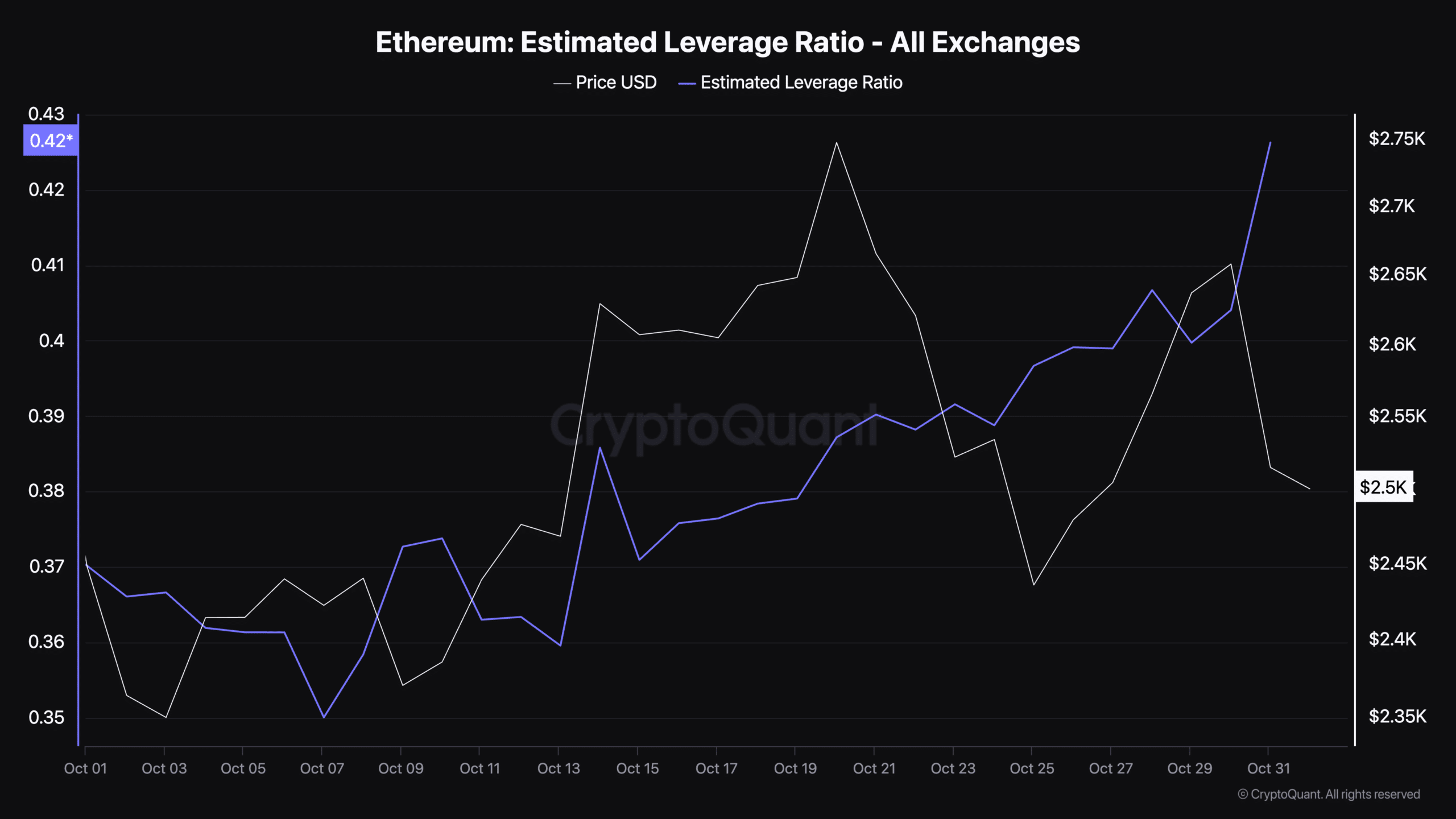

In summary, recent data from CryptoQuant shows that Ethereum’s approximate loan-to-value ratio has risen, going from 0.35 in early October to 0.42 currently. This figure represents the extent of leverage or borrowed funds employed by traders, and a higher value suggests more borrowing is happening.

An increase in the leverage ratio could indicate that traders might be assuming higher risks, possibly anticipating price increases.

On the other hand, a higher leverage ratio might increase market volatility since highly leveraged trades become more reactive to price fluctuations. Consequently, if Ethereum’s price experiences an unforeseen shift, it could result in more pronounced changes.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-02 00:08