-

ETH started the week with positive moves.

The ETH open interest is now over $11 billion.

As a seasoned analyst with over a decade of experience in the financial markets, I have witnessed numerous market cycles and trends. The recent developments in Ethereum (ETH) have caught my attention due to its potential bullish implications.

The endorsement of Ethereum [ETH] Exchange-Traded Funds (ETFs) has noticeably fueled curiosity about Ethereum, as shown by crucial market signals. Moreover, the recent surge in Ethereum’s value has boosted optimism among futures market participants.

Ethereum sees open interest increase

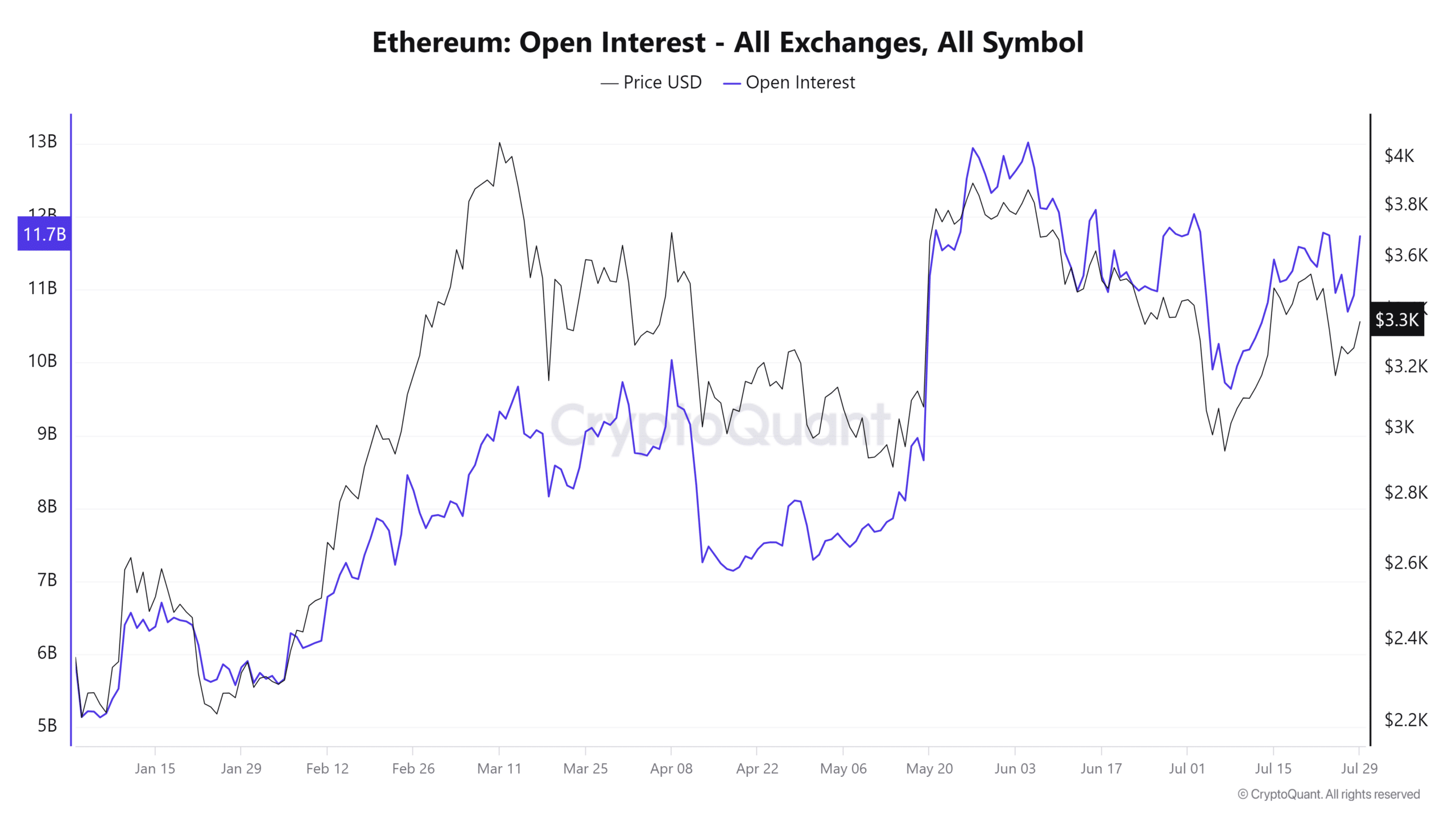

Based on data from CryptoQuant, there has been a notable change in the open interest volume for Ethereum over the past few days. Specifically, the open interest in ETH decreased from about $12 billion on July 2nd to approximately $9 billion by July 8th.

As a data analyst, I examine open interests, which refer to the quantity of unsettled derivative agreements, including futures and options, still pending in the market.

In recent weeks, open interest has seen a significant increase, surging past $11.8 billion by an additional $1.5 billion.

In the most recent trading day, there was a noticeable surge that pushed the volume up beyond $10.9 billion.

1. The rise in open interest might indicate a burgeoning curiosity or restored trust among traders. Key market occurrences, like the expectation or repercussions of pivotal events such as ETF approvals, frequently trigger this phenomenon.

1. An increase in open interest suggests fresh capital is flowing into the market, potentially indicating a positive or bullish trend.

Ethereum funding rate jumps to record-high

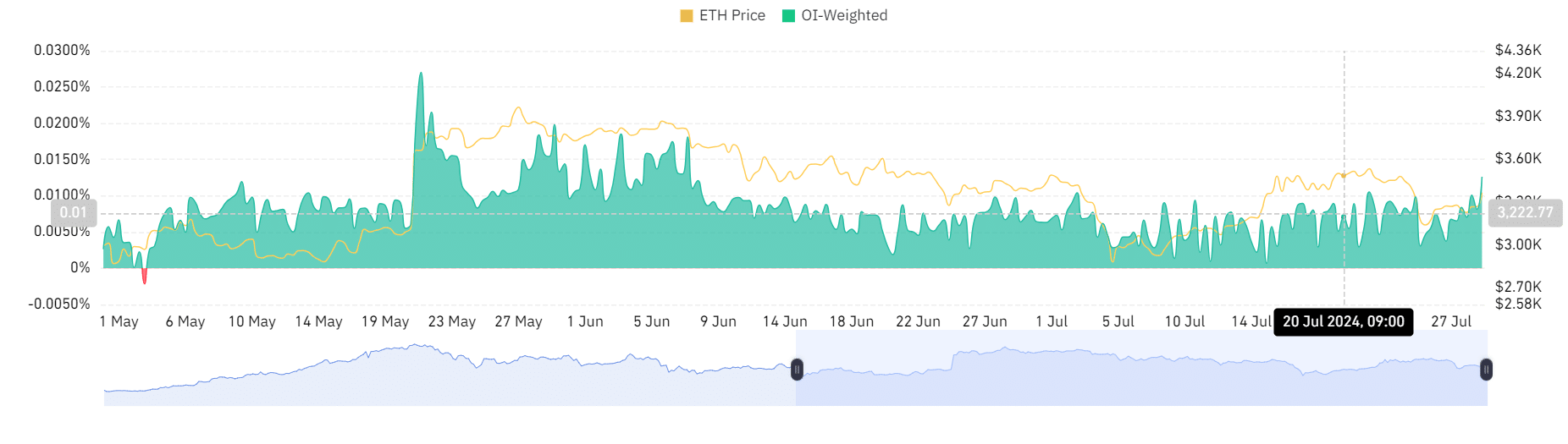

Based on Coingeasus’s statistics, there has been a significant increase in the Ethereum futures funding fee during the past 24 hours.

As an analyst, I’m reporting that the rate has surged significantly, currently standing at approximately 0.0126%. This is the highest it’s been since August 8th, signaling a notable increase following more than a month of relatively stable levels.

As a researcher studying market trends, I’ve observed that a higher funding rate often signifies robust investor interest in maintaining long positions for assets like Ethereum. This increased demand drives up the cost of holding these positions, which could be an indication of optimistic sentiments among traders, implying a bullish outlook towards Ethereum.

1. This surge could be interpreted as a hopeful sign, suggesting that investors anticipate an upswing in the price of Ether. Consequently, they tend to favor purchasing futures contracts at a higher cost.

ETH jumps by 3%

1) A recent examination of Ethereum’s price trajectory shows a significant surge, having risen by more than 3% within the past day.

Read Ethereum (ETH) Price Prediction 2024-25

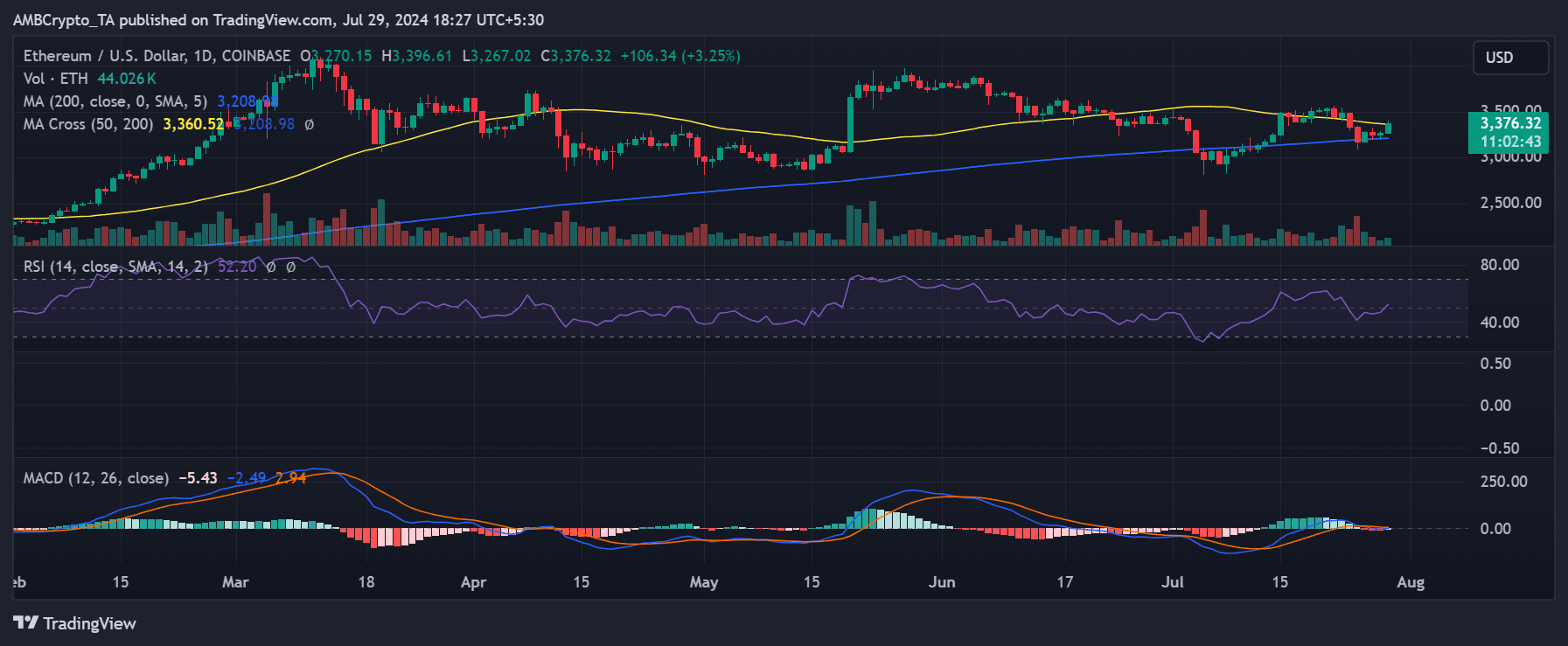

Based on AMBCrypto’s analysis of the daily time frame, Ethereum was approximately valued at $3,375, signifying a 3.3% increase compared to its previous positions.

As a researcher observing the cryptocurrency market, I’ve noticed an upward shift in Ethereum’s value that subtly pushes it towards a bullish trajectory. Upon examining the Relative Strength Index (RSI), I found it currently resting above the neutral line at present.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-07-30 11:04