-

Ethereum gas fees has fallen below $100,000.

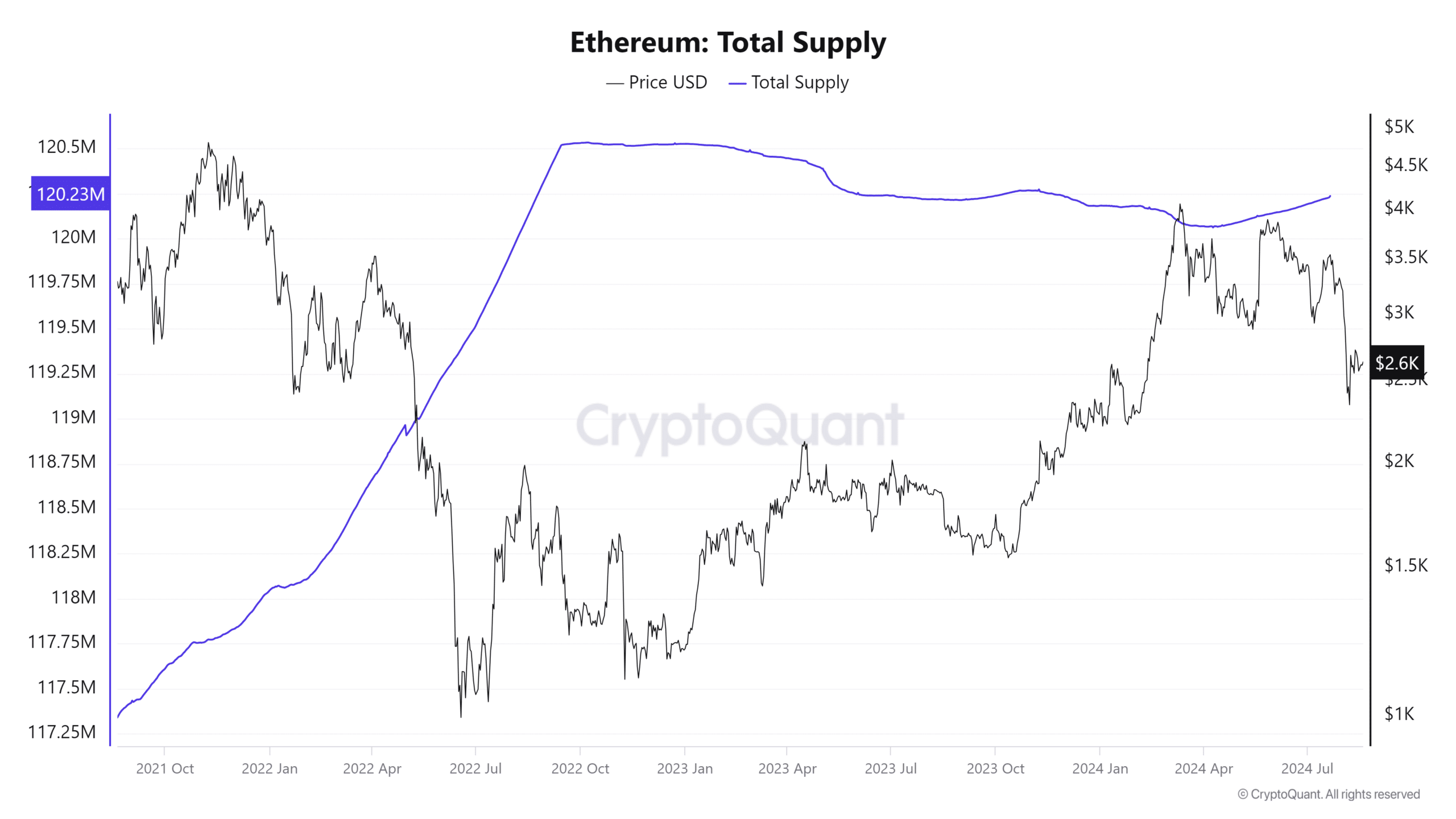

The total supply of ETH has increased in the last few months.

As an analyst with over a decade of experience in the cryptocurrency market, I must say that the recent developments in Ethereum (ETH) are both exciting and concerning. The drastic reduction in gas fees has made the network more accessible and affordable for users, which is undeniably a positive step forward. However, the potential impact on ETH value cannot be overlooked.

Recently, Ethereum (ETH), once known for its steep gas fees, has experienced a significant drop in transaction expenses.

With the decrease in fees, the network becomes more user-friendly and cost-effective, yet it raises worries about its possible influence on Ethereum’s worth.

Ethereum gas fees hit five-year lows

On August 19th, according to a Kaiko report, Ethereum’s gas fees dropped down to their lowest levels in five years.

As a seasoned blockchain enthusiast with over a decade of experience in the industry, I have witnessed numerous developments that have reshaped the landscape of this technology. One recent trend that has caught my attention is the surge in activity on Layer 2 solutions. Having seen similar patterns in previous bull markets, I can confidently say that this increased activity is a strong indicator of growing interest and adoption.

This upgrade notably lowered transaction fees on Layer 2 networks, contributing to the decline in overall gas fees.

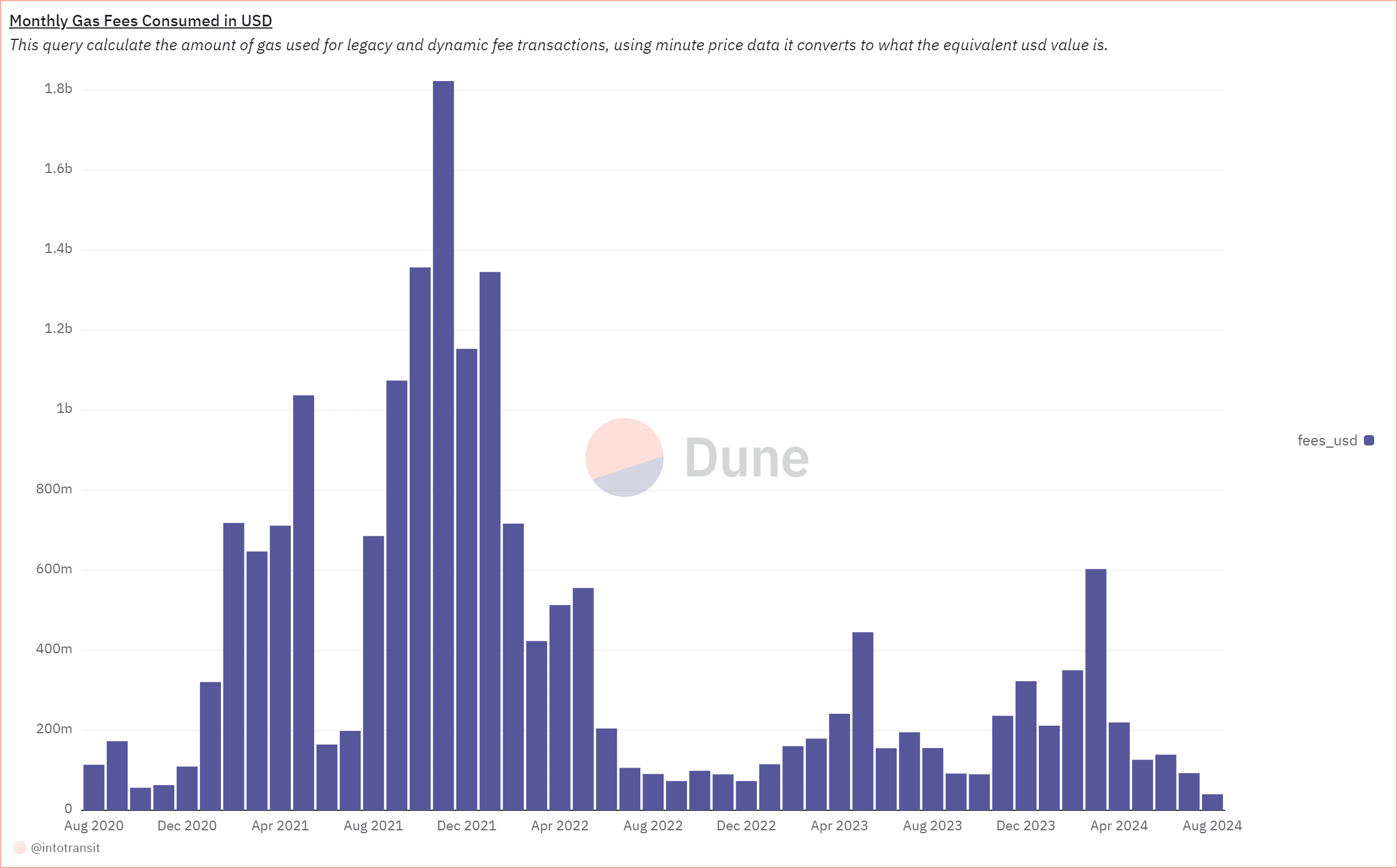

Based on data from Dune Analytics, it was in March 2024 when Ethereum’s gas fees experienced a substantial increase, surpassing approximately $603.2 million.

Ever since then, fees have been gradually decreasing, and it’s projected that they will reach approximately $93.4 million in July 2024. According to Kaiko’s findings, this month appears to be on a path towards recording the lowest fees yet.

Lowering gas fees can lead to less Ether (ETH) being destroyed, due to Ethereum’s EIP-1559 system which burns some part of gas fees, thereby decreasing the total amount of circulating ETH in the market.

As fees decrease, there’s less Ether being destroyed, which might result in a gradual expansion of the token’s total quantity over time.

Supply increase

Due to the Denmei update and more transactions happening on Layer 2, there’s been a significant drop in Ethereum transaction fees, which means less Ether is being consumed as a result.

Over time, the amount of ETH in circulation has steadily grown from 120 million in March 2024 to more than 120.2 million now, according to Glassnode’s data. This growth has been gradual yet persistent.

In Kaiko’s findings, it was pointed out that the increasing amount of ETH being supplied might limit any immediate price hikes, despite the presence of favorable factors like ETFs based on spot Ethereum.

A rise in the availability of Ethereum (ETH) might not be matched by an equal boost in demand, which could potentially lead to a decrease in ETH prices due to excess supply.

ETH remains in a bear trend

A glance at Ethereum’s price movement by AMBCrypto suggests that the $3,000 mark now serves as a notable psychological barrier for traders.

Currently, Ethereum stands around $2,648, exhibiting a modest rise of nearly 1% in its value.

Even though it experienced some growth, Ethereum has found it challenging to reach or surpass the $3,000 resistance point, with its short-term average (represented by the yellow line) serving as a significant obstacle.

Moreover, the Relative Strength Index (RSI) of Ethereum stood at approximately 40 as we speak, suggesting that it is currently experiencing a robust downward trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-21 00:08