-

ETH is more sensitive to U.S. elections than BTC, per Bitwise’s CIO.

The altcoin has been underperforming BTC since 2022; will the trend change?

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I find the recent assertion that Ethereum (ETH) is more sensitive to U.S. elections than Bitcoin (BTC) intriguing, yet not entirely surprising. Having observed the market’s dynamics over the years, it’s evident that certain altcoins do tend to react differently to geopolitical events compared to their counterparts like BTC.

Matt Hougan, the Chief Investment Officer at Bitwise, states that Ethereum (ETH) may have a greater impact from the results of the U.S. election compared to Bitcoin (BTC).

The executive pointed out that since Kamala Harris became the Democratic presidential nominee on July 21st, ETH has nearly doubled Bitcoin’s losses. In other words, he was stating that the value of Ether has significantly decreased compared to Bitcoin, starting from the day Harris replaced Biden as the candidate.

“Ever since Harris took over from Biden, Bitcoin (-8.68%) and Ethereum (-26.19%) have experienced a dip. In my viewpoint, Ethereum seems to be more affected by the election results compared to Bitcoin.”

After Harris took over from Biden, the price of Ethereum (ETH) has fallen from around $3,300 to less than $2,500. In contrast, Bitcoin (BTC) has also decreased in value, dropping from more than $68,000 to below $60,000 within the same time frame.

In this context, ETH‘s apparent heightened responsiveness to changes implies that the results of the U.S. elections in November may have a stronger influence on the altcoin compared to Bitcoin.

ETH is ‘still great’

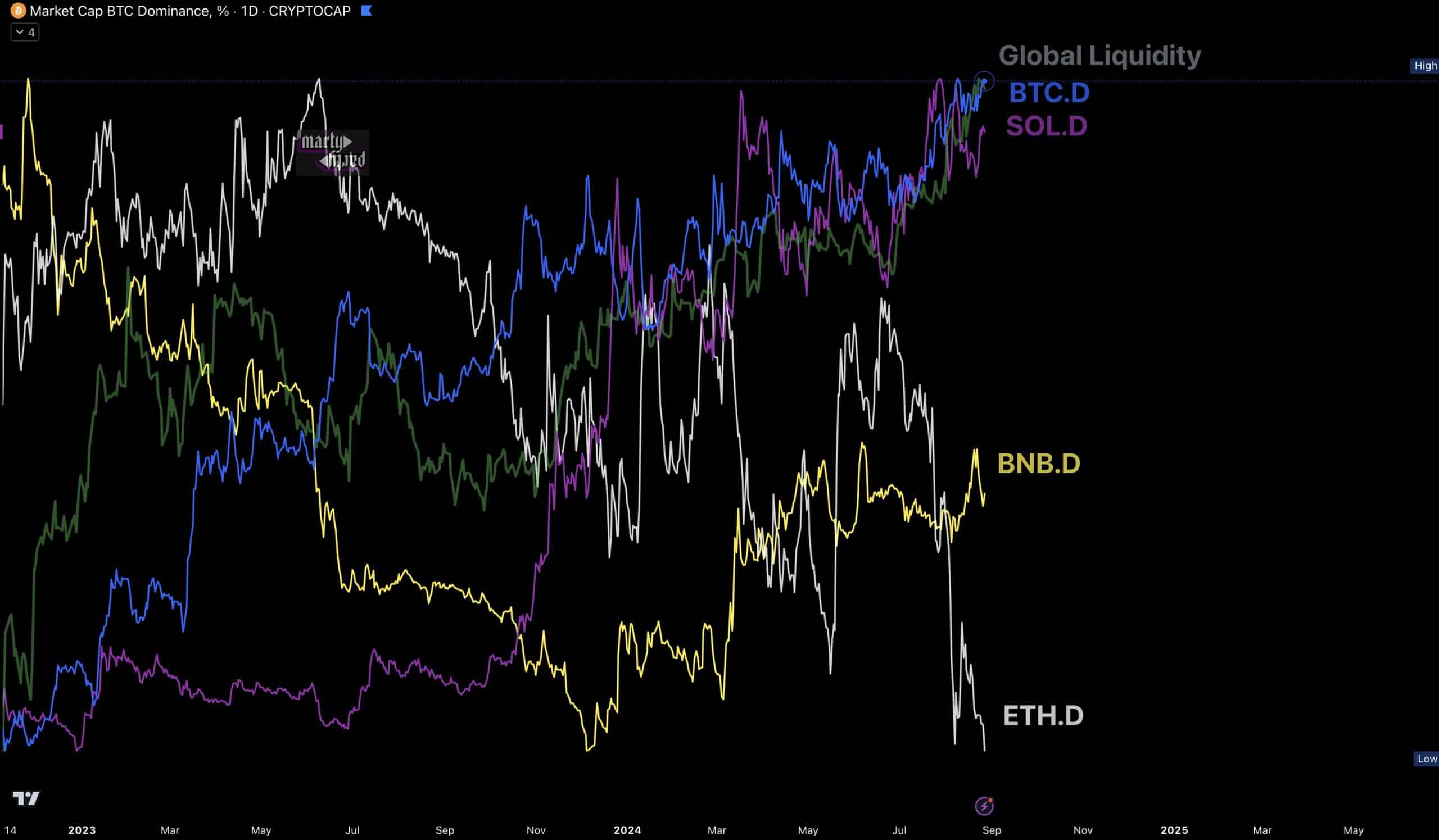

Moreover, during the period from July to August, Ethereum (ETH) saw a substantial decline in its market influence. Instead, liquidity shifted towards rival assets such as Bitcoin (BTC) and Solana [SOL], which gained popularity.

According to market commentator Marty Party, this didn’t augur well for the largest altcoin.

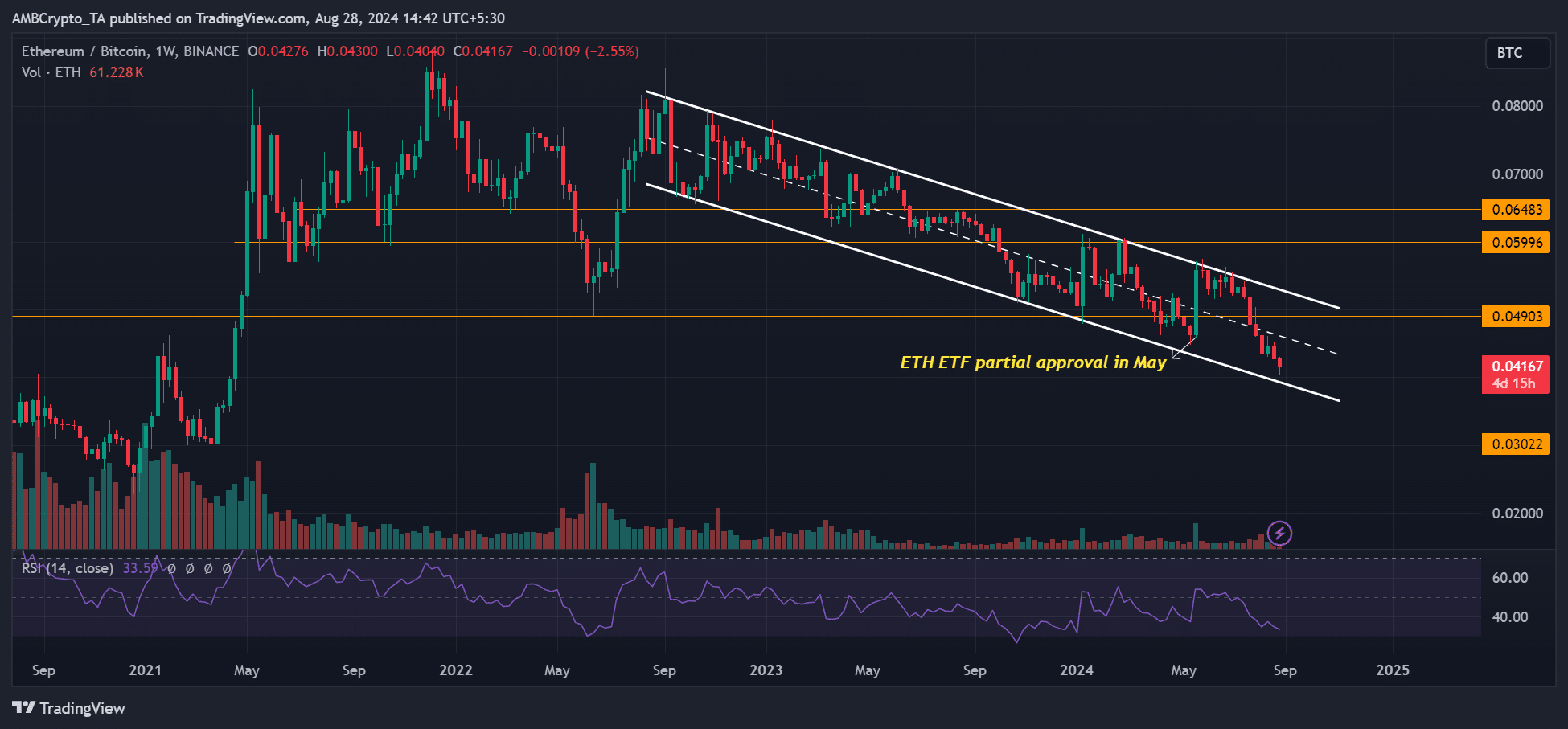

Since the end of 2022, an analysis of the relationship between ETH‘s price and BTC (ETHBTC ratio) has shown a consistent decline, indicating that Ethereum has not kept pace with Bitcoin over the past two years. In simpler terms, Ethereum has lagged behind Bitcoin in terms of price performance for approximately two years.

Unless the descending channel is broken, the ETH’s underperformance could extend.

Nevertheless, Vitalik Buterin, a key figure behind Ethereum, expressed confidence that Ethereum (ETH) remained strong even as the broader market’s sentiment showed weakness.

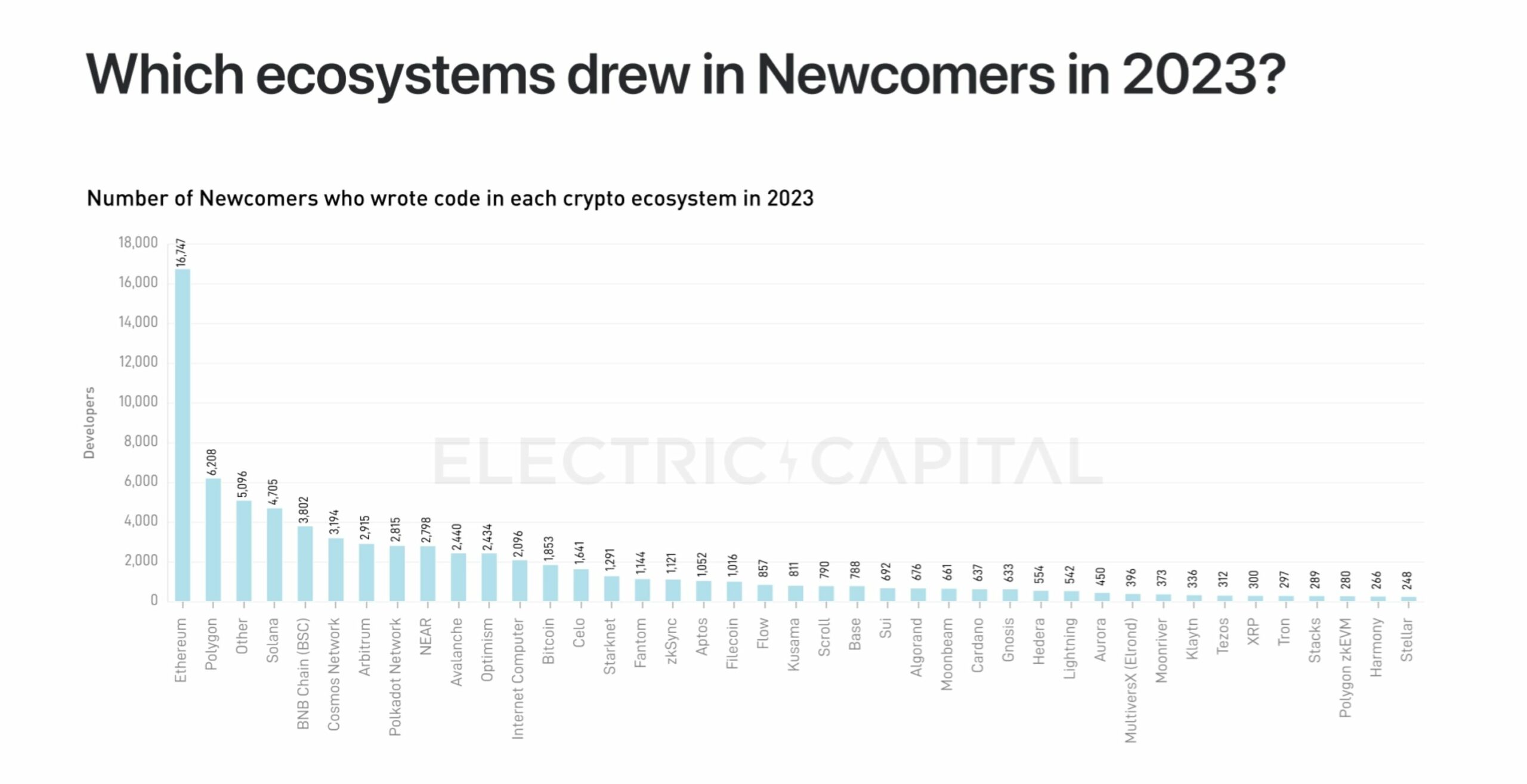

In a rebuttal against the notion that Solana had more developer count than ETH and would be the most preferred in the next 5 years, Buterin said,

“I find it intriguing that the graph groups Layer-2 solutions separately from Ethereum’s success. Despite this seemingly disadvantageous categorization, Ethereum still shines quite impressively.”

During that time, the value of Ethereum (ETH) dropped by 8% on Wednesday, falling beneath $2,500. This decline wiped out almost all of its growth from August’s recovery. For ETH to potentially resume an upward trend, it needs to regain the $2,500 mark first.

Read More

2024-08-28 22:15