-

ETH faces immense odds as the ETF deadline approaches

Analysts predict BTC or SOL as potential beneficiaries of ETH woes

As a seasoned crypto investor with a keen interest in Ethereum [ETH], I cannot help but feel a sense of unease as the ETF deadline approaches. Analysts predict that ETH could face immense odds if the SEC rejects spot ETH ETF applications, and the consequences could be dire.

If the predictions of recent analysts hold true, Ethereum (ETH) may encounter significant volatility or experience a major price crash.

As a crypto analyst, I believe that Ethereum [ETH] may experience further decline in relation to Bitcoin [BTC], should the Securities and Exchange Commission [SEC] decide against approving the pending spot Ethereum ETF applications by the end of May.

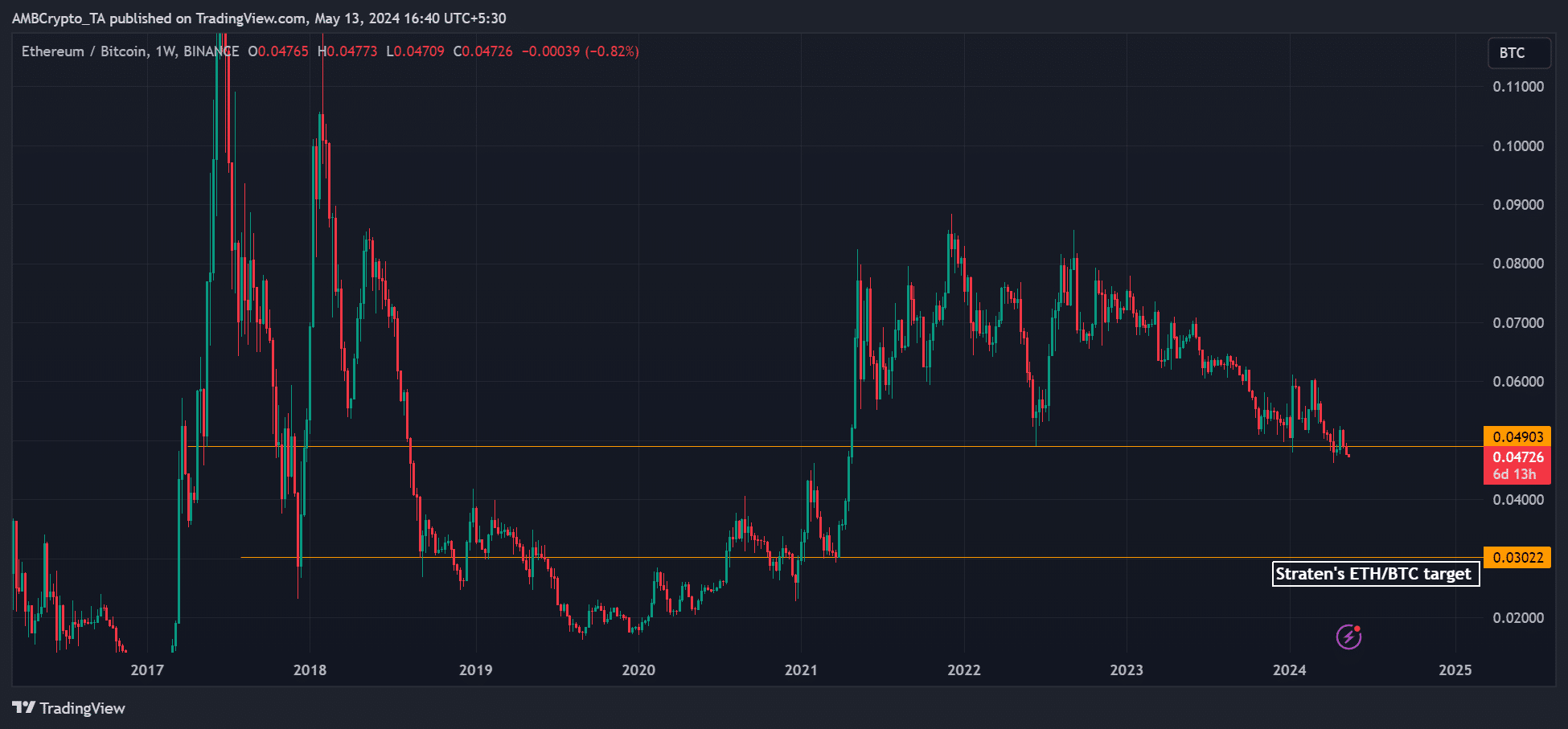

Ethereum seems to be heading towards a downturn. The rejection of the Ethereum-backed Spot Exchange Traded Fund (ETF) could cause the ETH/BTC ratio to decrease from its current level of 0.047 to an estimated 0.03 in the long term.

As an analyst, I would express it this way: The SEC has set deadlines for most Ethereum ETF applications between late May and August. Specifically, VanEck and Hashdex have filings due on the 23rd and 30th of May, respectively.

From next week, these are the upcoming dates that the markets are focusing on. According to Straten’s analysis, if an ETF application for Ethereum is denied, it could potentially decrease the ETHBTC ratio even more.

The ratio signifies the value of Ethereum relative to Bitcoin. A ratio of 0.047 implies that one unit of Ethereum equals 0.047 units of Bitcoin.

As a researcher studying Exchange-Traded Funds (ETFs) and their potential impact on cryptocurrency markets, I would explain it this way:

Ethereum’s inflationary ‘state’ could worsen price prospects

Currently, Ethereum produces more ETH than it destroys, resulting in an inflationary state for the cryptocurrency. In contrast, Bitcoin has a predetermined and finite supply of 21 million coins.

Straten pointed out that Ethereum’s inflationary characteristic and a decrease in transaction fees following the Ethereum London Upgrade caused Bitcoin to take the lead in terms of fees.

“The cost of transactions for Bitcoin is rising faster than Ethereum, with minimal action taking place in the Bitcoin network. Ethereum, on the other hand, has entered an inflationary phase. The recent update to Ethereum, called Dencun, brings down transaction fees, while the ETH burn rate increases its overall supply.”

Using data from UltraSound, AMBCrypto analyzed Ethereum’s inflationary trend. Over the last week, approximately 4,200 Ether were burned, while a significant amount of 17,600 Ether were minted during the same time frame.

As a crypto investor, I’ve noticed an significant increase in Ethereum’s token supply recently. Last week, Ethereum issued tokens to the tune of four times the amount that was burned. This sudden surge in supply could potentially put downward pressure on ETH prices.

According to Bitcoin advocate Fred Krueger, the Ethereum (ETH) price is likely to decline following Solana’s (SOL) success in offering cheaper transaction fees.

“However, Ethereum is outpaced by Solana’s affordable transaction fees. Consequently, we move on to Phase 2 of Ethereum’s upgrade, which reduces fees but makes ETH inflationary once again.”

Eric Balchunas, an ETF analyst at Bloomberg, expressed skepticism about the likelihood of Ethereum ETF applications being approved in May.

Should rejection occur, Ethereum’s price charts may experience a significant sell-off, potentially causing substantial losses for investors who have yet to realize their profits.

The impact on Bitcoin (BTC) and Solana (SETH) of the potential rejection of Ethereum (ETH) ETFs by the SEC, which could occur as early as next week, is yet to be determined.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-05-14 08:07