As a seasoned crypto investor with battle scars from previous market cycles, I must admit that the current situation with Ethereum [ETH] leaves me feeling a bit cautious. While ETH has shown promising scalability and widespread use in the blockchain space, its recent performance on higher timeframes is concerning. The peak in the Combined Books for spot order book depth in May signals the end of a rally, which historically precedes a bearish trend.

The leading alternative coin, Ethereum (ETH), is consistently drawing interest because of its impressive scalability and extensive adoption within the realm of blockchain technology.

On longer-term charts, Ethereum’s performance has been relatively weak for more than five months, leading some to question if the cryptocurrency market’s bull run might be nearing an end.

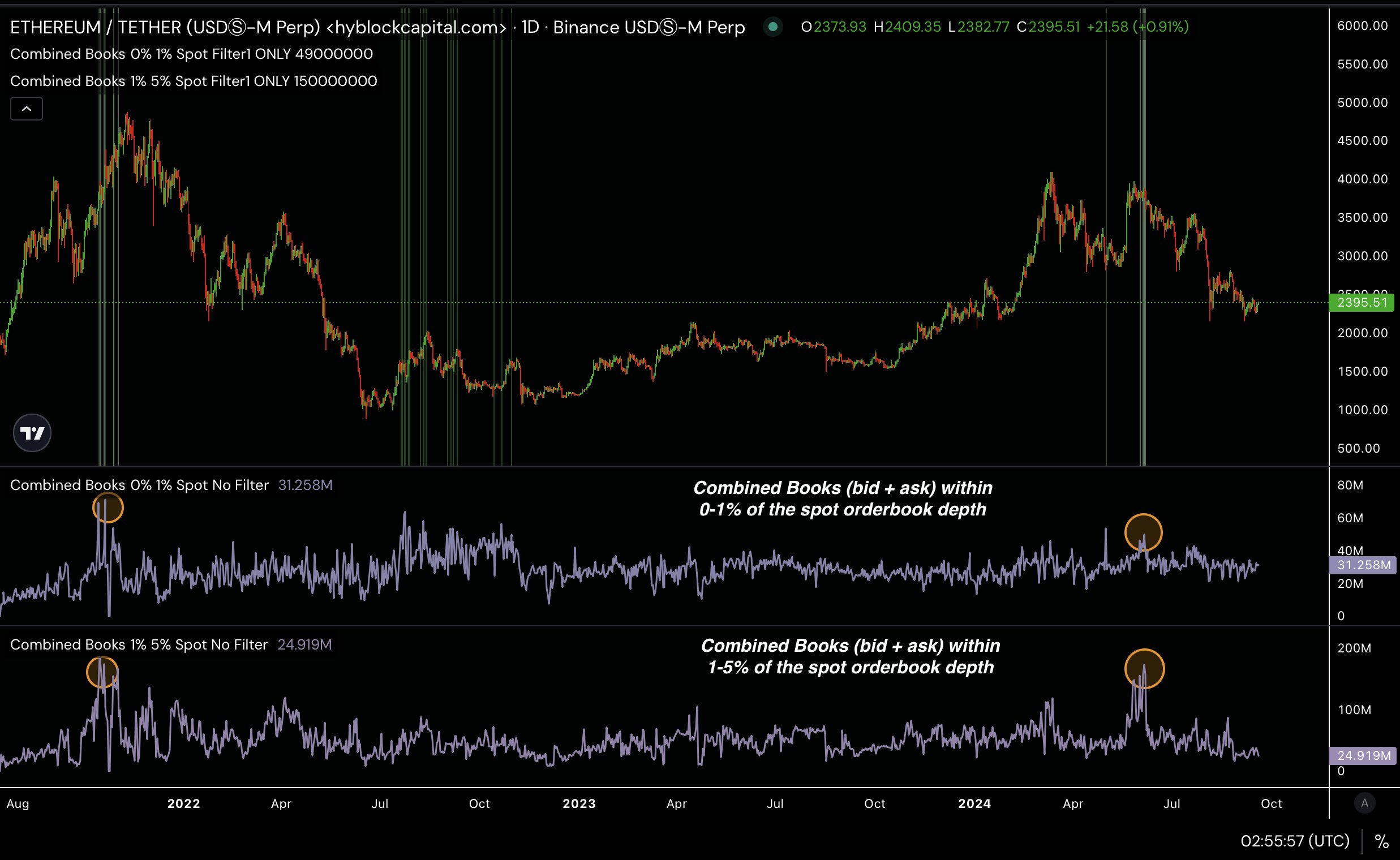

Over a 1-day period, our Ethereum (ETH) analysis indicates that the total volume of buy and sell orders at various price points reached its maximum in May on the order book.

This measurement, representing the peaks in passive limit orders for bidding and asking, frequently indicates the conclusion of an uptrend, preceding a potentially downward market direction (bearish trend).

Based on historical trends, it appears that ETH might have reached its peak during the bull market that concluded in May. Currently, we seem to be going through a period of market stabilization.

After that point, Ethereum (ETH) has been showing little directional movement, giving the impression of being stuck in place. However, is this behavior indicative of a bear market?

Is ETH in a bear market

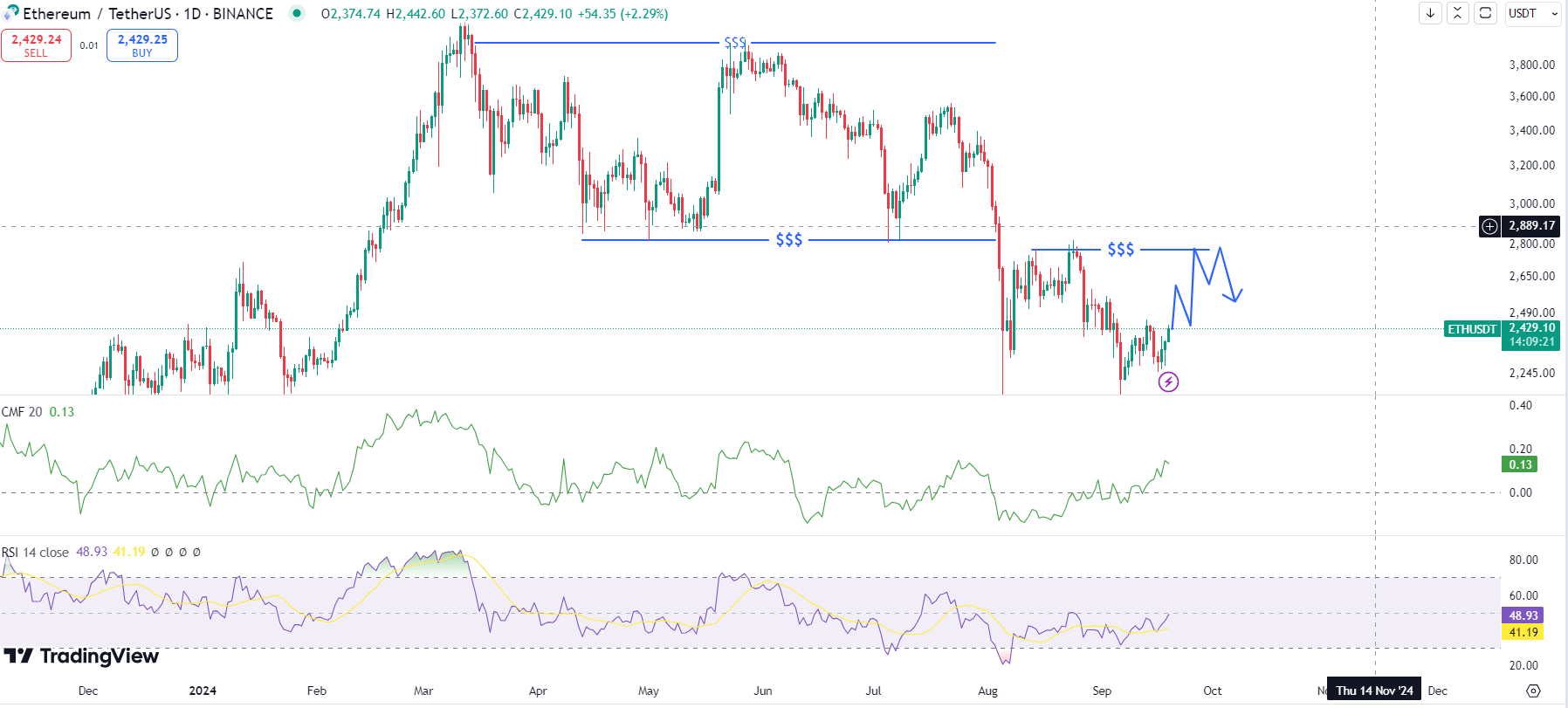

Examining Ethereum’s price fluctuations indicates a potential bear market scenario. Since early June, the ETH/USDT chart has shown a consistent downtrend, dipping below its daily range during the stock market plunge on August 5.

After that incident, it’s had difficulty bouncing back, suggesting a possible downturn in the market. Yet, at the moment, Ethereum’s price candles are showing a positive trend, potentially signaling a rebound towards $3000 following the steep decline.

The cost might hold steady near $3,000. If Ethereum surges and maintains above $3,000, a possible upward trend may ensue. However, if it falters and drops beneath that price point, a bear market could be imminent.

Based on current trends, the Chaikin Money Flow and Relative Strength Index (RSI) indicate a rising positive movement. This suggests that Ethereum’s bullish momentum could continue until it reaches the $3,000 price point.

Balance on all exchanges

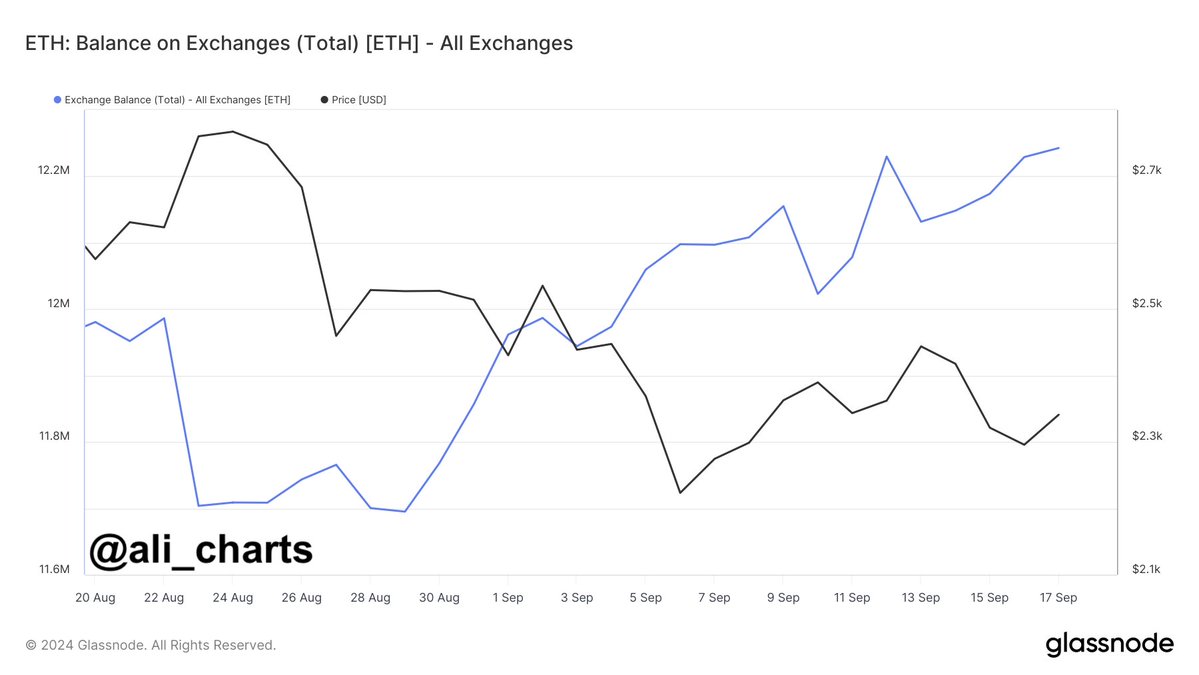

Additionally, scrutinizing the amount of Ethereum held on exchanges suggests an increased possibility of a downturn in the market, causing concern for investors.

Approximately 547,600 units of Ethereum, valued over $1.5 billion at the current moment, have moved to various exchanges during the last three weeks.

This suggests that traders might be cashing out their gains or minimizing their losses, which are signs that the market could be heading downwards.

As an analyst, I notice that substantial transfers of Ethereum (ETH) to exchanges often signal a potential intention to sell. This selling activity might lead to increased supply and potentially lower prices due to increased downward pressure.

BTC & ETH ETF outflow continues

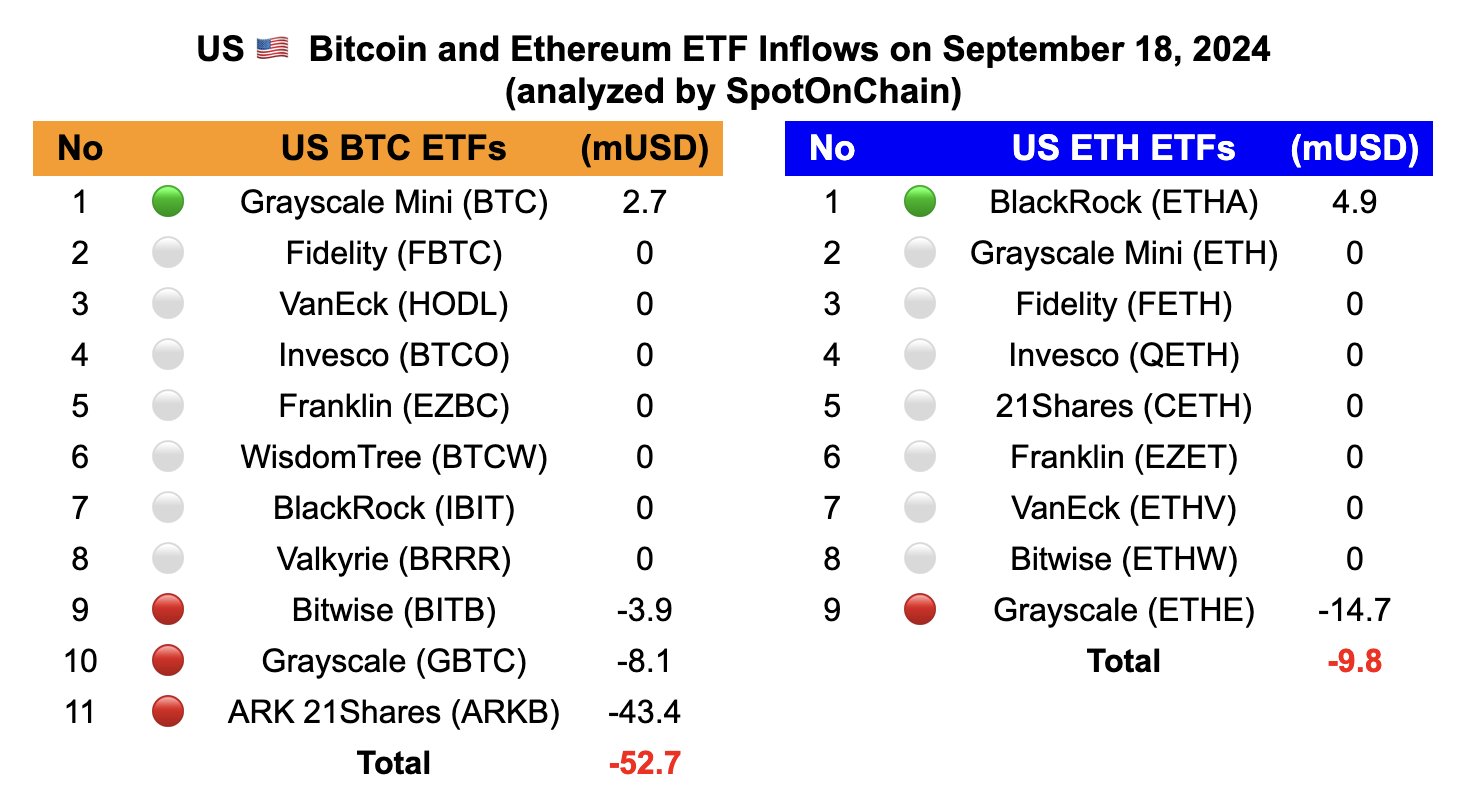

Furthermore, the reduction in assets from Ethereum and Bitcoin ETFs indicates a downturn in market sentiment. As of September 18, 2024, Ethereum ETFs have seen net outflows totaling $9.8 million.

Currently, Bitcoin is experiencing outflows amounting to $52.7 million, fueling worries about a potential market-wide decline. Moreover, Ethereum ETFs have been witnessing continuous outflows, while Bitcoin ETFs have recently shifted from inflows to negative flow after four consecutive days of positive inflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

During critical market periods, my observations suggest a potential build-up of pessimism or a pause in price action, which could be indicative of either a bearish trend or a period of consolidation, from the perspective of a crypto investor.

Though it hasn’t been definitively confirmed yet, there are indications that Ethereum’s price may find it difficult to rise significantly in the near future, assuming current market circumstances don’t undergo a major transformation.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-19 19:04