- Ethereum’s price increased by over 25% in the last seven days.

- Most metrics hinted at a price correction in the short-term.

As an experienced analyst, I have seen my fair share of market trends and price movements in the crypto space. The recent surge in Ethereum’s [ETH] price, with an increase of over 25% in just seven days, is a sight that many investors and traders have been eagerly waiting for. However, as someone who has closely monitored the market, I can’t help but notice some concerning signs that hint at a potential correction in the short term.

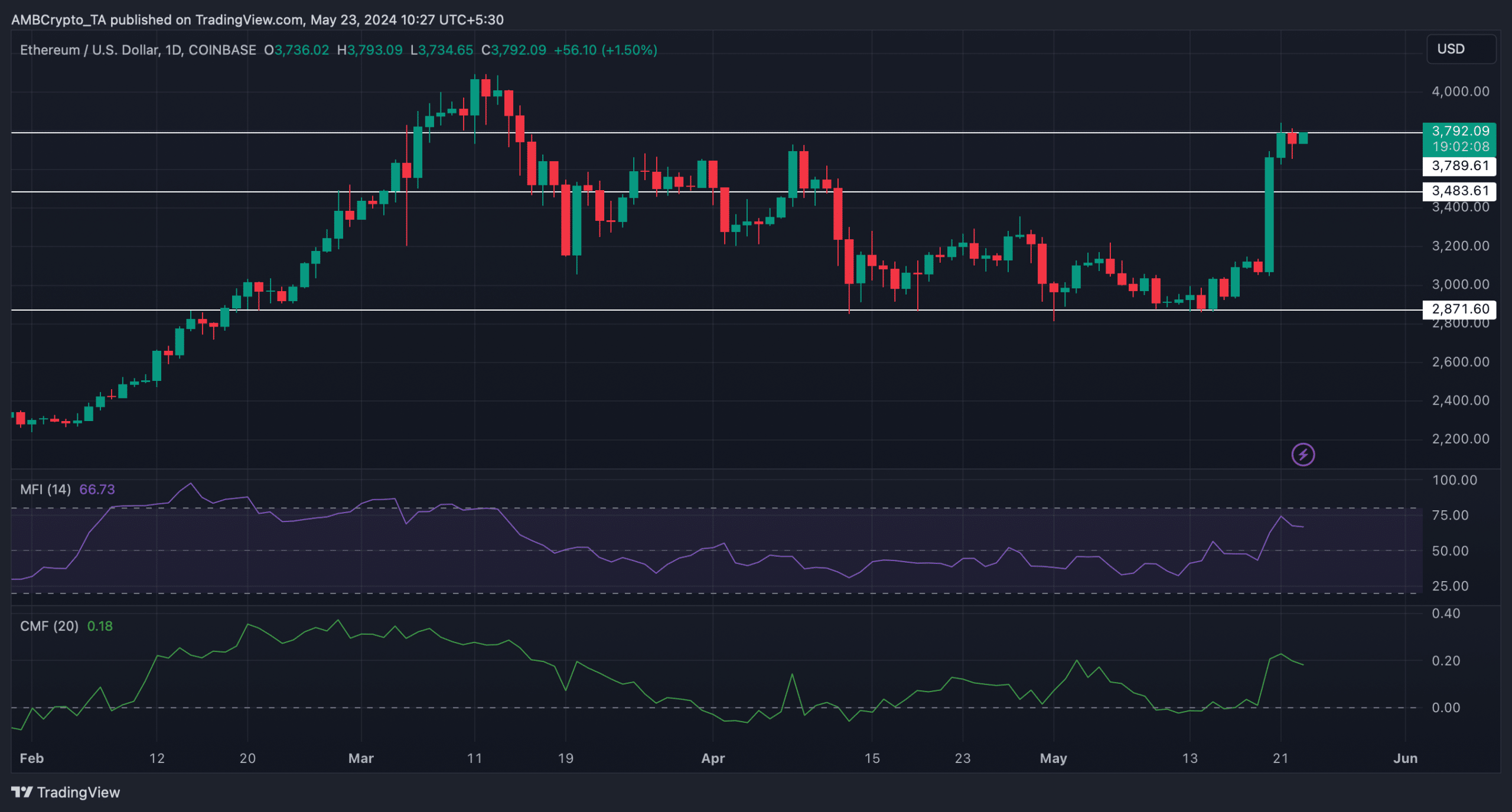

Over the past week, Ethereum’s [ETH] price experienced a significant surge, hovering well above the $3,700 threshold.

As the token’s price surged with bullish energy, large investors or “whales” displayed intriguing behavior, hinting at significant buying activity.

Ethereum whales are stockpiling

Last week, Ethereum (ETH) experienced fewer volatile price changes according to data from CoinMarketCap. However, a significant shift occurred on May 21st when ETH became bullish, leading to a price surge of over 25% within the past seven days.

As I pen down these words, Ethereum (ETH) is currently exchanging hands at a price of $3,789.10 in the market. Its market capitalization hovers above the $455 billion mark.

Apart from price, the number of ETH transactions also increased.

I’ve noticed an intriguing trend in Ethereum (ETH) transactions lately. According to a recent tweet from IntoTheBlock, there has been a significant surge in transactions exceeding $100,000. This is the highest such volume we’ve seen since late March. Many of these large transactions can be attributed to whales in the market.

In simpler terms, the tweet indicated that Ethereum addresses owning over 0.1% of the total supply have been purchasing the most ETH daily for the past month, implying that large investors or “whales” are actively buying Ethereum.

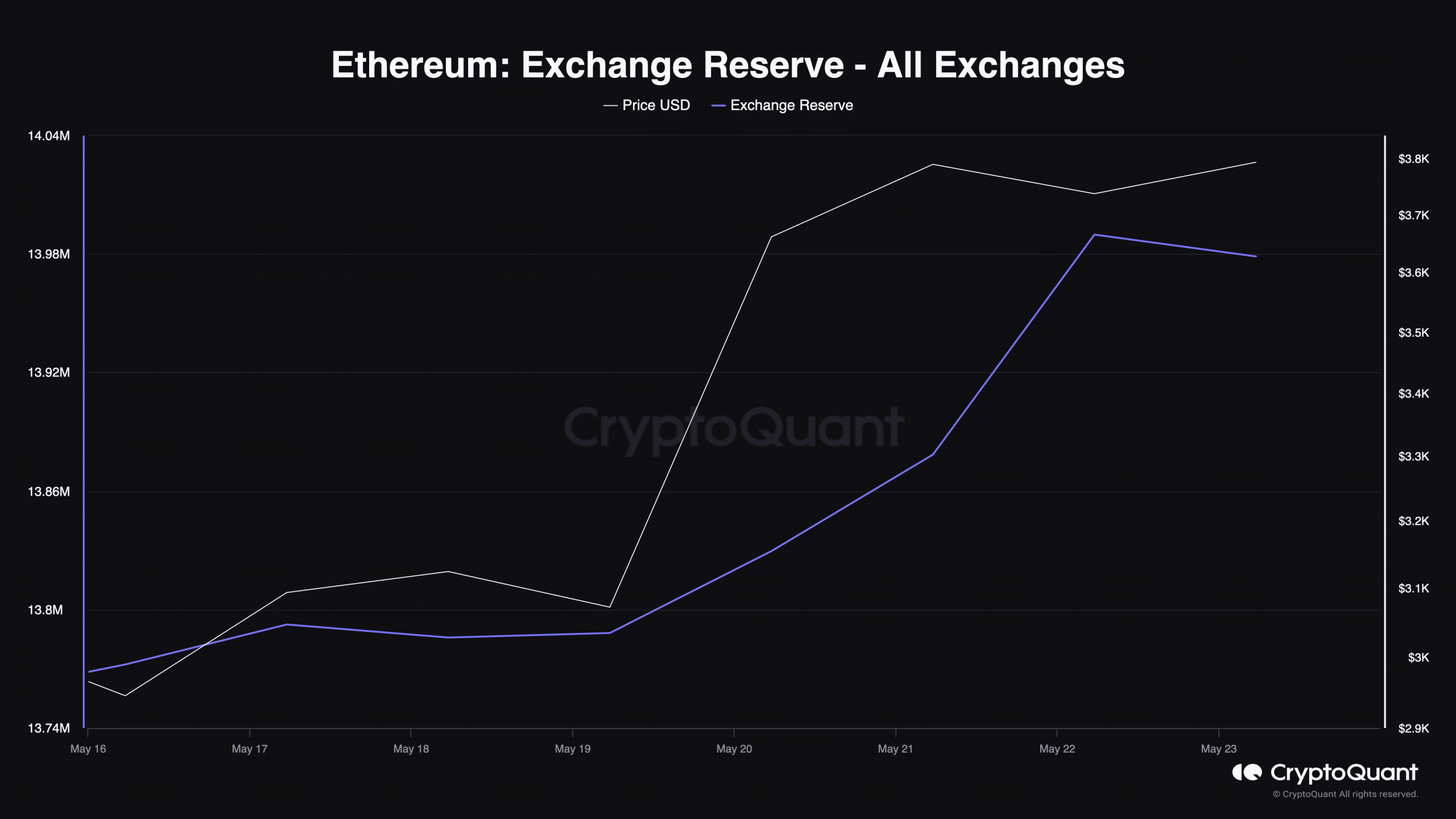

To determine if positive sentiment towards Ethereum was prevalent in the cryptocurrency market, AMBCrypto examined its key on-chain indicators.

We found that after a spike on the 22nd of May, ETH’s exchange reserve started to drop.

According to CryptoQuant’s data, the amount of Ethereum being deposited into exchanges recently was significantly lower than the average over the past week. This observation supports the idea that there is strong demand for Ethereum in the market and that buyers are actively purchasing it.

As a researcher studying Ethereum’s price trends, I have noticed that we may be approaching the end of the accumulation phase based on recent developments. The Ethereum market’s Relative Strength Index (RSI), which measures the magnitude and velocity of price changes, has entered the overbought zone. This means that Ethereum has experienced a significant price increase over a short period of time, potentially indicating that a correction or pullback may occur soon.

This might motivate investors to sell and, in turn, push the token’s price down in coming days.

Is a price correction inevitable?

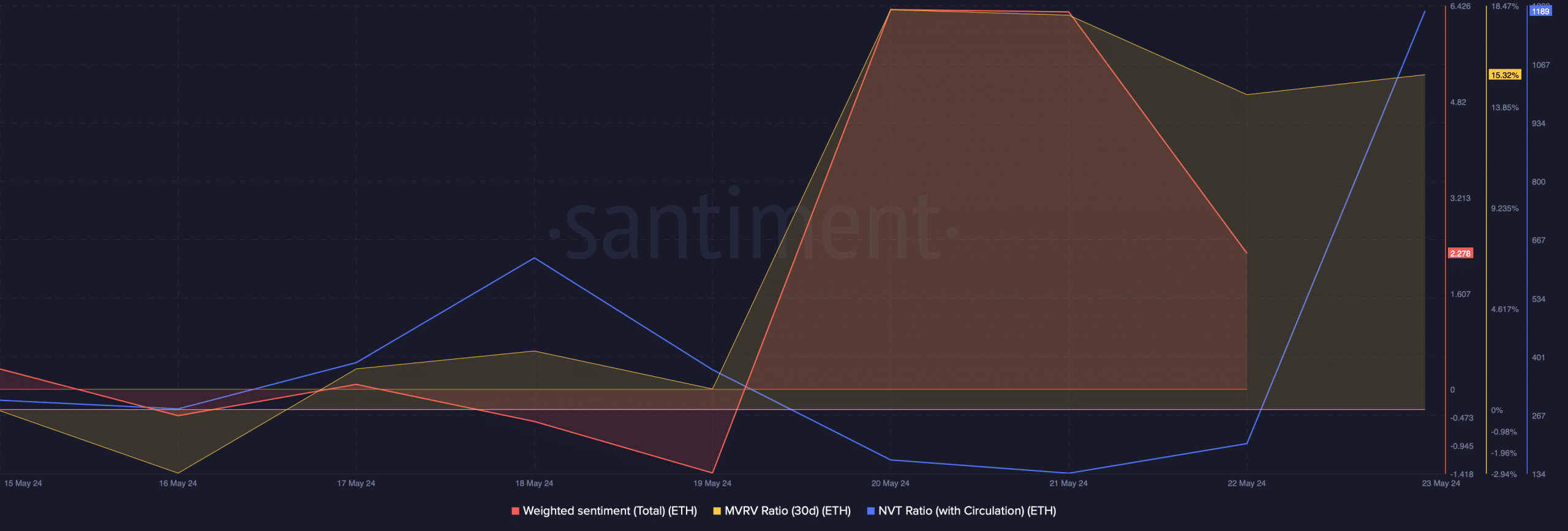

After examining the data provided by Santiment, AMBCrypto sought to determine if a price decrease for the token was imminent.

In simpler terms, the positive feelings towards Ethereum (ETH) decreased significantly over the past few hours, as indicated by its Weighted Sentiment. Furthermore, the Network Value to Transactions Ratio (NVT) for ETH experienced a substantial increase.

A rise in the metric means that an asset is overvalued, increasing the chances of a price drop.

Nonetheless, the MVRV ratio remained bullish, as it had a value of over 15% at press time.

As an analyst, I’ve observed that some market indicators have displayed bearish signs in recent times. Among these, the Money Flow Index (MFI) and the Chaikin Money Flow (CMF) have shown a decrease, suggesting that a price correction may be imminent.

If Ethereum (ETH) approaches the neighborhood of $3,400, investors could observe a decline in ETH’s price. However, if ETH aims to maintain its complete uptrend, it is crucial for the cryptocurrency to transform its current resistance at $3,790 into a support level instead.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-23 12:08