- Ethereum’s realized price upper band at $5.2K mirrors levels seen during the 2021 bull market peak, raising breakout expectations

- Rising exchange inflows and increased activity suggest the possibility of profit-taking.

As a seasoned crypto investor with a few battle scars and war stories to share, I find myself standing at the precipice of what could be Ethereum’s [ETH] next big move. The realization price upper band at $5.2K is reminiscent of the 2021 bull market peak, and while it stirs hope for a breakout, it also reminds me of the old adage: “History doesn’t repeat itself, but it often rhymes.

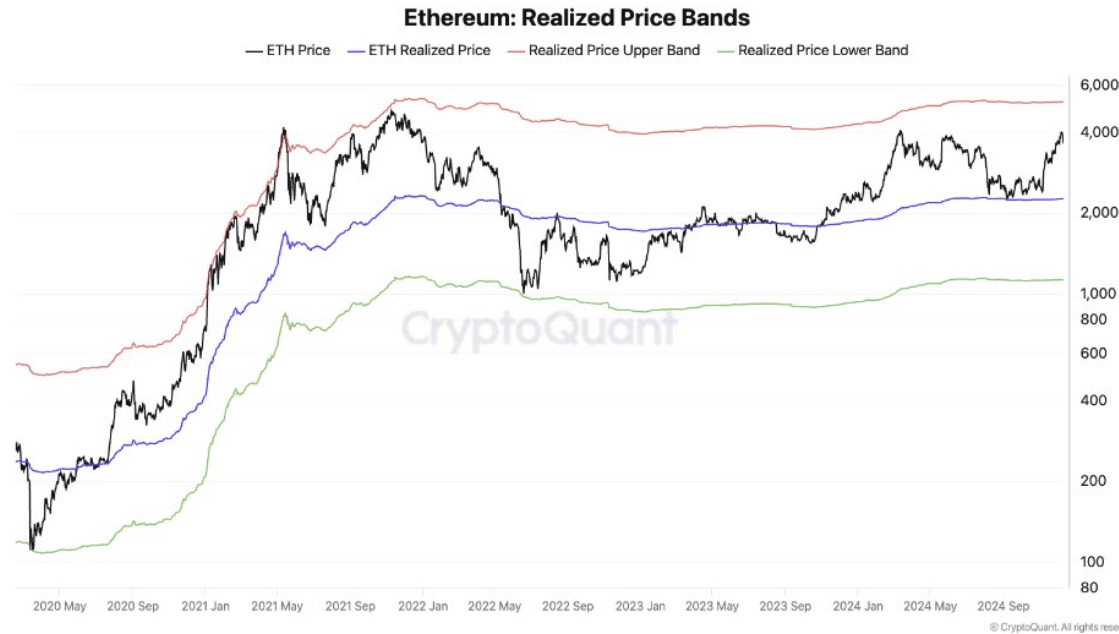

The value of Ethereum [ETH] appears to be nearing a significant surge, as its average purchase price level has risen to approximately $5,200 – a figure similar to those observed at the height of the 2021 market boom.

On-chain metrics pointed to strong demand, fueling hopes of a rally beyond $5,000.

However, with the changing market trends, investors find themselves pondering this question: Will Ethereum regain its past prominence, or is its future course being fundamentally altered by these new circumstances?

How realized price will affect this current cycle

At the current press moment, the upper band of Ethereum’s realized price stands at around $5.2K. This significant level serves as an important guide to anticipate possible market fluctuations.

The moving average price of each Ethereum unit (ETH) is crucial for recognizing patterns and trends within the market.

According to an analysis by AMBCrypto using CryptoQuant data, the present market situation seems to resemble the peak of the 2021 bull run, where the upper band of the realized price aligns closely with a dramatic surge in value.

Historically, reaching these high band levels has typically indicated either overheated market conditions or robust bullish trends, which usually come before substantial price fluctuations.

Profit-taking ahead?

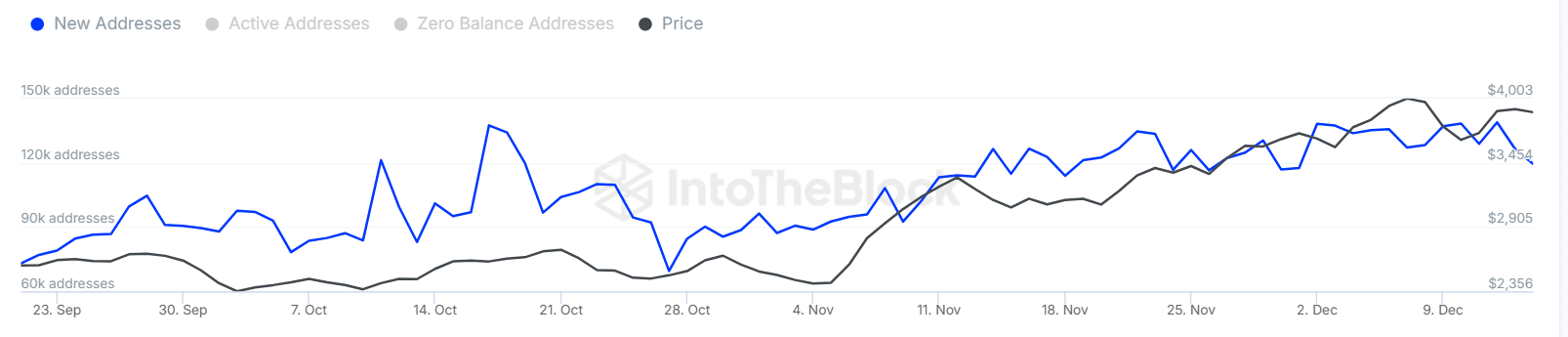

The market appears to be sending conflicting messages. However, the chart of active addresses suggests a rise of around 10-15% among users over the last week, suggesting increased network interaction and investment interest.

At the same time, trading volumes are almost up by 20%, indicating a rise in liquidity and trading activity.

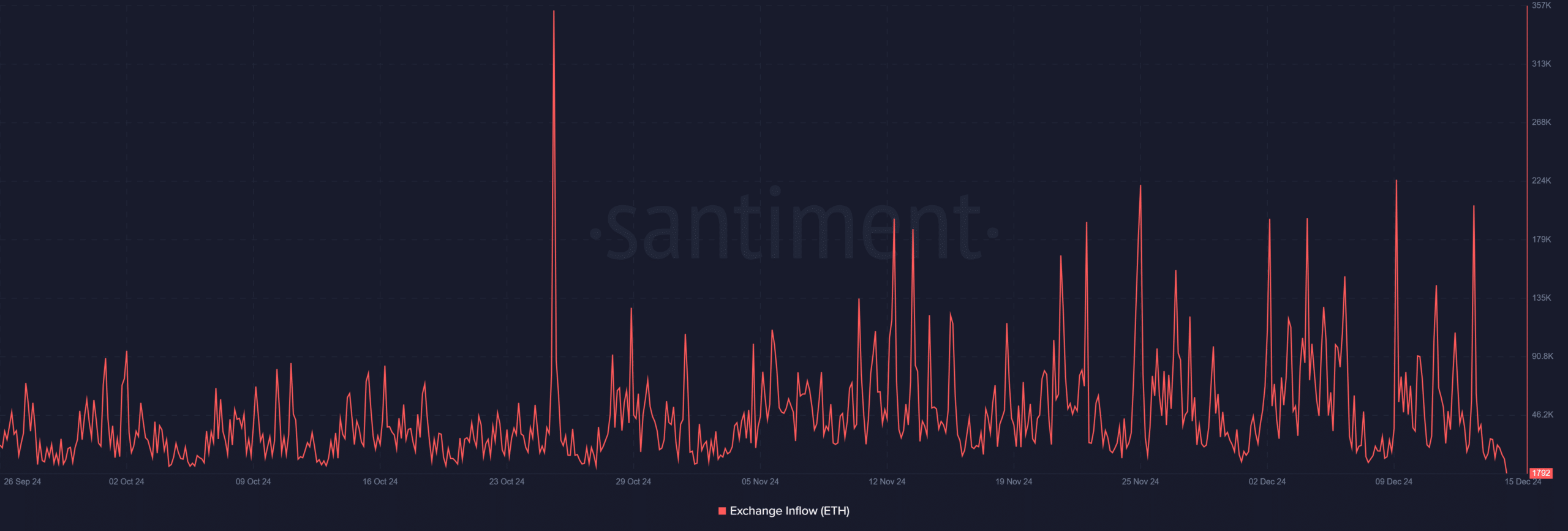

On the other hand, the increase in currency inflows by 25% has sparked worries about possible profit-making actions by investors.

Historically, these sudden increases in inflows suggest that investors could be preparing to offload their assets, especially when accompanied by an uptick in activity.

In the past, similar patterns have occurred at market peaks, where heightened involvement was followed by temporary price declines.

The data highlights a delicate balance — while strong participation and trading volumes signal optimism, inflows suggest caution. If inflows sustain, watch for potential downward pressure.

The future direction of the market – whether it strengthens further or experiences a decline – will be influenced by the price stability during upcoming trading sessions and any shifts in overall investor sentiment.

Market sentiment and the path forward

New information shows a change in investor feelings towards Ethereum as it nears crucial milestones. An increase in new user accounts is met with an uptick in transfers to exchanges, suggesting that some investors could be taking profits from their earnings.

Read Ethereum’s [ETH] Price Prediction 2024-25

If the ups and downs in prices continue to intensify, it’s possible that a more significant drop might occur if investors decide to sell off their holdings at these high points.

In simpler terms, it’s important to determine if the rise in Ethereum’s value is a lasting growth trend or a final spike before a potential downturn, as this understanding can help us predict the overall market’s balance.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-12-15 18:15