-

Sentiment appeared bullish ahead of the ETH ETF launch, with 40% of the total Ethereum supply now locked.

Bulls have kept bears at bay, suggesting that ETH might inch toward $3,500.

As an analyst with a background in cryptocurrency market analysis, I find the recent developments surrounding Ethereum [ETH] particularly noteworthy. Based on my assessment of the available data, I believe that the bullish sentiment ahead of the ETH Exchange Traded Fund (ETF) launch is genuine and could lead to significant price increases for ETH.

I analyzed the Ethereum blockchain transactions on the 11th of July and identified an intriguing transfer. An anonymous market participant moved a significant amount, specifically 6,400 ETH, to the Beacon depositor wallet. The Beacon Chain is my area of expertise, and I can confirm that it serves as the backbone for validating new blocks within the Ethereum network.

Translating this into clear and conversational English: Sending coins to this wallet signifies a preference among holders for keeping the supply stashed away instead of selling for trading.

As a researcher studying the cryptocurrency market, I have observed that hoarding large quantities of coins can help mitigate selling pressure. In the context of Ethereum (ETH), this could potentially prevent its price from dipping below the $3,000 mark.

ETH supply continues to fall

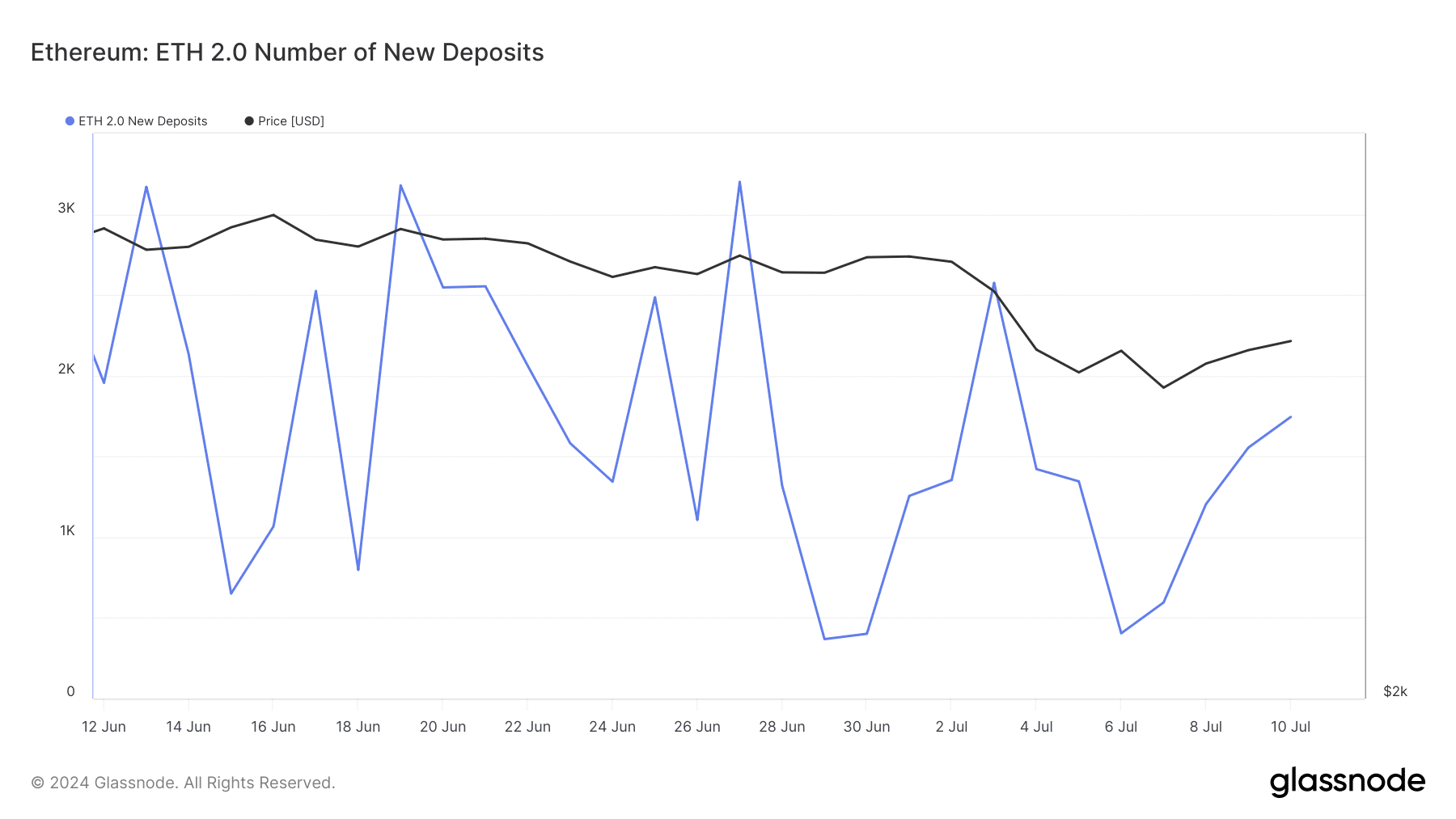

Yet, there was another significant development. Based on Glassnode’s data, Ethereum 2.0 new deposits have been on an uptrend.

When the metric rises, it signifies that investors holding altcoins have accumulated a minimum of 32 ETH in anticipation of rewards.

It’s interesting that this occurrence comes as the Ethereum ETF approval process nears its end. This decrease in circulation may indicate that the Ethereum community is optimistic about the upcoming event.

If 40% of Ethereum’s total supply is currently locked, and out of that amount, 28% is staked and 12% is bridged through smart contracts, then an increase in the amount of ETH being locked could potentially drive up the price of the cryptocurrency.

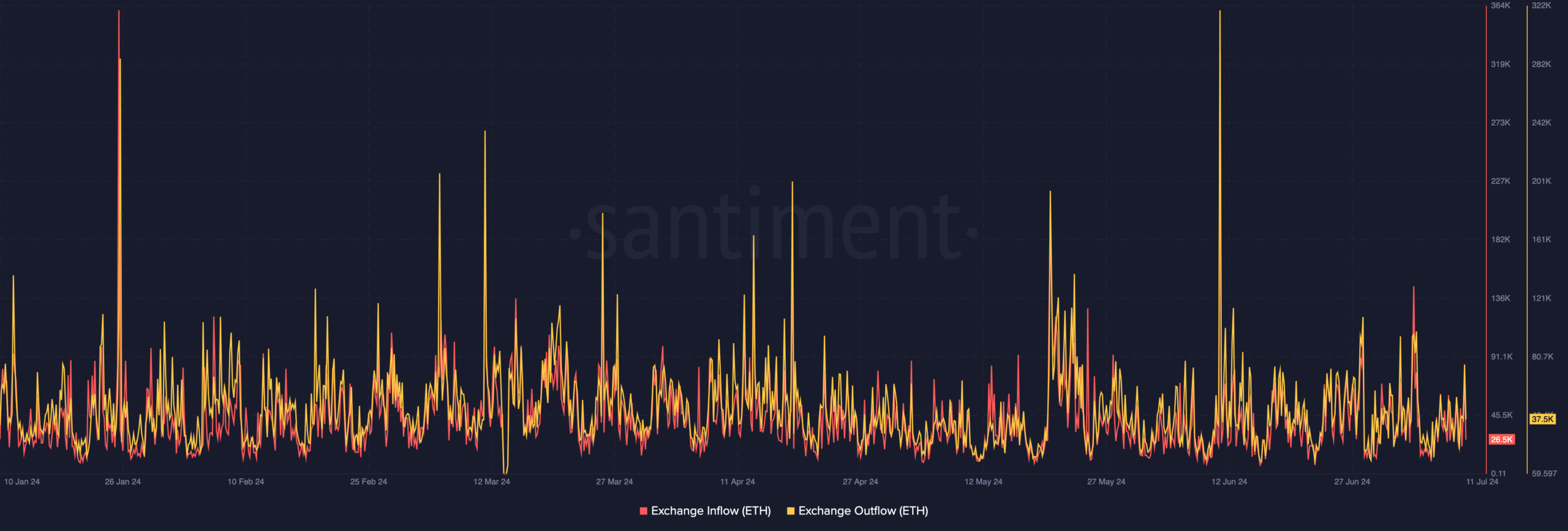

If the price is to rise, the quantity of coins available on exchanges must decrease. To determine if this condition was met, AMBCrypto examined Ethereum’s inflows and outflows.

In simpler terms, the inflow figure represents the quantity of cryptocurrency transferred into an exchange from outside sources. Conversely, outflow denotes the amount of Ethereum that has been taken out of the exchange.

If more assets are entering an exchange than are leaving, there’s a risk that the prices may need to adjust. On the other hand, an uptick in the amount of assets being taken out of the exchange can support the notion of a forthcoming price rise.

Based on Santiment’s data, there were 26,500 Ethereum (ETH) inflows at exchanges, but 37,500 outflows. This difference indicates a strong possibility that ETH’s price could increase within days or weeks following the commencement of official trading for ETFs.

A rally will begin sooner or later

As a crypto investor keeping a close eye on market trends, I’ve observed Benjamin Cowen, the founder of Into The Cryptoverse, sharing his insights on possible price movements.

Based on Cowen’s perspective, Ethereum (ETH) could surpass Bitcoin (BTC) in terms of performance as early as the last quarter of the year.

Based on historical trends, the ALT/BTC pair is expected to experience its last price decrease around August. Similarly, the ETH/BTC pair may see its final price decline towards the end of September. Finally, Bitcoin’s dominance is projected to reach its peak some time during the last quarter of the year.

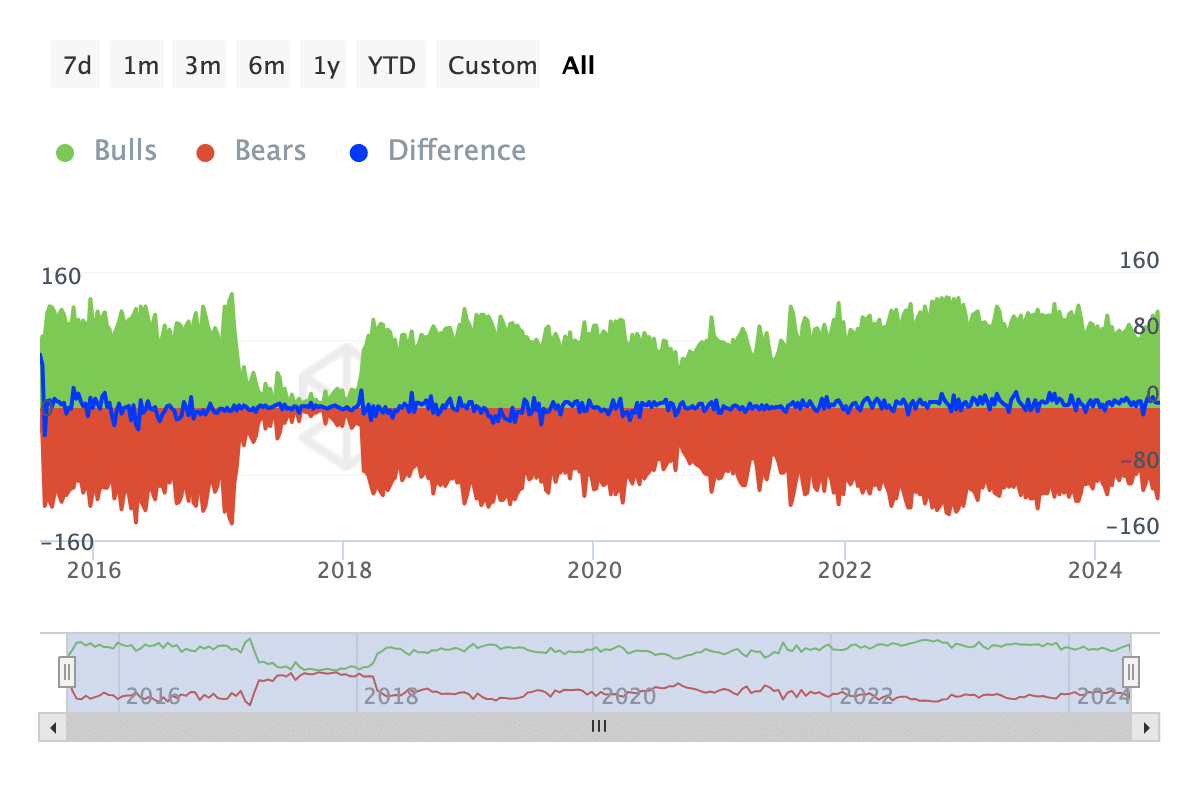

According to IntoTheBlock’s data, Ethereum may not hold off until later for a price increase. The Bulls and Bears indicator suggests this is due to the current market conditions.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As a researcher studying market dynamics, I would describe bulls and bears in this way: I focus on the investors or traders who represent approximately 1% of the total trading activity. Bulls are those who have bought this proportion of the market, while bears are the counterparts who have sold an equal percentage.

As a market analyst, I’ve observed that at the current moment, Ethereum’s bulls hold the upper hand over its bears. This implies that purchasing pressure is stronger than selling pressure in the market. If this trend persists, Ethereum’s price may revisit the $3,300 mark and could even approach the $3,500 level.

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

2024-07-12 14:16