On the last day of trading in April 8th, Ethereum [ETH] saw a significant price jump. At the same time, there was a rise in the amount of ETH flowing into exchanges, with Alameda taking advantage of this trend to boost its holdings.

Alameda dumps more Ethereum

Based on the latest information from Spot on Chain, it was found that Alameda Research, a subsidiary of FTX, transferred Ethereum to Coinbase for an amount equivalent to roughly 4,000 ETH. This transaction occurred when Ethereum was priced around $3,688 per token.

In February, this deposit represented Alameda’s initial substantial action, aligning with an uptick in Ethereum (ETH) prices.

Approximately 21,000 ETH, valued over $72 million, have been deposited by FTX and Alameda. This action follows the trend seen on February 8th in the market, marked by a substantial increase in ETH being transferred to exchanges.

Traders take advantage of the Ethereum rally

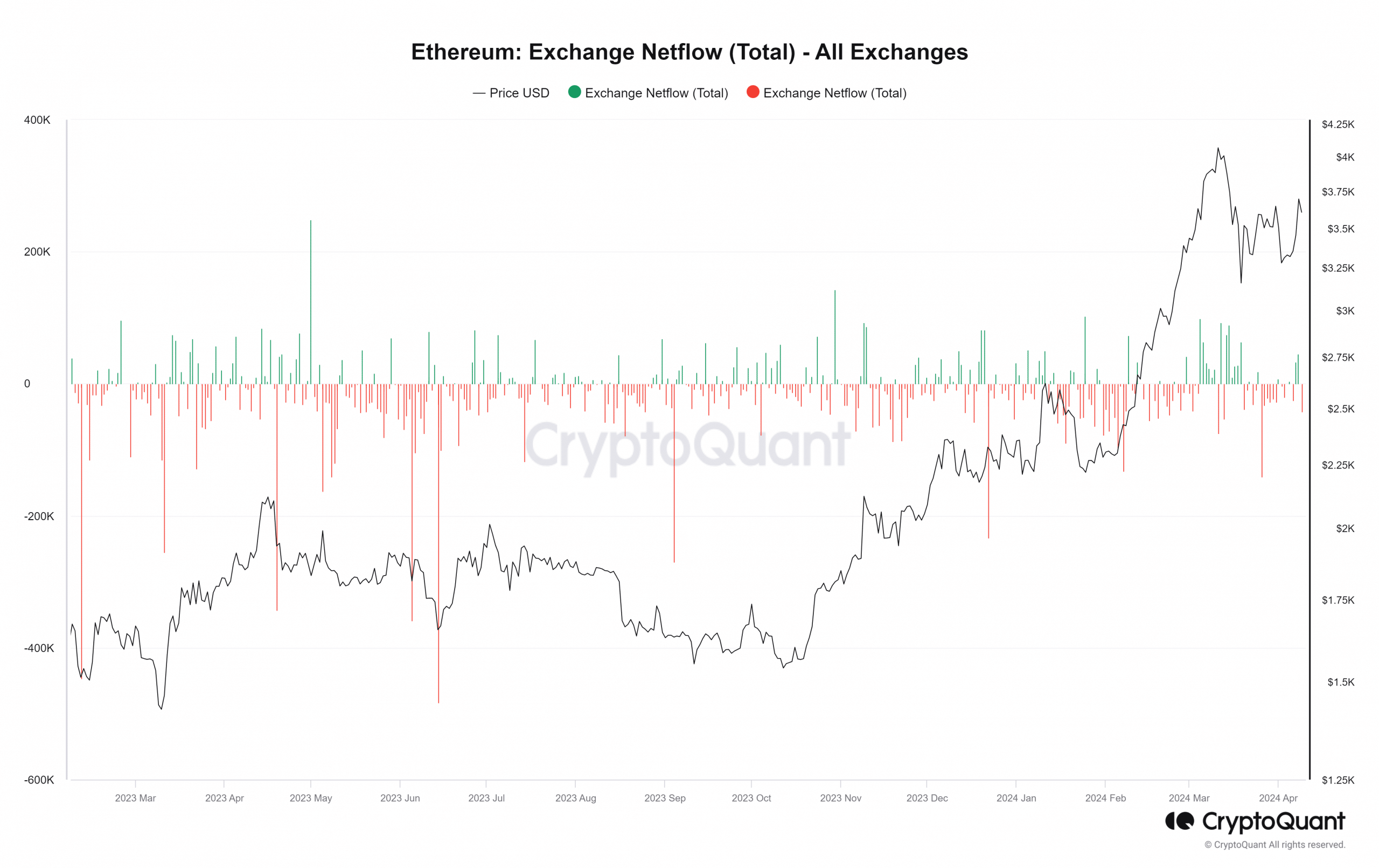

On the eighth of April this month, according to Exchange Netflow data analysis, Ethereum saw its greatest volume of transactions between exchanges. Furthermore, the data suggested that a larger amount of ETH was flowing in compared to out, implying that more investors were transferring their holdings into exchange platforms.

On the 8th of April, the graph showed approximately 45,000 ETH being deposited into these exchanges, implying that, similar to Alameda, other traders capitalized on the surge in ETH‘s price.

At the time of writing, there was a change in direction with a higher rate of ETH being taken out of exchanges than put in. Over 35,000 ETH have been withdrawn so far. This trend might be due to the slight decrease in ETH’s price during this period.

ETH sees 1% decline

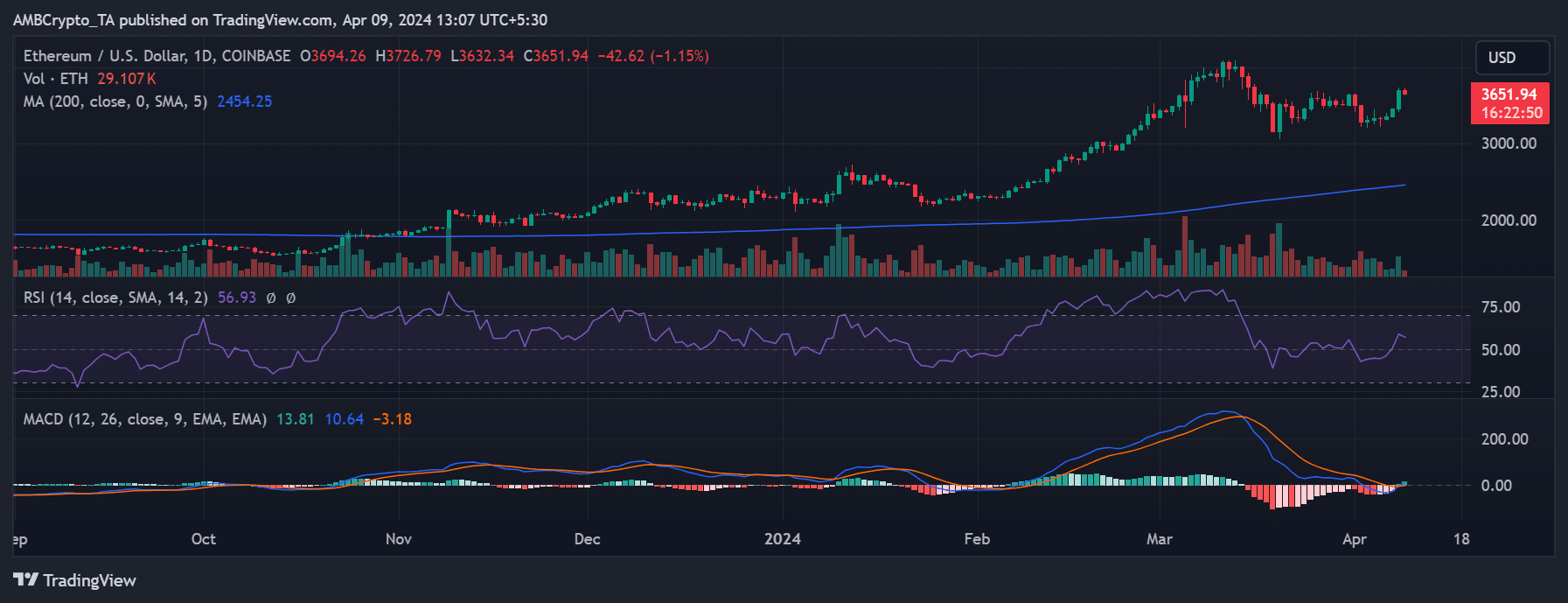

On the 8th of April, Ethereum experienced a notable jump, representing its biggest gain in a while. A look at the daily chart showed an almost 7% climb, resulting in ETH ending the day around $3,694.

At the same time, the ETH volume chart showed a significant jump, reaching over $19 billion, as its price rose dramatically.

When I penned this down, Ethereum’s value had dropped by more than 1% but stayed around $3,600.

Read Ethereum (ETH) Price Prediction 2024-25

In spite of the decrease, Ethereum continued to follow its bullish pattern, as shown by its Relative Strength Index.

Furthermore, the analysis of its size revealed a surge. As I pen this down, its size exceeded $20 billion, demonstrating continuous market engagement and heightened investor enthusiasm for Ethereum.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-04-09 17:11