-

ETH was down 3.2% in the 24-hour period at press time.

Derivatives market has been bearish on the coin for the last 2-3 days.

As a seasoned analyst with extensive experience in the crypto market, I’ve closely monitored Ethereum’s [ETH] recent price action and its correlation to the debut of the first-ever crypto spot exchange-traded funds (ETFs) in Hong Kong.

Ethereum (ETH), the world’s second largest cryptocurrency, has seen a downtrend since the debut of the first-ever cryptocurrency spot exchange-traded funds (ETFs) on the Hong Kong exchange.

Based on data from CoinMarketCap, the price of Ethereum reached approximately $3,250 right before the initiation of trading for the related funds on the Hong Kong Stock Exchange (HKEX).

Despite robust opposition, the value of the digital currency dipped to $3,020 at present, representing a 3.2% decrease within the past 24 hours.

Expert analysis by Ali Martinez, a recognized figure in tech analysis and trading, highlights the importance of the $3,200 mark as a notable resistance point for Ethereum (ETH) in recent discussions.

I recently discovered that approximately 2.43 million Ethereum addresses held around 5.14 million units of Ether at a certain point. Breaking through this significant resistance level was essential to fuel continued growth in the Ethereum market.

Spot ETFs start on a dull note

In Hong Kong, three Ethereum [ETH] ETFs focusing on the three-point structure and three Bitcoin [BTC] spot ETFs made their debut. This financial innovation comes as the city aims to establish itself as a leading player in the crypto sector.

According to AMBCrypto’s examination of HKEX information, each of the three ETFs linked to Ethereum finished the day with lower share prices. The lack of trading volume might have contributed to this trend, potentially impacting investor sentiment towards Ethereum and leading to a price decrease.

Speculative market bets against ETH’s rise

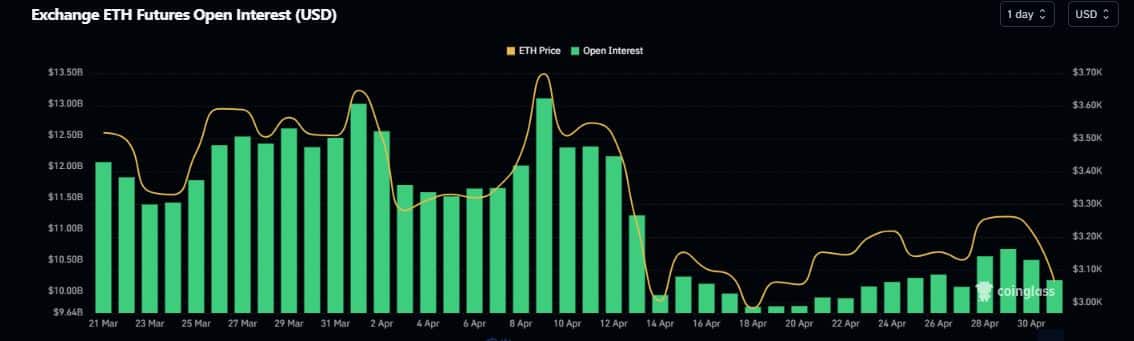

In the cryptocurrency market, a decline in ETH‘s value caused a ripple effect in the derivatives market. According to AMBCrypto’s assessment of data from Coinglass, open interest in ETH futures dropped by 4.5% over the past 24 hours.

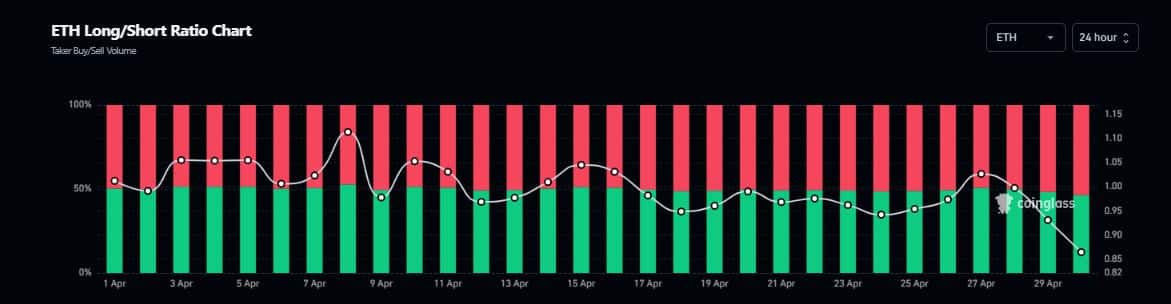

As a crypto investor, I’ve noticed an intriguing development in the derivatives market leading up to Hong Kong Ether ETFs’ opening day. The number of traders betting against Ethereum through short positions has been steadily increasing over the last 2-3 days, as indicated by the Longs/Shorts Ratio. This could be a sign that the market anticipates a less-than-ideal start for these ETFs.

As of this writing, nearly 53% of participants were bearish on the coin.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-04-30 23:03