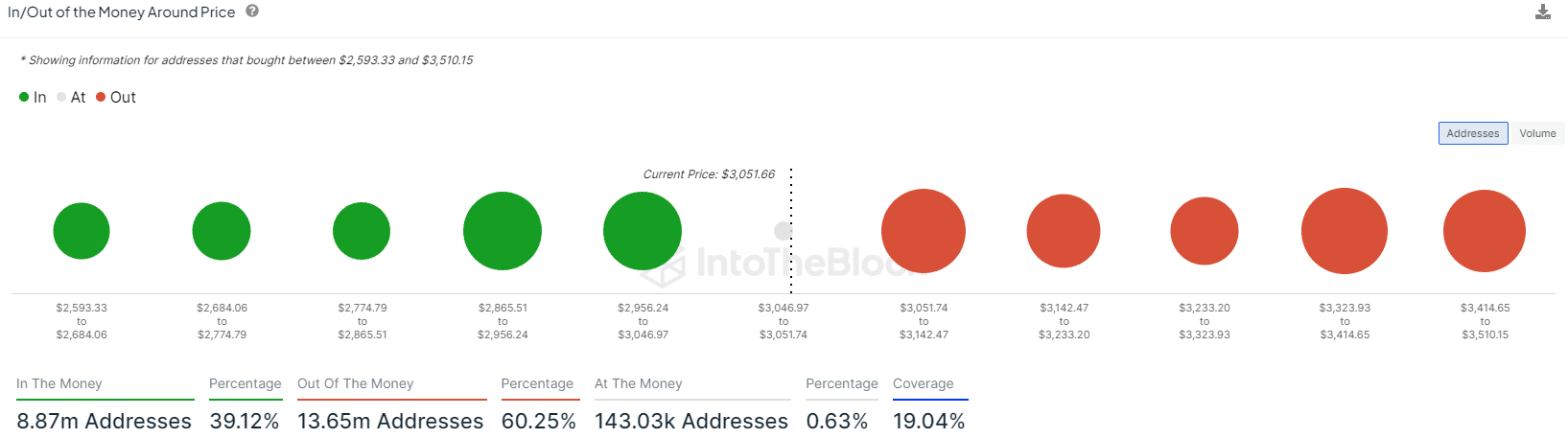

- Most short-term traders experienced losses and would be eager to exit their positions in case of a price bounce.

- The $2.8k level is likely to be revisited as support, but it is unclear if the bulls can hold on thereafter.

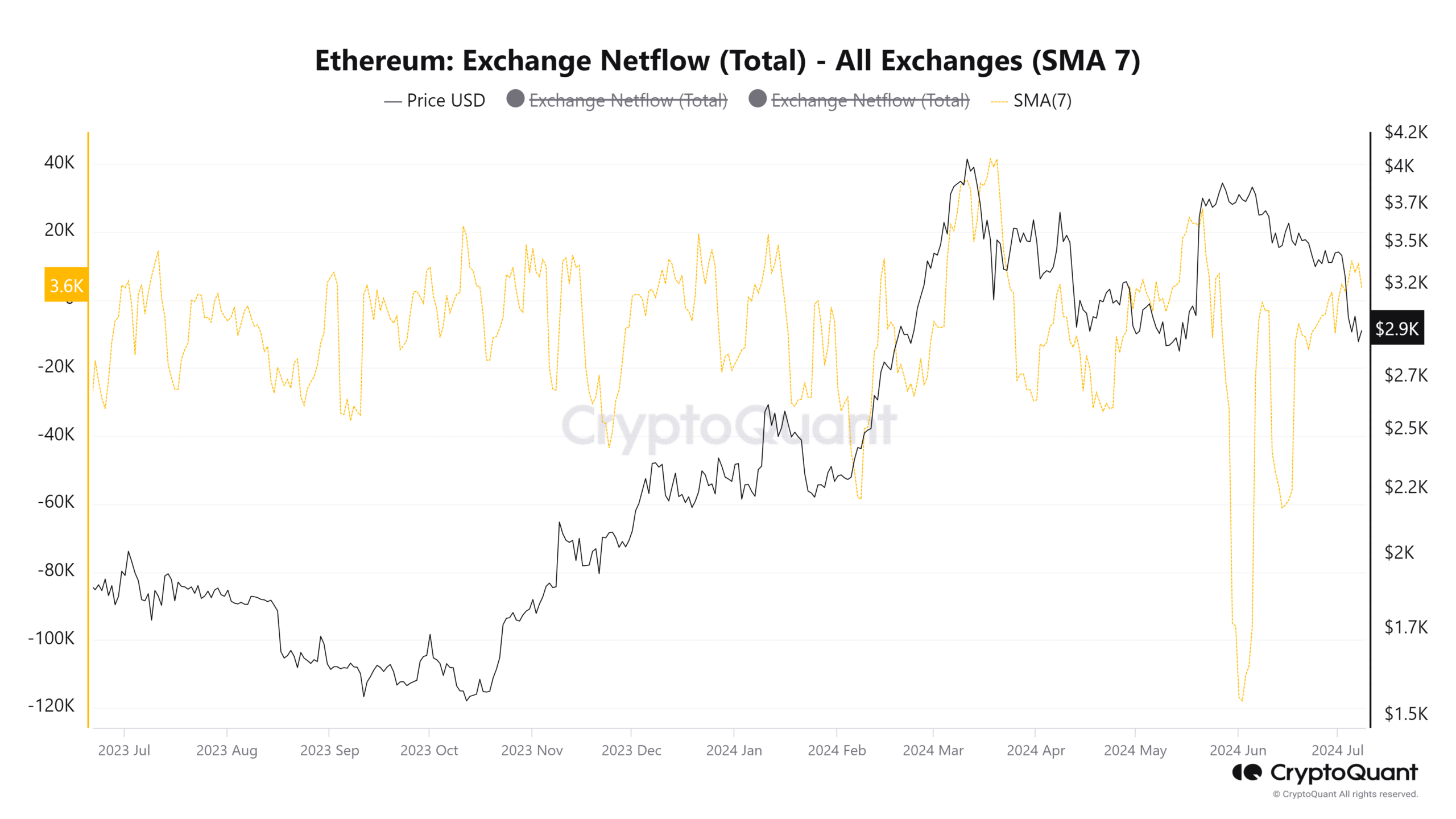

As an experienced analyst, I’ve seen my fair share of market fluctuations, particularly in the cryptocurrency space. The recent trend in Ethereum [ETH] has been disheartening for many traders, including myself. The negative exchange netflow in June, which indicated accumulation, did not prevent the prices from dropping below the $3k mark.

As a crypto investor, I’ve noticed a concerning trend with Ethereum [ETH] lately. The outflow from exchanges, which had been positive for months, suddenly took a sharp turn for the worse in June. However, instead of boosting ETH prices as we had anticipated, this shift led to a continued downward spiral and the value of our investments kept declining.

The market showed a pessimistic outlook with Ethereum’s price falling below the $3,000 mark. This significant threshold may face strong resistance, but Ethereum’s downward trend has been relentless in terms of selling pressure.

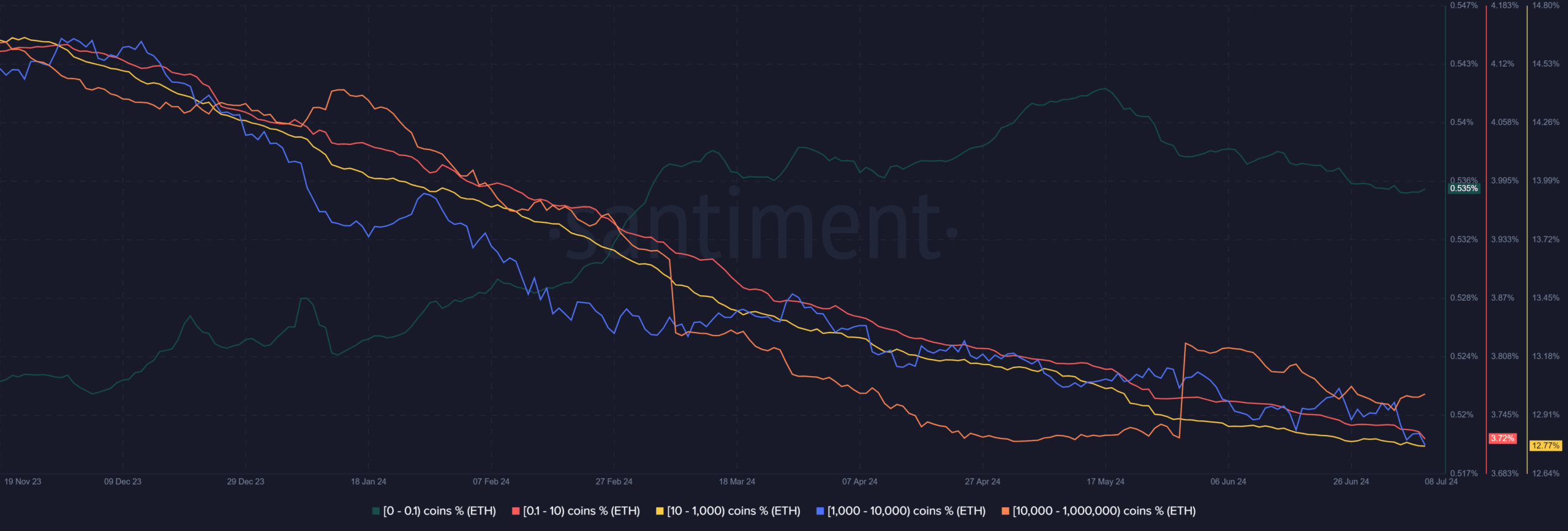

Whale accumulation did little to halt bearish trend

From the last week of June, the daily average of the exchange’s net flow turned strongly negative and persisted in this state until the 28th of that month.

Over the last ten days, it has made a positive appearance, coinciding with the significant price decrease that occurred in July.

Although a large number of Ethereum tokens were leaving exchanges, as evidenced by negative netflow, the token prices persisted in declining.

Investors would be hoping that this is the final jolt of pain before the trend turns bullish.

The examination of Ethereum supply distributions revealed a growth in the number of wallets holding between 10,000 and 1 Million ETH since mid-May. On the other hand, the wallets containing between 1,000 and 10,000 ETH experienced an upward trend around the end of June but have since decreased over the last week.

Large whale wallets, holding over 10,000 ETH, signaled accumulation. However, most other wallets have been reducing their Ethereum holdings.

Where can traders expect prices to find relief?

According to AMBCrypto’s analysis, the region between $2850 and $3000 serves as a significant support area due to the high concentration of cryptocurrency holders in that price range.

For the past three days, the price dipped to $2.8k and then rebounded to $3k, yet it remains uncertain whether buyers have enough strength to hold back the sellers’ pressure.

As an analyst, I’ve observed that approximately 60.25% of cryptocurrency addresses are currently underwater with their purchase prices being higher than the current market price. Consequently, when price bounces occur, these holders are likely to sell in order to breakeven on their investments. This selling pressure can further exacerbate the downward trend.

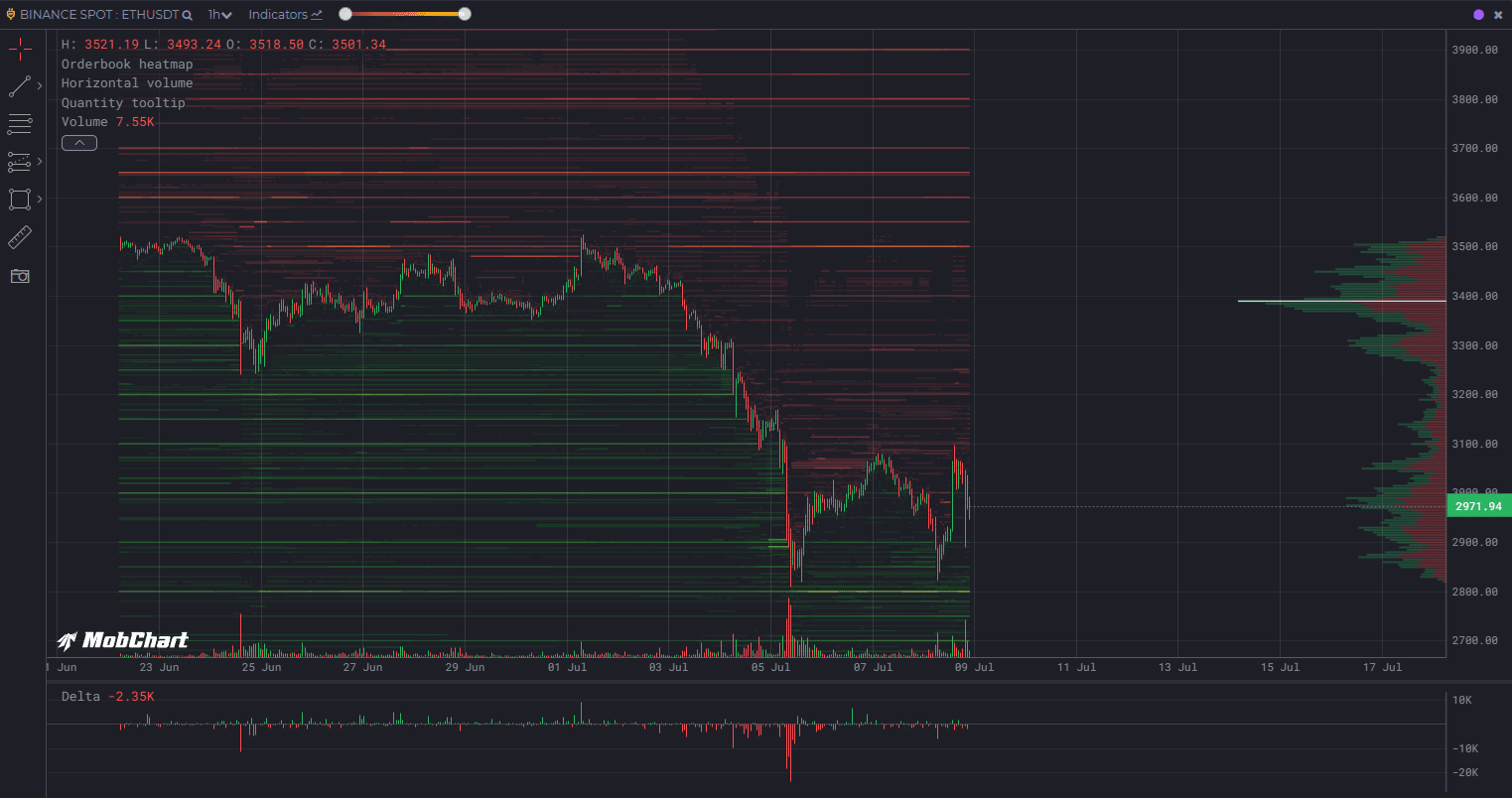

As a researcher studying the Ethereum market, I came across some intriguing data from MobChart. Notably, I observed substantial limit orders on the order books at specific price levels for Ethereum. More precisely, there are approximately $3.7 million worth of limit orders at the $3100 and $3170 price points. Above these levels, the resistance areas around $3220 to $3250 and $3500 collectively hold over $5 million in limit orders. These significant concentrations of limit orders suggest that these levels may serve as formidable short-term resistances for Ethereum price movements.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a crypto investor, I’m observing the current market situation and noting that around the $2800 mark, there are nearly $10 million in pending buy orders. It’s quite possible that this level could be tested once more. However, looking at the short-term metrics, it appears that bears have been dominating the market recently.

In June, the outgoing exchange volumes failed to curb the downward trend in prices. The most optimistic buyers can only anticipate a phase of stabilization close to the significant $3k price floor for now.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-07-09 12:07