- Ethereum whale that may have signaled July’s downside has started selling in bulk again

- Worth assessing the potential for a support bounce being cancelled

As a seasoned researcher with a penchant for deciphering the intricacies of the blockchain world, I find myself in a state of cautious anticipation when observing the recent activities of Ethereum whales. The whale that offloaded 3,000 ETH from its Ethereum ICO stash and followed it up with another 7,000 ETH earlier this July, is once again selling in bulk. This could potentially signal a resurgence of sell pressure, which, if history repeats itself, might not bode well for the price action of ETH.

When a whale (a large investor) decides to sell some of the Etherium (ETH) they’ve held since the Initial Coin Offering (ICO) stage of Ethereum, this event could potentially lead to substantial repercussions, as was recently observed according to Lookonchain.

Recent discoveries suggest a whale involved in the Ethereum Initial Coin Offering (ICO) recently disposed of 3,000 Ether. Analyzing data from Lookonchain, it was found that this same address had sold 7,000 ETH at the beginning of July this year. The significance of this lies in the potential connection to the altcoin’s price fluctuations.

After the sale of Ethereum (ETH) in July, there was a 15% drop in its price, which implies that such a big sale might be perceived as a trigger for selling. This also hints at the potential for increased selling activity in the near future, possibly leading to a surge of sell pressure.

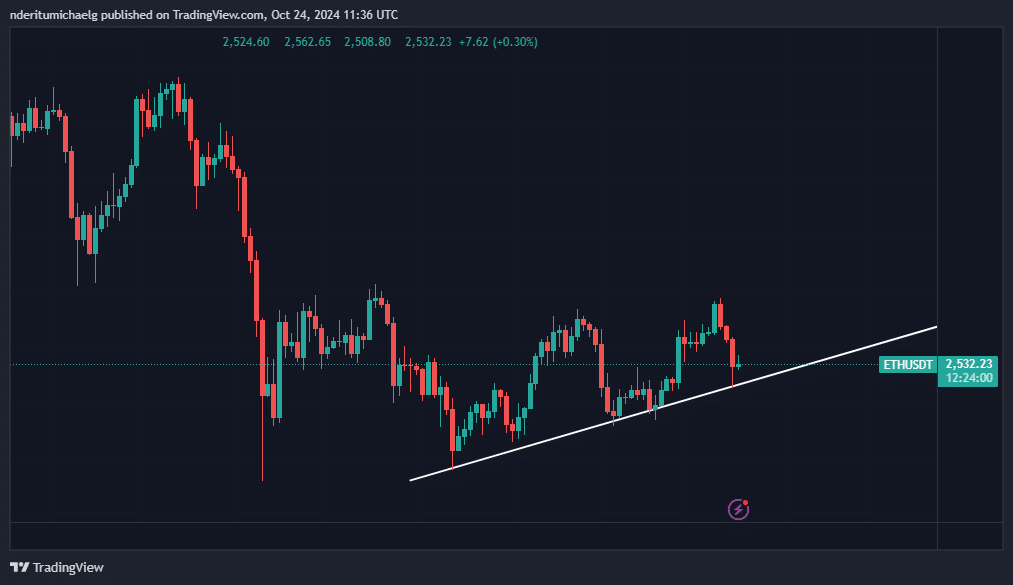

Currently, ETH is experiencing significant selling force, dropping to $2,526 at the point of this writing. This represents an approximately 8% decrease from its weekly peak. Notably, it has recently tested a short-term upward trendline in the last day, showing a slight rebound.

To summarize, it seems that large Ethereum ICO holders, as analyzed by Lookonchain, could potentially increase selling in the near future. Contrastingly, there’s speculation that ETH may rebound from the previously mentioned ascending support line.

More ETH volatility incoming, but which direction?

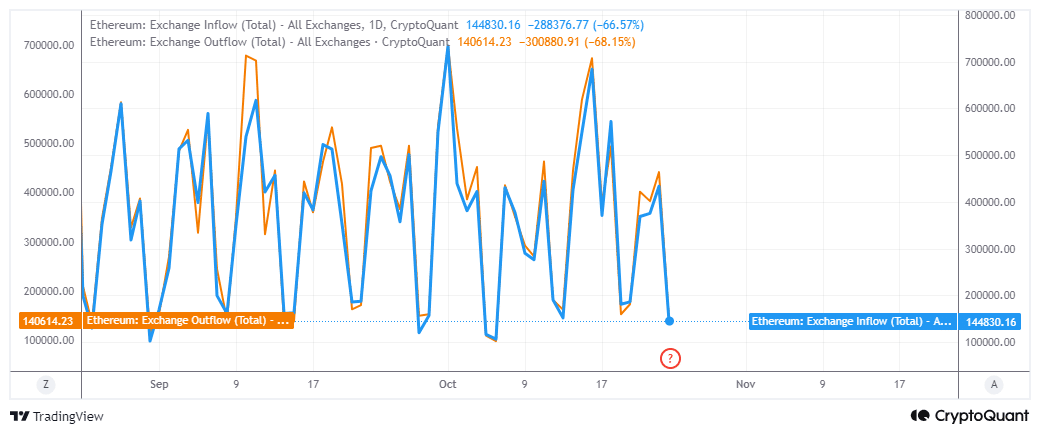

The data from ETH’s exchange transactions indicates a possible shift in the coming days, as both incoming and outgoing transactions have decreased to a point where they could reverse direction.

This means we may observe another surge in volatility. However, this could still go either way.

Over the past 24 hours, more Ethereum flowed into exchanges (144,830 ETH) than out of them (140,614 ETH). This indicates that sellers were more active than buyers, but interestingly, the price seems to have stabilized at its support level. One possible explanation for this could be significant whale activity.

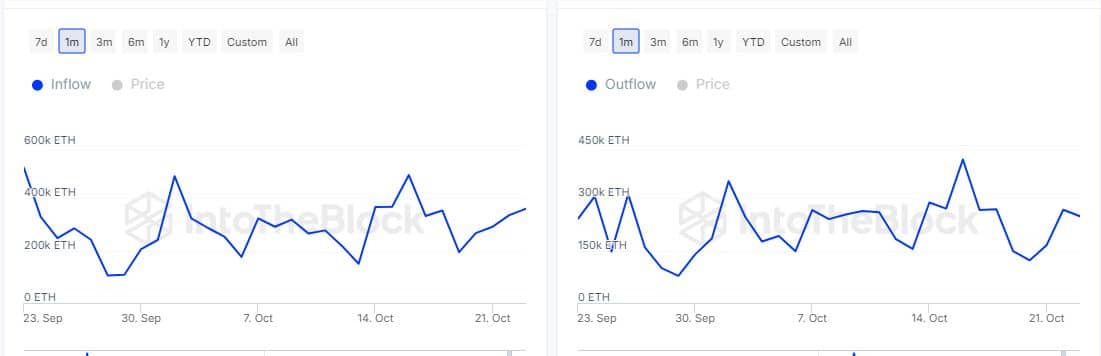

As a researcher, I’ve recently discovered some intriguing trends in Ethereum (ETH) flow data from IntoTheBlock. Notably, there has been an increase in the quantity of ETH moving into larger wallets, amounting to approximately 360,320 ETH. Conversely, outflows from these larger wallets have decreased significantly, with only about 248,590 coins leaving them.

Finally, the ownership data confirmed that whales have been accumulating at recent lows.

Despite no notable price increase over the past 24 hours, there seems to be a high level of doubt or uncertainty that may result in reduced demand.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-10-25 11:03