-

Realized price of Ethereum suggests ETH is in a bull trend right now

Ethereum’s price action and on-chain analysis seemed to support this analysis.

As a seasoned researcher with years of experience in the cryptosphere, I can confidently say that Ethereum [ETH] is currently riding a bull trend. The price action and on-chain analysis have been consistently supporting this bullish outlook. However, it’s crucial to remember that the crypto market can be as unpredictable as a roller coaster ride at an amusement park.

Despite a significant drop over the last five months, Ethereum (ETH) has managed to stay strong, consistently maintaining positions above its average purchase price as shown on the charts. This persistence suggests a positive market momentum or a bullish trend.

The current trend in Ethereum’s market value being higher than its realized price is a good indication. This is particularly significant because past altcoin market rallies have often started when Ethereum has consistently held its value above this specific level.

Furthermore, when I penned this, the overall value of altcoins was hovering around a supportive trend line for growth – Suggesting possible chances for long-term investment in altcoins.

Is ETH in a bull market?

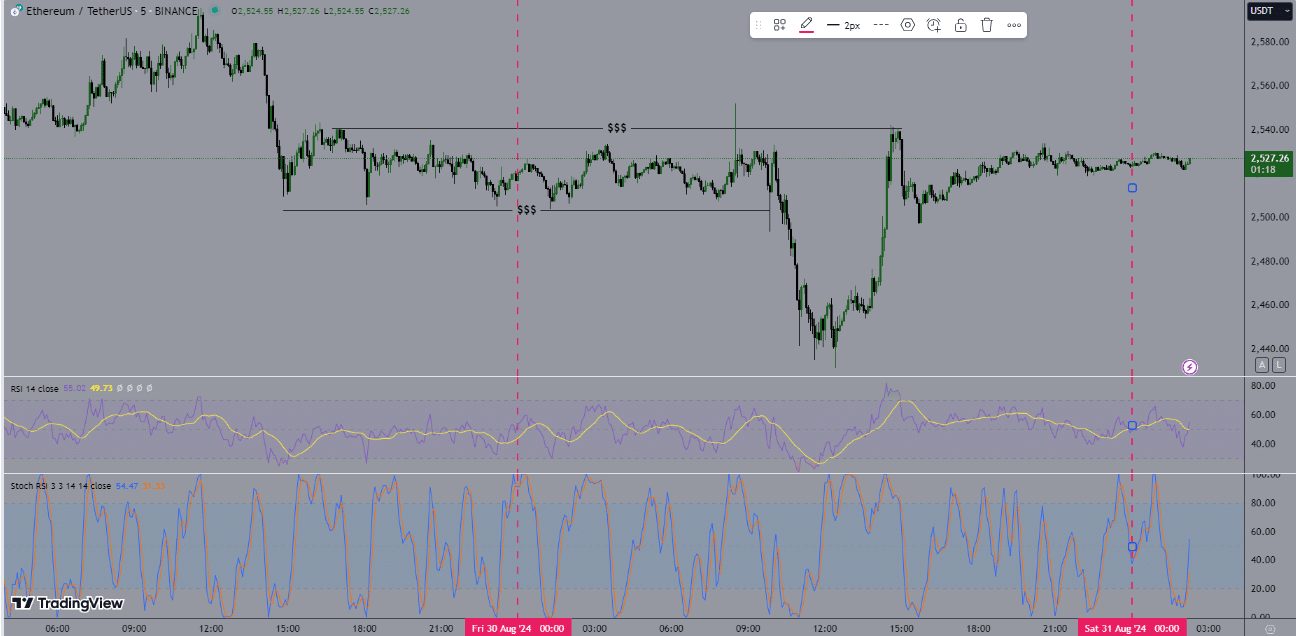

Looking at the movement of Ethereum’s value against Tether (ETH/USDT), yesterday’s daily chart ended in a Doji formation. On the shorter 5-minute scale, there appears to be a developing Head and Shoulders pattern, which often suggests an impending shift or reversal in trend.

Is there doubt about whether ETH is experiencing a rising trend? Indeed, it is, however, it’s now at significant points. If these points are breached, it might signal the end of this upward trend.

Investing in Ethereum could prove enticing for cryptocurrency traders, particularly since the Stochastic Relative Strength Index (RSI) on the daily scale suggests a potential shift away from an overbought state, which is typically associated with market reversals and may signal bottoms.

Ethereum’s supply crisis

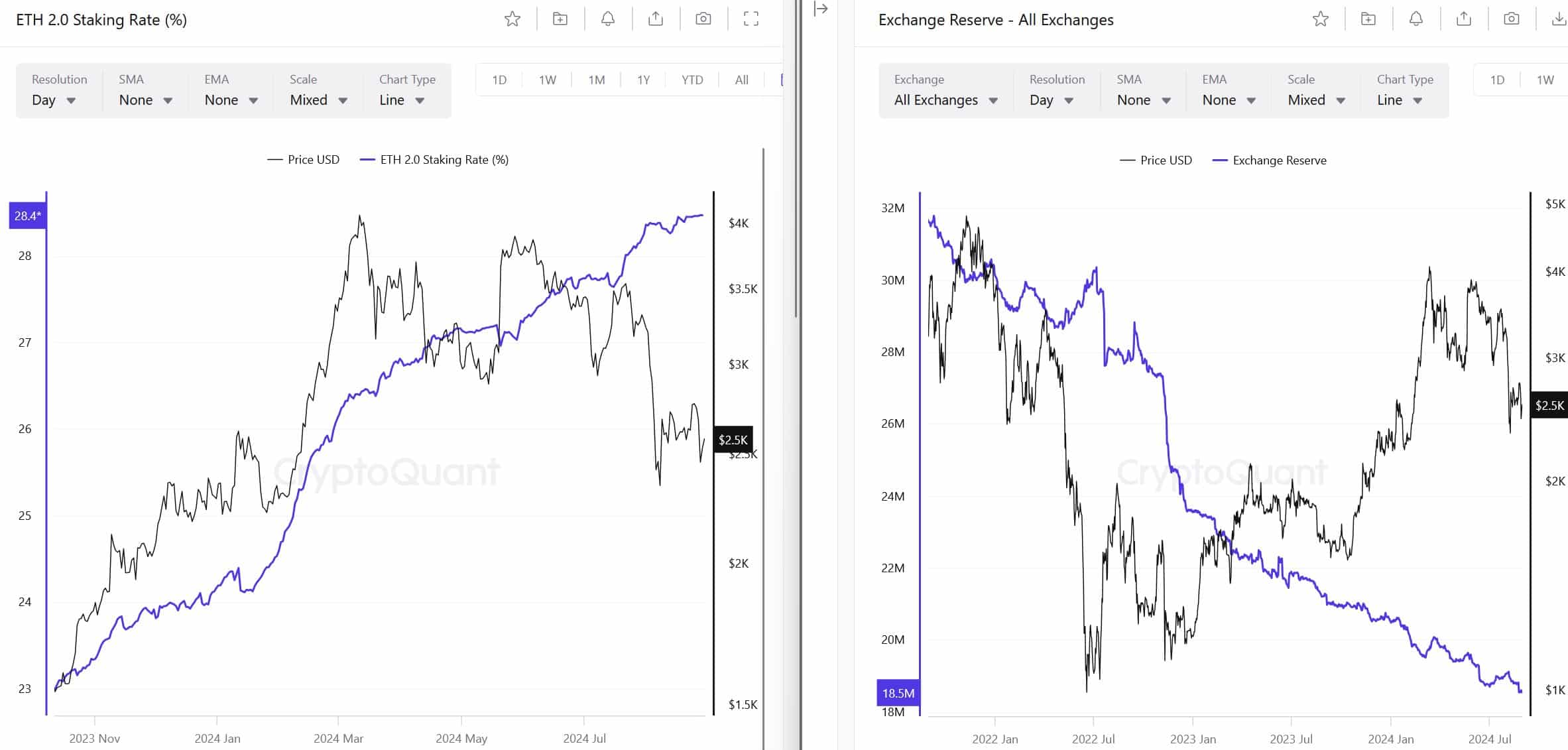

The bullish outlook for Ethereum is further supported by a looming supply crisis. Two key factors, ETH staking and exchange reserves, indicated that Ethereum is in a serious supply shortage.

As the staking rates climb higher and the exchange reserves shrink, it’s expected that when sellers run out and demand picks up, the price of Ethereum could skyrocket.

A significant amount of Ethereum has shifted from centralized exchanges to Liquid Staking Tokens, thereby reducing the available supply even more.

Stablecoin market cap & ETH transactions at ATH

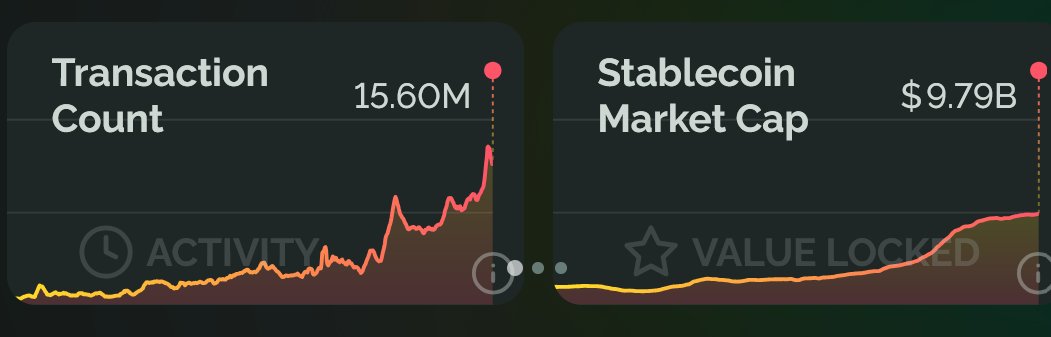

In the realm of stablecoins, Ethereum, a key figure, has experienced a substantial increase in the number of transactions being processed.

Despite its bearish price action, the Ethereum ecosystem is thriving, with transaction counts reaching an all-time high of 15.60 million.

The total value of stablecoins currently stands at a record-breaking $9.79 billion, indicating robust foundations potentially boosting Ethereum’s price further.

Rising whale activity

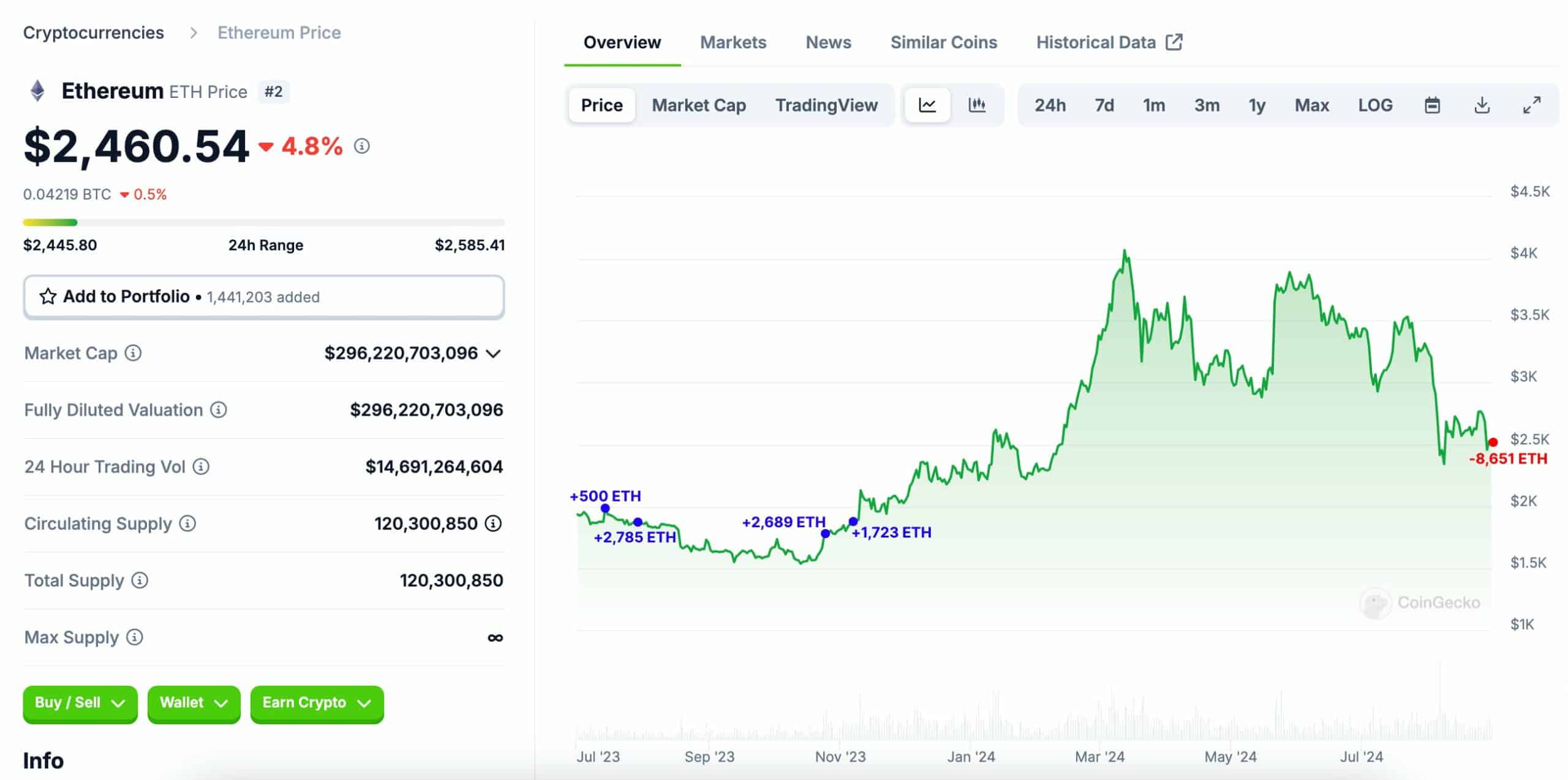

The level of whale transactions has significantly increased, as evidenced by one such whale transferring 8,651 Ether (equivalent to around $21.47 million) into Coinbase, netting an estimated profit of about $5 million.

In the time period between July 14th and November 6th, 2023, this whale had removed a total of 7,697 ETH (equivalent to approximately $14.3 million) from Coinbase at an average price of around $1,859 per ETH.

At its highest point, the whale’s earnings from Ethereum (ETH) surpassed a staggering $16 million. This dramatic increase in whale activity hints at a potential substantial rise in the value of ETH in the upcoming days. Notably, this trend becomes more pronounced as larger investors start shifting their assets.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-31 17:12