- Ethereum staking sees a record weekly Netflow of +10k ETH.

- ETH has surged by 7.82% over this period.

As a seasoned crypto investor with a knack for spotting trends, I find myself quite intrigued by the recent developments in Ethereum (ETH). The record weekly netflow of +10k ETH into staking and the 7.82% surge over the past week have certainly caught my attention.

For the past month, the value of Ethereum [ETH] has seen a surge in interest and climbed to a high of $3500, marking its highest point since July.

Although Ethereum [ETH] hasn’t matched Bitcoin‘s [BTC] recent achievements (hitting new all-time highs five times within a week), it has experienced a significant surge of 34% when compared to its monthly performance.

Over the last seven days, Ethereum has experienced a significant surge, rising from a bottom of $3031 to a peak of $3500. Remarkably, during this timeframe, the amount of Ethereum being staked reached an all-time high. As reported by Maartunn, the weekly netflow of ETH staking has achieved a new record.

Ethereum staking sees a record weekly netflow

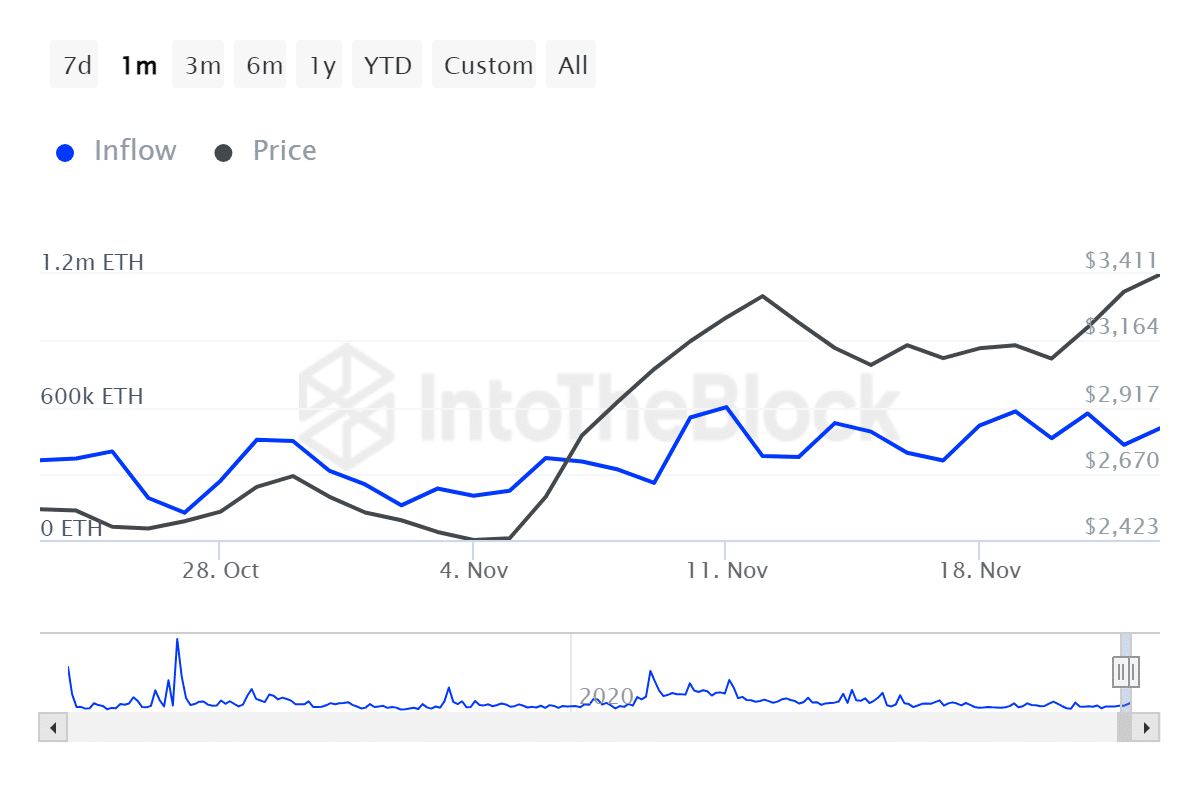

Based on data from IntoTheBlock, Ethereum’s staking has seen a significant increase in inflow over the past week following several months of outflows.

During the last seven days, there was a net increase of approximately 10,000 Ether in Ethereum’s staking pool. This is because 115,000 Ether were deposited, while 105,000 Ether were withdrawn.

The massive influx of funds significantly alters market behavior, as withdrawals have consistently surpassed deposits over an extended period.

According to Maartunn’s findings, several key elements contributing to the rise include a rise in ETH prices and enhancements in the staking system structure.

Consequently, this transition significantly impacts ETH’s pricing because it decreases the amount of ETH available on the market, thereby reducing inflation. Typically, a decrease in supply coupled with increasing demand is crucial for a price surge.

Consequently, the rising influx signifies a crucial optimistic marker for the expansion of the entire Ethereum system and the potential worth of Ether (ETH).

What ETH charts show

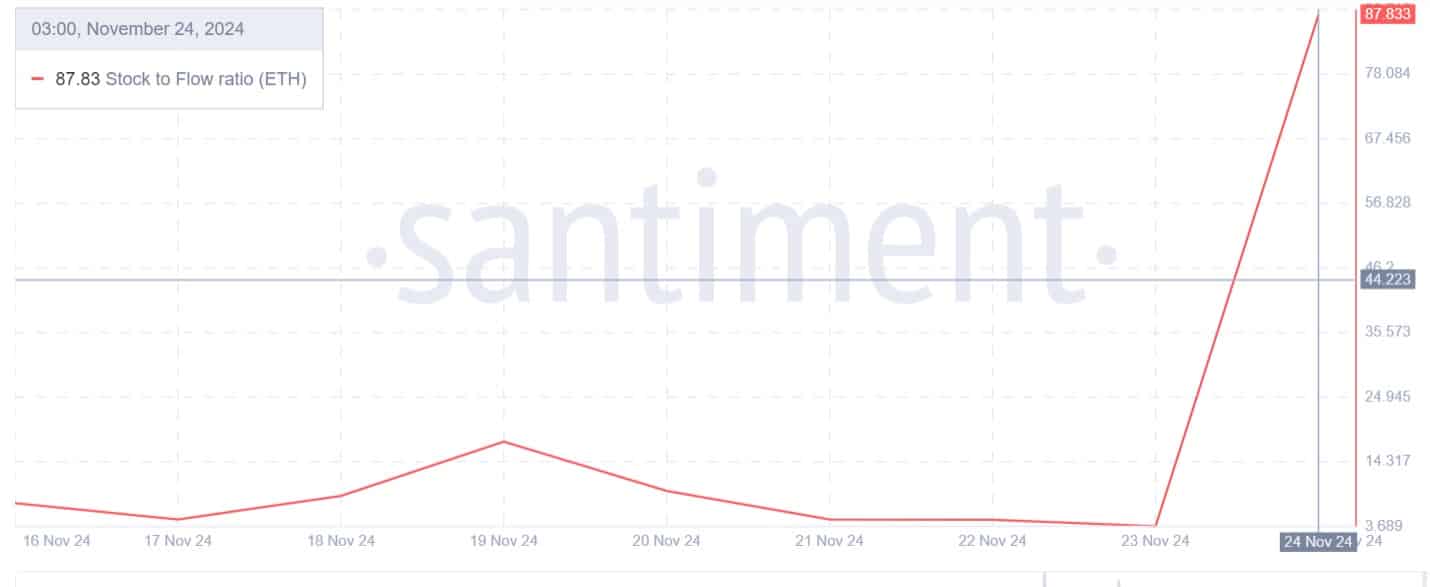

The decrease in Ethereum’s supply becomes more evident with the increasing Stock-to-Flow Ratio (SFR). An ascending SFR suggests that the asset is growing more scarce. Scarcity often contributes to value because it limits the amount available, thereby reducing oversupply.

When an asset is low in supply and higher in demand, prices often appreciate.

Similarly, a review of IntoTheBlock data indicates an increase in Ethereum transfers by significant investors. This surge reached its peak level for the month.

This market activity suggests that significant investors are actively buying the cryptocurrency, thereby increasing demand and consequently depleting its availability.

Impact on price charts?

It appears that as more funds flow into Ethereum (ETH), its price has been positively affected. Consequently, with an uptick in deposits, ETH’s value has climbed and reached a new peak recently.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Currently, ETH is experiencing a significant increase, climbing up by approximately 7.82% to reach a trading price of $3381. This suggests that while bears seem to be in control, Ethereum is steadily gaining traction and showing signs of an upward trend.

Should buyers dominate the market, it’s plausible that Ether (ETH) might witness further growth. In such a scenario, I anticipate ETH breaking through its resistance at $3560.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-25 13:11