- Ethereum sets a new year-to-date inflow record at $2.2 Billion, beating its 2021 highs.

- ETH could hit $10K in the midterm if more chain activities continue to thrive.

As a seasoned crypto investor with a knack for spotting trends and a penchant for Ethereum, I can confidently say that the recent inflow record of $2.2B year-to-date is nothing short of impressive. It’s like watching a rocket take off, and Ethereum is the star of this show. The surge in investor confidence, institutional backing, and the performance of Ethereum ETFs are all indicators that we might just be at the beginning of a significant bull run.

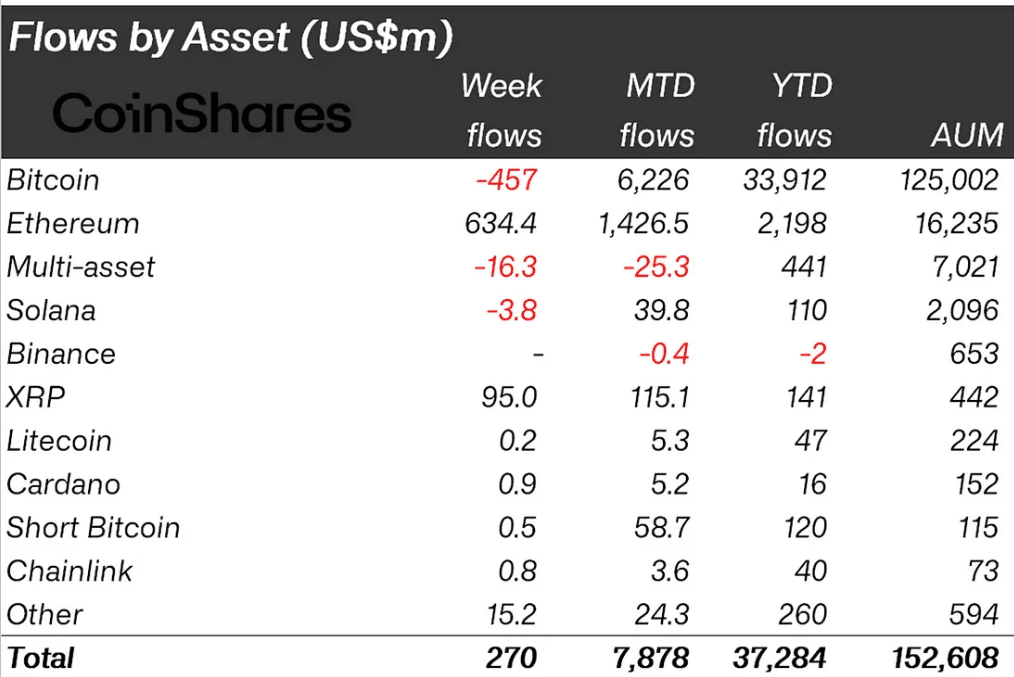

This year, Ethereum (ETH) has smashed its own record for incoming funds, hitting an impressive $2.2 billion so far, eclipsing its previous high from 2021.

Over the past while, investments amounting to approximately $634 million have been pouring in, suggesting a marked increase in investors’ trust and overall market optimism.

The increase can be linked back to the outstanding performance of Ethereum-based ETFs. These exchange-traded funds (ETFs) are now favored by many investors because they provide an indirect way to invest in Ether without actually purchasing the digital currency directly.

It’s clear that there’s an increasing institutional involvement, as substantial amounts are consistently being channeled into Ethereum-related investment options.

In simpler terms, although there were ups and downs and unpredictable changes in the Ethereum market, its general direction seemed positive, or ‘bullish’. The growing support from institutions has provided a robust base for further expansion.

These advancements occurred at a time when there was a general rise in investments into cryptocurrency Exchange-Traded Products (ETPs). Among these products, Ethereum and Bitcoin attracted the most investment, making them the frontrunners in this market.

ETH TVL and Spot ETFs inflows

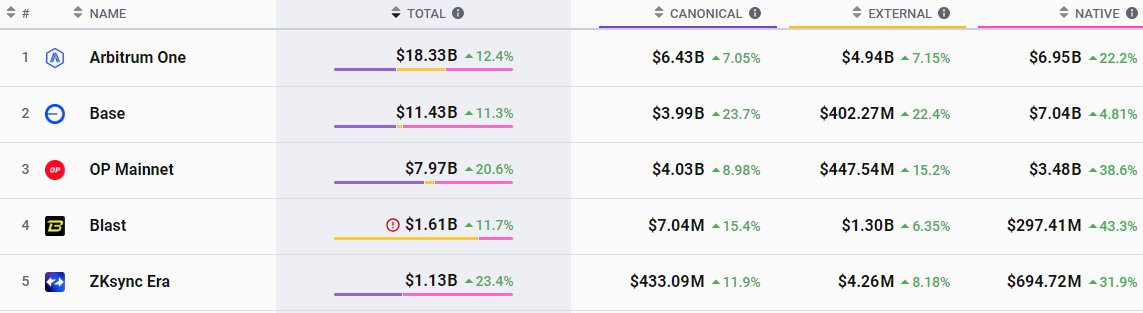

Over the last seven days, there was a substantial surge of approximately $4.81 billion into Ethereum, resulting in a substantial rise in the amount of value it holds, according to data from Lookonchain.

The increased influxes have driven up Ethereum’s Layer-2 systems to unprecedented heights, as the total value locked (TVL) collectively reached an all-time high of $51.5 billion – a staggering 205% increase compared to the same time last year.

Furthermore, the Total Value Locked (TVL) in Base increased by an impressive $302.02 million, a clear indication of increased user engagement and advancements in its scalability.

The surge in decentralized finance (DeFi) Total Value Locked (TVL) has not only reached levels similar to November 2021 but also expanded its offerings with a rise in liquid staking choices, the integration of Bitcoin into DeFi, and stronger involvement from Solana and other scaling solutions.

Moreover, there’s been a significant increase of approximately $24.23 million in investments into Ethereum-based spot ETFs, representing the sixth day in a row with positive inflows.

On a standout day, the BlackRock ETHA ETF attracted an impressive $55.92 million, while Fidelity’s FETH ETF demonstrated robust growth with a net inflow of $19.90 million.

Combined, the total market worth of Ethereum spot ETFs now stands at $11.13 billion, underscoring a persistent and increasing fascination with Ethereum as a crucial asset within the digital currency sector.

Price action to hit $10K

This progress might propel Ethereum to unprecedented levels, as suggested by the chart over a three-day span, which indicates a burst through a consolidation triangle and a significant spike.

Starting from early 2021, Ethereum’s price has generally moved upward, experiencing occasional pullbacks and periods where it stabilizes.

As a dedicated researcher, I’m observing Ethereum (ETH) poised to potentially break out from a triangular chart formation, suggesting a possible upward trajectory. If this pattern holds true, we might witness a significant spike that could propel ETH towards the impressive milestone of $10,000.

Read Ethereum’s [ETH] Price Prediction 2024–2025

If the current upward trend persists, with Ether’s price briefly exceeding $3600, it appears that Ethereum might realistically reach $10,000 within the intermediate term, given continued robust activity on the network.

The actions suggest robust demand from buyers and positive market feelings, potentially paving the way for Ethereum’s expansion into new heights.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-04 02:16