- Ethereum popularity increased materially according to recent data.

- Staking participation was on the rise as prices remained stable.

As a seasoned crypto investor, I’ve witnessed the ebb and flow of various altcoins in the market. Ethereum [ETH], in particular, has piqued my interest lately due to its increased popularity and the rising participation in staking.

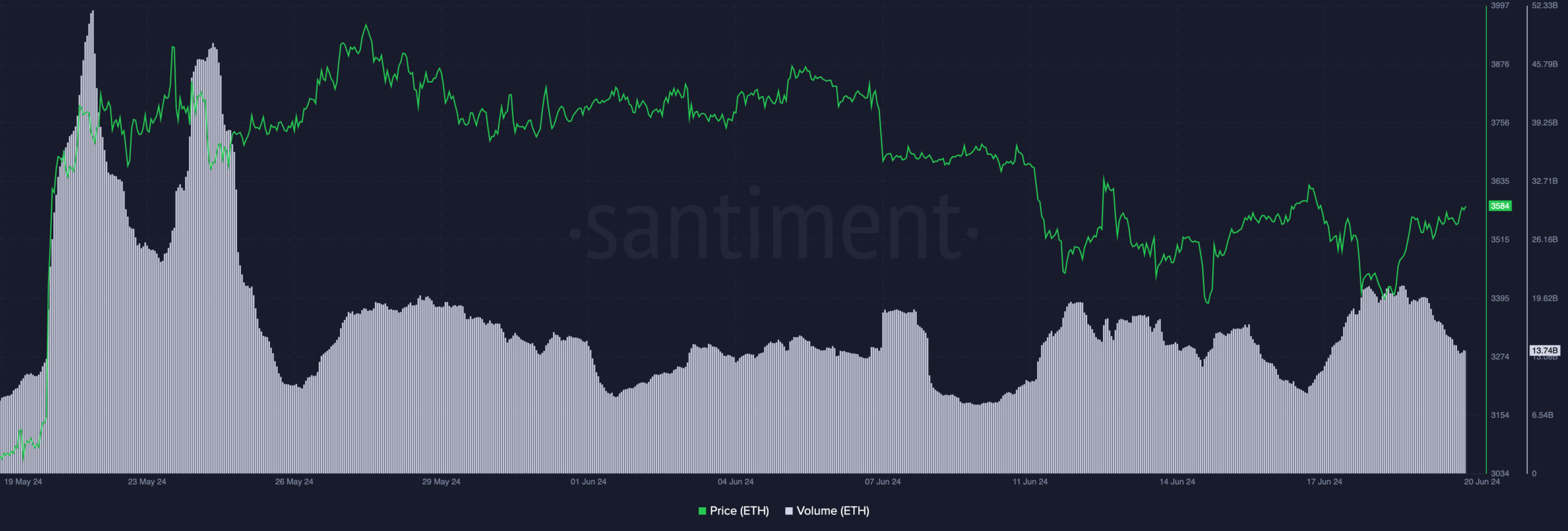

Over the last several days, the price of Ethereum’s ETH token has remained unchanged. Surprisingly, there has been growing enthusiasm among traders for this cryptocurrency alternative.

Ethereum’s popularity grows

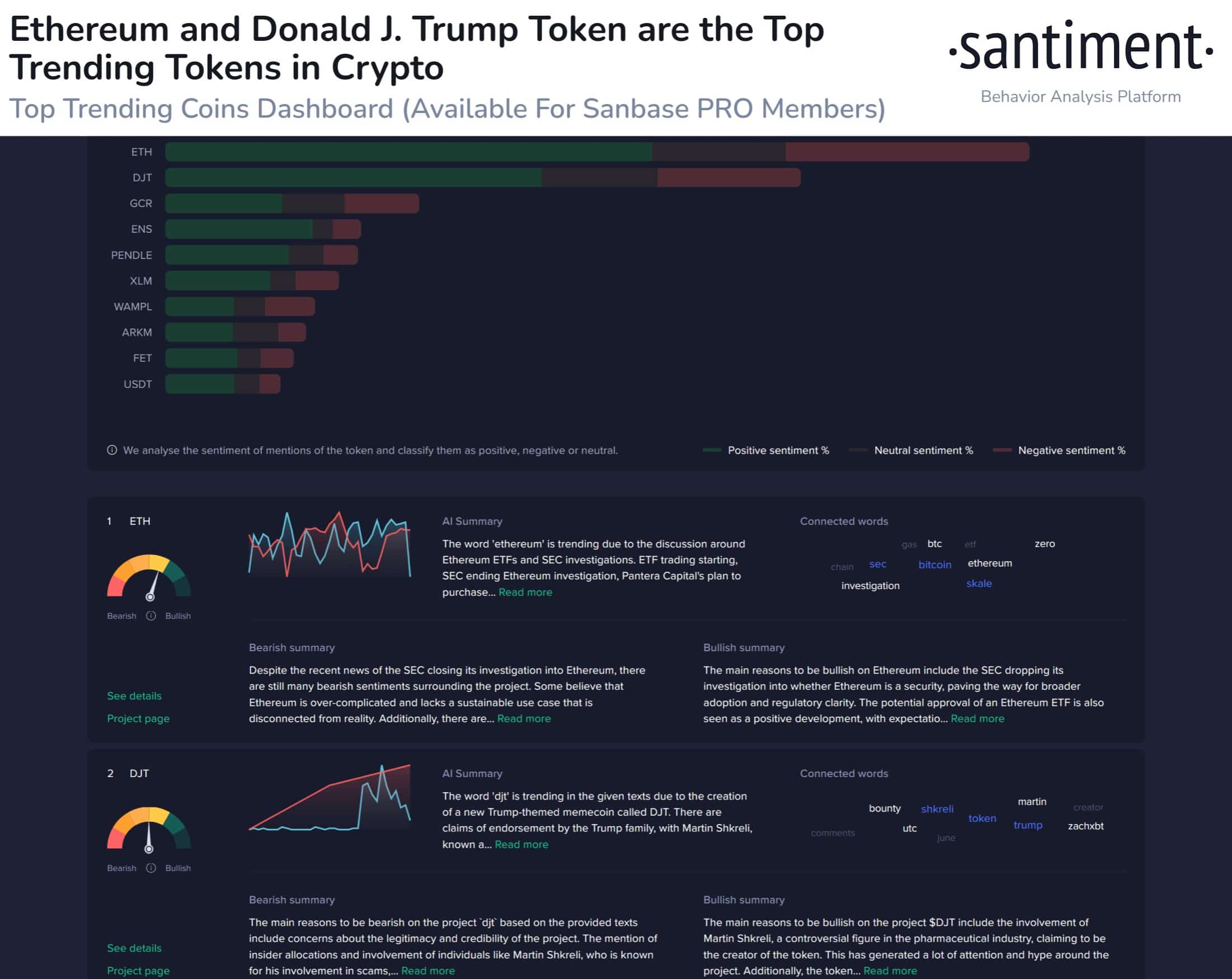

Based on Santiment’s recent findings, I noticed a considerable surge in Ethereum (ETH) popularity over the past few days.

The ongoing debates about Ethereum ETFs, SEC probes, regulatory changes, and Consensys’ campaigns for Ethereum’s classification have been fueling the growing interest in this cryptocurrency.

The surge in interest towards Ethereum sparked various opinions, with some viewing it as a bearish sign while others saw it as a bullish development.

The data from Santiment indicated that investors’ pessimistic views may have been fueled by the possibility of the Securities and Exchange Commission (SEC) categorizing Ethereum as a commodity.

Although the SEC has abandoned the probe, the possibility of the securities watchdog targeting the cryptocurrency could create challenges for the Ethereum network. It might also serve as an obstacle in the approval process for other Ethereum Exchange-Traded Funds (ETFs), which is currently a significant source of investor enthusiasm.

As a crypto investor, I’ve noticed that the regulatory struggle between Ripple and the Securities and Exchange Commission (SEC) has created uncertainty in the market. If the SEC were to take similar action against Ethereum, it could negatively impact market sentiment and potentially dampen my investment enthusiasm for other cryptocurrencies.

The ambiguity regarding Ethereum’s regulatory classification and potential restrictions poses challenges for the initiative.

From a optimistic viewpoint, Ethereum had numerous advantages. For example, the termination of the SEC investigation significantly enhanced the validity of Ether sales, removing the classification as securities.

This news has led to a surge in ETH-related altcoins and a more stable market environment.

Additionally, the advancement of interoperability solutions linking Ethereum with other blockchains signified robust expansion and increasing use in the Ethereum community.

State of staking

Regarding Ethereum’s staking market, there has been a notable uptick in the number of participants. Yet, this surge has been accompanied by heightened volatility in staking yields.

As a crypto investor, I’ve noticed that a larger number of validators participating in a proof-of-stake network can lead to several benefits. However, the unpredictability of returns due to high volatility in yields can be dissuasive for some investors who prefer more stable income streams.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As a researcher studying the Ethereum network, I’ve observed that the price volatility could be attributed to various factors. One possible explanation is the shifts in network fees, also known as Miner Extractable Value (MEV), or modifications in the total amount of staked ETH.

As of the moment this statement is being made, Ethereum (ETH) was priced at $3,587.52 on the market. Within the last day, there was a 0.67% increase in ETH’s price. Contrastingly, the amount of Ethereum being traded had decreased by 27%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-20 13:11