-

ETH has declined by over 4% in the last 24 hours.

A further decline could trigger panic sales from some holders.

As a seasoned researcher with years of market analysis under my belt, I’ve seen my fair share of market fluctuations, and Ethereum’s current situation is no exception. The recent 4% decline within 24 hours paints a grim picture, one that could potentially escalate if not handled carefully.

In simple terms, Ethereum (ETH) has seen a substantial drop in the last 24 hours, undoing most of its weekly gains. The data suggests that Ethereum is facing strong selling activity, which might cause it to fall more if the price doesn’t stabilize at crucial points.

Ethereum is down

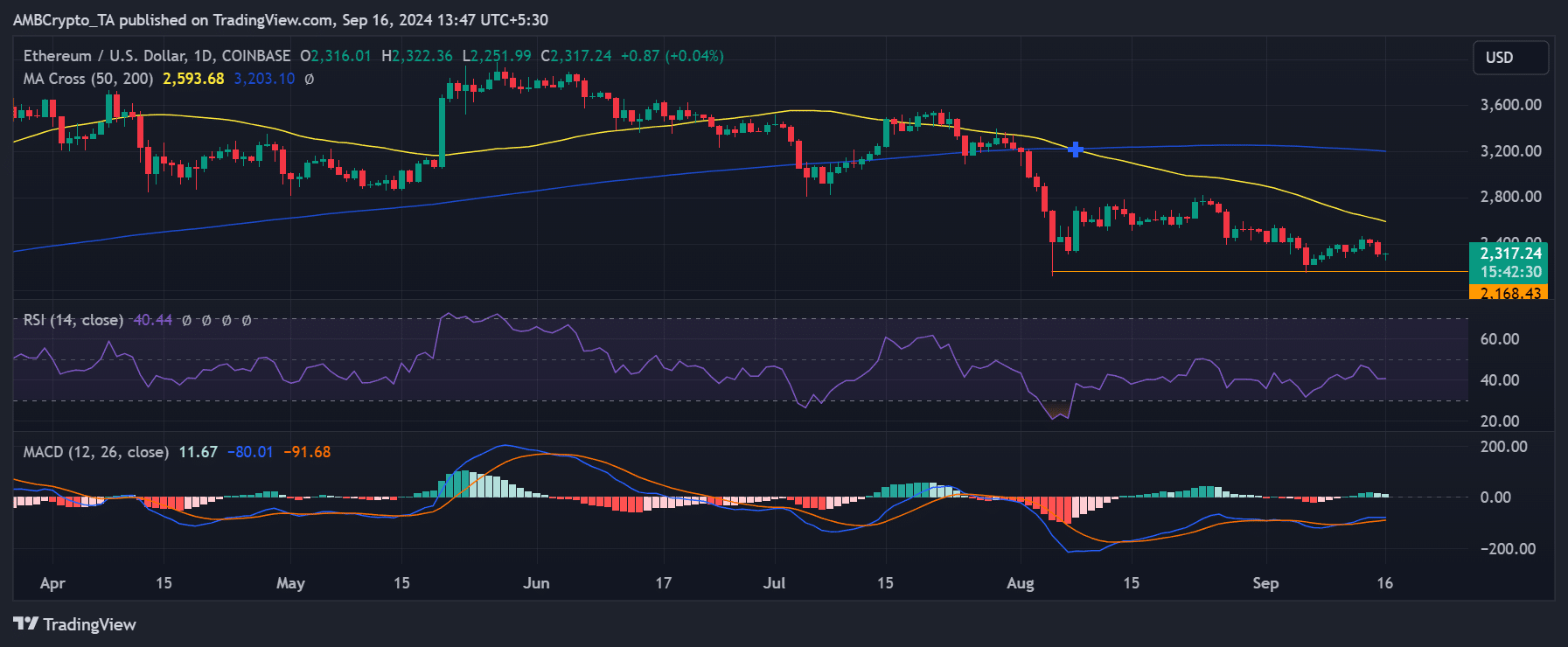

Examining Ethereum’s day-by-day price movement unveiled that it started the week on a downward spiral, shedding approximately 4.21% by the end of trading on September 14th, which left its value around $2,316.

Currently, Ethereum is showing a steady decrease, currently valued around $2,300, experiencing a minimal drop of nearly 1%.

If Ethereum maintains its current trajectory, it may encounter resistance at approximately $2,224 – a level where it has previously gained support following similar price drops. If the downward momentum persists, a significant support level to keep an eye on is around $2,168, which could be a crucial area for potential price stabilization.

Furthermore, Ethereum continues to show signs of a downward trend based on its Relative Strength Indicator (RSI). At present, this indicator reads approximately 40, suggesting that Ethereum is approaching the oversold territory. This could imply a decrease in buying power and potential weakness moving forward.

Ethereum sees more sell pressure

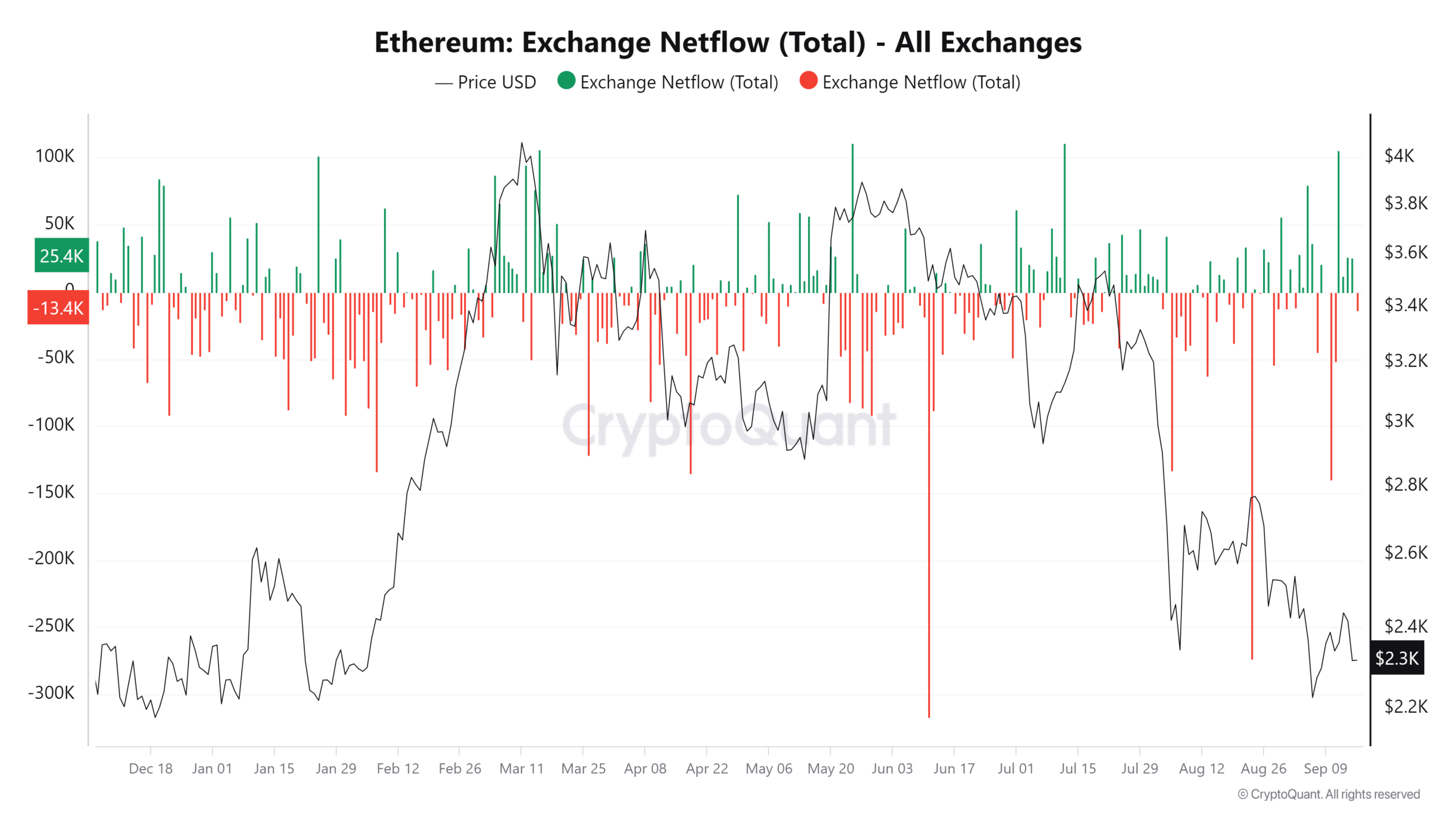

Over the last five days, there’s been a recurring trend in Ethereum’s exchange outflow-inflow balance, indicating more Ethereum is being withdrawn from exchanges than deposited. This positive netflow was initiated by a substantial deposit of over 105,000 ETH into exchanges on September 12th.

During this timeframe, it appears that a larger amount of Ether has been transferred to exchanges, often signifying higher levels of selling activity.

As a crypto investor, I’ve noticed the recurring trend of ETH being moved to exchanges, which could indicate traders are looking to cash out or dispose of their holdings. This increased sell pressure seems to be a significant factor hindering Ethereum’s efforts to maintain its recent price surge.

Additionally, it appears that the total trade volume during the previous trading day dropped approximately to 7 billion dollars, signifying less trading activity. This pattern seems to indicate that more sell orders are being placed than buy orders, as suggested by the comparison between volume and price trends.

Currently, according to Santiment’s data, the trading volume has soared beyond $14 billion, nearly doubling compared to the last session. Yet, it remains uncertain if the rise in volume is due to buyers or sellers, and which group might ultimately be in control.

Key holders hold clues to the next price trend

Based on information from IntoTheBlock, approximately 1.7 million wallets currently possess Ethereum at its current price point, cumulatively owning around 53 million ETH. This suggests that the current price range is a crucial support area, indicating potential resistance to any significant decrease in value.

Currently, these holders are balanced, neither gaining a profit nor experiencing a loss.

Read Ethereum (ETH) Price Prediction 2024-25

Should Ethereum’s value fall beneath a crucial threshold, some investors might rush to sell their holdings to minimize potential losses. With a trading volume of about 53 million Ether, a broad selling trend could trigger a steep drop in the price.

However, if ETH can maintain this price range, it might stave off further declines.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-09-16 23:03