-

UNI’s price surged after the protocol disclosed a plan to introduce the ERC-7683 standard.

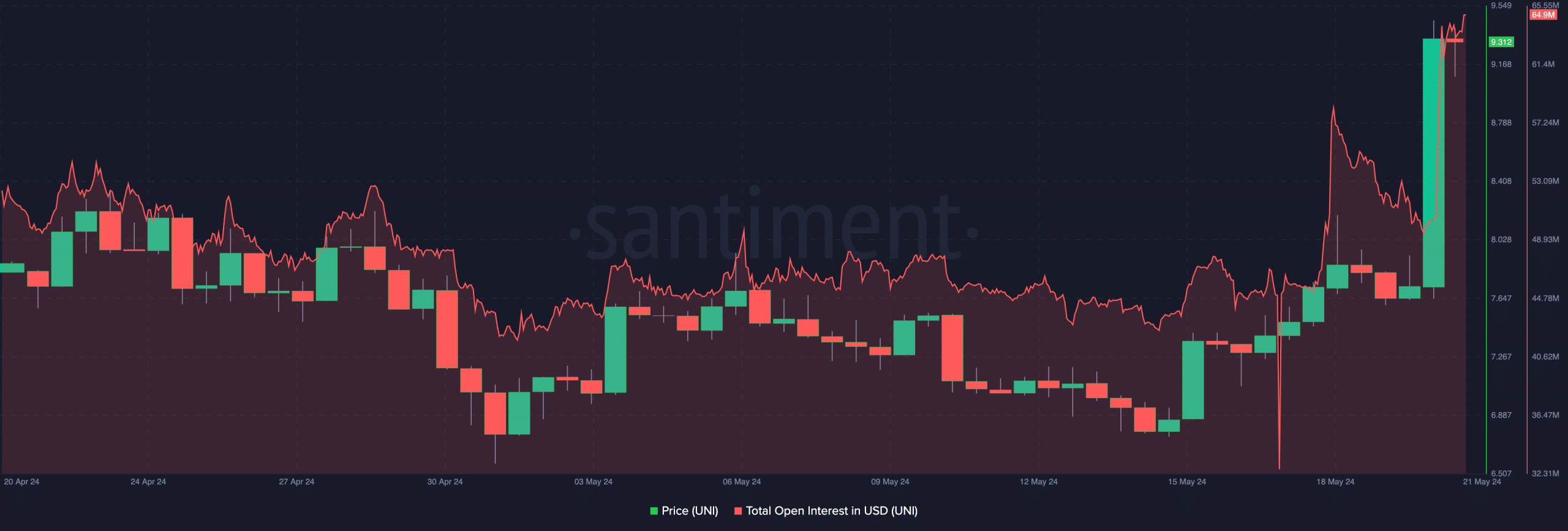

Open Interest hit a monthly high, activity spiked, while the token could rise to $12.

As an experienced analyst, I believe that Uniswap’s [UNI] sudden surge to $9.30 within 24 hours cannot be attributed solely to the increased odds of ETH spot ETF approval. While that may have played a role in Ethereum’s price jump, UNI’s breakout was driven by more fundamental developments on the Uniswap network.

In an unexpected development within the past 24 hours, UNISwap (UNI) surged by 18.98%, reaching a peak of $9.30.

Several individuals may have attributed the rise in ETH‘s price to optimistic news about the potential approval of Ethereum [ETH] spot Exchange-Traded Funds (ETFs) by the United States Securities and Exchange Commission (SEC). Consequently, the value of ETH surged.

Although it contributed, there were other significant factors at play. Based on AMBCrypto’s examination, key developments and on-chain activities were essential for UNI‘s price surge.

The Labs come with a new standard

On May 20th, Uniswap Labs announced the introduction of a novel token standard named ERC-7683 in the Ethereum network for public reference.

It is a standard for creating and issuing smart contracts on the Ethereum blockchain.

Based on Uniswap Labs’ statement, implementing this standard is predicted to address fragmentation within the network and enhance cross-chain communication. (The proposal suggests)

Through the use of a common, inter-chain intent system, different blockchains can communicate with each other and collaborate on shared resources like broadcasting orders and managing execution networks.

As an analyst, I’ve noticed an intriguing development following the recent announcement – UNI‘s Open Interest (OI) has witnessed a significant surge. At this very moment, its Open Interest stands at $64.90 million. This figure is noteworthy because it surpasses the last observed value from over a month ago.

An uptick in Open Interest (OI) signifies that there’s a rise in the number of outstanding derivative contracts, suggesting an influx of capital into the market. Conversely, a downturn in OI implies fewer new contracts are being created and existing positions may be being closed or reduced, indicating a drain of liquidity from the market.

Activity rises, sets UNI for another price boost

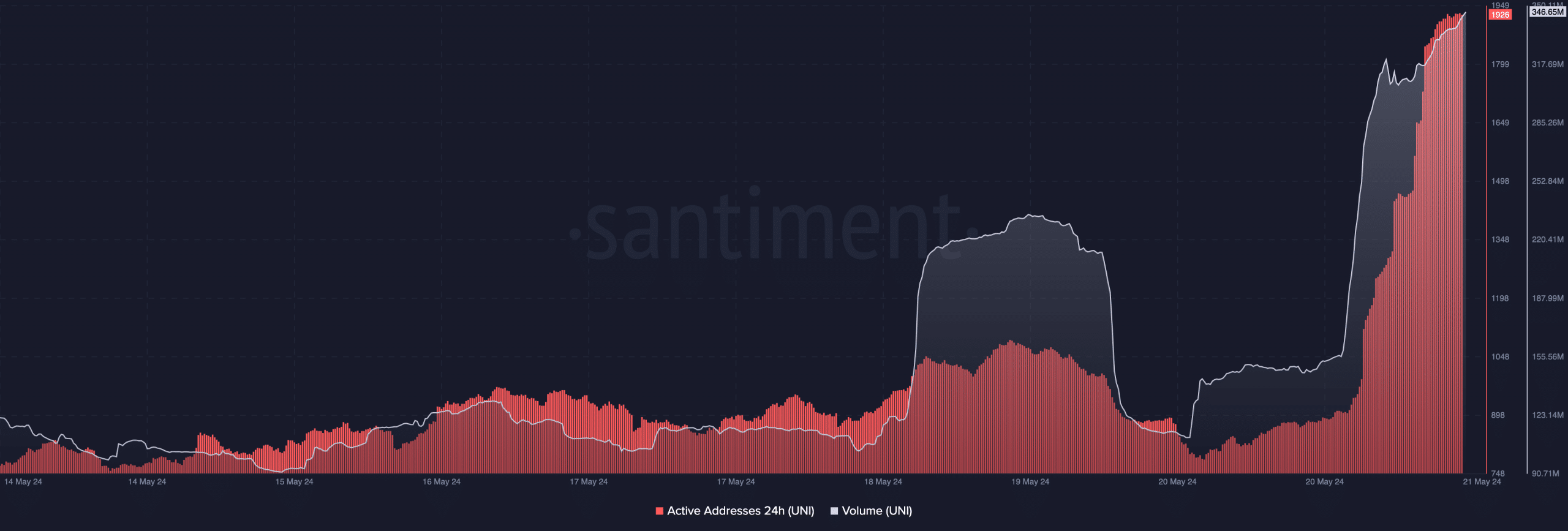

Placing the ask price next to it, the high volume indicated strong buying activity among market participants. Should the value persistently climb higher, it’s plausible for UNI‘s price to follow suit.

As a crypto investor, I believe there’s a possibility that the token’s price may surge beyond its previous March high. This upward trend wasn’t solely driven by Open Interest (OI) though. Other developments on the network also contributed significantly to this price hike.

One method for rephrasing this statement in a clear and conversational tone is: One type of address showed continuous activity around the clock. An uptick in the number of such addresses indicates that a significant number of users are engaged in interacting with the blockchain.

As a crypto investor, I would interpret a decrease in the number of unique addresses interacting with the UNI network according to this: When the count goes down, it signals that fewer individual wallets are accessing the platform on a weekly basis. In contrast, for UNI specifically, Santiment’s on-chain data indicated a weekly high of 1926 active addresses, suggesting an increase in user engagement.

As an analyst, I’ve noticed a significant uptick in confidence among UNI holders recently. This increase in faith often results in heightened buying activity. I believe this surge of optimism played a role in driving up UNI’s price.

Realistic or not, here’s UNI’s market cap in ETH terms

Furthermore, UNI‘s volume of $346.65 million at the present moment indicates a heightened level of interest in AMBCrypto.

As a researcher studying UNI‘s market trends, I would hypothesise that an uptick in this figure could correspond with a rising token price. With the current momentum, it seems plausible for UNI’s cryptocurrency value to reach between $12 and $15 within a brief timeframe.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-05-22 05:11