-

BlackRock bought ETH worth $109.9 million, spurred by the latest price decline.

Slight accumulation observed, especially from whales, but retail is still fearful.

As a seasoned researcher with years of experience under my belt, I find myself intrigued by the recent market dynamics of Ethereum (ETH). The latest move by BlackRock, a titan in the financial world, to buy ETH worth $109.9 million amidst the price decline is a significant development.

🚨 BREAKING: Trump's Tariffs May Rock EUR/USD!

Shocking new analysis predicts massive volatility ahead. Markets brace for impact!

View Urgent ForecastAs a researcher observing the current Ethereum [ETH] market, I find myself intrigued by the reduced prices. Given this situation, my expectation is that potential buyers might be enticed to re-enter the market, drawn in by the attractive discounts.

As a researcher, I find myself closely monitoring the ETF market due to the surge in demand for Ethereum (ETH) they’ve been generating. Given that there might not be an increase in sell-side pressure imminently, it’s crucial to stay attuned to their activities and potential impact on the Ethereum market.

As a seasoned trader with years of experience in the volatile world of cryptocurrencies, I find myself intrigued by the recent shift in market dynamics. Last week, the bears had launched a fierce assault on the market, causing a significant dip that left many investors shaken. However, recent data suggests that the bears are now retreating, providing an opportunity for strategic players to capitalize.

This was a sizable increment, compare to the amount that Blackrock purchased in the previous day.

As a crypto investor, I paused my Ethereum (ETH) buying spree on the 2nd of August, as the selling pressure seemed to be escalating. However, by the 5th of August, I felt that the tide had turned slightly, and I resumed my ETH accumulation, investing a total of $47.1 million during that period.

As a researcher examining market trends, I observed a significant increase in net buying pressure on that particular day, amounting to approximately $98.4 million. This figure is notably higher than the $48.8 million net buying pressure recorded during the preceding day.

Over the past two days, this upward trend suggests regained investor confidence following the previous market downturn. Furthermore, it hints that the ETF managers are seizing the opportunity presented by the lower-than-usual Ethereum prices.

Conversely, the majority of other ETH ETFs have been relatively inactive, choosing to remain idle or invest modest amounts.

As a researcher, I’ve observed an interesting trend in the other end of the spectrum: the Grayscale ETHE ETF. Unlike many others, it has been witnessing withdrawals rather than inflows. Notably, this ETF stands out with its hefty annual fee of 2.5%.

On the 6th of August, it exerted a selling force of approximately $39.7 million during the trading session.

Sales outflow has significantly decreased compared to the last week of July, suggesting a lack of enthusiasm among sellers for discounted prices.

Is ETH accumulation gaining traction?

As a crypto investor, I’ve certainly noticed an uptick in sell pressure for Ethereum over the past couple of days. However, I’m curious to know if there’s significant buying interest at this moment as well. Is the market showing any signs of strong demand for ETH?

We compared ETH concentration before and after the crash, and here’s what we found.

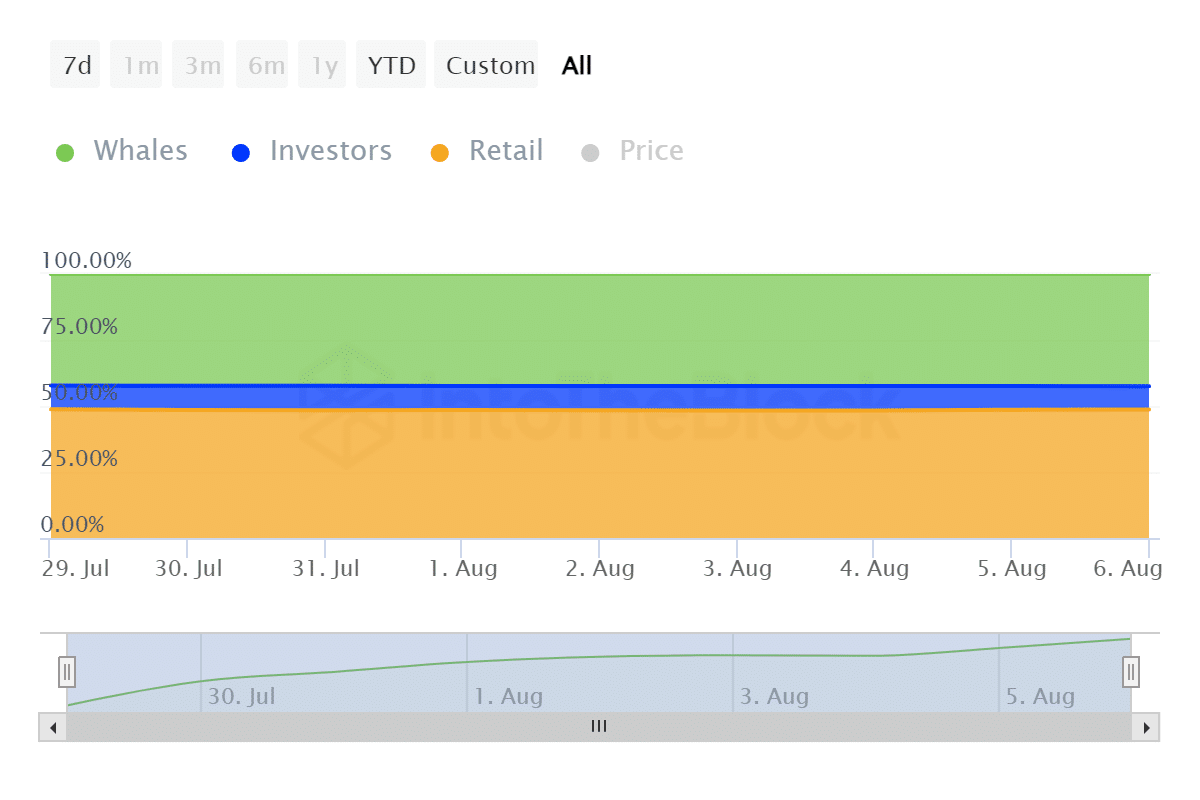

Approximately a week ago, the ownership of Ethereum (ETH) was distributed as follows: Whales accounted for about 42.19%, holding approximately 56.66 million ETH; investors owned around 9.09%, or roughly 12.2 million ETH; and retail traders controlled nearly 48.72%, with approximately 65.43 million ETH in their possession.

As a seasoned cryptocurrency investor with over a decade of experience under my belt, I find it fascinating to see how the distribution of Ethereum (ETH) has evolved over time. The latest data suggests that whales are holding a significant chunk of ETH, approximately 57.13 million, while investors hold slightly less at 11.93 million. Retail investors, on the other hand, make up the majority with 65.39 million ETH.

Based on the recent data, it appears that whales increased their ETH possessions when prices dipped. As of now, both investors and common traders are reportedly holding fewer Ethereum compared to a week earlier.

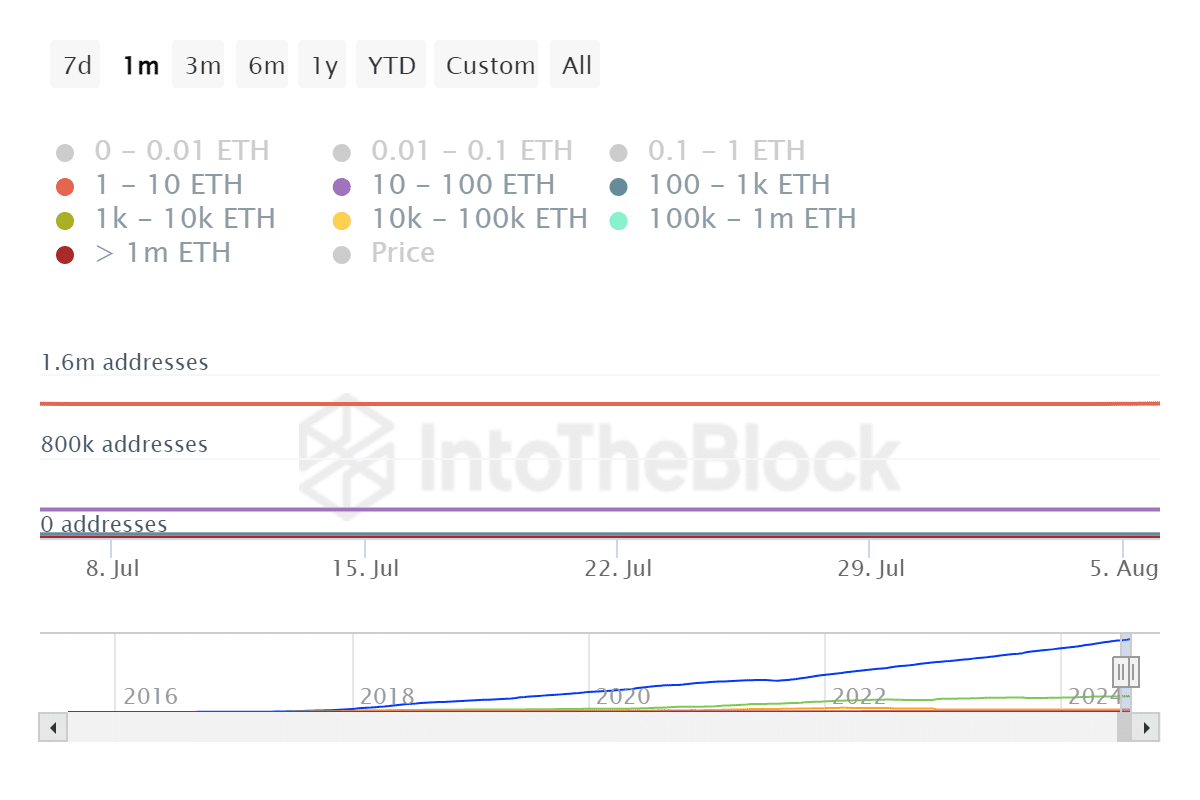

We also decided to explore address holdings to determine which class of whales were accumulating.

Read Ethereum’s [ETH] Price Prediction 2024-25

Our findings revealed that there were five addresses owning over 1 million ETH during the last 30 days. Addresses holding between 100,000 ETH and 1 million ETH dropped from 93 to 92.

In simpler terms, the number of Ethereum addresses holding between 10 and 100 ETH increased by 780 addresses, while the number of addresses holding between 10,000 and 100,000 ETH decreased by 32 addresses.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-08-07 19:04