-

DOT’s price dropped by 20% in the last 30 days.

A few technical indicators looked bullish on the token.

For the past few days, Polkadot [DOT] tokens have seen their price influenced by active bearish forces. Yet, this short-term trend may only represent the beginning of a more significant movement in the market.

If the latest data is to be considered, the possibility of DOT initiating a bull rally is high.

Polkadot is getting ready for a pump

Based on CoinMarketCap’s data, DOT‘s price remained relatively unchanged during the past week. however, there was a significant decline within the previous 24 hours, with the token losing more than 1.8% of its value.

Currently, DOT is priced at $8.42 in the markets and has a market value exceeding $12 billion. But take heart, investors, as an uptrend emerges in DOT‘s price graph.

According to a recent tweet from FLASH, a well-known cryptocurrency analyst, the price of Polkadot is on the verge of shattering its current bullish trend, which historically has triggered significant price increases.

In simpler terms, the cost of DOT began to surge in a bullish manner during February and November of 2023 following a breakthrough above a comparable trend. If past patterns hold true, investors could expect DOT‘s price to reach new heights, potentially even approaching its previous March highs.

In addition to hitting a significant mark in network activity, DOT has seen impressive growth in its user base. According to AMBCrypto’s recent report, over 605,000 active accounts are now part of the DOT ecosystem, demonstrating robust network utilization and increasing adoption.

Is a bull rally inevitable?

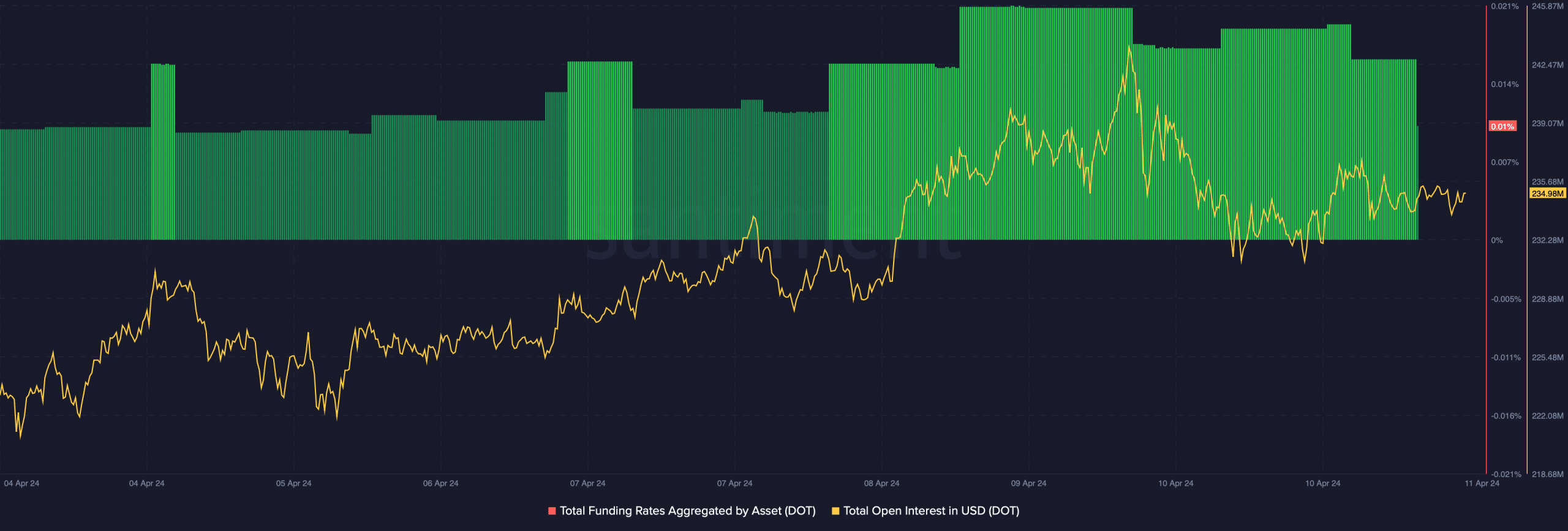

At Santiment, we examined DOT‘s on-chain metrics with AMBCrypto to assess if the cryptocurrency could rise above its current pattern. Notably, our analysis of the data indicated that DOT had a substantial amount of open interest.

When the metric increases, it could be a sign that the current price direction may persist, which in this case was downward.

The funding rate for the token suggested a downtrend. Normally, the token’s price moves in the opposite direction of the funding rate. With DOT having a high funding rate, it appears likely that the token’s value may decrease even more.

Realistic or not, here’s DOT market cap in BTC’s terms

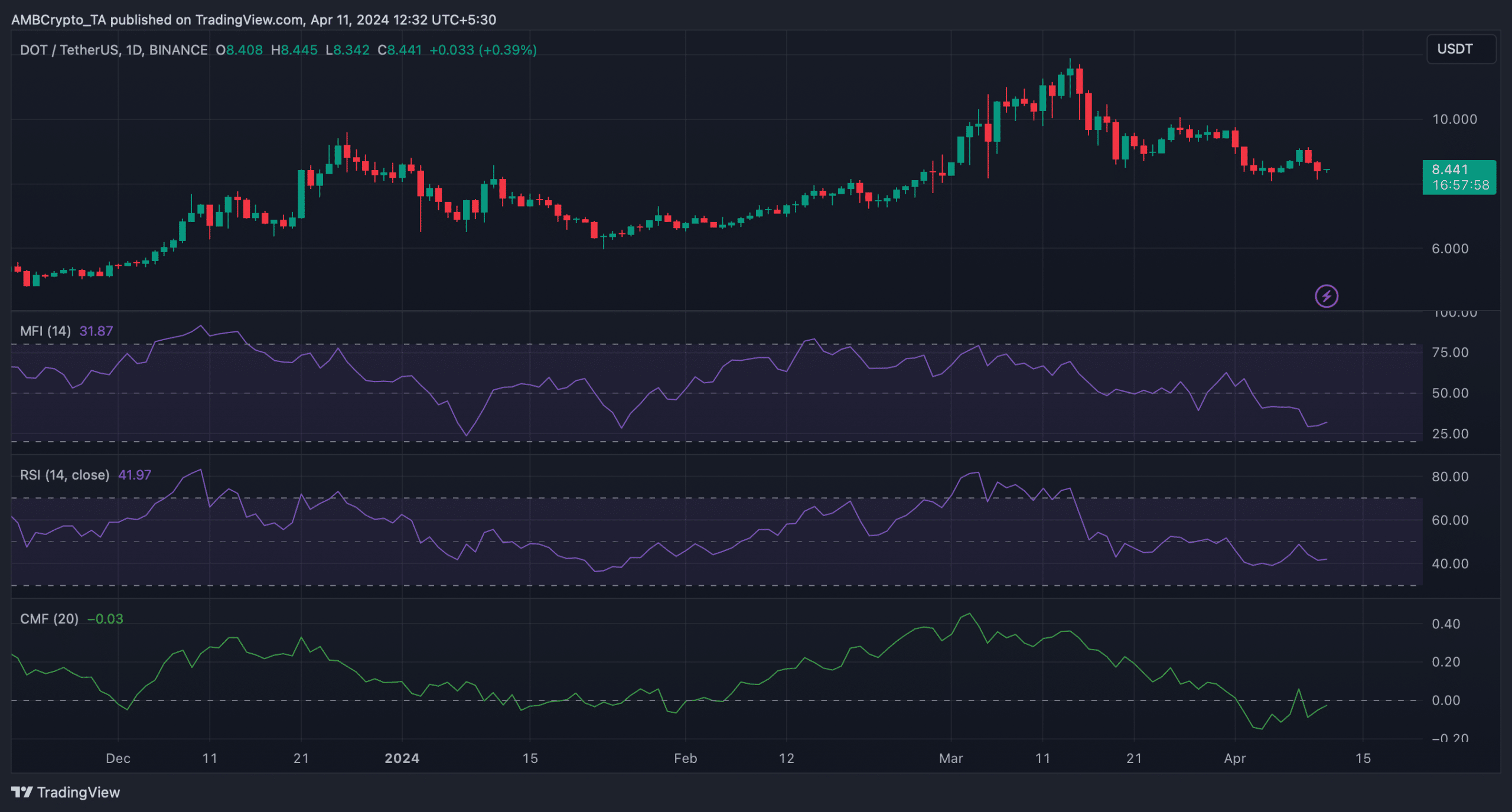

After that, we decided to examine Polkadot’s daily chart to assess the potential for an uptrend in DOT‘s price. Based on our examination, the Relative Strength Index (RSI) of DOT was showing bearish signs since it was sitting below the neutral threshold.

Instead of “However, the Chaikin Money Flow (CMF) and Money Flow Index (MFI) supported the possibility of DOT breaking above the bullish pattern by registering upticks in the recent past,” you could say:

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-04-11 22:15