-

Jump Trading’s ETH selloff could impact Ethereum price and overall market sentiment negatively.

Despite selloffs, most ETH holders were “in the money,” suggesting potential price recovery.

As a seasoned crypto investor with a knapsack full of lessons learned from the market’s ebb and flow, I find myself observing the latest development involving Jump Trading’s Ethereum selloff with a mix of intrigue and cautious optimism.

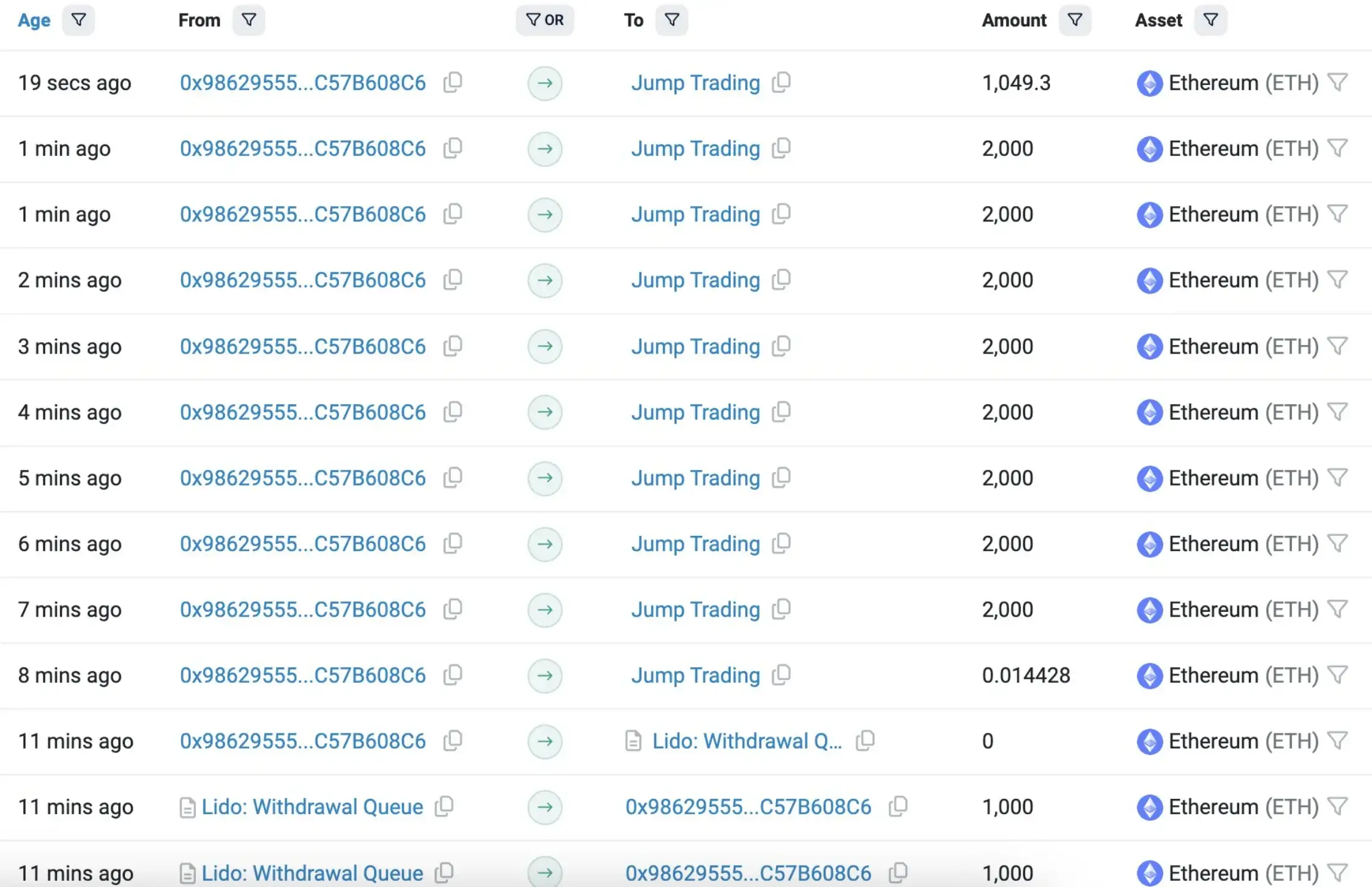

As a crypto enthusiast, I’ve recently learned an intriguing piece of news regarding Jump Trading. According to reports from Lookonchain on X (previously known as Twitter), this significant player in the crypto market has been aggressively selling off its Ethereum [ETH] holdings.

Jump Trading’s move

As someone who has closely followed the cryptocurrency market for several years now, I must say that Jump Trading’s recent decision to offload a significant portion of its Ethereum holdings during a period of market volatility is an interesting development. Based on my observations and experiences in this space, such a move suggests that the firm is adapting its strategy to navigate the volatile nature of the crypto market more effectively. This shift could potentially be a strategic move to minimize risk or capitalize on new opportunities, but it’s always important to keep a close eye on market trends and make informed decisions.

The post from Lookonchain asserted,

“They claimed 17,049 $ETH($46.44M) from #Lido and transferred it out for sale.”

It further went on to say,

“Jump Trading currently has 21,394 $wstETH($68.58M) left.”

What’s more to it?

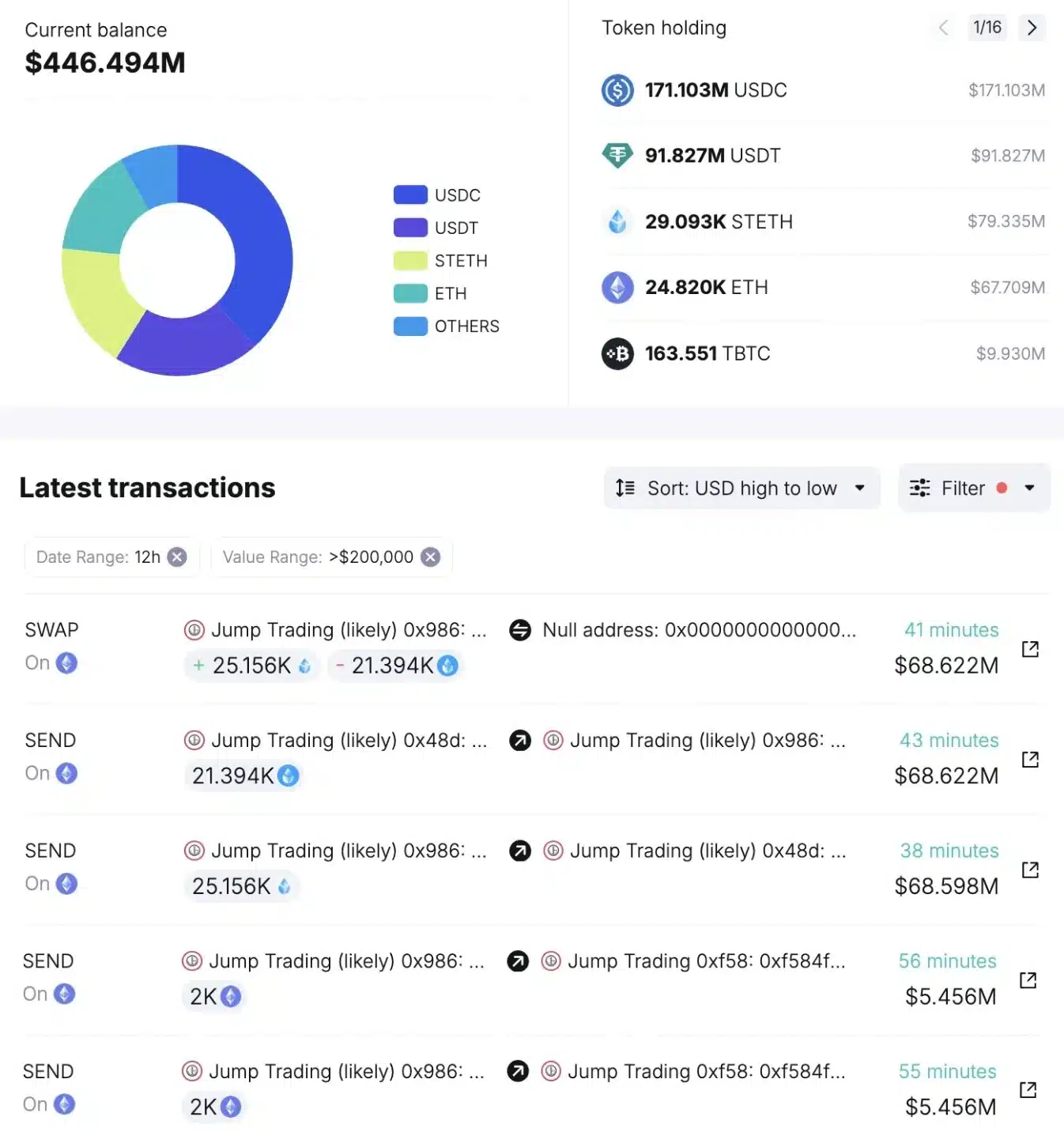

Moreover, according to Spot On Chain, Jump Trading recently exchanged 21,394 wstETH for 25,156 stETH, and unlike its previous practice, it did not immediately request withdrawals from Lido Finance.

At present, the company manages approximately 148 million dollars worth of Ethereum holdings. This includes 24,993 Ether stored in wallet 0xf58, as well as 29,093 staked Ether (stETH) that are locked up with Lido.

Lately, there’s been an increase in stock sell-offs, and this spike happened after Kanav Kariya left Jump Crypto in July. This departure came after the Commodity Futures Trading Commission (CFTC) started investigating Jump Crypto back in June.

Community reaction

Commenting on Jump Trading’s actions, X user DCinvestor tweeted,

“Disorderly selling is occurring at Jump Trading, causing a decline in prices below $3K. This strategy may not hold up well over time. Frankly, it’s a relief to see such an exploitative player exit the market.”

Echoing this sentiment, an X user named Ace remarked,

“Manipulation. They are really just want to buy more.”

ETH’s price future outlook uncertain

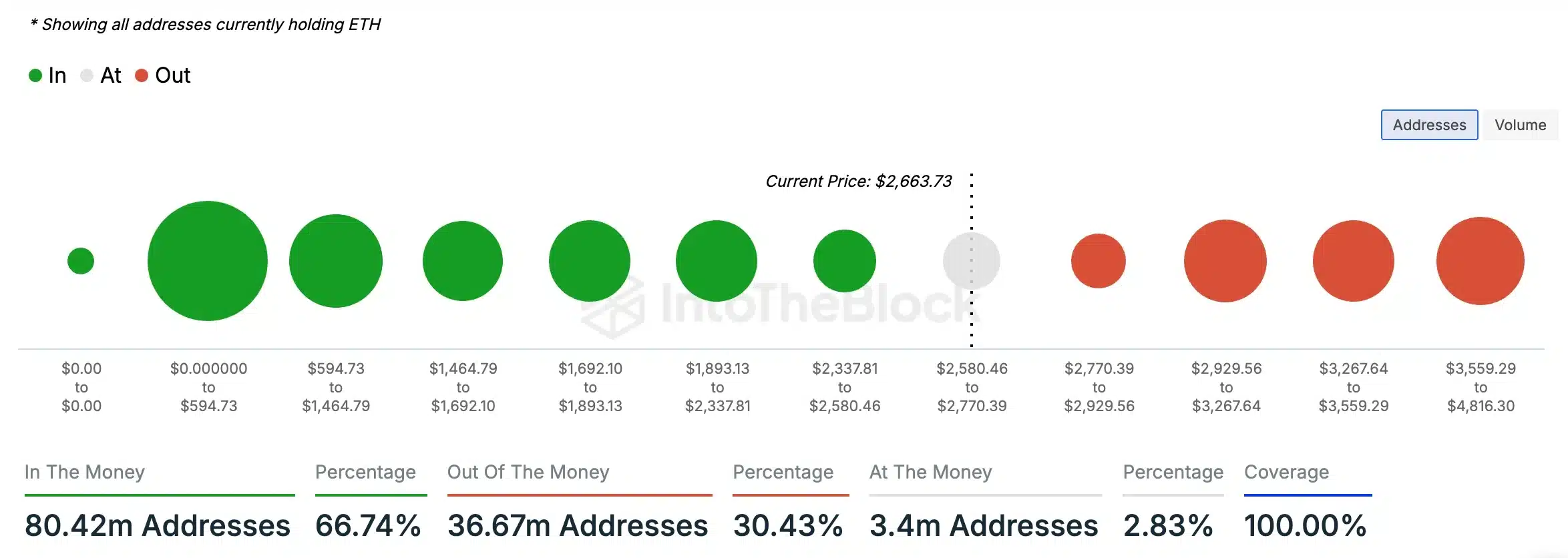

Even though there are worries about a possible decline in the price of Ethereum because of Jump Trading’s selling actions, more detailed information seems to present a subtler scenario instead.

Currently at the time this is being written, Ethereum (ETH) is being traded for approximately $2,728. Over the last 24 hours, there has been a slight uptick of 0.82%.

Even though the Relative Strength Index (RSI) was still below its neutral level, suggesting ongoing bearishness, AMBCrypto’s examination presented a potentially positive outlook instead.

More than two-thirds (66.74%) of Ethereum (ETH) owners found themselves in a profitable position at the current moment, as the value of their ETH exceeded what they originally paid for it.

The majority of investors indicated an optimistic stance, while only about one third (30.43%) found themselves in a negative position, or “out of the money.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-15 09:20