- Ethereum whales sold 60,000 ETH valued at more than $200M after the price dropped to a weekly low.

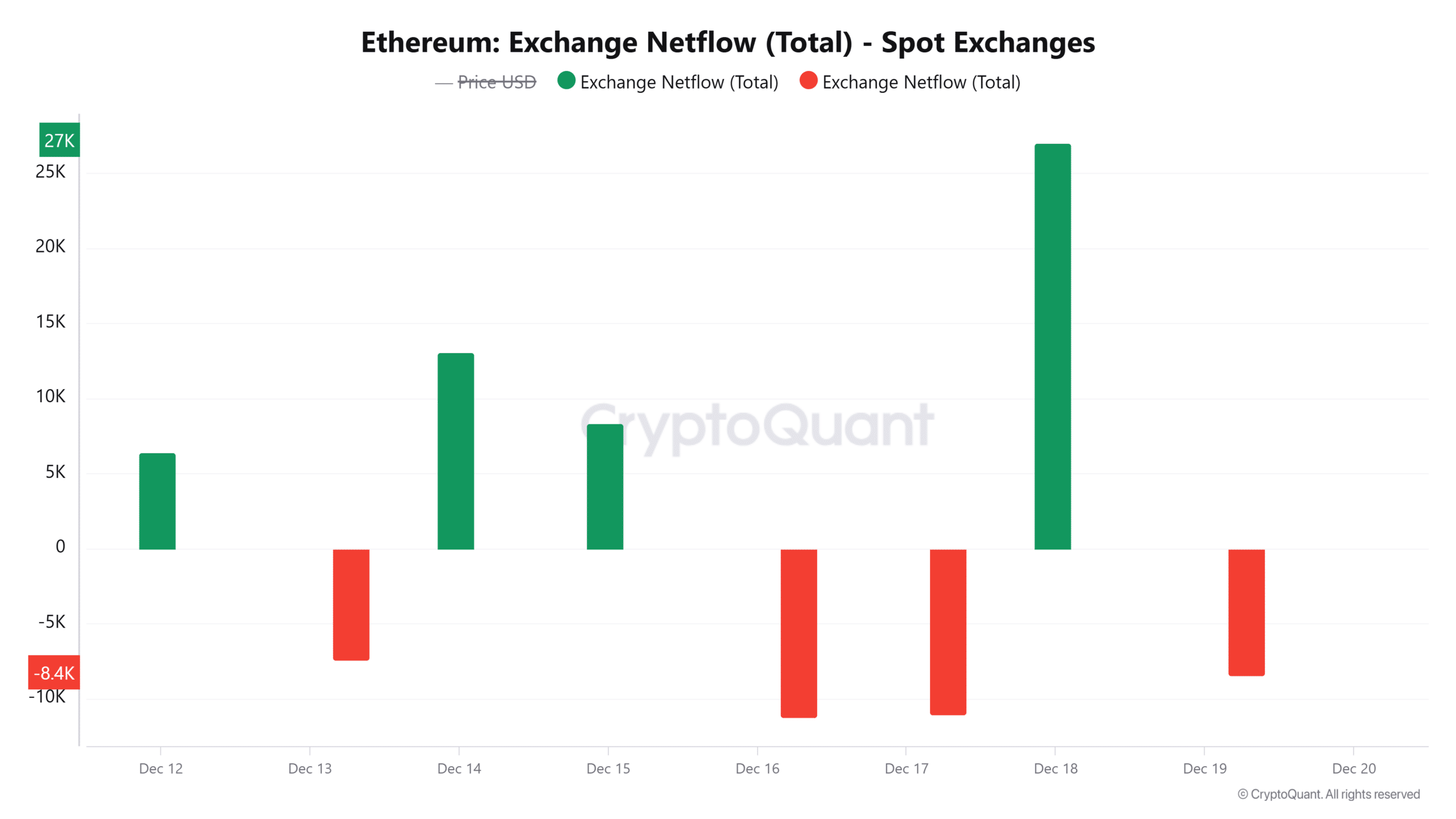

- At the same time, positive netflows to exchanges have spiked to a weekly high.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by these recent developments in Ethereum (ETH). The sudden sell-off by whales holding between 1,000 and 10,000 ETH, amounting to over $200 million, is a significant event that could potentially impact the market dynamics.

Currently, Ethereum (ETH) is at its weekly low of $3,683, following a 4% decrease in the last day. This decline results in a 6% loss over the past week. However, it’s important to note that despite this dip, Ethereum still boasts a 17% growth over the past month.

Lately, a drop caused the cumulative Ethereum liquidations to reach $124 million, with $108 million being from long liquidations. This happened as many long-position holders scrambled to settle their trades, and large Ethereum investors also saw fit to substantially decrease their Ethereum holdings.

Ethereum whales move $200M ETH

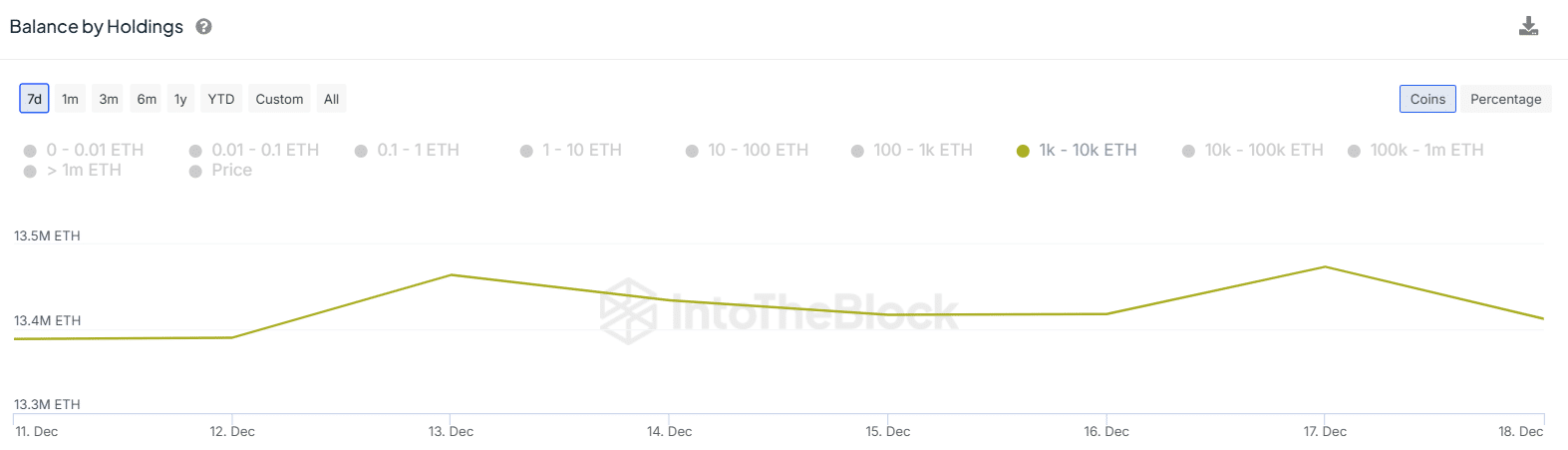

On December 18th, it was observed that Ethereum whales (addresses holding between 1,000 and 10,000 ETH) decreased their holdings from approximately 13.47 million to 13.41 million Ether. This reduction equates to the sale of about 60,000 Ether worth over $200 million in total.

According to reports from AMBCrypto, approximately 57% of all altcoins are held by ETH whales. If these large investors start selling their holdings, there could be an increase in supply and a decrease in demand, which might put downward pressure on the price due to increased sell-side pressure.

Surge in exchange inflows

The increase in trading activities can also be seen as a surge in transactions to immediate exchange platforms, following the peak of positive transactions into these platforms over the past week.

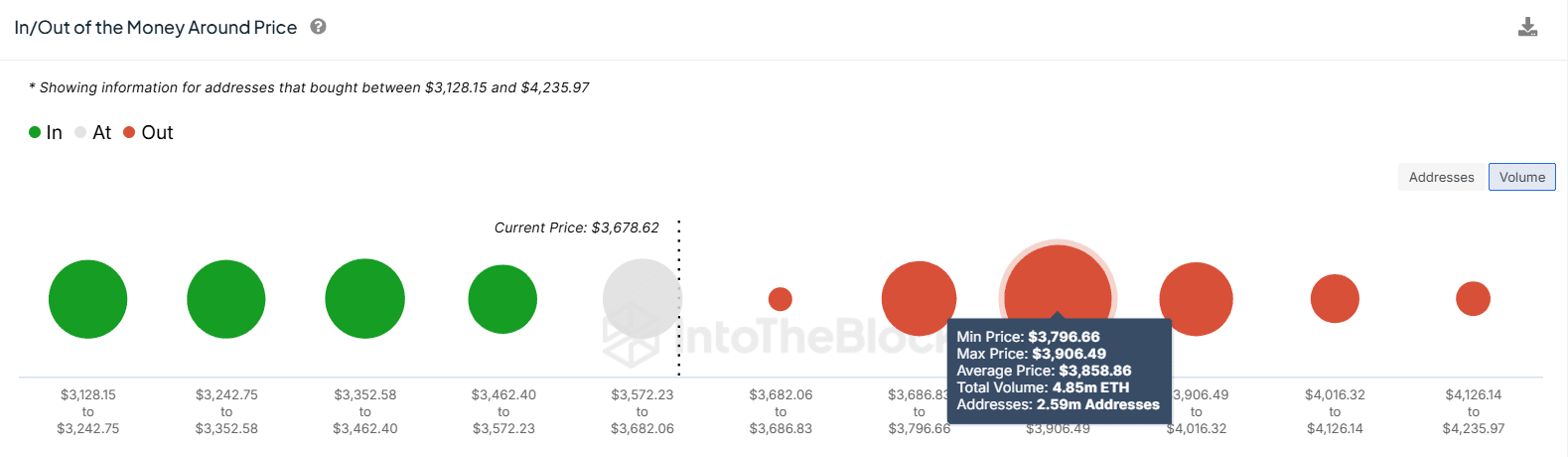

The sudden decline in prices led to a significant fall of ETH from approximately $3,900 down to $3,500. If the selling trend persists without an increase in buying activity, it could lead to further price drops, creating a bearish outlook for Ethereum.

Has institutional demand slowed?

This month, there’s been a substantial boost in institutional interest for Ethereum (ETH), evident by the upward trend in investments into spot ETFs. For the past 18 days straight, these investment products have seen a continuous flow of funds, as reported by SoSoValue.

18th December marked a low point as total inflows dropped to $2.45 million, the first such decrease since late November. Meanwhile, the Grayscale Ethereum Mini Trust experienced an outflow of $15 million, signifying the first negative flow since November.

Increased investments into these ETFs have sparked interest, propelling Ethereum above the $4,000 mark. Should interest wane, there might be a subsequent drop in its price.

What’s the next target for ETH?

At approximately $3,800 to $3,900, a significant area for Ethereum (ETH) supply has been established. According to IntoTheBlock’s data, about 2.59 million wallets have bought around 4.85 million ETH at these price levels.

Should purchasers return to the market, the potential upward trend might encounter solid opposition at this region since traders aim to realize their profits. Yet, if the digital currency manages to surpass this area, it could lead to further profits.

Analyzing derivatives data

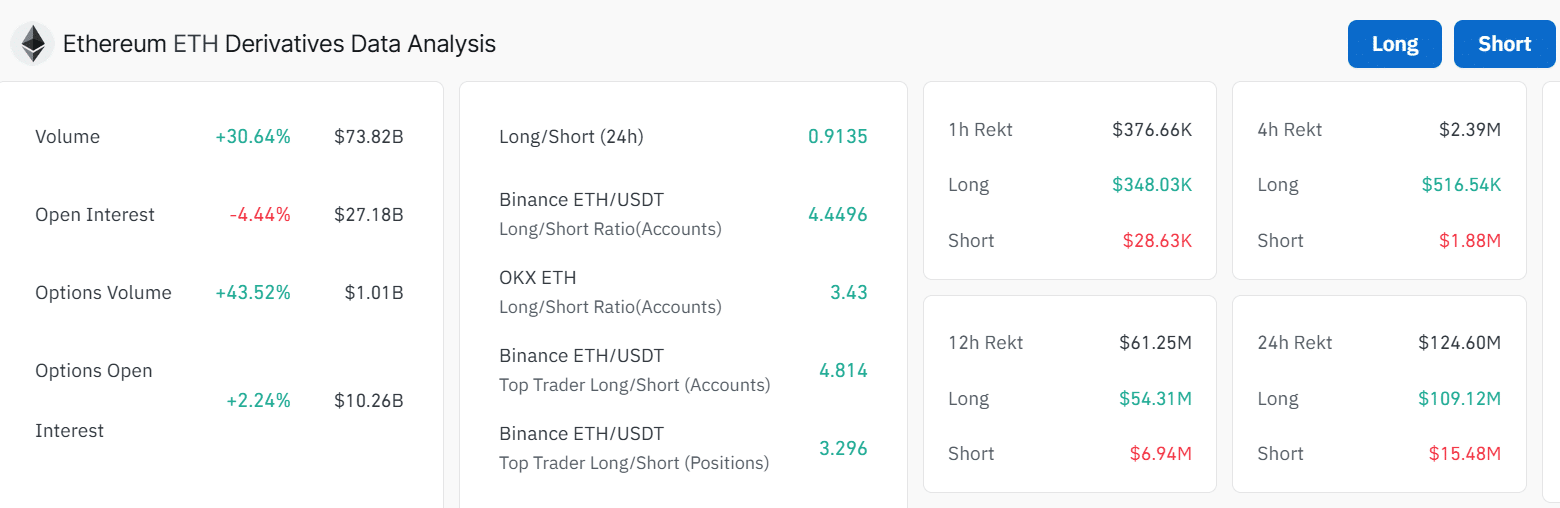

According to Coinglass, there’s still a lot of speculation surrounding Ethereum (ETH) in the derivatives market. Contrary to a 4% drop in open positions, the volume of derivative trades has skyrocketed by approximately 30%.

Additionally, Ethereum’s open interest at $27 billion is just 6% shy of all-time highs.

Read Ethereum’s [ETH] Price Prediction 2024-25

It seems that the majority of derivative traders have opted for short positions based on the high long/short ratio at $0.91, indicating a dominant bearish outlook amongst them.

Read More

2024-12-19 23:04