- A recap of how Ethereum has been lagging behind compared to some of its top rivals.

- Why Bitcoin dominance could be the key to ETH unlocking explosive growth.

As a seasoned researcher with years of experience in the crypto realm, I have witnessed the ebb and flow of various digital assets. And while Ethereum [ETH] has been criticized for underperforming compared to its top rivals, I firmly believe that it could soon turn the tables. The key to unlocking explosive growth lies in Bitcoin’s [BTC] dominance.

Recently, Ethereum [ETH] has faced criticism for its perceived underperformance, being labeled as the “king of altcoins.” However, potential shifts may be on the horizon. A significant factor that could drive change might be the level of dominance held by Bitcoin [BTC].

This month, Ethereum’s market capitalization has increased by approximately $100.61 billion since it hit its lowest point. On the other hand, Bitcoin saw a market cap growth of more than $480 billion over the same timeframe.

The lack of reaching new all-time highs could be considered as a significant indicator of Ethereum’s poor performance.

Similarly to certain leading competitors, it has experienced peaks in its Total Value Locked (TVL). For instance, on November 12th, its TVL reached a high of $66.77 billion. Yet, this was below its previous peak in June at $72.72 billion.

The pattern was mirrored by transaction data as well. Last week saw Ethereum’s on-chain transactions reach their peak of 1.29 million on November 12, marking the highest number of daily transactions it recorded in that period.

Yet, the figure remained below its highest daily transaction tally seen in October, reaching a high of approximately 1.32 million transactions on the 18th of that month.

A significant aspect where there were perceived shortcomings was the price movement. However, it’s important to note that Ethereum has shown a strong, positive trend in November.

Over the past fortnight, it surged by an impressive 44.61% from its lowest point to its peak. Yet, during this time, Bitcoin was venturing into new pricing territories, whereas Ethereum was yet to approach its all-time high value.

Ethereum could redeem itself if…

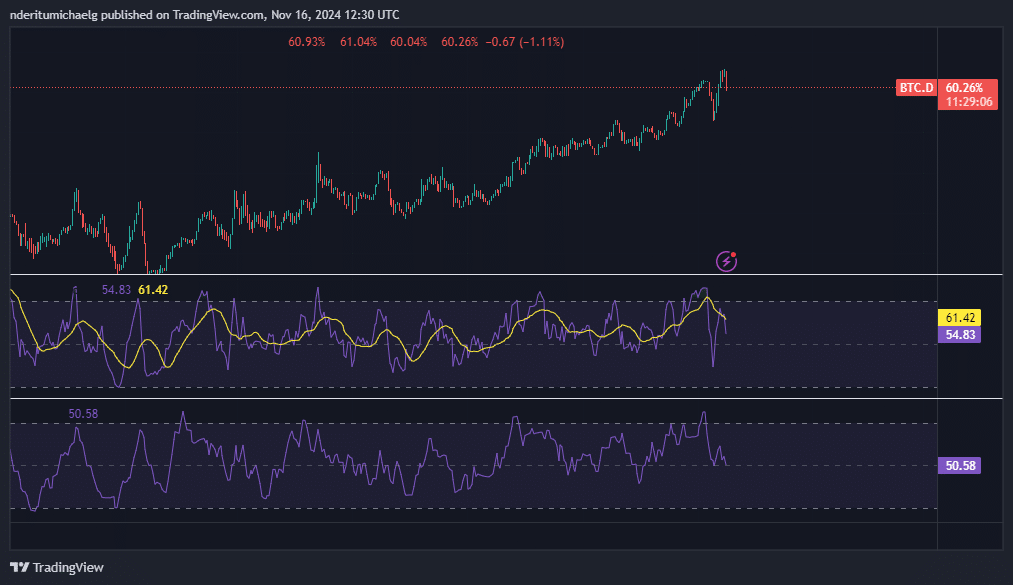

For several months now, Bitcoin’s dominance over the cryptocurrency market has been increasing significantly, suggesting that a large portion of new capital flowing into digital currencies is being invested in Bitcoin. Yet, should Bitcoin’s dominance begin to decrease, we could see a shift in where the majority of crypto liquidity goes.

At the time of writing, Bitcoin’s dominance appeared poised for a potential decrease, primarily due to recent negative movements over the past 24 hours and a bearish divergence pattern with the Relative Strength Index (RSI).

Also, its money flow indicator confirmed that liquidity flows may already be in favor of altcoins.

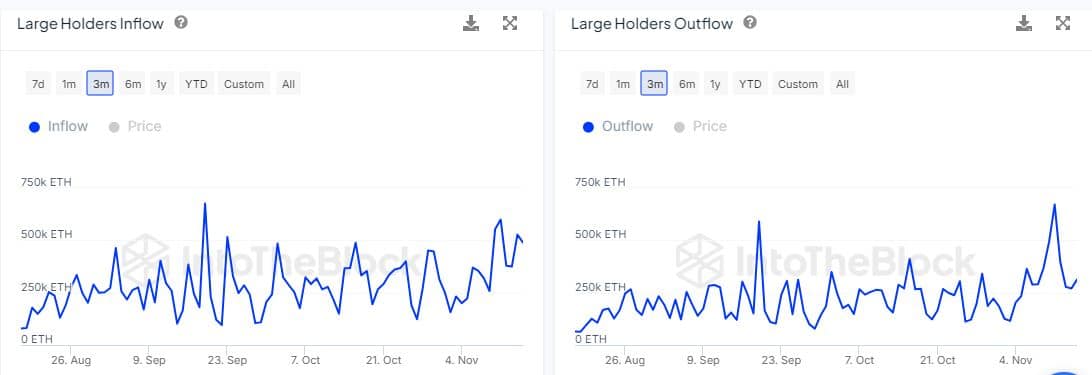

The liquidity flow into Ethereum may already be taking place. The gap between large holder inflows and outflows has been widening.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As a researcher, I’ve observed an interesting trend in Ethereum holdings: Large inflows amounted to more than 488,000 ETH by the 15th of November, indicating substantial investment. However, during the same trading session, large outflows reached approximately 312,430 ETH, suggesting a significant portion of these holdings were withdrawn or sold.

This could indicate that ETH is building up more momentum as BTC dominance starts declining.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 13:11